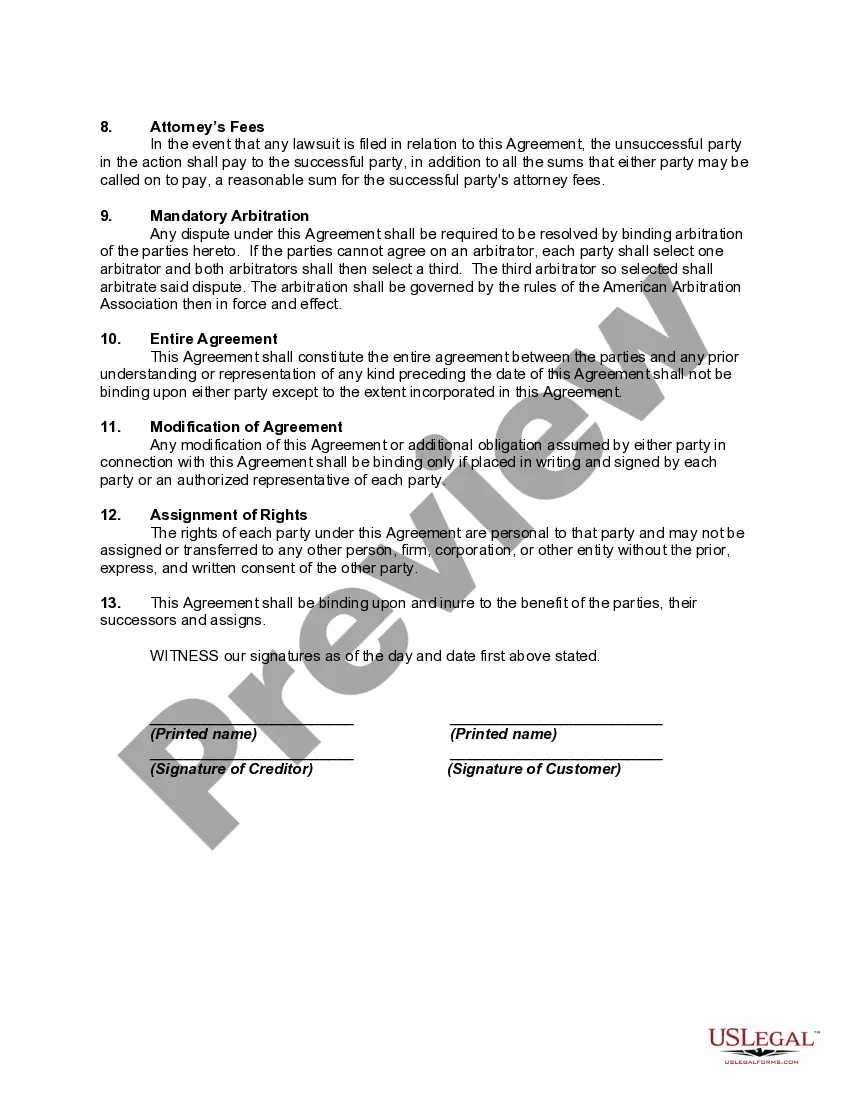

Any Creditor Debt Without A Loan

Description

How to fill out Agreement To Extend Debt Payment?

Drafting legal documents from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of preparing Any Creditor Debt Without A Loan or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

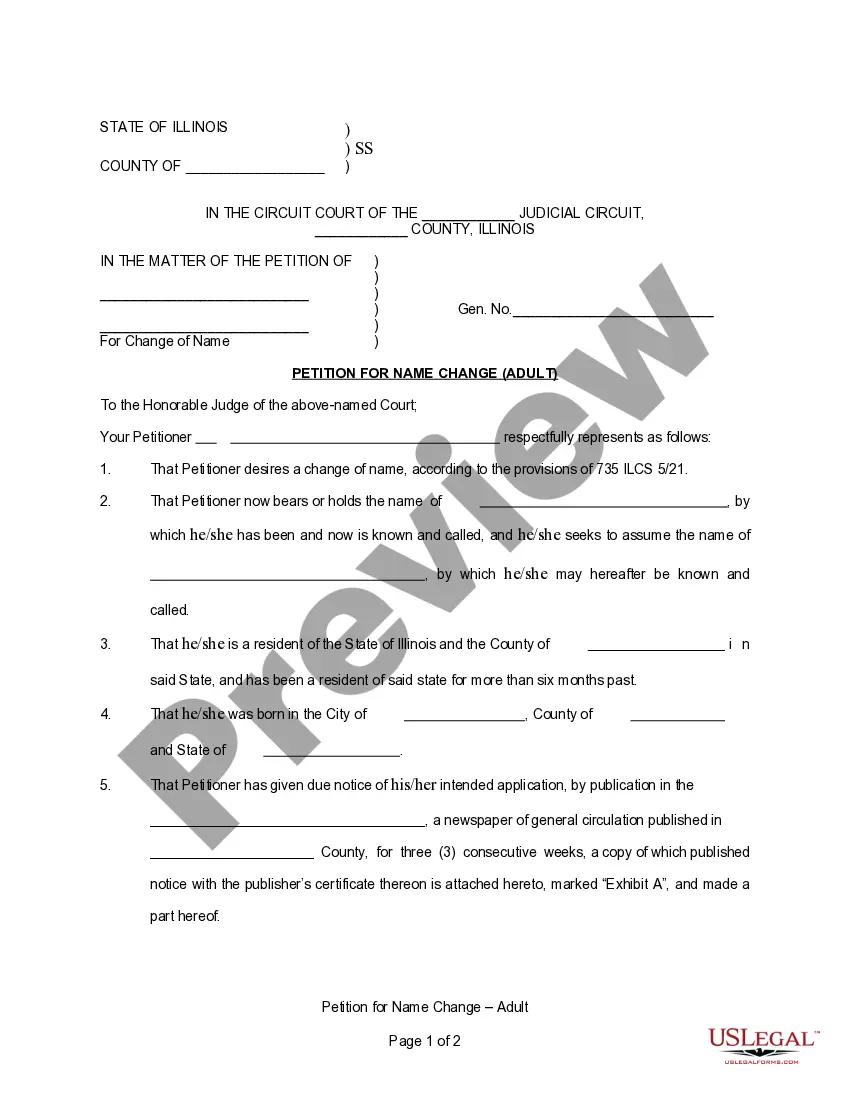

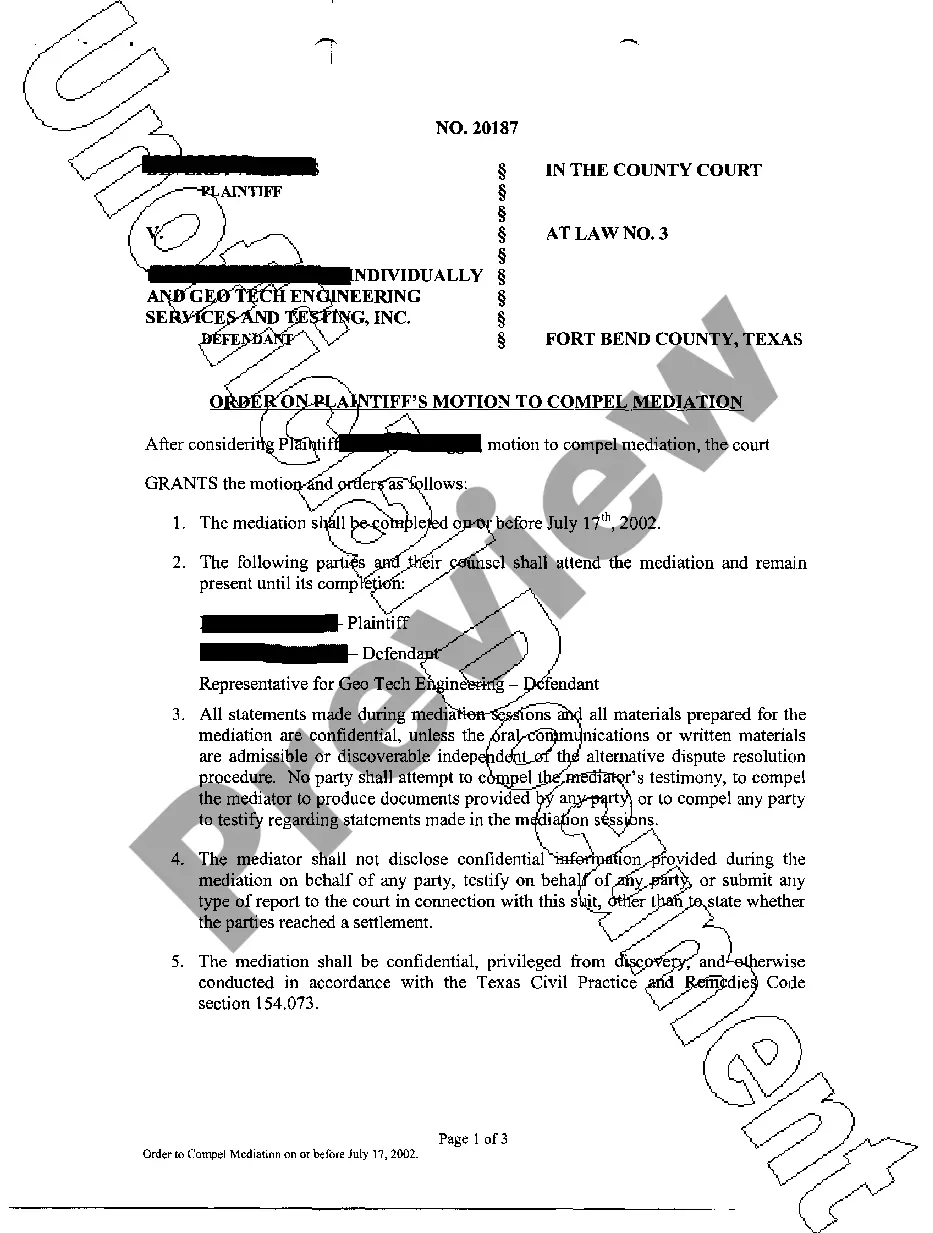

Our online library of more than 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant templates carefully prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Any Creditor Debt Without A Loan. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes little to no time to set it up and navigate the catalog. But before jumping straight to downloading Any Creditor Debt Without A Loan, follow these recommendations:

- Check the document preview and descriptions to ensure that you have found the document you are looking for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Any Creditor Debt Without A Loan.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

Credit card debt can be tackled with debt settlement programs or filing for bankruptcy. Some of these options can help you get much-needed temporary financial relief. Still, there are drawbacks to consider, including the risk of being sued or selling assets.

Bankruptcy will allow you to discharge your unsecured debt like credit card debt, old utility and rent bills, payday loans, unsecured personal loans, and medical bills. If you're low-income, you can file a Chapter 7 bankruptcy. You'll have to take an eligibility test called a Means Test.

A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you. If the account has been sold to another creditor, that creditor must prove that it has the right to sue to collect the debt.

You can sue the debt collector for violating the FDCPA. If you sue under the FDCPA and win, the debt collector must generally pay your attorney's fees and may also have to pay you damages. If you're having trouble with debt collection, you can submit a complaint with the CFPB.

Explain your current situation. Tell them your family income is reduced and you are not able to keep up with your payments. Frankly discuss your future income prospects so you and your creditors can figure out solutions to the problem.