Gm Financial Non-Funded Lien Release: A Comprehensive Guide Introduction: A Gm Financial Non-Funded Lien Release refers to a legal document issued by Gm Financial, a leading automotive financing company, to release a non-funded lien on a vehicle. This lien release is typically provided once the borrower has paid off their loan or fulfilled their financial obligations related to the vehicle. It serves as proof that the lien holder no longer has any claim on the vehicle. Keywords: Gm Financial, non-funded lien release, automotive financing, legal document, lien holder, loan fulfillment, vehicle ownership. Types of Gm Financial Non-Funded Lien Release: 1. Standard Non Funded Lien Release: The Standard Non-Funded Lien Release is the most common type provided by Gm Financial. It is issued to borrowers who have successfully paid off their auto loan, enabling them to obtain a clear title to their vehicle. Keywords: Standard Non-Funded Lien Release, auto loan, clear title. 2. Partial Non Funded Lien Release: In certain cases, borrowers may want to remove a specific portion of the lien on their vehicle. Gm Financial can issue a Partial Non-Funded Lien Release to release only a portion of the lien while still maintaining a claim over the remaining balance. Keywords: Partial Non-Funded Lien Release, specific portion, maintaining claim. 3. Prioritized Non Funded Lien Release: A Prioritized Non-Funded Lien Release is granted to borrowers who need to prioritize the release of a lien over a vehicle due to various reasons such as selling or refinancing the vehicle. It expedites the lien release process and allows the borrower to proceed with their intended transaction promptly. Keywords: Prioritized Non-Funded Lien Release, expedite, selling, refinancing, transaction. 4. Escrow Non-Funded Lien Release: In situations where the vehicle's ownership is under dispute or held in escrow, Gm Financial may issue an Escrow Non-Funded Lien Release. This document releases the lien but transfers any financial responsibilities associated with the lien to the designated escrow holder until the dispute is resolved. Keywords: Escrow Non-Funded Lien Release, ownership dispute, escrow holder, financial responsibilities. Conclusion: A Gm Financial Non-Funded Lien Release is an essential document that releases the lien holder's claim on a vehicle, providing borrowers with proof of ownership and the ability to proceed with various transactions seamlessly. The types of non-funded lien releases offered by Gm Financial cater to different circumstances, ensuring flexibility and convenience for borrowers. Keywords: Gm Financial, non-funded lien release, proof of ownership, convenience, flexibility.

Gm Financial Non Funded Lien Release

Description

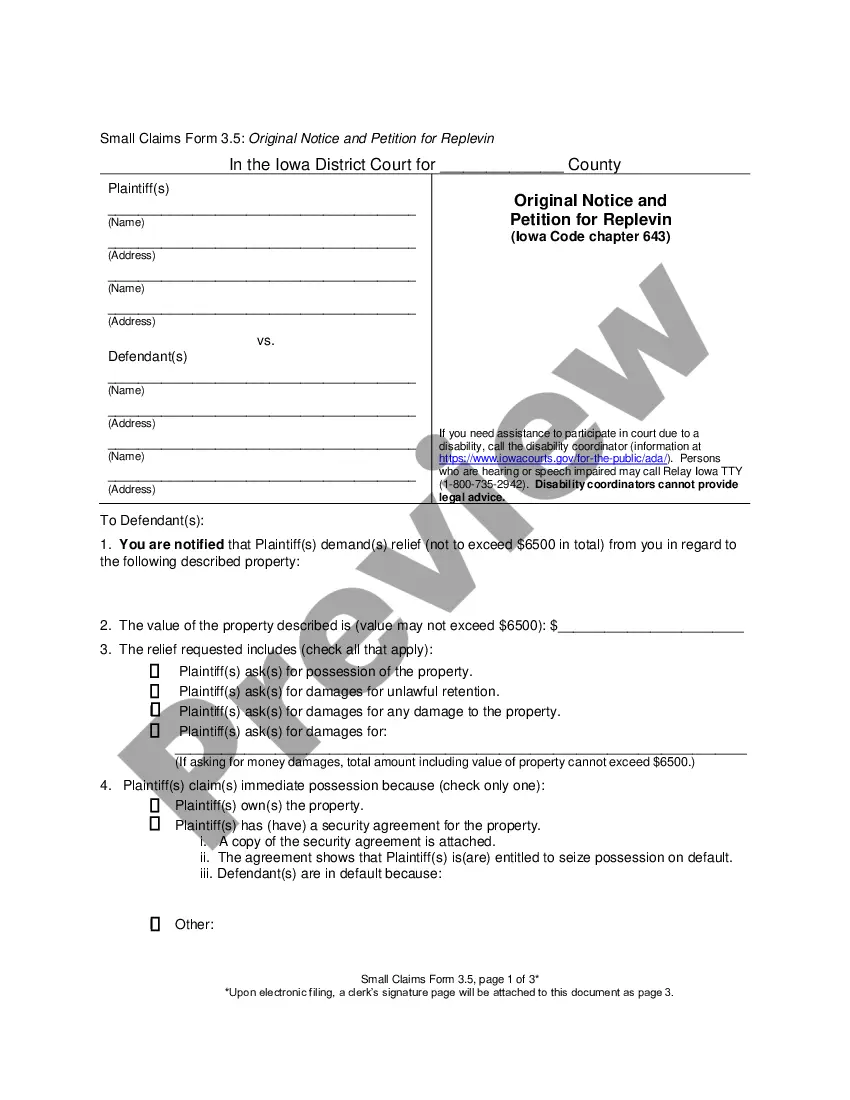

How to fill out Waiver And Release Of Lien By Contractor?

Whether for business purposes or for individual matters, everybody has to handle legal situations at some point in their life. Completing legal documents needs careful attention, starting with selecting the appropriate form sample. For example, when you choose a wrong version of the Gm Financial Non Funded Lien Release, it will be turned down once you submit it. It is therefore crucial to get a trustworthy source of legal documents like US Legal Forms.

If you need to get a Gm Financial Non Funded Lien Release sample, follow these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it matches your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to locate the Gm Financial Non Funded Lien Release sample you require.

- Get the template when it meets your requirements.

- If you already have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the file format you want and download the Gm Financial Non Funded Lien Release.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time searching for the right template across the internet. Use the library’s simple navigation to get the appropriate template for any situation.

Form popularity

FAQ

It's possible to negotiate a lease buyout with GM. However, with used car prices at record highs, GM is less likely to agree to a lower buyout price. Additionally, since GM dealers stopped allowing third-party buyouts, they may not be willing to negotiate.

You will typically receive a title or lien release, depending on the state the vehicle is titled in, 30 days after your account is paid in full (or earlier as required by state law).

Early payments Whenever you make a payment with GM Financial, any accrued interest is paid first. So, if you make a payment early, less interest will have accrued and more of your payment will go toward the principal.

Payments MyAccount: Pay online or on the GM Financial Mobile app. Paying online with a bank account is free, but debit payments may have a fee. ... Phone: Call us to pay. However, there may be a fee. Mail: You can send a check or money order via mail to pay your bill. View our mail FAQ for the correct address.

You will typically receive a title or lien release, depending on the state the vehicle is titled in, 30 days after your account is paid in full (or earlier as required by state law).