Irrevocable Trust For Child

Description

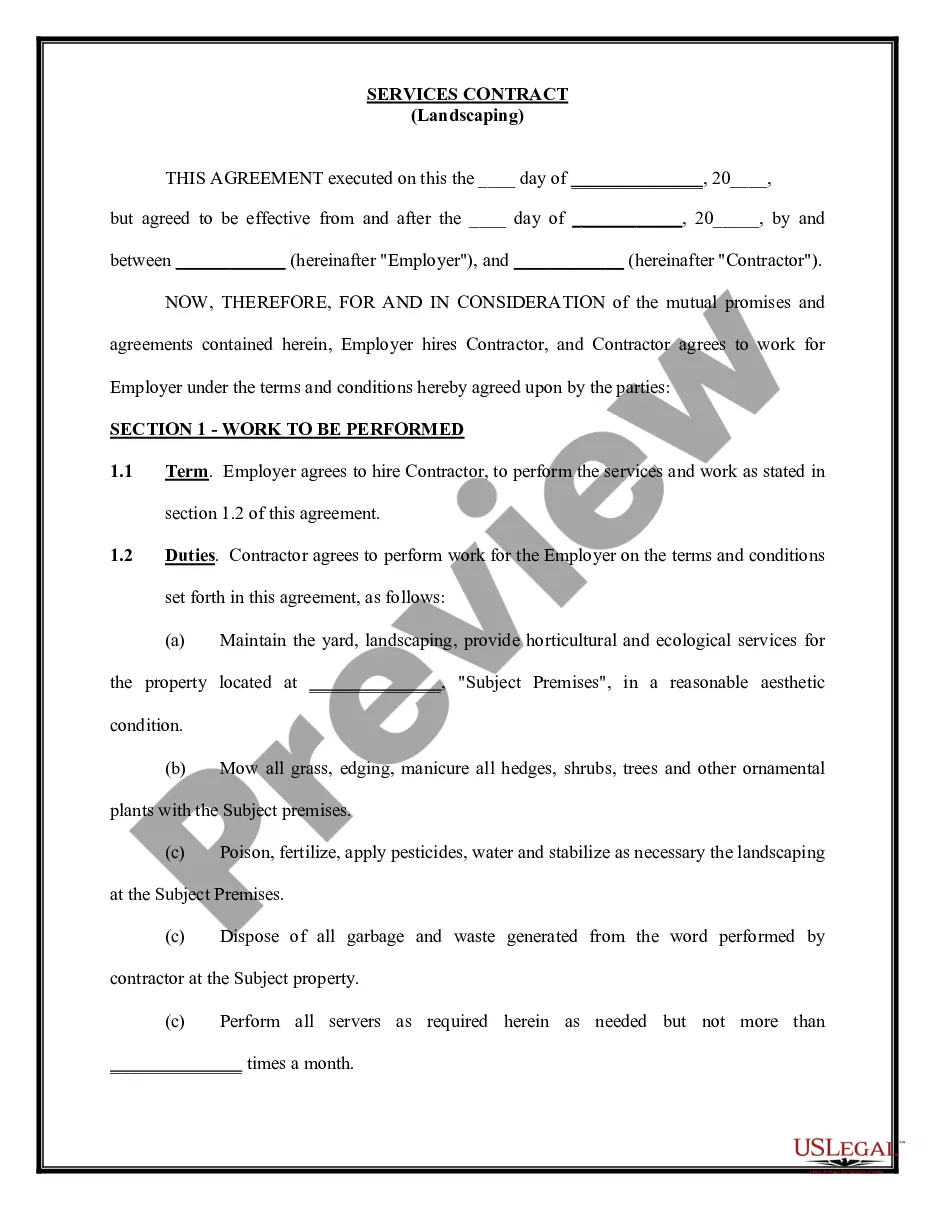

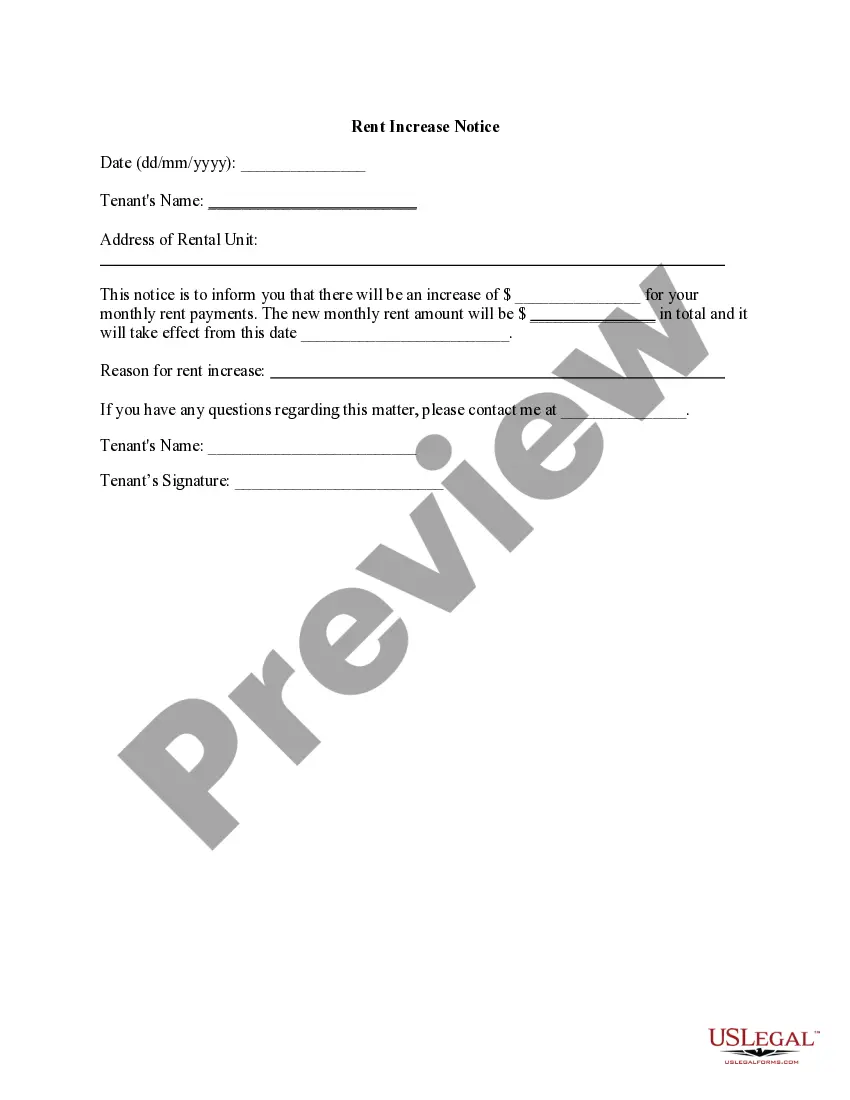

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

- If you're an existing user, log in to your account at US Legal Forms and locate the irrevocable trust template. Make sure your subscription is still active; otherwise, renew it based on your payment plan.

- New users should start by reviewing the preview mode and description of the irrevocable trust form. Ensure it fits your needs and complies with your local jurisdiction.

- If the selected form doesn't meet your requirements, use the search feature to find the appropriate template.

- Once you find the right form, click the 'Buy Now' button and choose a subscription plan that works for you. You'll need to create an account to access additional resources.

- Enter your payment information to complete the purchase process, using your credit card or PayPal for convenience.

- After purchasing, download the form to your device and access it anytime through the 'My Forms' section in your account.

Utilizing US Legal Forms for creating an irrevocable trust ensures you have access to a robust collection of templates tailored for various legal needs. Their extensive library and user-friendly interface can significantly simplify the paperwork involved.

Take charge of your child's future with confidence. Start creating your irrevocable trust today using US Legal Forms.

Form popularity

FAQ

The primary downside to an irrevocable trust for child is the lack of flexibility once established. You cannot change or dissolve the trust without complicated legal procedures, which may not suit all situations. Additionally, transferring assets into the trust may have tax implications you need to consider, making it essential to consult with a legal expert such as the professionals at US Legal Forms, who can guide you through this complex decision.

Certain assets may not be suitable for an irrevocable trust for child, including personal property that you wish to retain control over, assets that you may need access to for living expenses, and any assets that might trigger financial aid disqualifications. Additionally, retirement accounts should typically remain outside the trust to avoid unfavorable tax consequences. Assessing these exclusions helps ensure that the irrevocable trust aligns with your long-term financial strategy.

Having an irrevocable trust for child allows you to protect their assets from creditors, minimize estate taxes, and ensure that your child receives resources according to your wishes. This type of trust secures funds for their future without the risk of mismanagement. By setting up this trust, you can establish control over how, when, and why your child receives the assets, promoting financial responsibility.

While an irrevocable trust for child has many benefits, there are also drawbacks to consider. Once established, you cannot modify or dissolve the trust without the consent of beneficiaries, which may limit your control over those assets. Furthermore, transferring assets into the trust may trigger gift tax implications. It's essential to weigh these factors carefully and possibly consult with a financial advisor to ensure this approach aligns with your family's needs.

Setting up an irrevocable trust for child provides several advantages that can offer peace of mind to parents. It not only secures assets but also shields them from potential creditors and legal issues. Additionally, an irrevocable trust can ensure that funds are managed responsibly and distributed according to your wishes. By planning ahead, you empower your child with financial stability and security for their future.

Yes, you can write your own irrevocable trust for a child, but careful attention is essential. It is crucial to include all relevant details, such as the trustee's obligations and how assets will be managed. However, creating a legally binding and effective trust document can be complex. To simplify the process, explore uslegalforms, which provides templates and guidance for drafting your own irrevocable trust for child.

Filling out an irrevocable trust for a child involves several key steps. First, gather all necessary information such as the child's details, the trustee's information, and the assets to include. Next, carefully complete the trust document by specifying the terms, conditions, and beneficiaries. Consider using a reputable platform, like uslegalforms, to ensure that your irrevocable trust for child complies with legal requirements.

Leaving your house to your children is often best accomplished through an irrevocable trust for child. This arrangement allows you to retain control over the property while ensuring that your children benefit from it in the future. Additionally, it can help minimize taxes and protect the property from creditors.

The best way to leave your property to your children may involve setting up an irrevocable trust for child. This option not only secures the property's future but also provides flexibility in how you wish your children to receive and manage the asset. Exploring this route can help you achieve peace of mind regarding your legacy.

To give your house to your child without incurring taxes, establishing an irrevocable trust for child can be an effective strategy. This trust can bypass certain taxes upon transfer and protect your assets from being taxed as part of your estate. However, it is essential to seek legal advice to navigate the complexities of tax regulations.