Assignment Of Inheritance Without A Will

Description

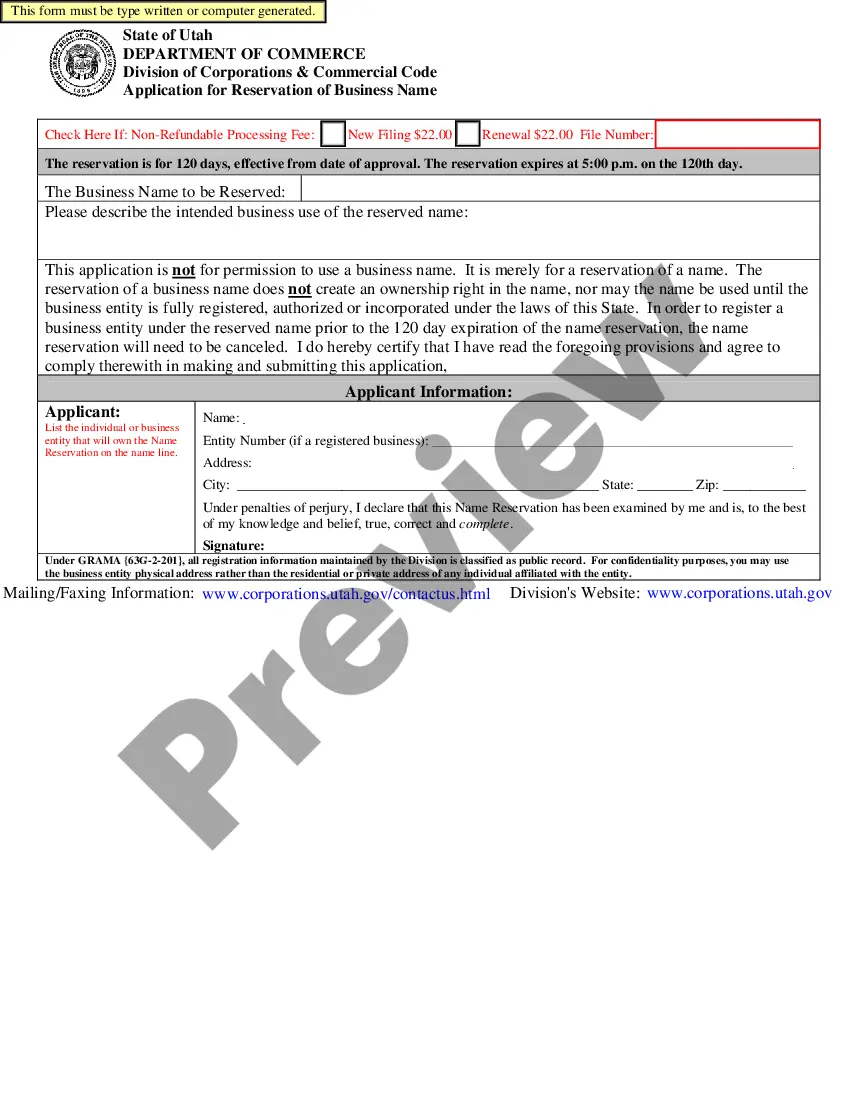

How to fill out Assignment Of Portion Of Expected Interest In Estate In Order To Pay Indebtedness?

Creating legal documents from the ground up can occasionally be intimidating. Certain situations might require extensive research and significant financial investment.

If you seek a more straightforward and cost-effective method for preparing Assignment Of Inheritance Without A Will or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously prepared for you by our legal experts.

Utilize our platform whenever you require trusted and dependable services through which you can effortlessly locate and download the Assignment Of Inheritance Without A Will. If you’re a returning customer and have previously established an account with us, simply Log In to your account, choose the template, and download it immediately or re-download it anytime later in the My documents section.

Download the file, then complete, sign, and print it out. US Legal Forms prides itself on a flawless reputation and over 25 years of experience. Join us today and make document completion a hassle-free and efficient process!

- Don’t possess an account? No problem. It only takes a few minutes to register and browse the catalog.

- Before proceeding to download Assignment Of Inheritance Without A Will, consider these suggestions.

- Review the form preview and descriptions to confirm that you have located the document you need.

- Ensure that the template you select adheres to the laws and regulations of your state and county.

- Select the appropriate subscription plan to obtain the Assignment Of Inheritance Without A Will.

Form popularity

FAQ

Assignments are executed in writing and delivered to the executor of the estate. An assignment must be filed with the probate court before the transfer can be done. If you are thinking of assigning your inheritance, you need to note that assignments create tax issues for both the assignor and assignee.

Distribution of assets if there is no will For a New York resident without a will, a surviving spouse inherits the entire probate estate if there are no children or other descendants.

If you die without a will in Michigan, also known as intestate, state law and the probate court will control the distribution of your estate. Your assets will be distributed to legally recognized beneficiaries ing to intestacy succession law.

For a New York resident without a will, a surviving spouse inherits the entire probate estate if there are no children or other descendants. If there are descendants, the surviving spouse gets the first $50,000 and the balance is divided one-half to the spouse and one-half to the decedent's descendants.

If a person dies without a will they are considered intestate "without a will". Therefore that person's property and estate is distributed ing to the state that is their home state. Real property is handled ing to state law. The distribution of all property is by relationship to the deceased.