Agreement Promoters Contract For Loan

Description

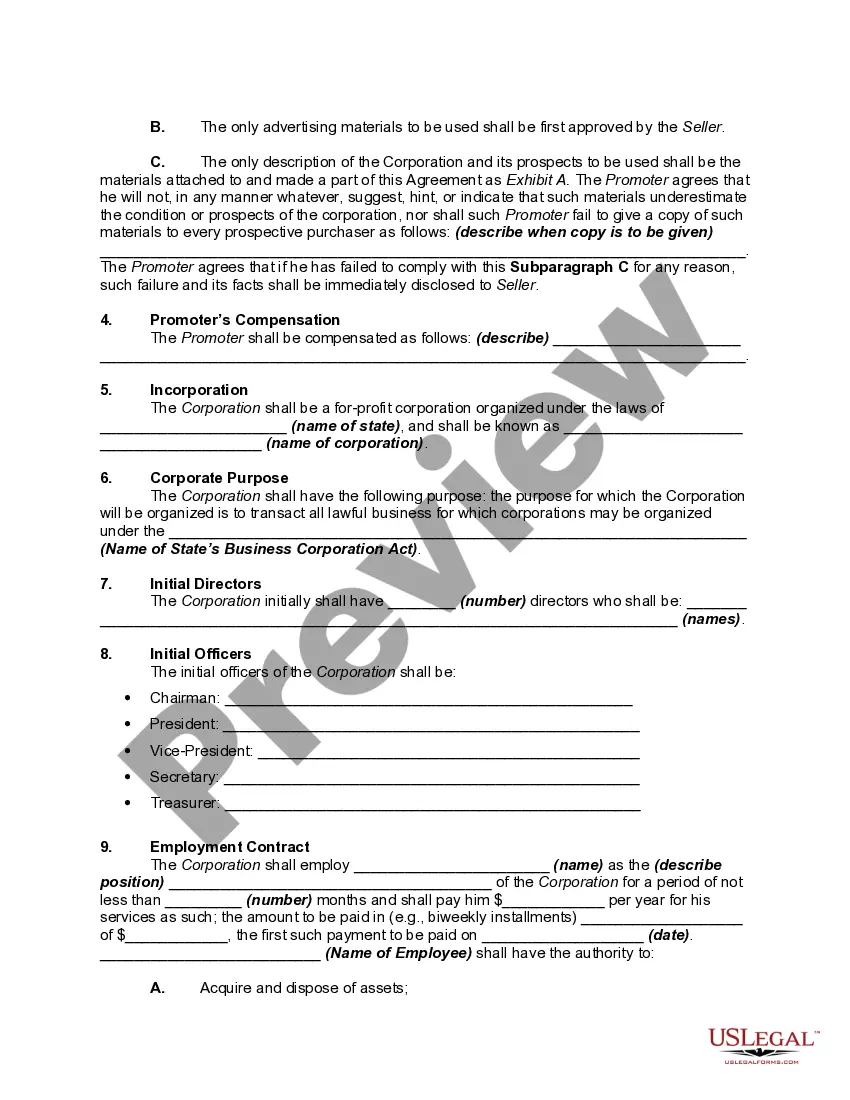

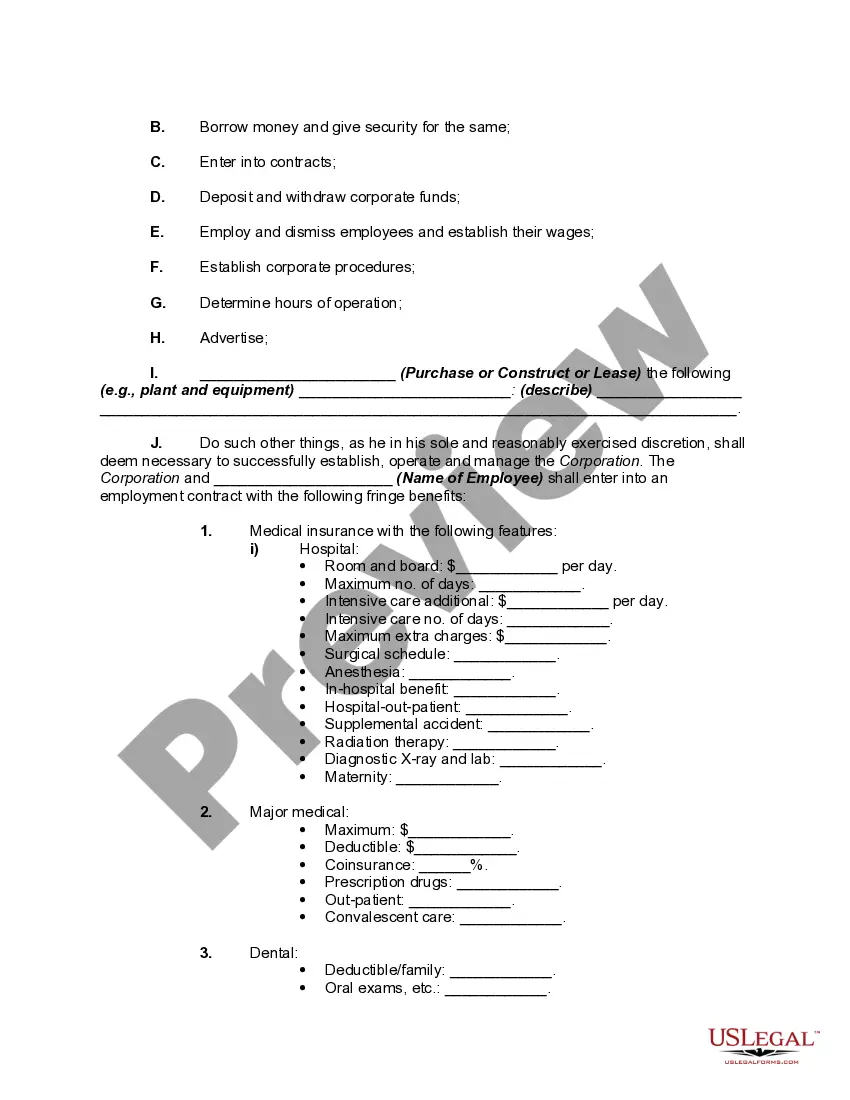

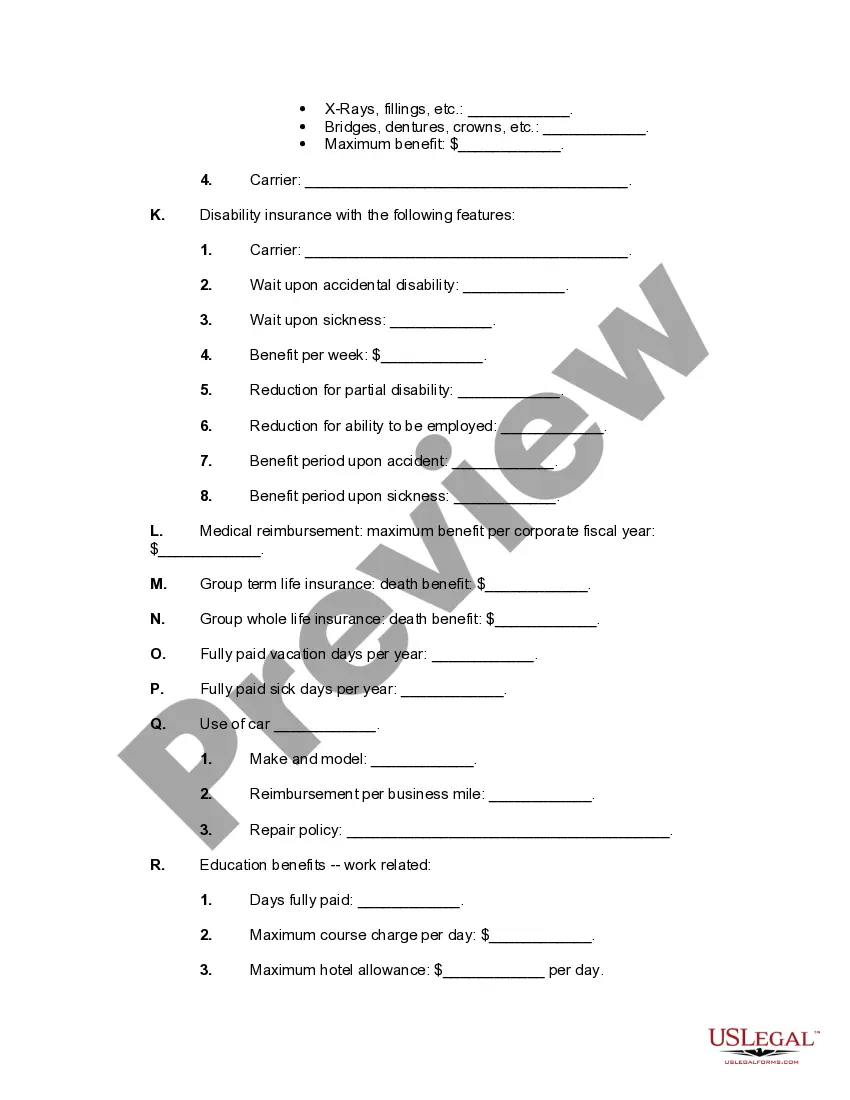

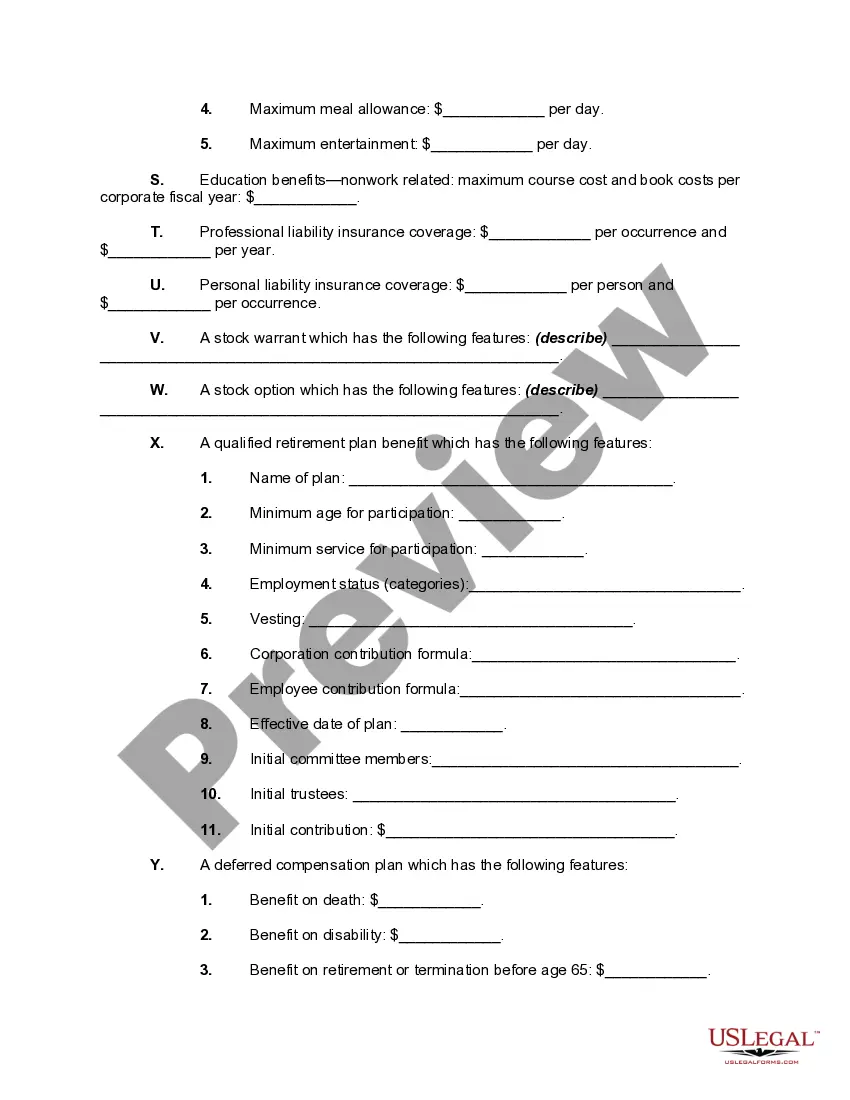

How to fill out Preincorporation Agreement Between Incorporators And Promoters?

Individuals typically connect legal documentation with something intricate that only a specialist can manage.

In some respect, this is accurate, as creating an Agreement Promoters Contract For Loan requires significant expertise in subject matter criteria, encompassing state and local regulations.

However, with US Legal Forms, circumstances have shifted to be more convenient: pre-prepared legal templates for any personal and commercial occasion tailored to state legislation are consolidated in a single online repository and are now accessible to all.

Print your document or transfer it to an online editor for a faster completion. Every template in our collection is reusable: once obtained, they are kept in your account. You can access them at any time you require via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current forms categorized by state and application area, allowing you to search for Agreement Promoters Contract For Loan or any specific template in just a few minutes.

- Returning users with an active subscription must Log In to their account and select Download to retrieve the form.

- Users new to the site will need to set up an account and subscribe prior to downloading any files.

- Here are the instructions on how to obtain the Agreement Promoters Contract For Loan.

- Review the content of the page thoroughly to confirm it suits your requirements.

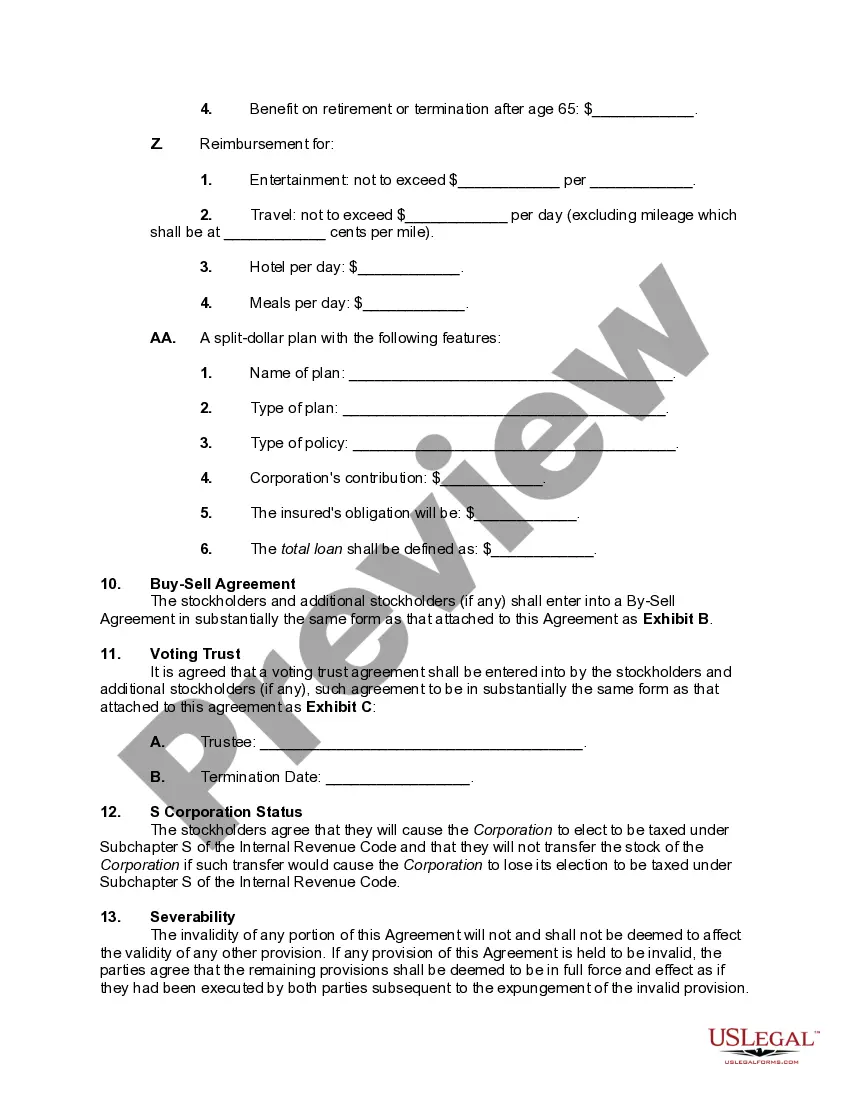

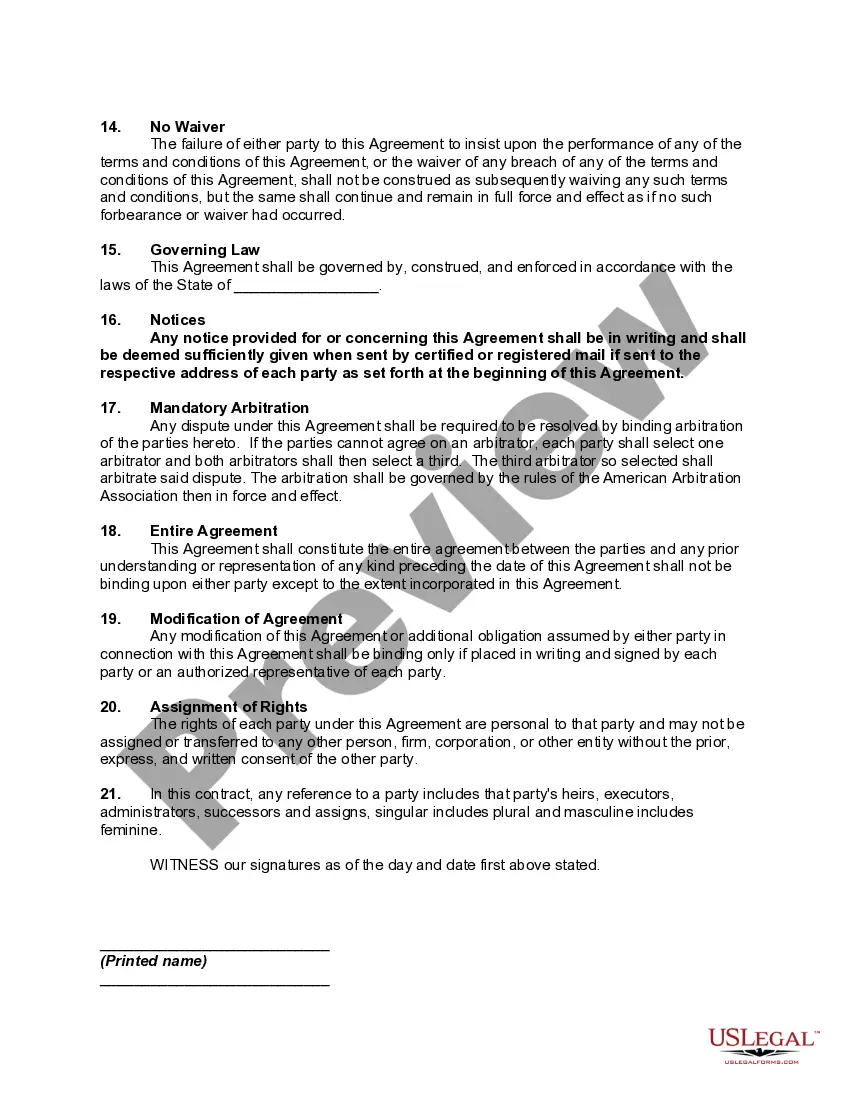

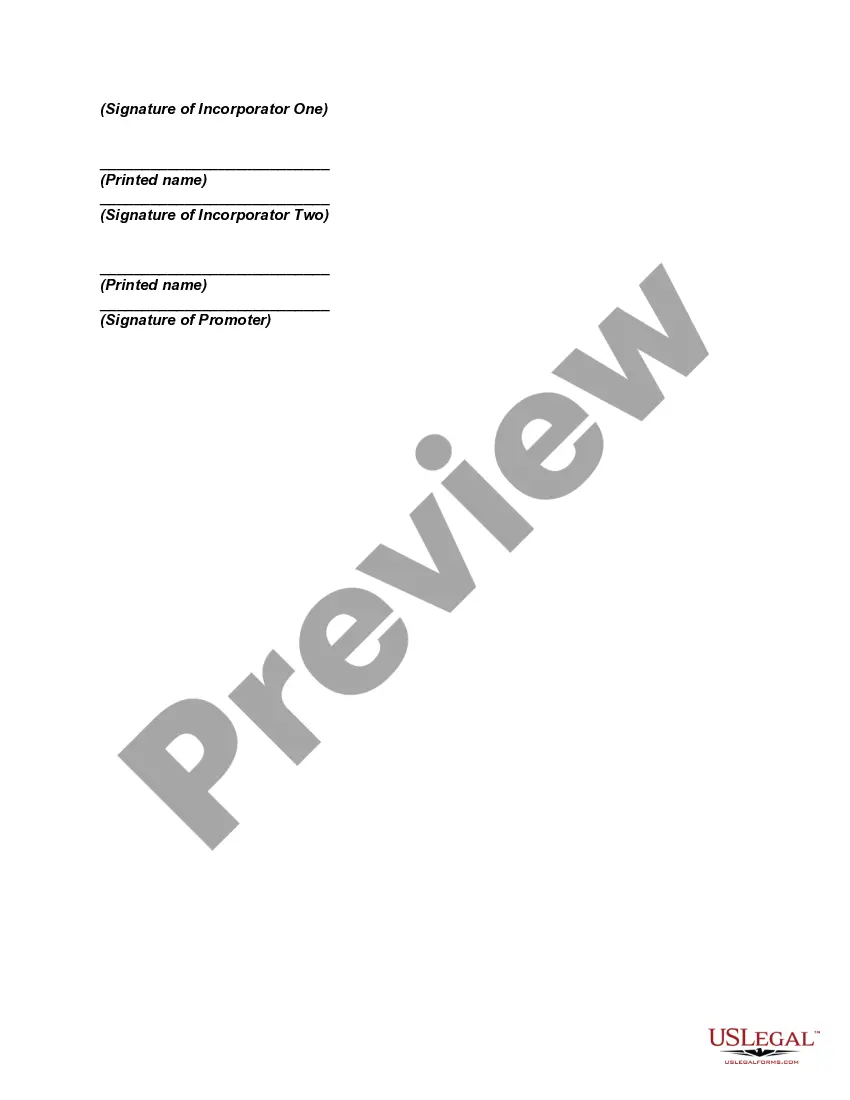

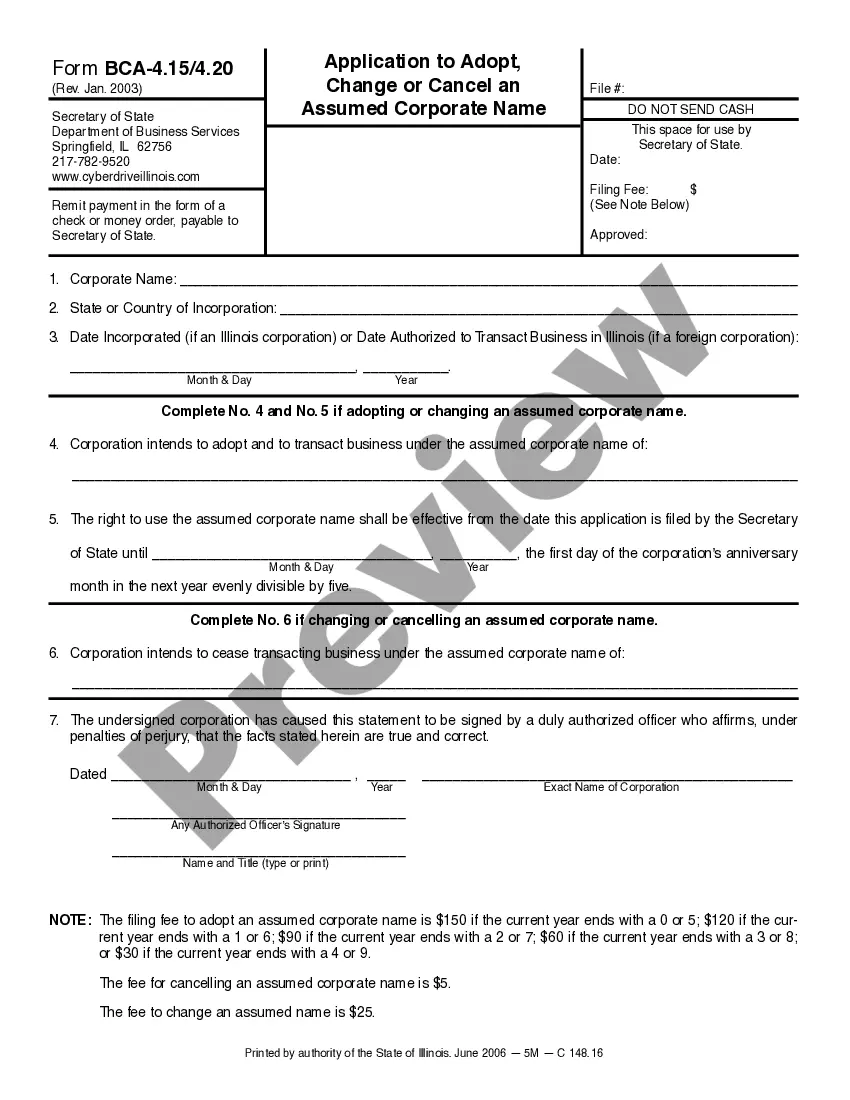

- Examine the form description or verify it through the Preview feature.

- If the previous example does not fit your needs, look for another sample in the Search field above.

- Once you locate the suitable Agreement Promoters Contract For Loan, click Buy Now.

- Select a pricing plan that aligns with your requirements and financial plan.

- Create an account or Log In to move on to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose your preferred format for the sample and click Download.

Form popularity

FAQ

Loan agreements are binding contracts between two or more parties to formalize a loan process. There are many types of loan agreements, ranging from simple promissory notes between friends and family members to more detailed contracts like mortgages, auto loans, credit card and short- or long-term payday advance loans.

Loan agreements are beneficial for borrowers and lenders for many reasons. Namely, this legally binding agreement protects both of their interests if one party fails to honor the agreement. Aside from that, a loan agreement helps a lender because it: Legally enforces a borrower's promise to pay back the money owed.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

Common items in personal loan agreements.The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.