Credit Report Inaccurate For The Cell

Description

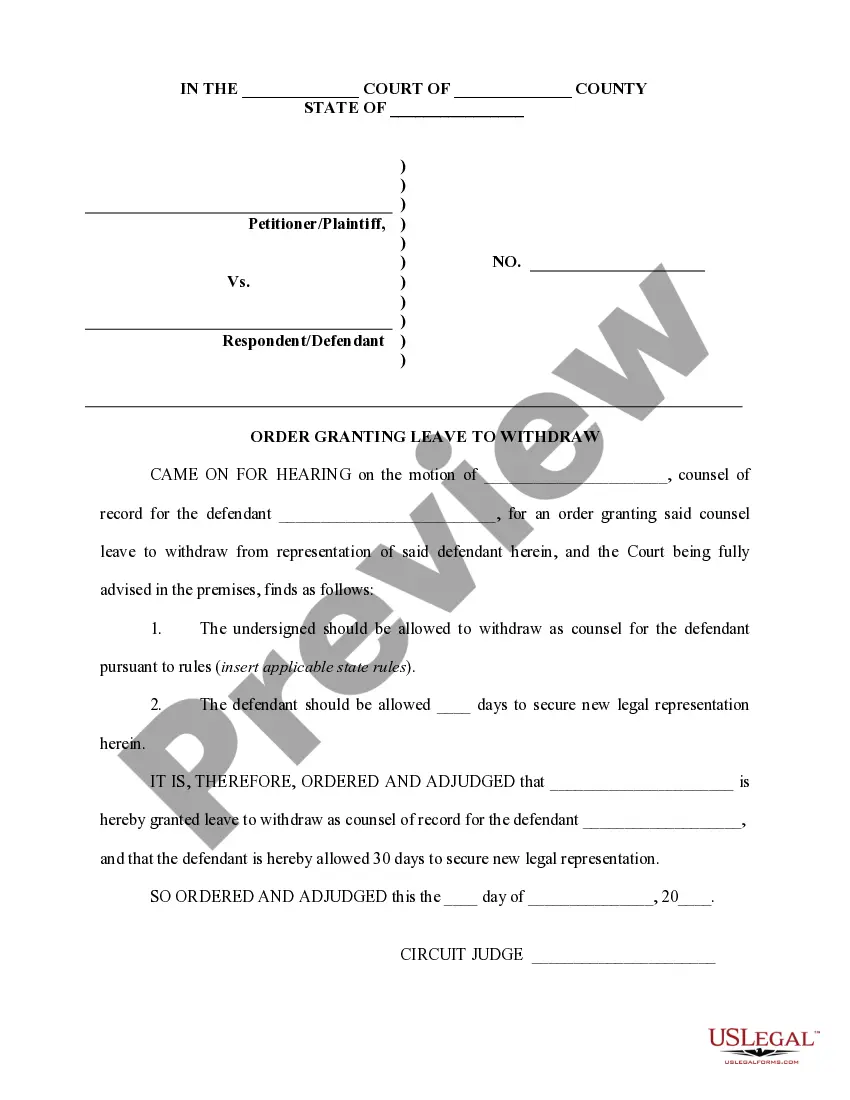

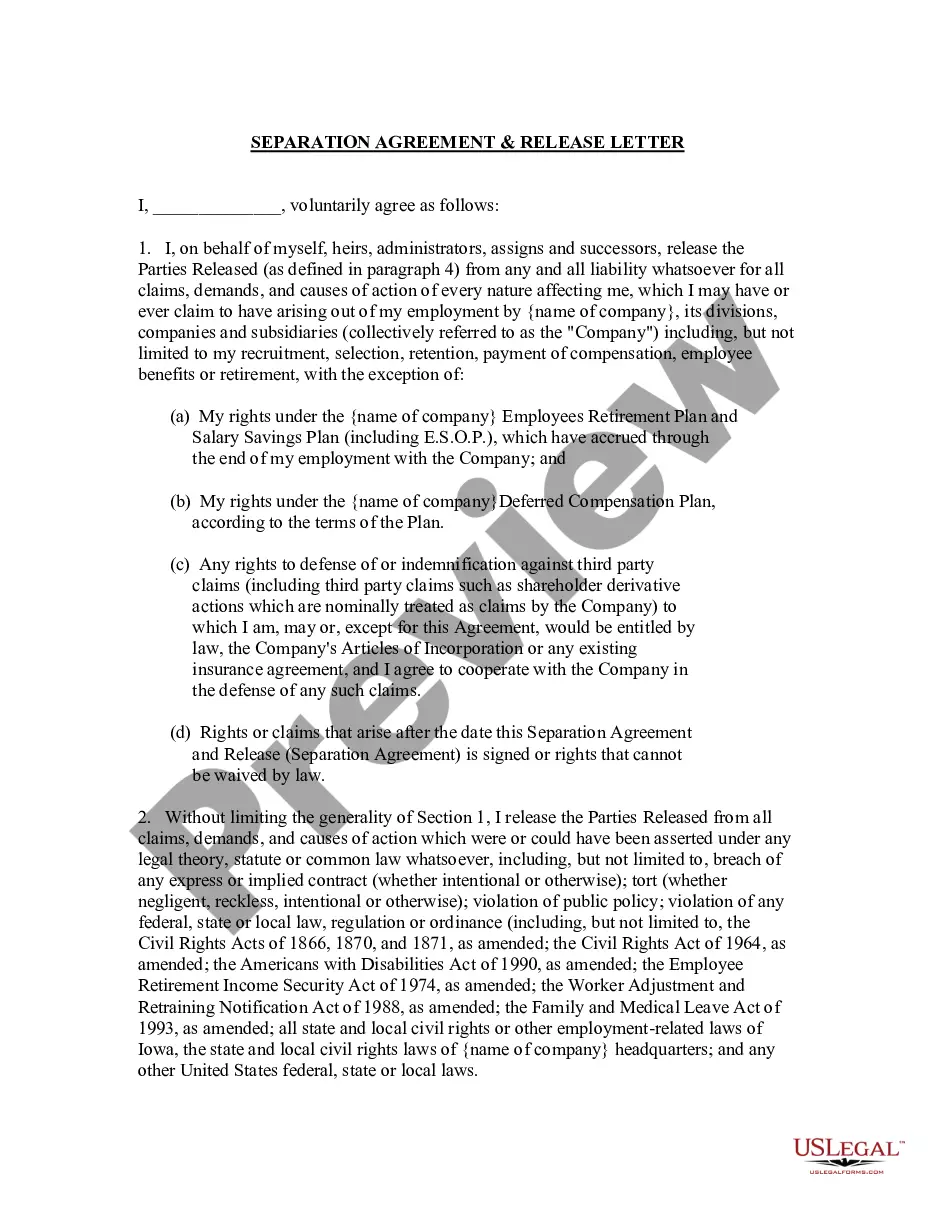

How to fill out Letter To Credit Bureau Requesting The Removal Of Inaccurate Information?

- Log into your US Legal Forms account to access previously downloaded templates or download new forms relevant to your situation.

- Preview the form descriptions and ensure you select a template that fits your specific needs and local jurisdiction requirements.

- If necessary, utilize the Search feature to locate other templates that may more accurately reflect your situation.

- Purchase the document by selecting an appropriate subscription plan and registering if you haven’t already done so.

- Complete your purchase by entering your credit card information or using PayPal for a secure transaction.

- Download your completed form to your device and access it later through the My Forms section of your profile.

With US Legal Forms, you gain access to an extensive library of over 85,000 legal forms, making it easier to find and fill the correct documents. Plus, expert assistance is available to ensure that your paperwork is completed accurately, providing peace of mind.

Don't let an inaccurate credit report hold you back. Take action today with US Legal Forms and secure your financial future!

Form popularity

FAQ

To report a false credit inquiry, you should first gather all relevant information regarding the inquiry, including dates and the reporting agency involved. Next, contact the credit reporting agency directly and provide them with the details. They will typically ask for documentation to support your claim. If necessary, you can also use USLegalForms to find legal documents that help you dispute inaccuracies effectively.

Disputing an inaccurate credit report involves submitting a formal dispute to the credit reporting agency. You can do this online or via mail by including evidence of the error. The agency will then review your claim and provide a response within 30 days. For those seeking assistance, US Legal Forms offers tools and resources to streamline the dispute process, helping ensure that your credit report accurately reflects your financial history.

To remove a false collection from your credit report, start by gathering any documentation that supports your claim. Once you have your evidence, file a dispute with the credit reporting agency. They are required to investigate the dispute within 30 days. If the collection is indeed inaccurate, it will be removed, helping to improve your credit score.

If your credit report is wrong, it can lead to various complications, such as being denied loans or higher interest rates. Upon discovering inaccuracies, it’s important to take timely action to dispute those errors. A credit report inaccurate for the cell can significantly affect your financial health. By addressing these issues promptly, you can protect your credit profile.

Absolutely, you have rights when your credit report is wrong. The FCRA grants you the right to dispute inaccuracies and to have them investigated. Additionally, you can request that the credit reporting agency provides an explanation of the findings. Understanding your rights is crucial for ensuring your credit report remains accurate and fair.

Yes, you can sue for incorrect credit reporting if you find inaccuracies that negatively impact your life. The FCRA allows individuals to seek damages if their credit reporting agencies fail to correct or properly investigate disputed information. If you have faced denial of credit or other issues due to a credit report inaccurate for the cell, consider consulting with a legal expert. They can guide you through the process of taking legal action.

The Fair Credit Reporting Act (FCRA) outlines the laws concerning inaccurate reporting on a credit report. Under this law, you have the right to dispute any information you believe is incorrect. Creditors and credit reporting agencies must investigate your claims and correct any inaccuracies, ensuring your credit report accurately reflects your financial history. If you find your credit report inaccurate, it’s essential to understand your rights and take action.

To clear wrong information on your credit report, begin by reviewing your report carefully. Identify any discrepancies and gather relevant documentation to support your claims. Next, file a dispute with the credit bureau to initiate a review. Using uslegalforms can provide you with the necessary resources to effectively address these issues.

Correcting inaccurate information on your credit report is essential for maintaining your credit score. Familiarize yourself with the dispute process at each credit bureau. Submit your claims along with supporting documents. If you need help, consider using uslegalforms, which can streamline the process for you.

Removing inaccurate information from your credit report requires a clear process. Start by disputing the inaccuracies with the relevant credit reporting agency. Provide documentation that verifies the incorrect data. This can effectively help in getting the necessary corrections made.