Ucc Termination Statement Form With The Irs

Description

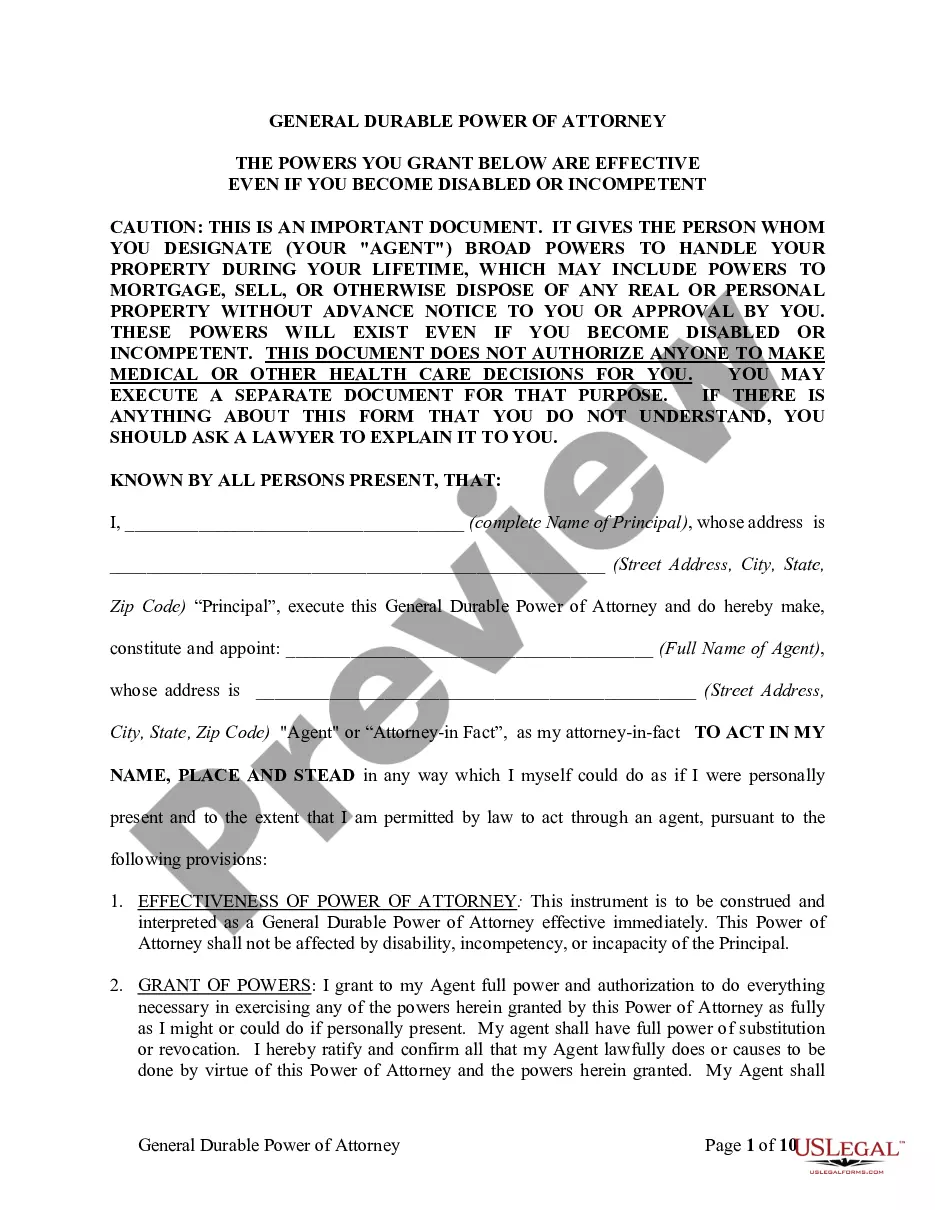

How to fill out Sample Letter For UCC-3 Termination Statement?

Managing legal documents can be perplexing, even for experienced individuals.

When seeking a Ucc Termination Statement Form With The Irs and lacking the time to dedicate to finding the correct and current version, the task can be exhausting.

US Legal Forms caters to any needs you might have, ranging from personal to business documents, all in one location.

Use sophisticated tools to fill out and manage your Ucc Termination Statement Form With The Irs.

Here are the steps to take after retrieving the form you need: Confirm it is the correct one by previewing it and reviewing its details. Ensure that the template is valid in your state or county. Click Buy Now when ready. Choose a monthly subscription plan. Select the format needed, and Download, fill out, eSign, print, and send your document. Leverage the US Legal Forms online catalog, backed by 25 years of experience and dependability. Streamline your regular document management into a straightforward and user-friendly process today.

- Explore a repository of articles, guides, and handbooks related to your situation and needs.

- Conserve time and effort in finding the documents required and leverage US Legal Forms’ enhanced search and Review tool to locate the Ucc Termination Statement Form With The Irs.

- If you possess a membership, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents tab to revisit the documents you've previously saved and to manage your folders accordingly.

- If you're new to US Legal Forms, create a free account to enjoy unlimited access to all the advantages of the library.

- Utilize a comprehensive online form directory that could significantly improve efficiency for those handling these matters.

- US Legal Forms stands as a leader in the realm of online legal documents, boasting over 85,000 state-specific legal forms available whenever needed.

- Access legal and business forms specific to your state or county.

Form popularity

FAQ

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

Legal requirements for the UCC-1 In order for a UCC-1 to hold weight in a legal proceeding, it must include the exact legal name of the debtor, the collateral included in the lien and the name of the secured party.

3 termination statement (a ?Termination?) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.

An Example of a UCC Lien Filing If you secure equipment financing, the lender will file a UCC lien to state that if the debt for the espresso machine is not repaid, the lender has the right to repossess the espresso machine or seize other assets from your business.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.