Cause Statute Limitations For Credit Card Debt

Description

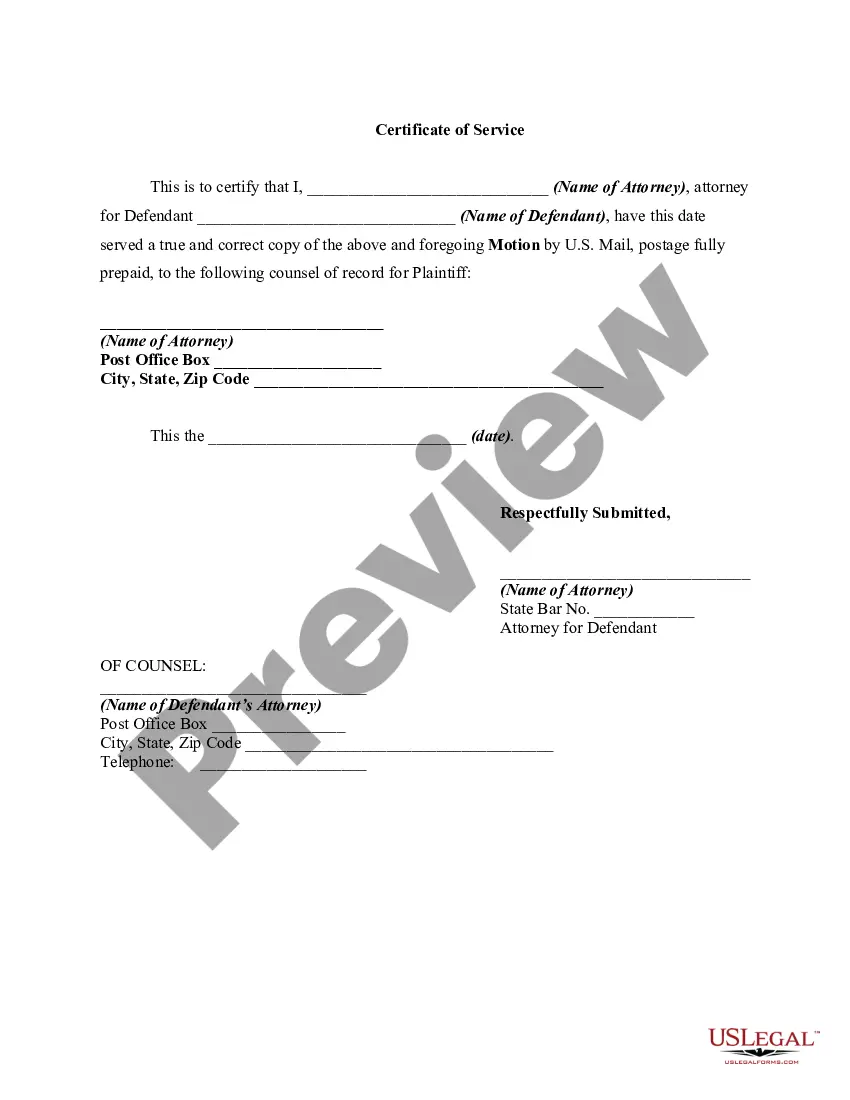

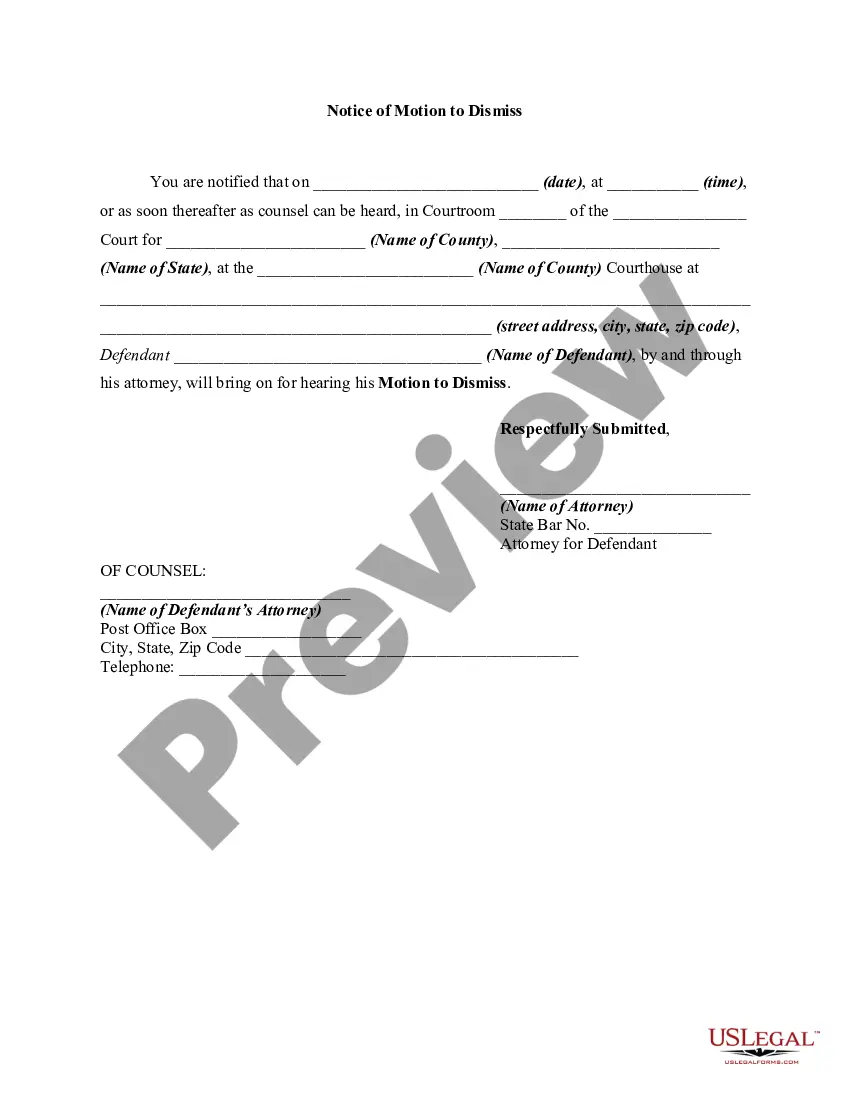

How to fill out Motion To Dismiss Action With Prejudice Of Plaintiff's Cause Of Action Barred By Statute Of Limitations?

Dealing with legal paperwork and operations might be a time-consuming addition to the day. Cause Statute Limitations For Credit Card Debt and forms like it typically require you to look for them and navigate the way to complete them effectively. As a result, if you are taking care of financial, legal, or personal matters, using a extensive and practical online library of forms at your fingertips will go a long way.

US Legal Forms is the number one online platform of legal templates, offering over 85,000 state-specific forms and numerous resources to assist you complete your paperwork effortlessly. Discover the library of pertinent documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Shield your document management procedures using a top-notch service that lets you prepare any form within minutes with no additional or hidden fees. Simply log in to the profile, identify Cause Statute Limitations For Credit Card Debt and acquire it straight away from the My Forms tab. You may also gain access to formerly downloaded forms.

Is it the first time utilizing US Legal Forms? Register and set up up your account in a few minutes and you’ll gain access to the form library and Cause Statute Limitations For Credit Card Debt. Then, adhere to the steps below to complete your form:

- Ensure you have discovered the proper form by using the Review feature and looking at the form description.

- Pick Buy Now as soon as ready, and select the monthly subscription plan that suits you.

- Select Download then complete, eSign, and print the form.

US Legal Forms has 25 years of experience assisting consumers manage their legal paperwork. Find the form you require right now and enhance any operation without having to break a sweat.

Form popularity

FAQ

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

If you write a letter, instead of using the tear-off form, the debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or ...

Canadian legislation states that creditors and collection agents cannot take legal action against you if it has been six years or more from the date that you last acknowledged the debt. In many Canadian provinces, this time period is even shorter.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.