Trust Agreement Form Blank For Deed

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Regardless of whether it is for professional reasons or personal issues, each individual must confront legal matters at some stage of their life.

Filling out legal documents requires meticulous care, starting with choosing the right form template.

Once downloaded, you can fill out the form using editing software or print it and complete it manually. With a vast US Legal Forms catalog available, you will never have to waste time searching for the right template online. Use the library’s intuitive navigation to find the suitable template for any circumstance.

- For example, if you select an incorrect version of a Trust Agreement Form Blank For Deed, it will be declined when submitted.

- Thus, it is essential to have a reliable source for legal documents like US Legal Forms.

- If you need to acquire a Trust Agreement Form Blank For Deed template, adhere to these straightforward steps.

- Locate the template you require by utilizing the search box or catalog navigation.

- Review the form’s description to ensure it corresponds with your situation, state, and county.

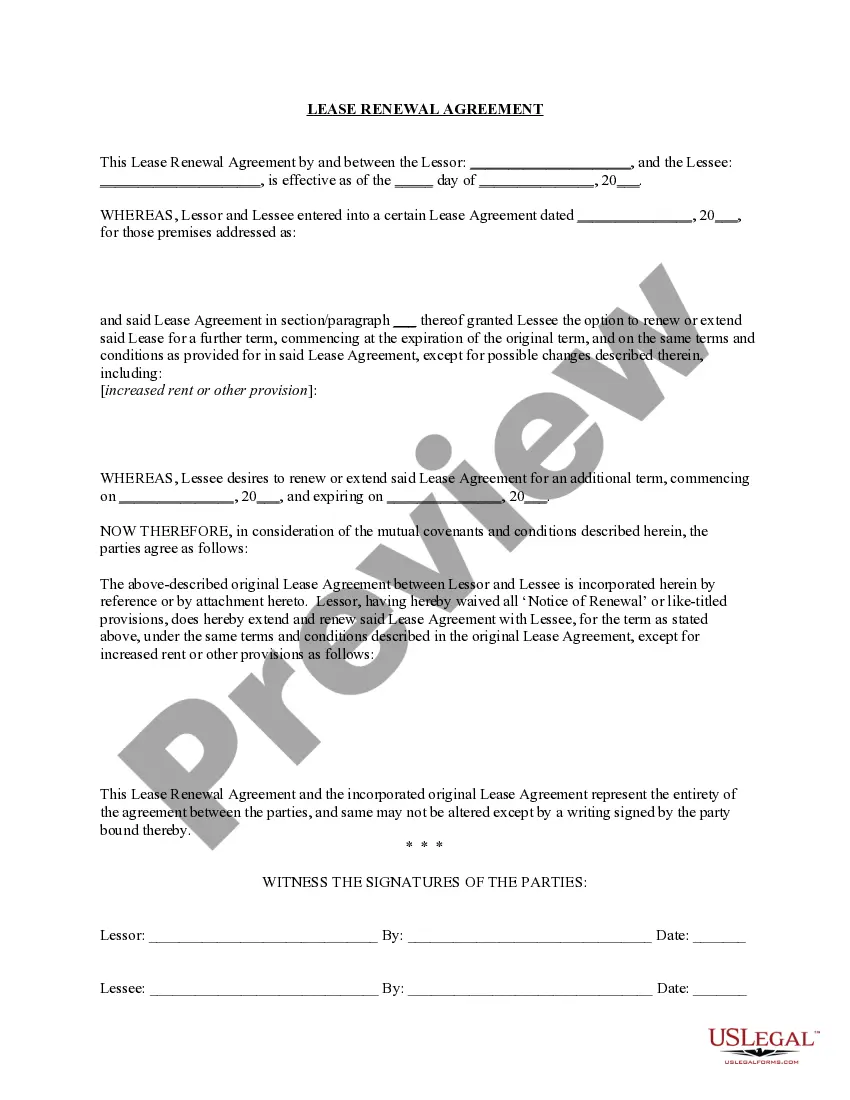

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to find the Trust Agreement Form Blank For Deed sample you need.

- Obtain the file if it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not yet have an account, you can get the form by clicking Buy now.

- Choose the suitable pricing option.

- Fill out the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the desired file format and download the Trust Agreement Form Blank For Deed.

Form popularity

FAQ

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund's objectives, who can be a member and whether benefits can be paid as a lump sum or income stream.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

There are two basic types of Deeds of Trust, the Long Form and the Short Form. The Long Form, which could be 20-30 pages long, is the one used by institutional lenders. The Short Form is the one that is most usually prepared by your Escrow Officer.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...