Car Title Lien Release Letter Without Title

Description

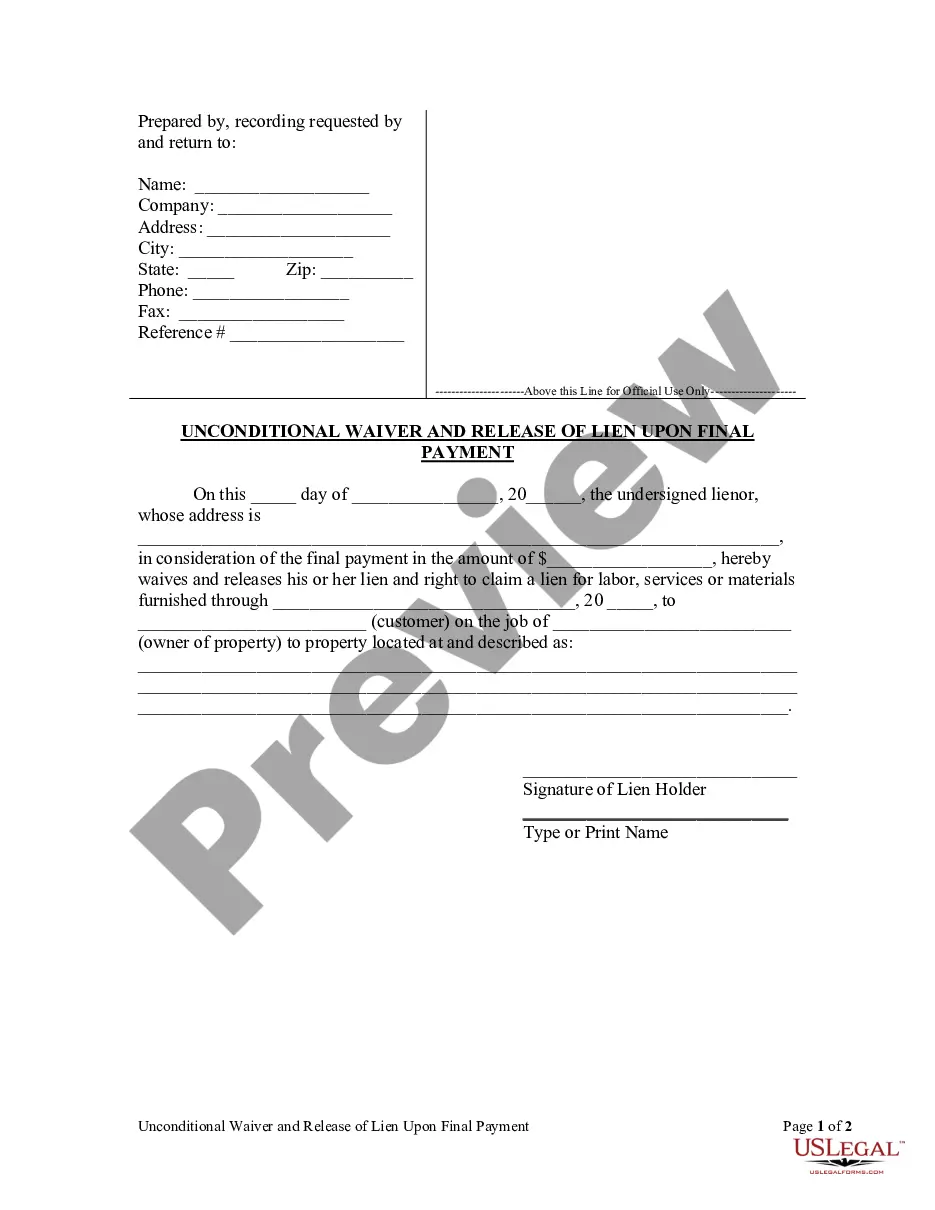

How to fill out Waiver And Release Of Lien By Contractor?

Securing a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents demands precision and meticulousness, which is why it is crucial to acquire Car Title Lien Release Letter Without Title samples solely from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and delay your situation. With US Legal Forms, you have minimal concerns. You can access and review all details regarding the document’s applicability and significance for your situation and in your region.

After acquiring the form on your device, you can edit it using the editor or print it and complete it manually. Eliminate the hassle associated with your legal documentation. Discover the vast US Legal Forms library where you can locate legal templates, verify their relevance to your needs, and download them instantly.

- Use the catalog navigation or search function to find your template.

- Examine the form’s details to determine if it meets the requirements of your region.

- Check the form preview, if available, to confirm the template is indeed what you need.

- Return to the search and seek the correct document if the Car Title Lien Release Letter Without Title does not match your needs.

- Once you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to obtain the template.

- Select the pricing option that fits your requirements.

- Proceed to the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Car Title Lien Release Letter Without Title.

Form popularity

FAQ

If you've lost your lien release, don't worry; you can still obtain a new one. Reach out to the lender or lienholder to request a replacement document, as they are required to provide you with a copy. In the meantime, having a car title lien release letter without title can help you prove ownership while you await the new release. US Legal Forms offers resources to assist you in navigating this situation effectively.

A lien release is a document that indicates a lender has relinquished their claim to a vehicle, while a title serves as proof of ownership. When you have a car title lien release letter without title, it proves that you have settled any debts associated with the vehicle. This release is crucial for transferring ownership or registering the vehicle. You can easily acquire a lien release template through US Legal Forms, ensuring you complete the process correctly.

If you find yourself without a title, obtaining a car title lien release letter without title is your best option. Start by contacting the lender or the lienholder to request this letter, as it serves as proof that the lien has been satisfied. Additionally, you can apply for a duplicate title through your state's Department of Motor Vehicles. Using US Legal Forms can simplify this process, providing you with the necessary templates and guidance.

Releasing a Lien On a motor vehicle, trailer, manufactured home, vessel, or outboard motor, Sections 301.640, 306.420, and 700.370, RSMo require the lienholder to release the lien on a separate document within 5 business days after the lien is satisfied. The release document shall be notarized.

After the lien on a vehicle is paid off, the lienholder has 10 days after receipt of payment to release the lien. If the lien was recorded on a paper title, the lienholder mails the title to you.

Remove a lienholder if you have an original or certified copy of your title Schedule a title transfer appointment with the tax office. Complete the Application for Texas Title (130-U) Provide your original release of lien letter or document and a valid photo ID. Pay the $33 application fee for a new title.

Requesting the Re-Issuance of a Lien Free Title You must provide the New Jersey title endorsed with a lien or the New Jersey title with the lien satisfaction letter attached. The fee is $60.

5 Ways To Remove A Lien From A Car Title #1: Lien release letter. #2: Letter of non-interest. #3: The lender was shut down. #4: The lender went out of business. #5: Court-ordered title. BONUS: Your lien may have already been discharged by your state.