Transfer With Assets

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

Managing legal documents can be daunting, even for the most skilled experts.

When searching for a Transfer With Assets and lacking the time to locate the correct and current version, the process may become overwhelming.

Employ cutting-edge tools to finalize and manage your Transfer With Assets.

Tap into a valuable library of articles, guides, and resources tailored to your circumstances and needs.

Enjoy the US Legal Forms online catalog, backed by 25 years of experience and reliability. Simplify your daily document management with a straightforward and user-friendly process today.

- Conserve time and effort in searching for the documents you require, using US Legal Forms' sophisticated search and Review tool to locate Transfer With Assets and acquire it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, seek out the form, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and manage your folders as desired.

- If you’re new to US Legal Forms, create a free account to gain unlimited access to all the platform's advantages.

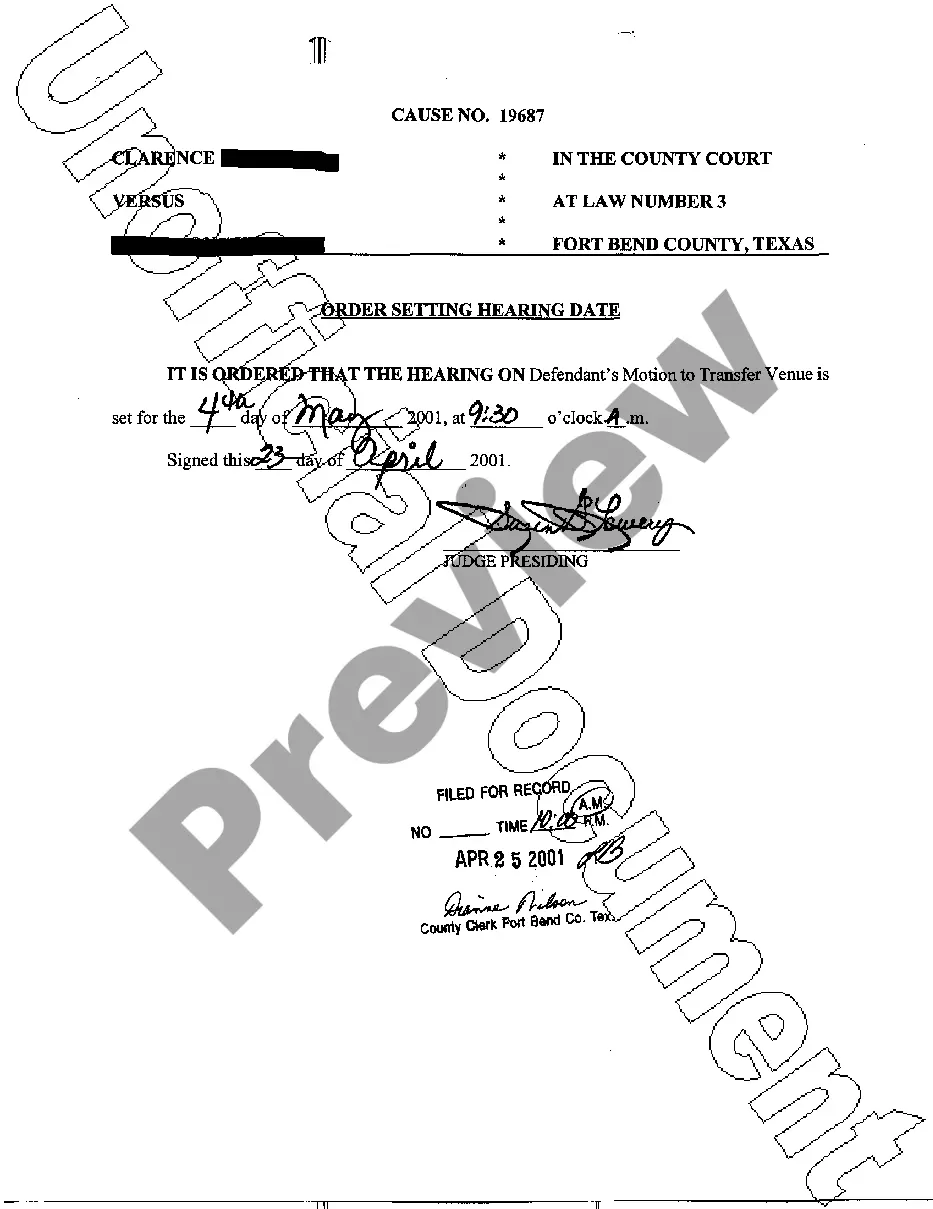

- Upon accessing the needed form, ensure it is the correct document by previewing it and reviewing its details.

- Utilize a robust online form repository that can transform how one handles these issues efficiently.

- Access state- or county-specific legal and business documents effortlessly.

- US Legal Forms meets your requirements, whether personal or commercial, all in a single location.

Form popularity

FAQ

What Does Asset Transfer Mean? An asset transfer occurs when one person gives ownership of an asset to another person or to a group of people. Life insurance policies can be used to transfer assets to beneficiaries.

A common method of asset transfer is through sale or purchase agreements. These agreements outline the terms and conditions of the transfer, including the purchase price, payment terms, and warranties.

For Example, a Business Transfer Agreement is structured to give effect to a comprehensive sale of assets and liabilities of one entity to another entity. It is in the form of a purchase and transfer of ownership agreement wherein details regarding the sale of the business and its assets are captured.

Types of Transferring Assets A transfer happens when an account holder moves money from one account to another, such as from a checking account to a higher-interest savings account or from savings to an individual retirement account (IRA) account. The transfer doesn't need to occur within the same bank.