Testamentary Trusts For Dummies

Description

How to fill out Testamentary Trust Provision In Will With Spouse To Receive A Life Estate In Farm Land With Remainder Interest In Land To Pass To Trust For The Benefit Of Children?

- If you’re a returning user, log in to your account and click on the Download button to retrieve your necessary form, ensuring your subscription is active.

- For first-time users, start by exploring the Preview mode to find the right testamentary trust template that fulfills your local jurisdiction requirements.

- If the selected template doesn't meet your needs, utilize the Search tab above to explore other options and choose the appropriate form.

- Once you've found the suitable document, click on the Buy Now button and select a subscription plan that fits your needs; you'll need to create an account for access.

- Complete your purchase by entering your payment details or using your PayPal account for seamless transaction.

- Download the template to your device and keep it saved in your profile’s My Forms section for easy access in the future.

US Legal Forms is committed to empowering users by providing a vast selection of over 85,000 editable legal forms, making it easier than ever to create professional-grade legal documents.

Get started today to ensure your testamentary trusts are set up correctly and efficiently—visit US Legal Forms and take control of your legal needs!

Form popularity

FAQ

The benefits of a testamentary trust include asset protection, clear distribution instructions, and potential tax advantages. This type of trust helps avoid probate, ensuring quicker access to funds for your beneficiaries. By learning about testamentary trusts for dummies, you can maximize the benefits for your loved ones and create a legacy that reflects your wishes.

Someone might need a testamentary trust to maintain control over their assets even after they have passed away. This trust can help manage distributions for young children or beneficiaries who may not be financially responsible. Using testamentary trusts for dummies can simplify the complex process of estate planning.

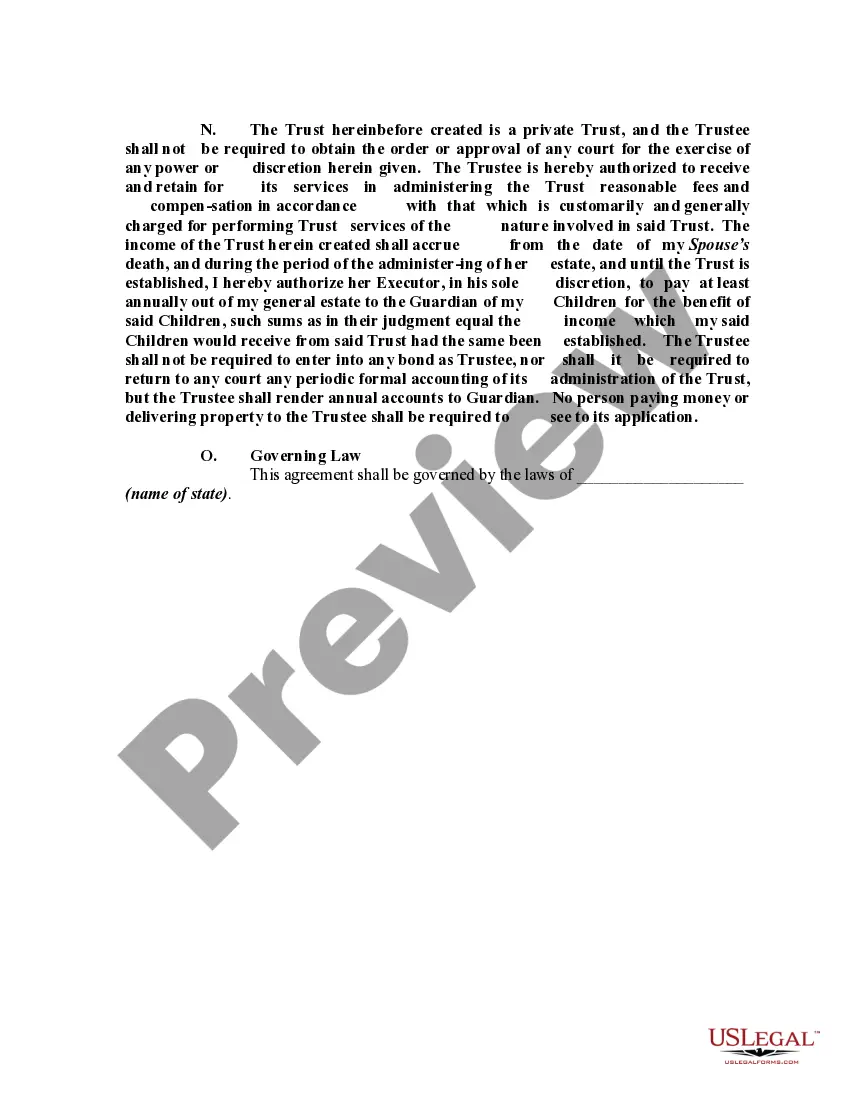

In simple terms, a testamentary trust is a legal arrangement created in a will that takes effect after death. It allows you to specify how and when your assets will be distributed to your heirs. Understanding testamentary trusts for dummies can make it easier to plan your estate effectively.

The point of a testamentary trust is to manage and distribute your assets according to your wishes after you die. This type of trust offers control over when and how your beneficiaries receive their inheritance. By employing testamentary trusts for dummies, you ensure that your dependents are taken care of in a structured manner.

Testamentary trusts for dummies are set up through a will and only take effect after the creator passes away. In contrast, normal trusts, or living trusts, are established during a person's lifetime and can be managed while they are still alive. This primary difference highlights when the trust becomes active and how it is managed.

An example of a testamentary trust might involve a parent who creates the trust to provide for their children after their death. The trust could specify that the funds will be used for education expenses until the children turn 25. Such specific stipulations ensure that the creator's intentions are met. To learn more about how this process works, utilize resources on testamentary trusts for dummies.

One significant disadvantage of a testamentary trust is that it generally goes through probate, which can be a lengthy legal process. This may delay the beneficiaries’ access to assets and increase the costs associated with the estate. Understanding these challenges is crucial when considering a testamentary trust. For clarity, exploring testamentary trusts for dummies will simplify this complex issue.

A testamentary trust offers several advantages, including control over asset distribution, protection for minor children, and potential tax benefits. However, it also has disadvantages such as potential delays in asset distribution and higher legal fees associated with its administration. Weighing both sides can help you determine if this option suits your needs. Gaining insights from testamentary trusts for dummies can aid in your understanding.

The lifespan of a testamentary trust usually lasts until the trust's terms are fulfilled, often when beneficiaries reach a designated age. However, some trusts may continue for a longer period if they are set up to manage assets or income over time. The specific duration can vary based on the wishes of the individual who created the trust. Learning about testamentary trusts for dummies can provide clearer details on this matter.

In a testamentary trust, the trustee holds legal ownership of the assets for the benefit of the beneficiaries. This arrangement allows the trustee to manage, invest, and distribute the assets according to the terms laid out in the trust. While beneficiaries have equitable rights to the assets, they do not have direct ownership until the trust terminates. For more insights, you can explore testamentary trusts for dummies.