Zero Balance Account Opening Letter Format

Description

How to fill out Sample Letter For Disputed Balance Notice?

Regardless of whether for commercial reasons or personal matters, everyone must contend with legal scenarios at some point in their lives.

Completing legal documents requires meticulous attention, beginning with selecting the appropriate form example. For example, if you select an incorrect version of the Zero Balance Account Opening Letter Format, it will be rejected upon submission. Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you will never have to waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to find the right template for any circumstance.

- Locate the template you require by using the search box or catalog navigation.

- Review the form’s description to confirm it aligns with your situation, state, and county.

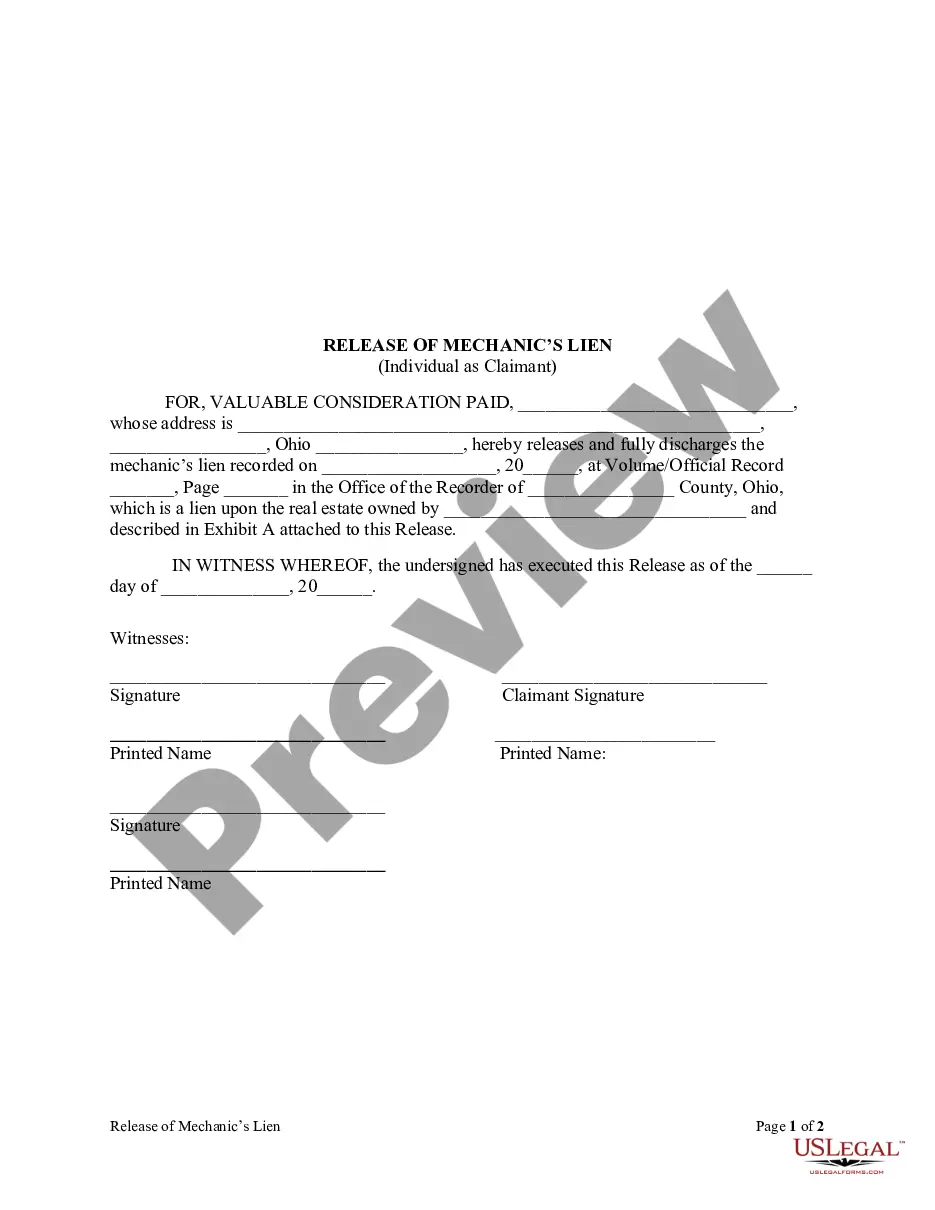

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Zero Balance Account Opening Letter Format sample you need.

- Download the file if it satisfies your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the document format you prefer and download the Zero Balance Account Opening Letter Format.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

balance account refers to a savings bank account, which has a zero balance in it and yet not charged. It is legally known as Basic Savings Bank Deposit (BSBD) account as per the Reserve Bank of India (RBI) guideline. The facility is provided by banks to encourage more savings among people.

balance account refers to a savings bank account, which has a zero balance in it and yet not charged. It is legally known as Basic Savings Bank Deposit (BSBD) account as per the Reserve Bank of India (RBI) guideline.

Examples of a Zero Balance Account Every time a department has to pay a vendor or make a purchase, they won't need to add money to those accounts; instead, the precise amount will be sent automatically from the main account to the relevant ZBA to cover the day's transactions.

Customers may open a zero-balance savings account through the Pradhan Mantri Jan-Dhan Yojana (P.M.J.D.Y.)

A zero balance account (ZBA) is an account in which a balance of zero is maintained by transferring funds to and from a master account. ZBAs are not consumer products but are used by larger businesses. An organization may have multiple zero balance subaccounts to monitor and track spending by department or project.