Custody Agreement Template Pa For Unmarried Parents

Description

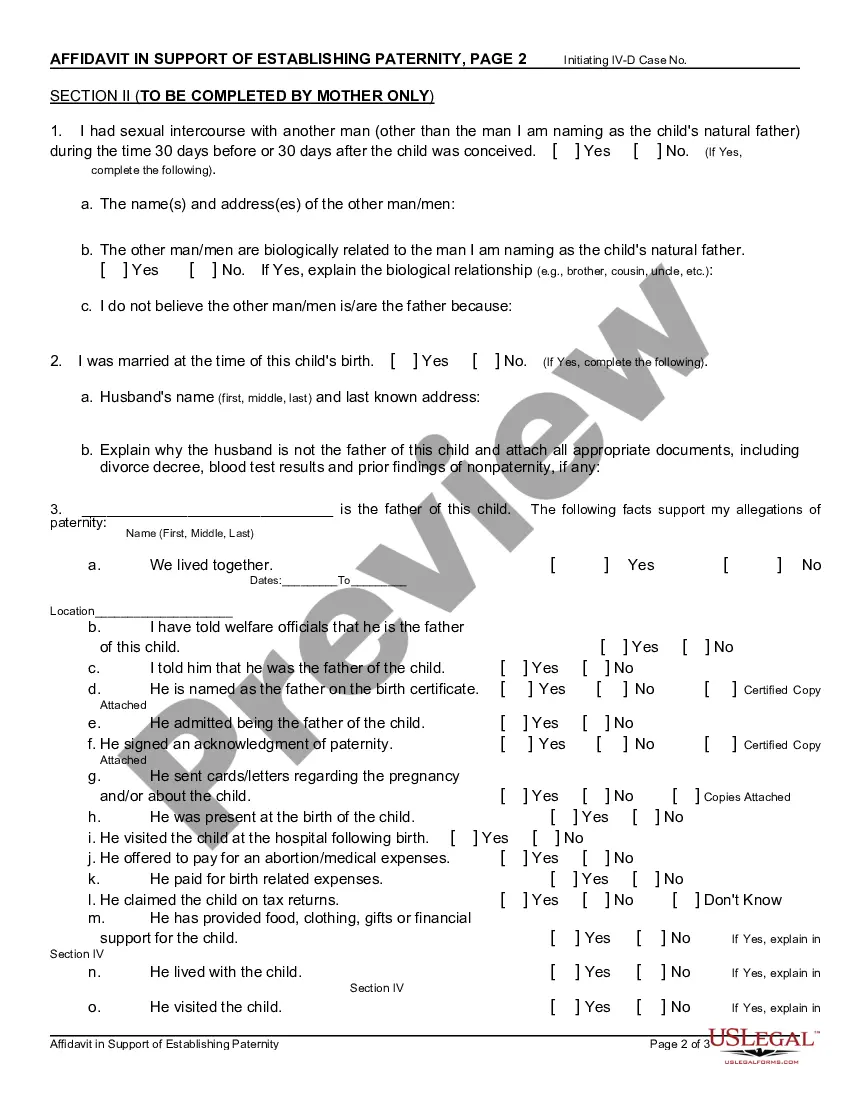

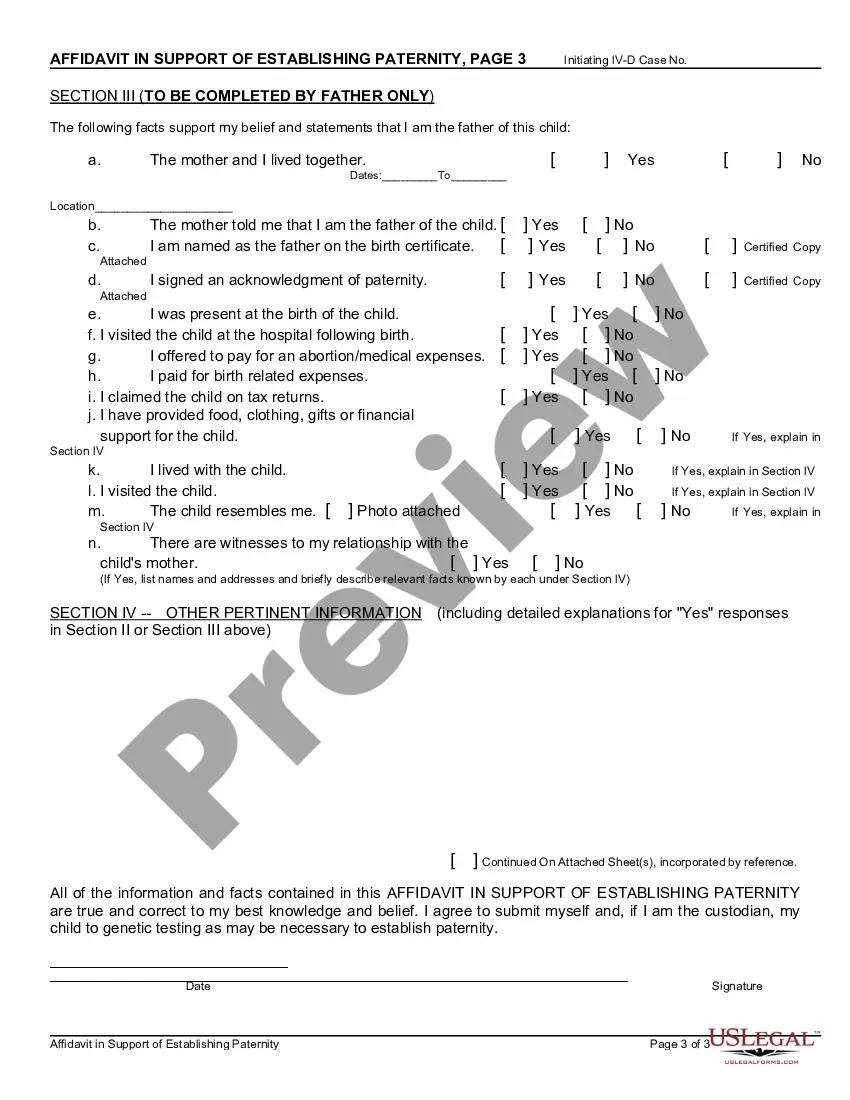

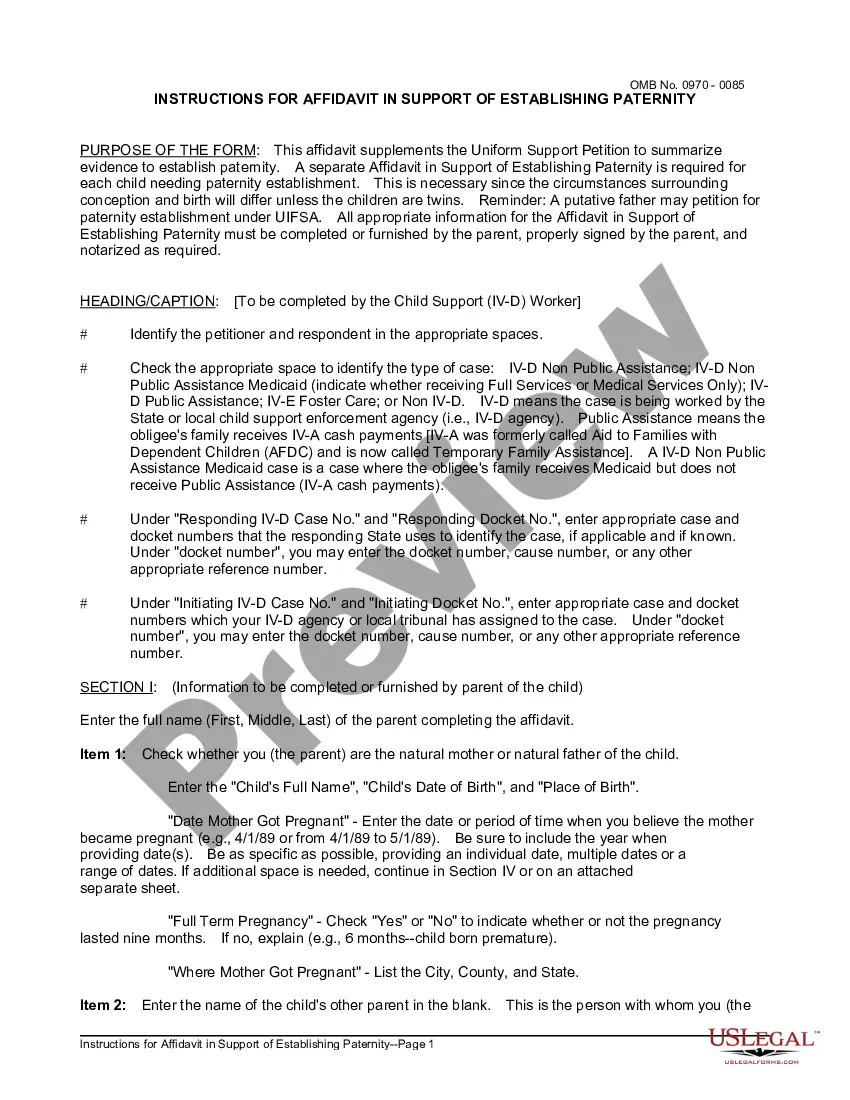

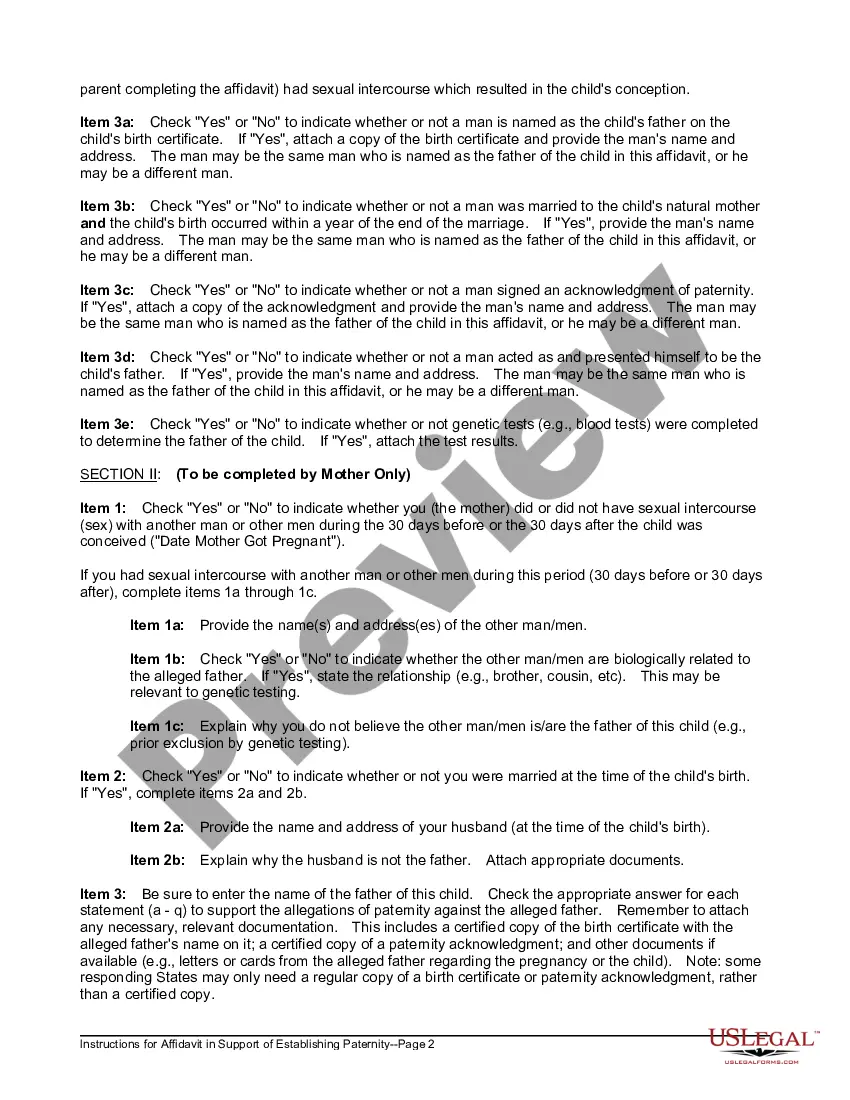

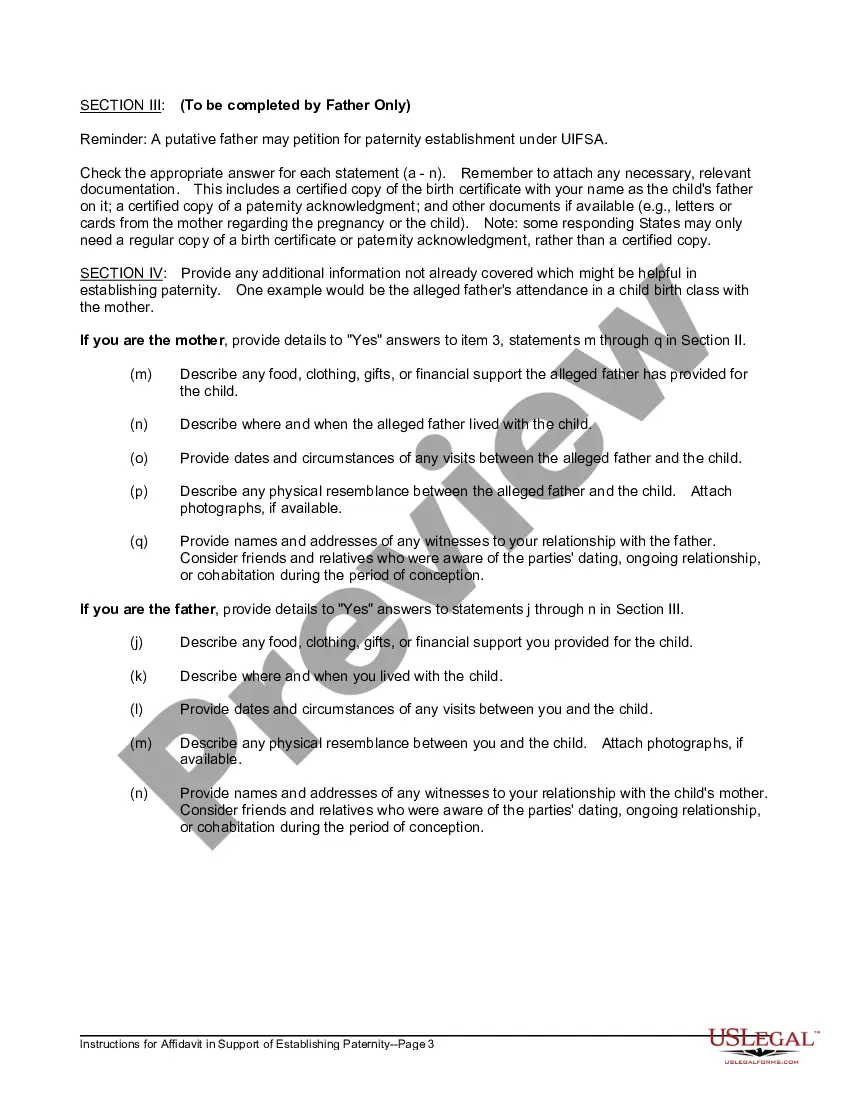

How to fill out Affidavit In Support Of Establishing Paternity?

The Custody Agreement Blueprint Pa For Unmarried Guardians you find on this site is a reusable legal blueprint composed by qualified attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has delivered individuals, organizations, and legal experts with more than 85,000 validated, state-specific documents for any corporate and personal circumstance. It’s the quickest, most straightforward, and most dependable method to acquire the documents you require, as the service ensures bank-level data protection and anti-malware safeguards.

Choose the format you prefer for your Custody Agreement Blueprint Pa For Unmarried Guardians (PDF, Word, RTF) and store the sample on your device.

- Search for the paper you need and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your needs. If it does not, utilize the search bar to locate the suitable one. Click Buy Now when you have identified the template you require.

- Subscribe and Log In.

- Select the payment plan that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and review your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

Yes, keeping a child away from the other parent can have negative consequences, especially if there is no court order in place. It may lead to disputes that escalate into legal battles. Therefore, it's crucial to create a custody agreement template pa for unmarried parents to establish clear guidelines and protect your rights as a parent. This approach can help prevent misunderstandings and foster a cooperative relationship with the other parent.

Montana LLC Cost. The cost to form a Montana LLC with the state is $35 to file your Articles of Organization online. If you're forming a Series LLC, you'll need to pay an additional $50 for each LLC in the series. After forming your LLC in Montana, you'll also need to pay $20 to file your annual report each year.

Montana is a tax-free state and doesn't have sales tax. Montana resale businesses that need to send a resale certificate to their vendor can use the Montana Business Registry Resale Certificate service to do so.

To register a foreign corporation in Montana, you must file a Montana Certificate of Authority with the Montana Secretary of State. You can submit this document online. The Certificate of Authority for a foreign Montana corporation costs $70 to file.

To Register a Business with the Secretary's Office Go to the Forms section in the left side menu. Choose the applicable form. Choose Domestic forms for a Montana business. Choose Foreign forms for a business formed in another state/country that will be doing business in Montana.

The state of Montana does not have a standard state business license. Since the state does not have a state sales tax, businesses are also not required to obtain any kind of seller's permit. There are, however, many statewide specialty licenses for certain professions and industries.

There are five steps that should be followed to obtain a license as a wholesale food establishment: CONTACT LOCAL HEALTH OFFICAL TO DETERMINE WHETHER A LICENSE IS REQUIRED. SUBMIT FOOD FACILITY PLAN TO LOCAL HEALTH OFFICIAL. SUBMIT WHOLESALE FOOD REVIEW FORM TO STATE OR LOCAL OFFICIAL. ... REGISTER BUSINESS WITH FDA.

Create an LLC in Montana Select a Name for the LLC. ... Designate a Montana Registered Agent. ... File Articles of Organization. ... Write a Montana LLC Operating Agreement. ... Get an Employer Identification Number from the IRS. ... File BOI Report to FinCEN. ... Open a Bank Account in Montana.

Pick a Business Structure. Your business's entity type is the first important choice you'll make while registering your business in Montana. ... Name Your Business. ... File Formation Paperwork. ... Draft Internal Records. ... Get Montana Business Licenses. ... Organize Your Money. ... Get Business Insurance. ... Understand Your Tax Burden.