Loan Request Format

Description

How to fill out Request To Lender Or Loan Servicer For Loan Modification Due To Financial Hardship - Requesting Change To Fixed Rate Of Interest Of Adjustable Rate?

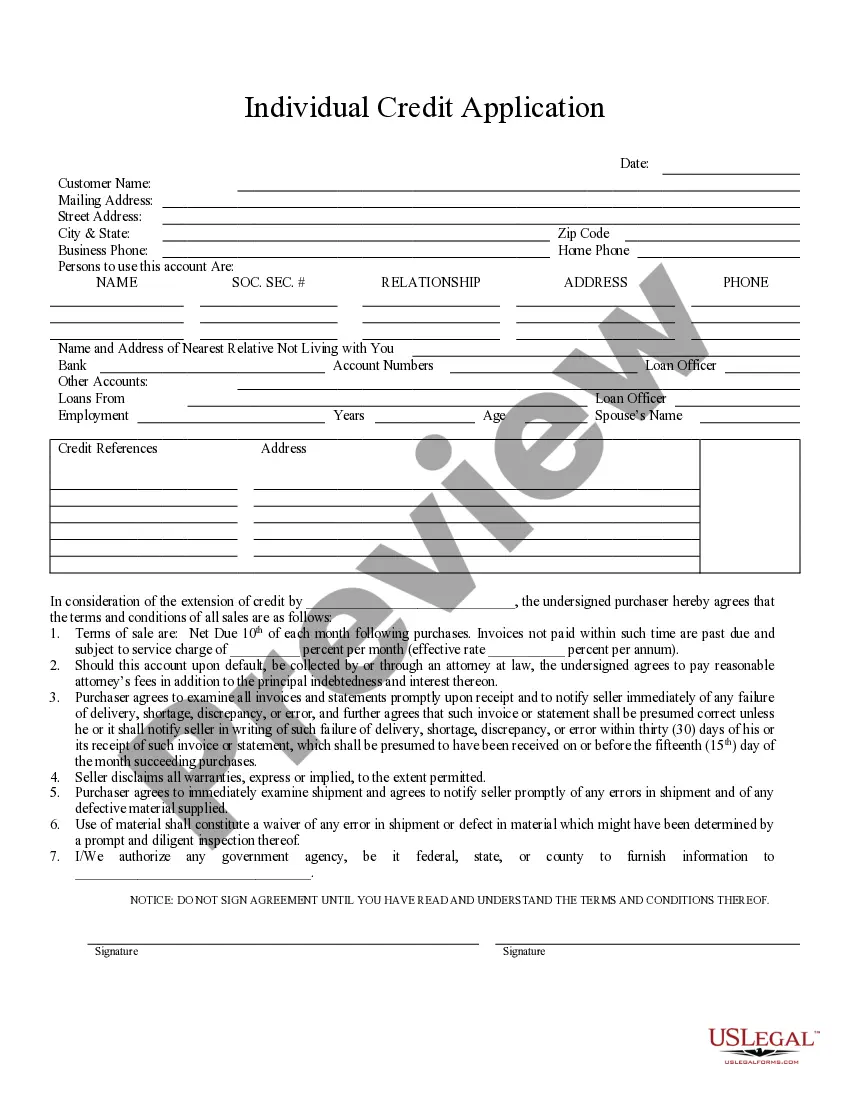

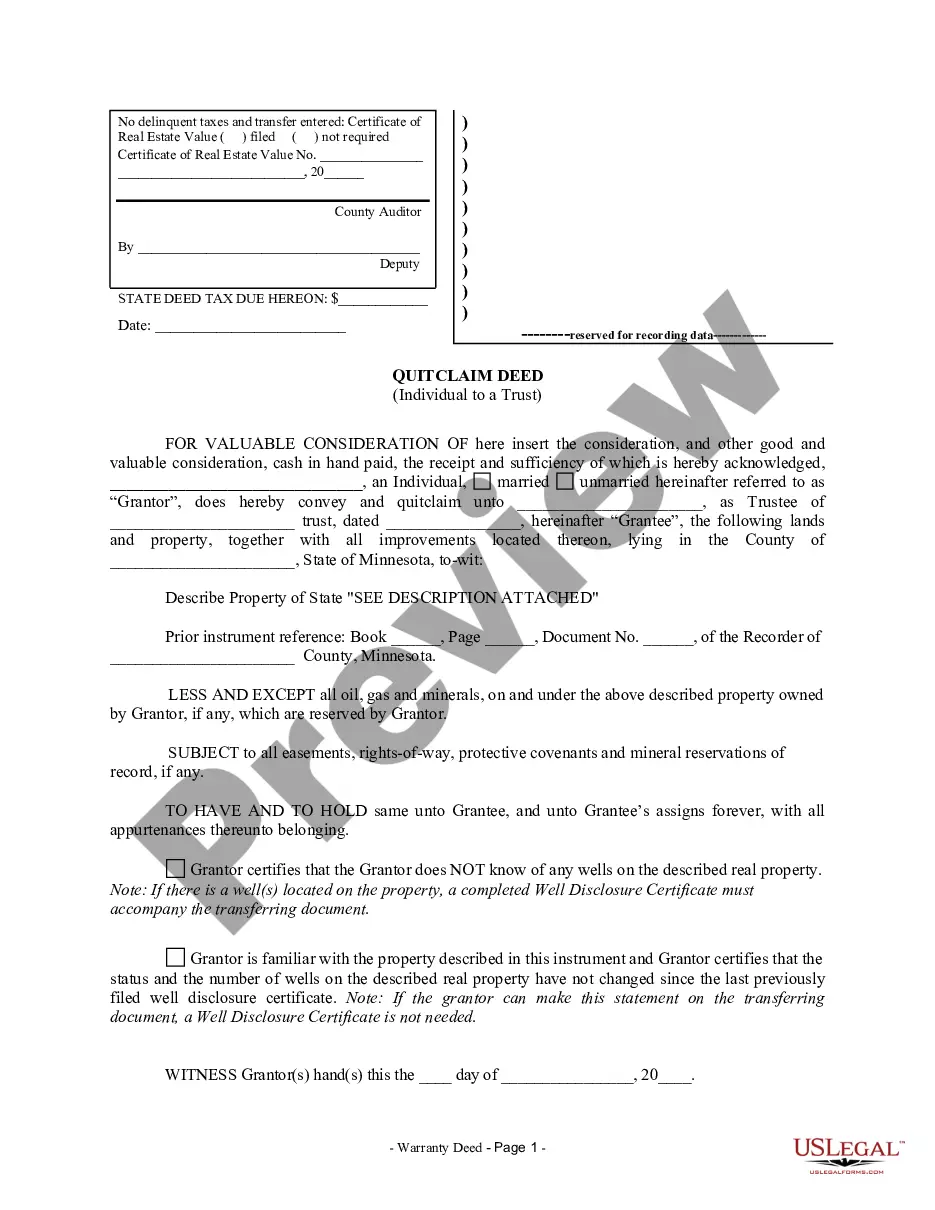

The Loan Application Template you see on this page is a reusable formal format created by skilled attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners more than 85,000 verified, state-specific documents for any business and personal occasion. It’s the quickest, easiest, and most reliable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware security.

Register for US Legal Forms to have verified legal templates for every situation in life at your fingertips.

- Explore the document you need and review it. Look through the file you searched and preview it or check the form description to verify it meets your requirements. If it doesn't, utilize the search function to find the correct one. Click Buy Now once you have located the template you need.

- Register and Log In. Choose the pricing option that works best for you and create an account. Use PayPal or a credit card to complete a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template. Choose the format you desire for your Loan Application Template (PDF, Word, RTF) and save the sample onto your device.

- Complete and sign the document. Print out the template to fill it in by hand. Alternatively, employ an online multi-purpose PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Redownload your documents when necessary. Use the same document again whenever required. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

When writing a request for a loan, focus on being concise and to the point. Use a formal tone and include necessary details such as the loan amount, purpose, and a repayment plan in your loan request format. This will increase your chances of a positive response and demonstrate your seriousness about the loan.

To request a loan from someone, approach them with a clear explanation of your financial needs. Use a structured loan request format to outline both the amount you need and the reasons for your request. This approach not only shows respect but also helps bolster your case for receiving the loan.

Writing a loan request letter requires clarity and organization. Start with a formal greeting, state your purpose, and outline the loan request format including the amount and purpose for borrowing. Finally, express your willingness to discuss the terms further and thank the reader for their consideration.

When asking for a loan, it is essential to consider your relationship with the person you are approaching. Make your request using the appropriate loan request format, outlining your reasons for borrowing and providing reassurance about repayment. Always remain courteous and express gratitude, regardless of their response.

To politely request for a loan, begin with a clear and respectful approach. Use a friendly tone while explaining your need for the loan and how you plan to repay it. Be upfront about the specifics, including the amount and purpose, aligning your request with a proper loan request format to convey professionalism.

To compose a polite formal request, start by addressing the recipient respectfully. Clearly state your purpose for making the request and include any relevant details that support your case. Make sure to express gratitude for their consideration and close with a courteous sign-off. Using a well-structured loan request format can enhance the clarity and professionalism of your request.

To write a simple letter of request, start by clearly stating your purpose at the beginning. Use a formal greeting, such as 'Dear Recipient's Name'. Next, outline the details of your request, ensuring to include the format required for the loan request. Finally, conclude with a polite closing statement, thanking the recipient for their consideration. Following this structure will help ensure your letter is professional and effective.

A loan request proposal should begin with an introduction stating the purpose of the loan. Provide detailed information about your current financial situation and the specific amount you are requesting. Include a repayment plan outlining how you intend to repay the loan. A well-structured loan request format can significantly enhance your proposal's effectiveness.

A loan agreement format outlines the terms and conditions of the loan between the lender and borrower. You should include details such as the loan amount, interest rate, repayment schedule, and consequences for default. Clarity and comprehensiveness in your agreement help prevent misunderstandings. Utilizing a template can simplify this process.

To write a formal request for a loan, begin with a formal greeting, then state your purpose right away. Explain your financial needs clearly, including the amount and reason for the loan. Conclude with a summary of your repayment capabilities and a polite closing. A well-crafted loan request format will make your request more persuasive.