Irrevocable Form Trust For Minor Child

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Creating legal documents from the ground up can occasionally feel somewhat daunting.

Certain cases may necessitate extensive research and require a significant financial commitment.

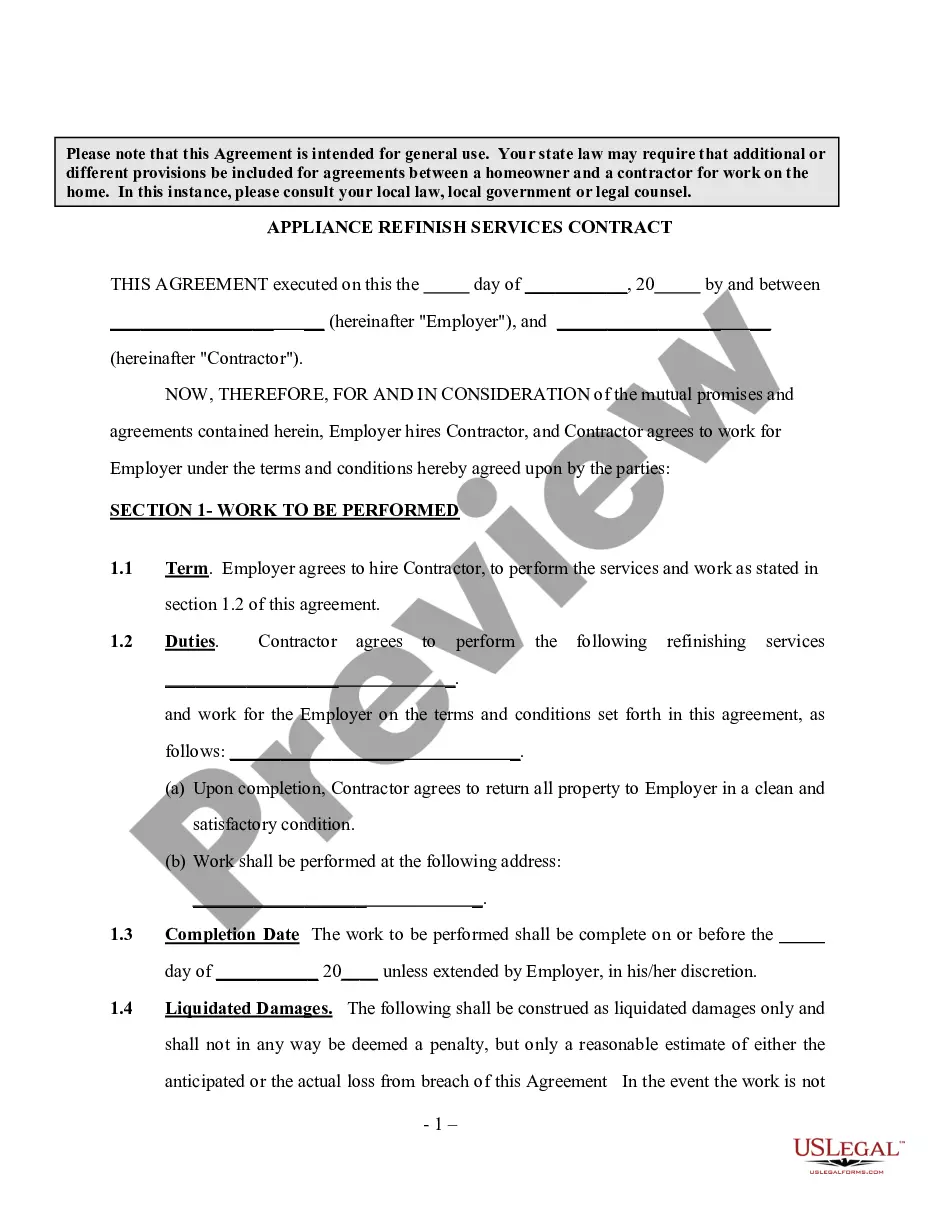

If you’re looking for a more simple and economical method of preparing an Irrevocable Form Trust for a Minor Child or any other documentation without the hassle of unnecessary complications, US Legal Forms is always at your service.

Our online library of over 85,000 current legal templates covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-compliant forms meticulously assembled for you by our legal experts.

Examine the form preview and descriptions to confirm you have located the form you need. Verify that the form you select is in line with the regulations and laws of your state and county. Choose the most suitable subscription option to acquire the Irrevocable Form Trust for Minor Child. Download the file, then complete, sign, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and simplify document preparation into an effortless and efficient process!

- Utilize our website whenever you require dependable and trusted services for quickly finding and downloading the Irrevocable Form Trust for Minor Child.

- If you’re already familiar with our services and have set up an account with us previously, simply Log In to your account, find the form, and download it immediately or re-download it anytime later in the My documents section.

- Not registered yet? No worries. Setting it up only takes a few minutes, allowing you to explore the library.

- Before directly downloading the Irrevocable Form Trust for Minor Child, consider these recommendations.

Form popularity

FAQ

An example of an irrevocable trust is a trust specifically designed to benefit a minor child, often referred to as an irrevocable form trust for minor child. In this trust, parents can transfer assets that will only be accessed by their child when they reach a specified age. This ensures that the assets are protected from creditors and provide long-term financial support for the child. Tools available on US Legal Forms can assist you in crafting this type of trust.

A trust fund is a legal entity established for the purpose of holding assets for the benefit of specific people, or even for an organization. Children are frequent beneficiaries of trust funds because trust funds can safeguard your assets and make sure they are used for your children's stewardship.

Irrevocable Trusts Using an irrevocable trust allows you to minimize estate tax, protect assets from creditors and provide for family members who are under 18 years old, financially dependent, or who may have special needs.

Irrevocable life insurance trusts This type of trust (also called an ILIT) is often used to set aside funds for estate taxes. An ILIT might be particularly useful if you own a family business that's set to remain in your estate when you pass away.

Even with strong financial management skills, the money left to children is still vulnerable to creditors' claims, divorce, lawsuits, or estate taxes. By using a beneficiary-controlled trust, the risks can be reduced while allowing your children some control over their own trusts.

Disadvantages of Irrevocable Trusts Fairly Rigid terms: They are not very flexible. Once the terms are established, they can be difficult to change. The Three-Year Rule: If you include life insurance in an irrevocable trust and pass away within three years, the proceeds return to your estate and become taxable.