Default Promissory Note With Collateral Sample

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Individuals frequently equate legal documents with complexities that require the attention of an expert.

In a certain sense, this holds true, as creating a Default Promissory Note With Collateral Sample requires significant knowledge of relevant criteria, including state and local laws.

Nevertheless, with US Legal Forms, the process has become simpler: a collection of ready-made legal templates for various life and business situations tailored to state regulations is gathered in one online library and is now accessible to all.

Choose the format for your sample and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once obtained, they remain in your profile for future access whenever necessary through the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms categorized by state and purpose, making it easy to find a Default Promissory Note With Collateral Sample or any other specific template in just a few minutes.

- Previously registered users with an active subscription must Log In to their accounts and click Download to retrieve the form.

- New users to the platform will first need to register for an account and subscribe before they can save any documentation.

- Here’s a step-by-step guide on how to obtain the Default Promissory Note With Collateral Sample.

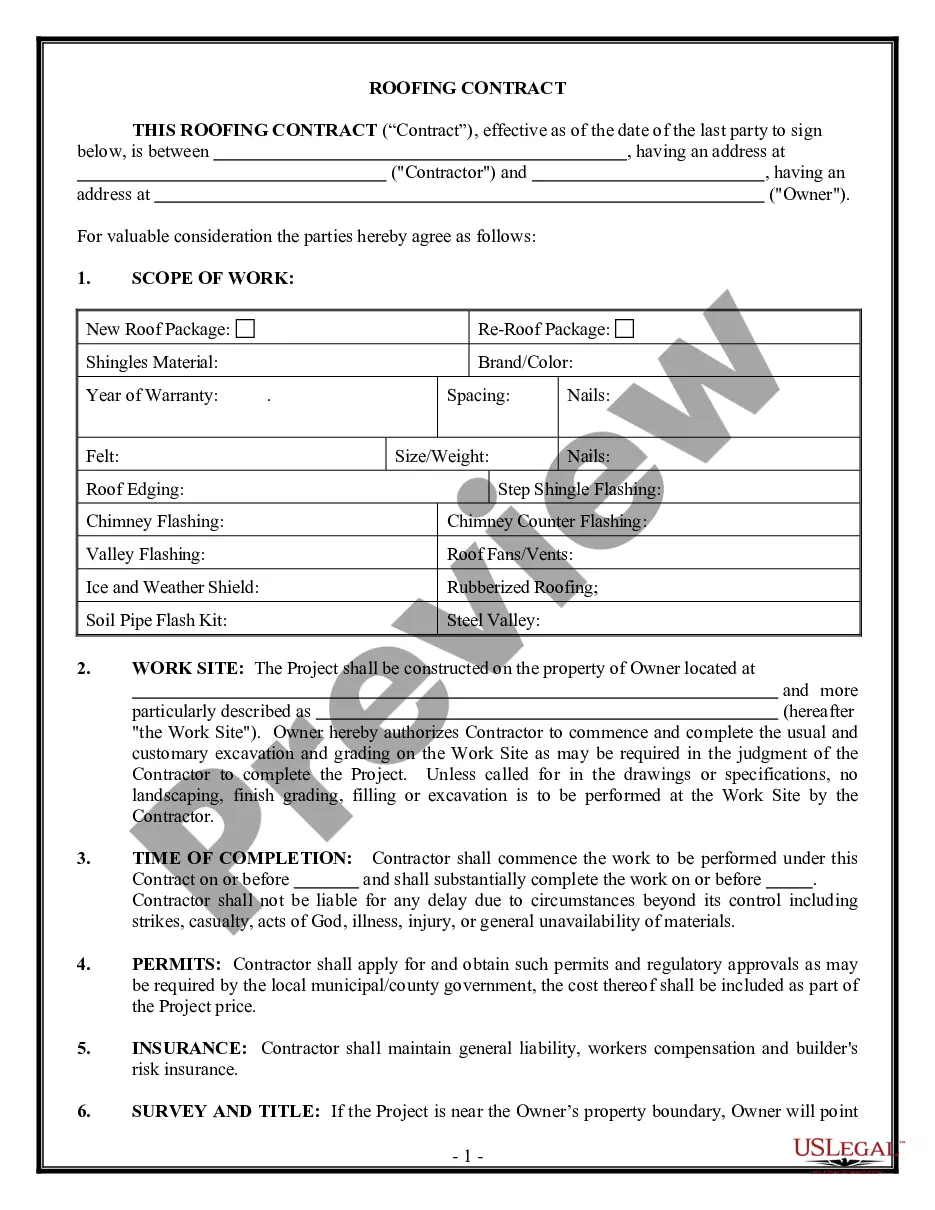

- Examine the page content carefully to ensure it meets your requirements.

- Review the form description or check it using the Preview feature.

- If the previous sample does not meet your needs, find another sample using the Search field above.

- Once you find the appropriate Default Promissory Note With Collateral Sample, click Buy Now.

- Select a subscription plan that aligns with your preferences and financial situation.

- Register for an account or Log In to continue to the payment page.

- Complete your payment for the subscription using PayPal or your credit card.

Form popularity

FAQ

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to sign a loan agreement onlineLoad the loan agreement template.Fill in the lender and borrower information.Specify the loan amount and the date of the loan.Specify the loan delivery method.Fill in the details of the loan repayment schedule and regular payment options.More items...

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.