Interest States Sample Formula

Description

How to fill out Assignment Of Interest In United States Patent?

Creating legal documents from the ground up can frequently be intimidating.

Various situations may require extensive research and significant expenses.

If you’re looking for a simpler and more cost-effective method of generating Interest States Sample Formula or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers almost every facet of your financial, legal, and personal affairs.

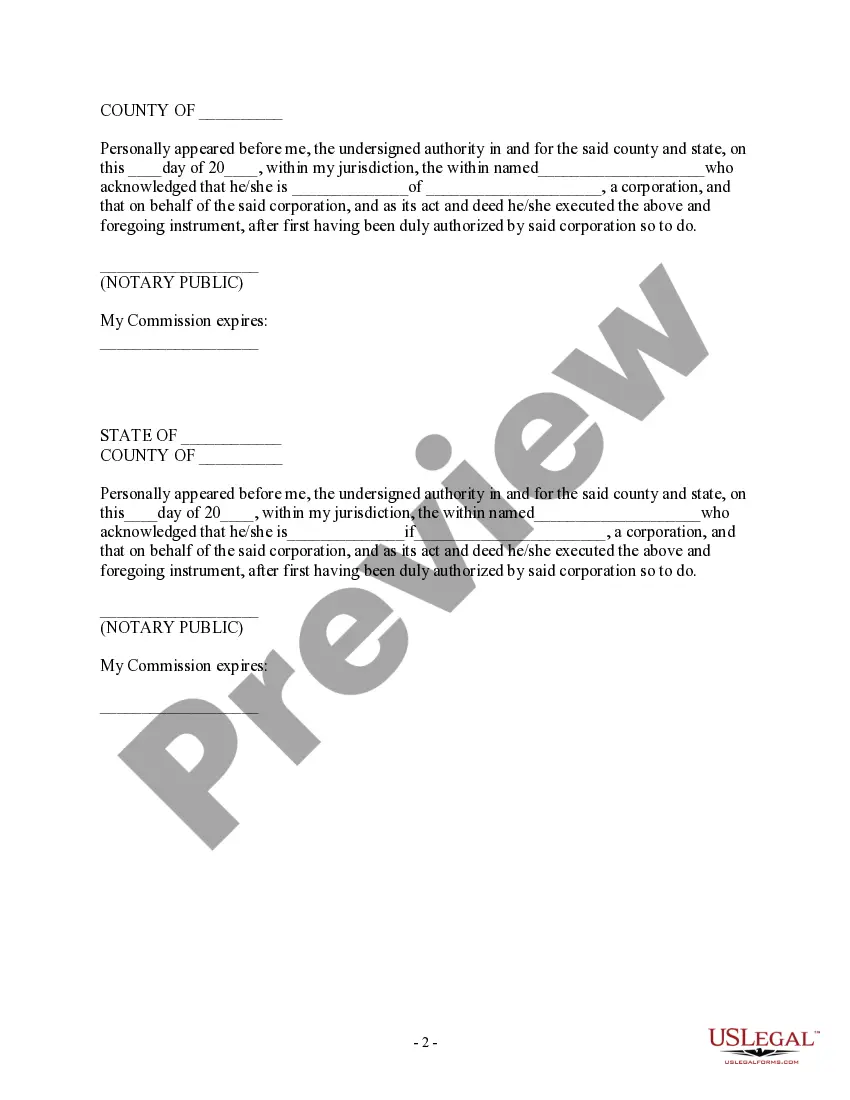

However, before directly downloading the Interest States Sample Formula, adhere to the following guidelines: Review the document preview and descriptions to ensure you have located the correct document. Verify that the form you choose aligns with the regulations and laws of your state and county. Select the most appropriate subscription plan to acquire the Interest States Sample Formula. Download the file, then complete, validate, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and simplify document processing into a straightforward and efficient task!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require dependable services through which you can effortlessly locate and download the Interest States Sample Formula.

- If you're familiar with our services and have previously registered with us, simply Log In to your account, find the form, and download it, or re-download it anytime from the My documents section.

- Don’t have an account? No problem. It only takes a few minutes to create one and browse the catalog.

Form popularity

FAQ

If you borrow $1,000 from a bank for one year and have to pay an agreed $60 in interest for that year, your stated interest rate is 6%. Here is the calculation: Stated interest rate = Interest ÷ Principal. = $60 ÷ $1,000 = 6%

= P × R × T, Where, P = Principal, it is the amount that initially borrowed from the bank or invested. R = Rate of Interest, it is at which the principal amount is given to someone for a certain time, the rate of interest can be 5%, 10%, or 13%, etc., and is to be written as r/100.

Simple Interest Calculation: Formula: Simple Interest (SI) = Principal (P) x Rate (R) x Time (T) / 100.

Simple interest is calculated by multiplying the principal, the amount of money that is initially invested or borrowed, by the rate, the speed at which the interest grows, and the time, how long money is being invested or borrowed. In other words, the formula for simple interest is I = P R T .

The formula to calculate compound interest is to add 1 to the interest rate in decimal form, raise this sum to the total number of compound periods, and multiply this solution by the principal amount. The original principal amount is subtracted from the resulting value.