Understanding Child Support For Illinois

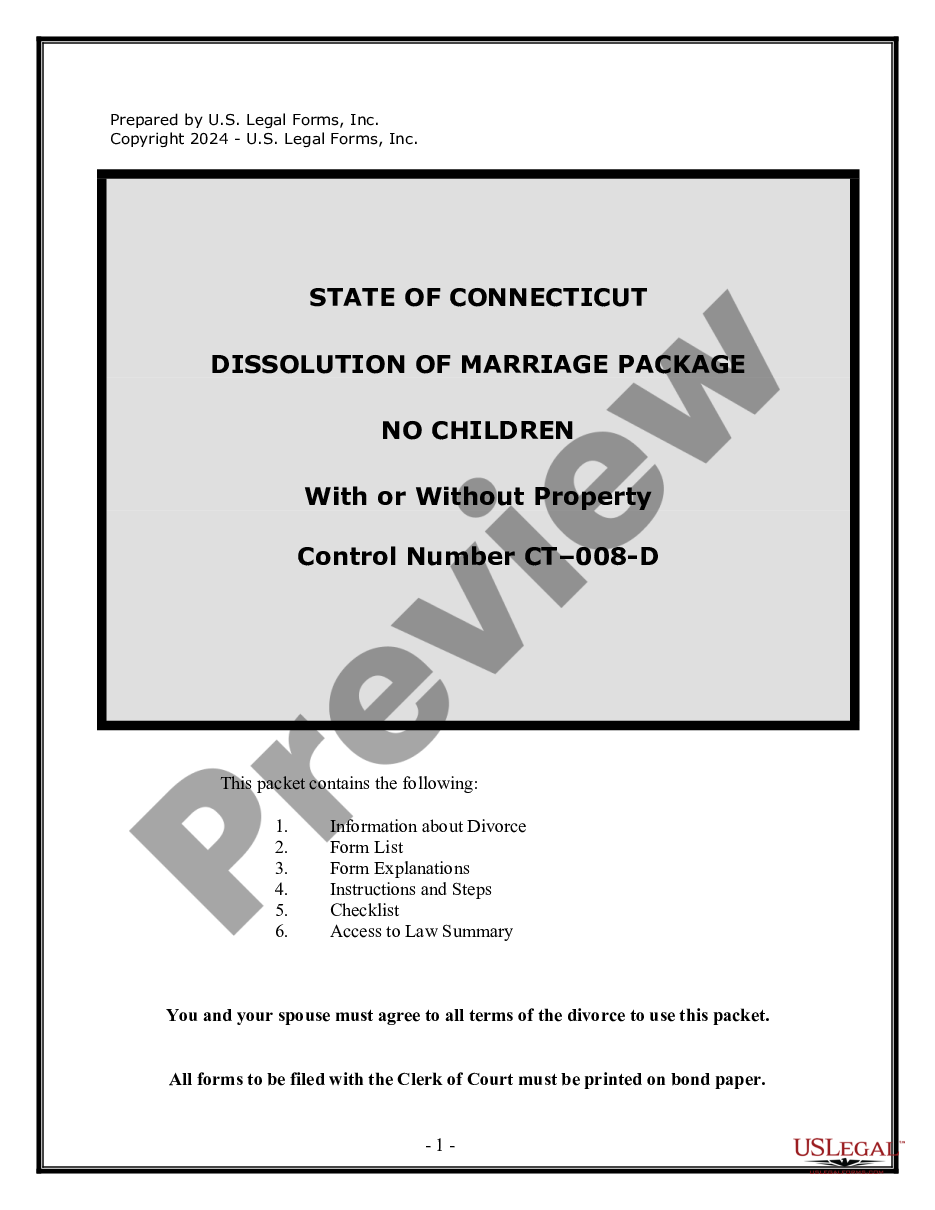

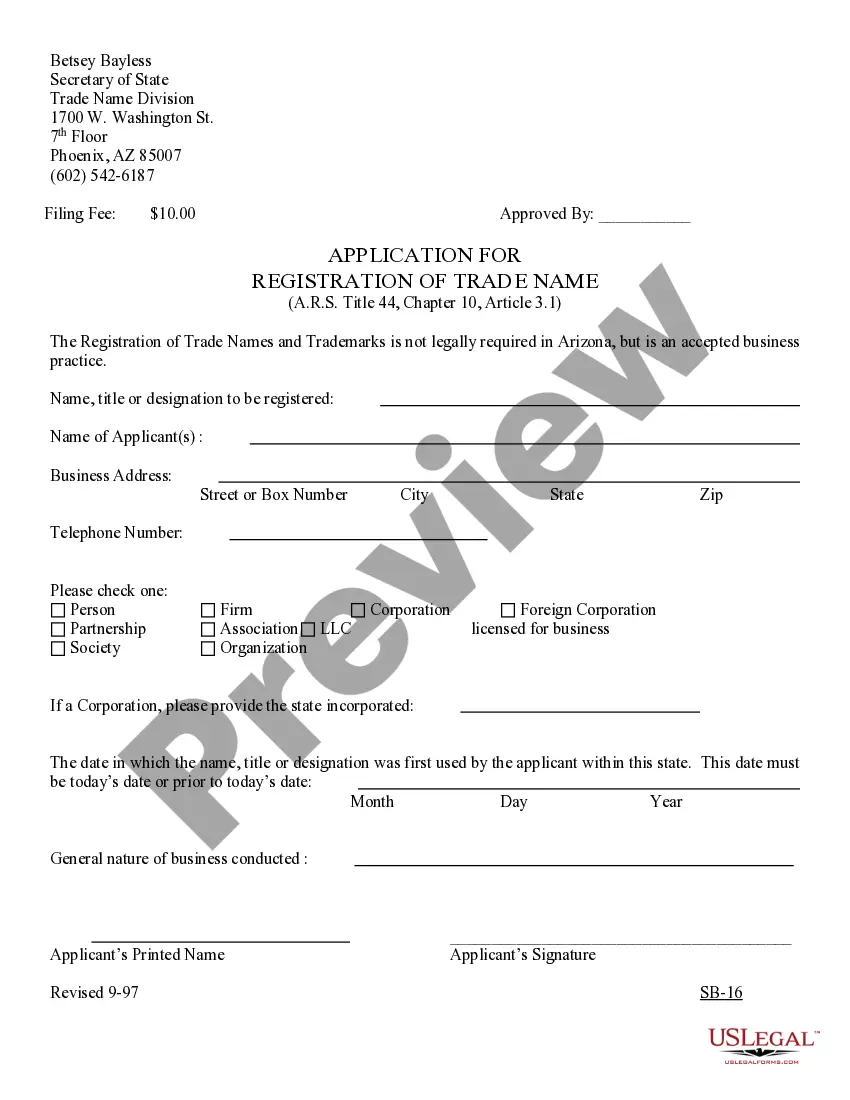

Description

How to fill out Final Child Support Payment Notice?

Creating legal documents from the ground up can occasionally be daunting. Some situations may require extensive research and significant financial investment.

If you seek a more straightforward and economical method of obtaining Understanding Child Support For Illinois or any other forms without unnecessary hurdles, US Legal Forms is readily available to you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific forms meticulously crafted by our legal professionals.

Utilize our platform whenever you need a dependable and trustworthy service through which you can easily search for and download the Understanding Child Support For Illinois. If you are an existing user and have previously registered with us, simply Log In to your account, find the template, and download it immediately or retrieve it again anytime in the My documents section.

US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and simplify the form-filling process!

- Inspect the form preview and descriptions to confirm you are accessing the correct document.

- Ensure that the template you choose complies with the statutes and regulations of your state and county.

- Select the most suitable subscription plan to acquire the Understanding Child Support For Illinois.

- Download the document. Then complete, authenticate, and print it out.

Form popularity

FAQ

Lay out Your Assets & Think About Final Wishes. ... Consider Your Digital Assets. ... Gather Documents Needed for Will Preparation. ... Choose Your Executor & Beneficiaries. ... Nominate Guardians. ... Sign Your Will. ... Store Your Will. ... Update or Amend Your Will.

How FreeWill works Fill out online. Just follow the step-by-step instructions to fill out the necessary information for your forms. Print out documents. The information you provided is turned into precise legal language, and provided back to you as a printable document. Sign and keep safe.

The Free Last Will and Testament Template for Word is a professionally drafted legal document that would detail your wishes for your funeral and your beneficiaries.

How do you write a pour-over will? Set up a living trust. Before you can make a pour-over will, you first need to create a living trust. ... Name your trustee as the beneficiary in your pour-over will. ... Name a will executor. ... Consider your other estate-planning needs.

Steps to Create a Will in Colorado Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses.

How to make a will without a lawyer in 7 steps Step 1: Create an account with an online service. ... Step 2: Designate an executor. ... Step 3: Identify beneficiaries. ... Step 4: Plan for your dependents. ... Step 5: Prepare your assets. ... Step 6: List your debts. ... Step 7: Execute your will.

How Does a Pour Over Will Work? A pour over will functions after an individual has already created a trust and funded the trust?meaning, they have placed certain assets in the trust to be given to beneficiaries after their death in order to avoid the probate court process.

A will is a document that approves you to designate how your property and property are allotted upon your death. The easiest structure of a will is a ?holographic? or handwritten will, which does not require witnesses or lawyers. A holographic will be written absolutely in the testator's personal handwriting.