Trust Grandchildren File For Unemployment

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Legal documents handling can be exasperating, even for experienced professionals.

When you are looking for a Trust Grandchildren Document For Unemployment and lack the time to dedicate to finding the right and current version, the process can be challenging.

With US Legal Forms, you can.

Access state- or county-specific legal and business forms. US Legal Forms meets all your needs, from personal to corporate documentation, in a single location.

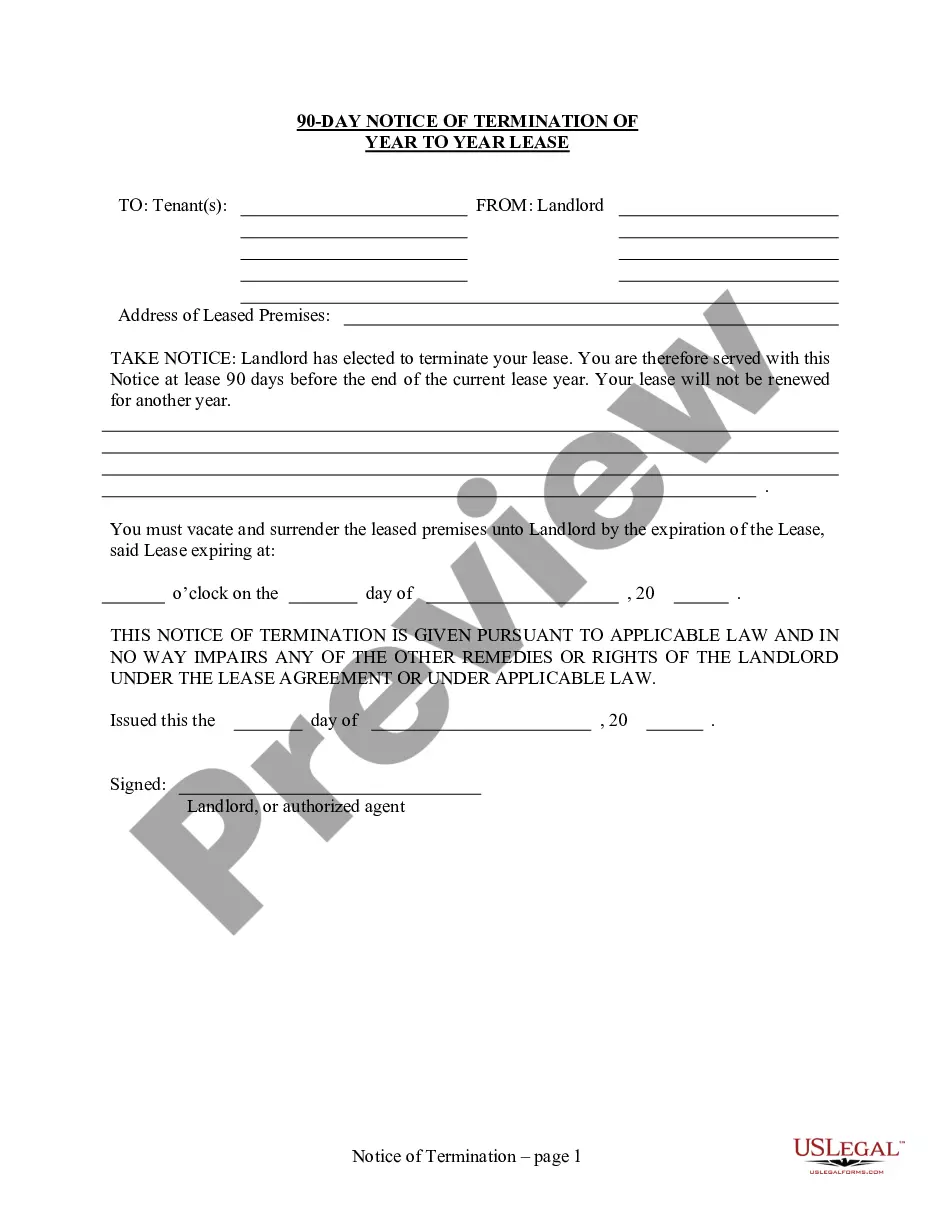

Here are the steps to follow after accessing the document you desire: Confirm this is the correct document by previewing it and checking its description. Ensure that the template is valid in your state or county. Click Buy Now when you are ready. Choose a subscription option. Select the format you prefer, and Download, fill out, eSign, print, and send your document. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Transform your everyday document management into a simple and user-friendly process today.

- Access a resource library of articles, guidelines, and manuals related to your circumstances and requirements.

- Save time and effort searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Review tool to locate Trust Grandchildren Document For Unemployment and download it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check the My documents tab to see the documents you previously downloaded and manage your folders as you wish.

- If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all library features.

- A powerful online form repository can significantly improve efficiency for anyone dealing with these matters.

- US Legal Forms is a market leader in digital legal documents, offering over 85,000 state-specific legal forms available at your convenience.

- Utilize advanced tools to complete and manage your Trust Grandchildren Document For Unemployment.

Form popularity

FAQ

Name grandchildren individually; if any pass away prematurely, the assets will be divided equally among the rest. Choose "Per stirpes," which means that if one of your children passes away before you do, their share will automatically go to their descendants.

One of the most preferred ways to leave assets to grandchildren is by naming them as a beneficiary in your will or trust. As the grantor or trustor, you are able to specify a set amount of money or a percentage of your total accounts and property to each grandchild as you see fit.

Establishing a trust Since trusts for grandchildren are legal structures, you'll work with an attorney to establish them. However, you may also want to discuss wealth planning and investment options with your contacts at Wells Fargo Private Bank before you finalize your plans, Sowell says.

Methods for gifting assets to grandchildren Perhaps the simplest approach to gifting is to give the grandchild an outright gift. You may give each grandchild up to $16,000 a year (in 2022) without having to report the gifts. If you're married, both you and your spouse can make such gifts.

A 529 plan, whole life insurance, an IRA, a Coverdell account, an a UTMA or UGMA or a trust (or a combination of them) can be great savings and investment vehicles to gift to a grandchild.