Mortgage Broker Agreement Form

Description

How to fill out Agreement For Broker To Act As Agent Of Buyer?

There's no longer a necessity to squander time searching for legal documents to adhere to your local state requirements. US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our website offers over 85k templates for any business and personal legal matters organized by state and area of use. All forms are properly drafted and verified for accuracy, so you can trust in obtaining an up-to-date Mortgage Broker Agreement Form.

If you are acquainted with our service and already have an account, you need to verify your subscription is active before acquiring any templates. Log In to your account, select the document, and click Download. You can also revisit all saved documents whenever needed by accessing the My documents tab in your profile.

Print your form to fill it out by hand or upload the sample if you prefer to work with an online editor. Preparing formal documents under federal and state laws is quick and straightforward with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you've never used our service before, the process will involve a few more steps to complete.

- Here's how new users can find the Mortgage Broker Agreement Form in our catalog.

- Examine the page content attentively to ensure it includes the sample you need.

- To do so, utilize the form description and preview options if available.

- Use the Search bar above to look for another template if the current one isn't suitable.

- Click Buy Now next to the template title when you discover the appropriate one.

- Choose the most suitable subscription plan and create an account or Log In.

- Make payment for your subscription with a card or via PayPal to continue.

- Select the file format for your Mortgage Broker Agreement Form and download it to your device.

Form popularity

FAQ

Top 10 Questions to Ask Your Mortgage BrokerWhich type of loan is best?Who is on your panel of lenders?What information do I need to have ready for my home loan application?What is the Interest Rate?What are the fees on the loan?Can I lock in my mortgage interest rate between now and settlement?More items...

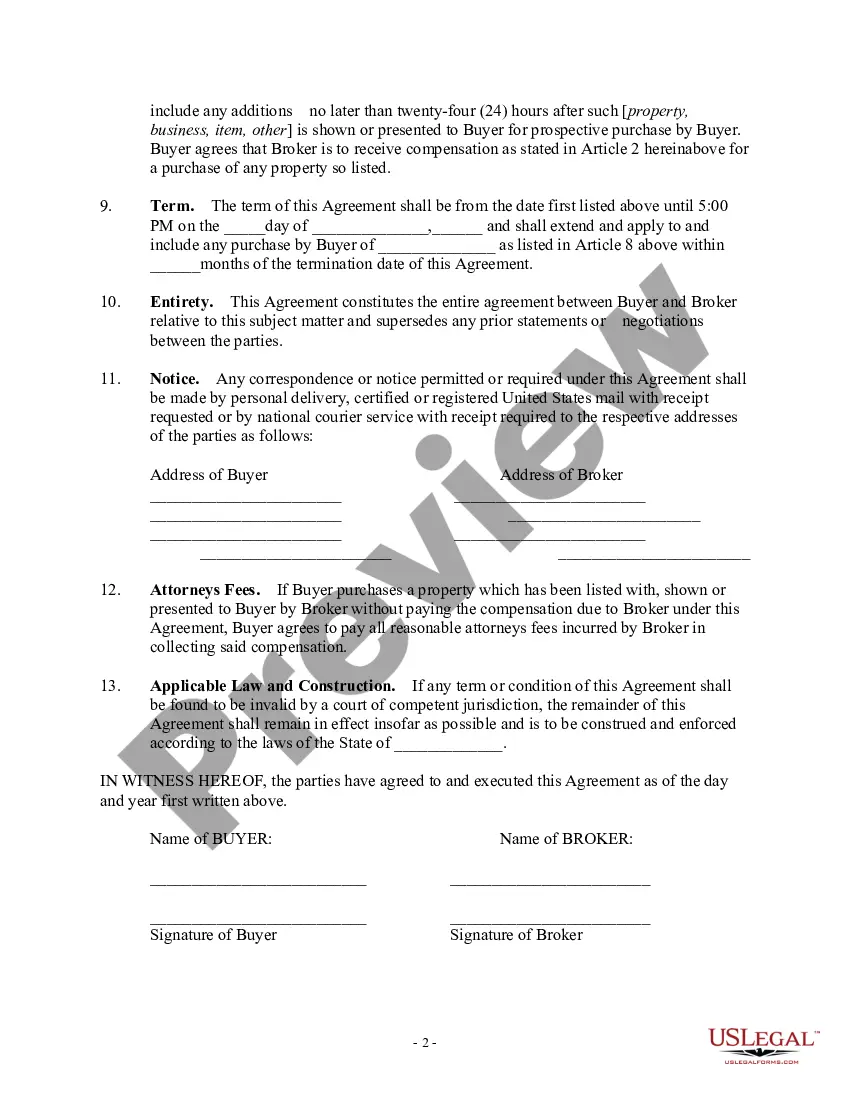

A mortgage broker agreement is a contract that outlines the terms of service and compensation, typically between a bank and a mortgage company or brokerage. Both parties sign this document before any work begins, ensuring that expectations are clear from the beginning.

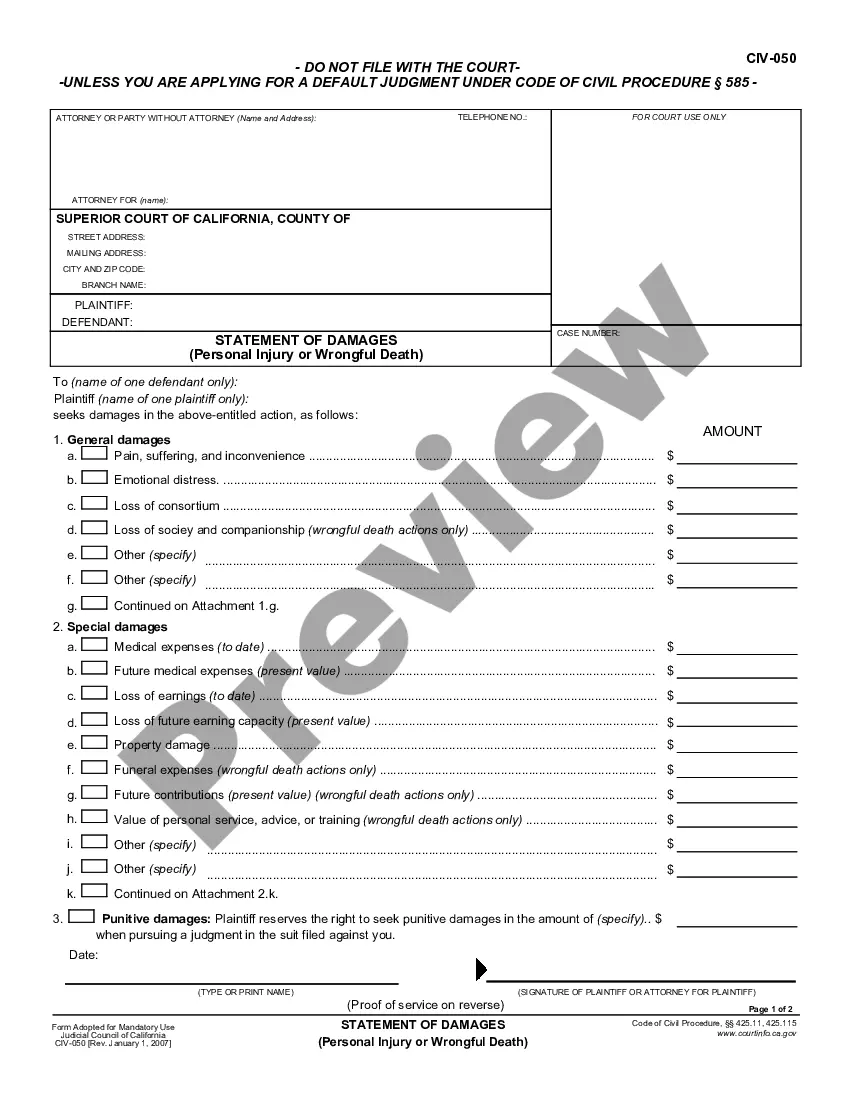

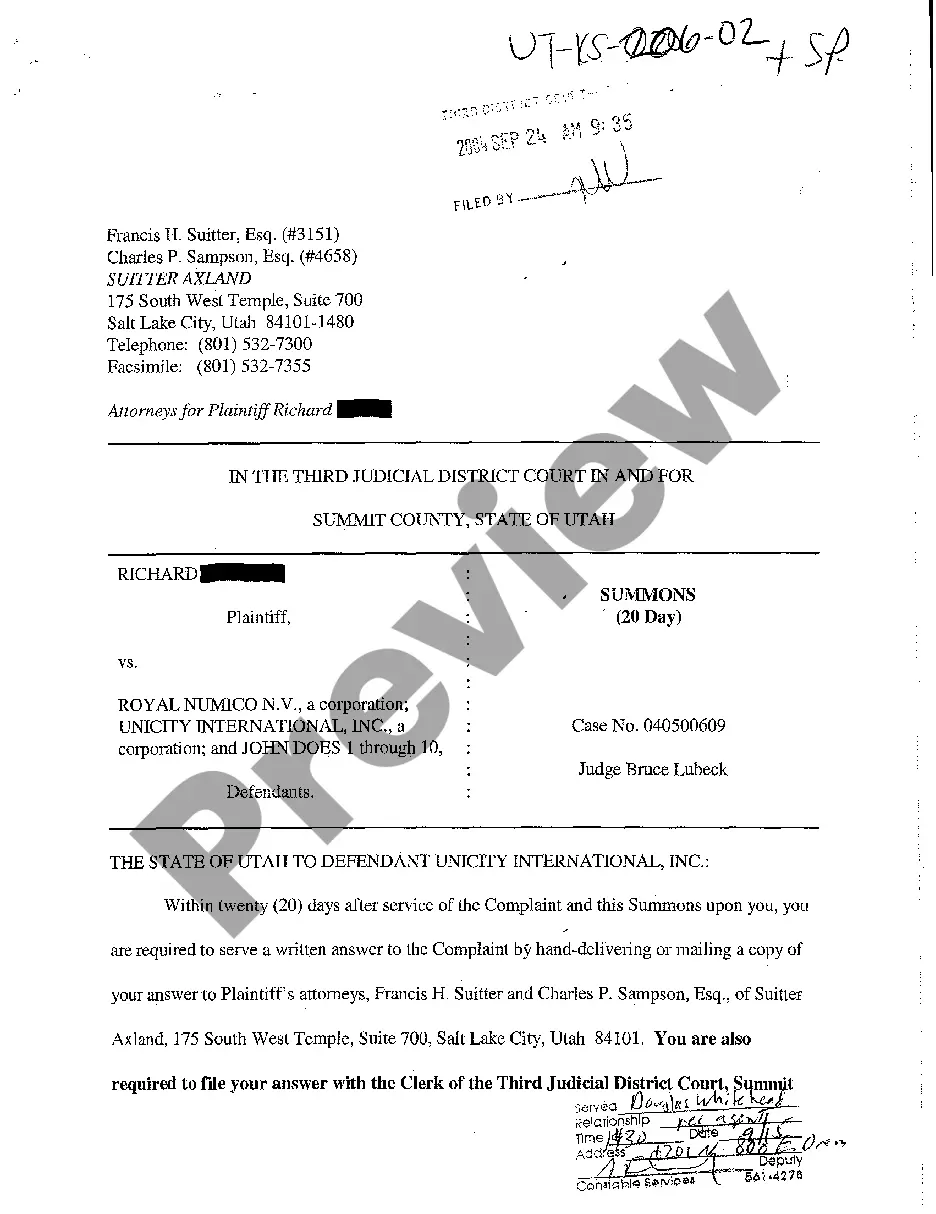

Mortgage Documents Each document can range from 1 to 25 pages and play a critical role in the processing of a loan.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.

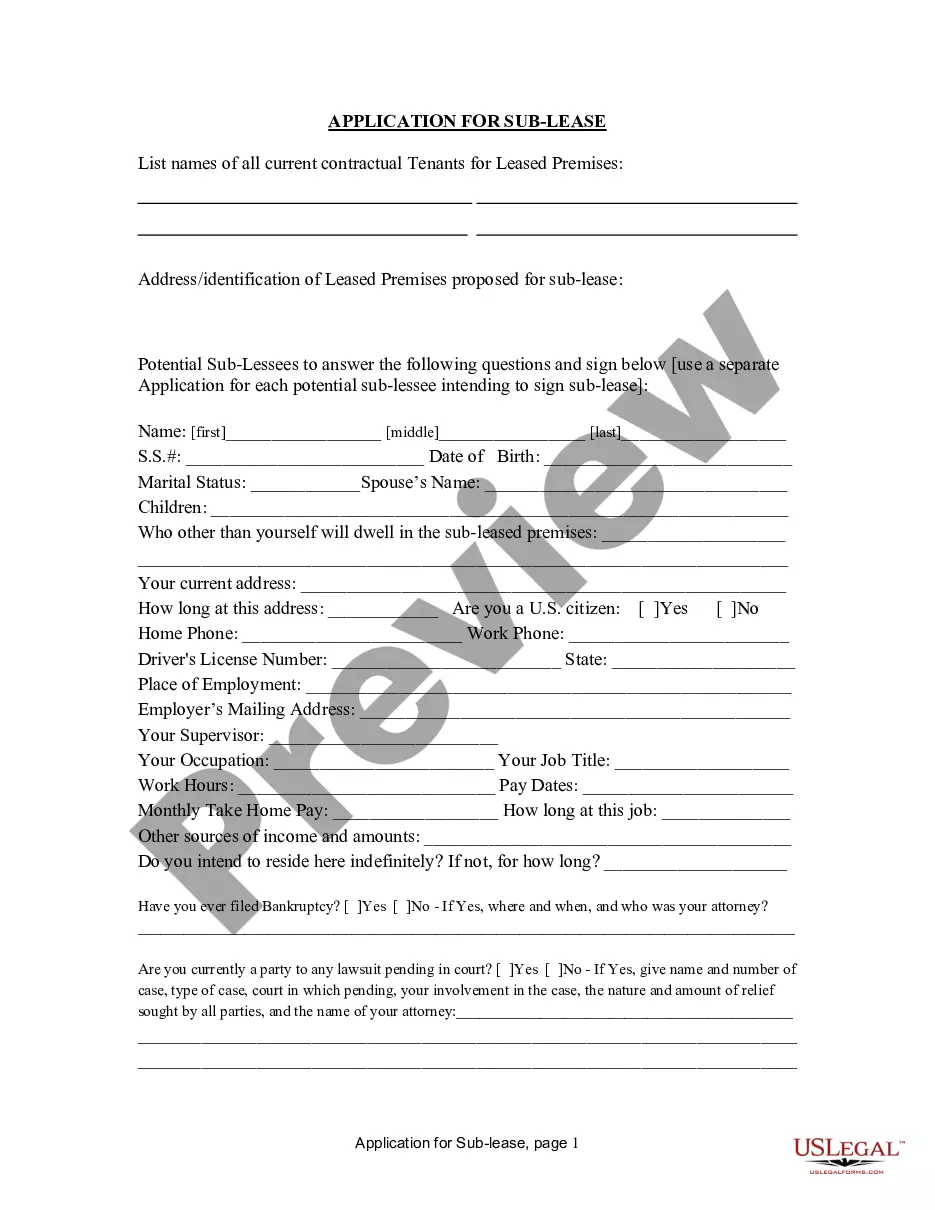

A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.