Affidavit Of No Ssn Withheld On W2

Description

How to fill out Affidavit Of Identity And Lack Of Social Security Number?

Regardless of whether it's for corporate aims or personal matters, each individual must confront legal issues at some stage in life.

Completing legal paperwork demands meticulous attention, starting with the selection of the appropriate form template.

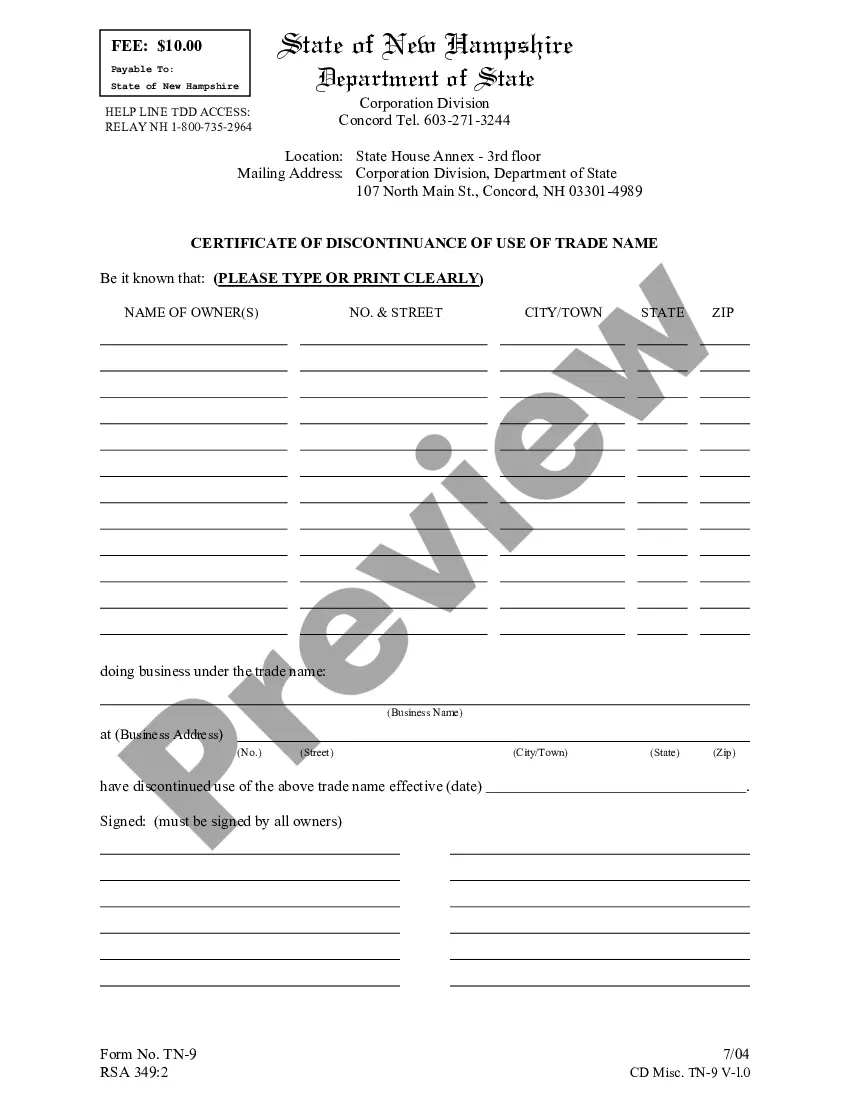

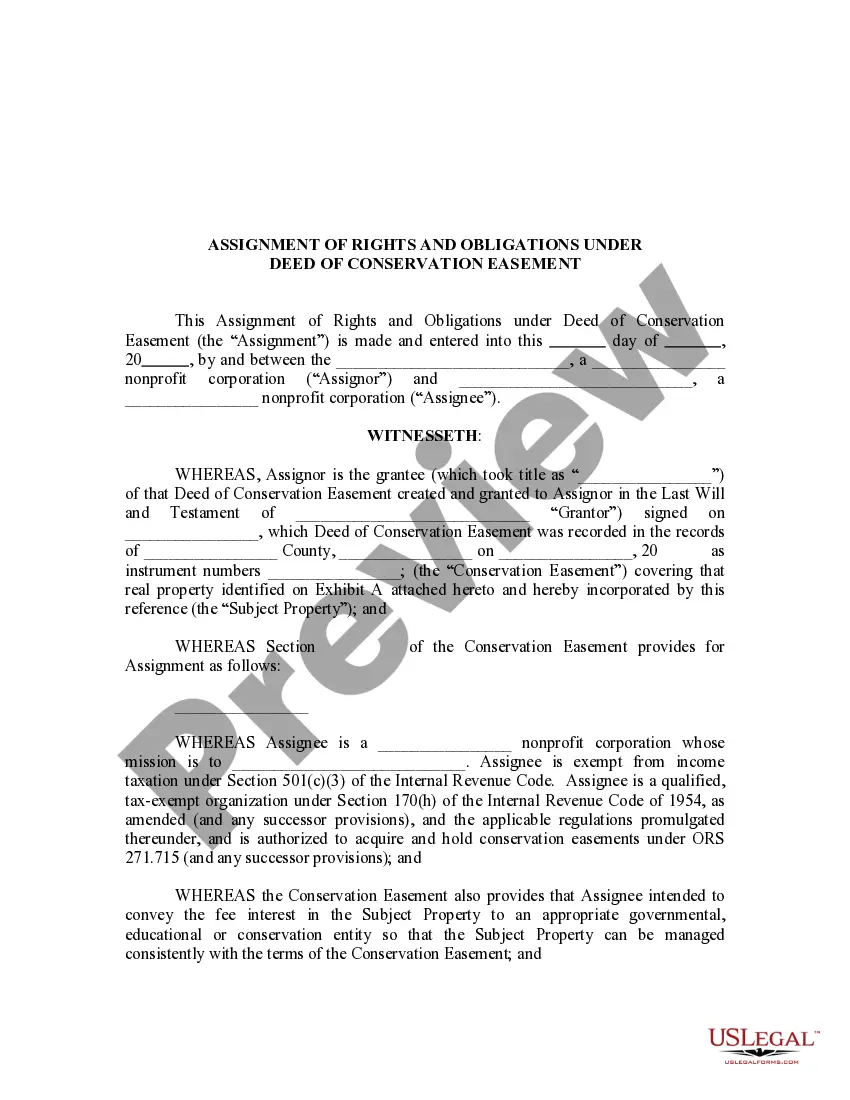

Select the desired file format and download the Affidavit Of No Ssn Withheld On W2. After downloading, you may complete the form using editing software or print it out and fill it out manually. With a vast US Legal Forms catalog available, you won't waste time searching for the appropriate sample online. Leverage the library’s user-friendly navigation to locate the correct template for any circumstance.

- For instance, if you choose an incorrect version of the Affidavit Of No Ssn Withheld On W2, it will be rejected once submitted.

- Thus, it is crucial to obtain a reliable source of legal documents such as US Legal Forms.

- If you need to acquire an Affidavit Of No Ssn Withheld On W2 template, follow these straightforward steps.

- Search for the sample you require using the search bar or catalog navigation.

- Review the description of the form to confirm it corresponds with your case, state, and county.

- Click on the preview of the form to examine it.

- If it is the wrong form, return to the search option to find the Affidavit Of No Ssn Withheld On W2 sample you require.

- Download the template once it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the suitable pricing option.

- Fill in the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

Form popularity

FAQ

While physical safety is essential, employers can't forget about their duty to keep an employee's personal and confidential information safe from predators. Truncating an employee's Social Security Number is a simple way to help protect your employee's identity.

A Social Security number is required to complete IRS Form W-4. Withholding will default to single and zero allowances if IRS Form W-4 is not submitted. Special rules apply to nonresident aliens for tax purposes filling out IRS Form W-4.

What do you do if you need to file Form W-2 for an employee with no SSN? If your employee applied for a card and has not received it yet, write ?Applied For? in Box A on Form W-2. If you're electronically filing Form W-2 for an employee without an SSN, enter 0's in the Social Security number field.

The potential employee can complete the W-4 form with no Social Security number, but they have to apply for a SSN by filling out Form SS-5, Application for Social Security Card. Once the form is filled out and submitted, you can allow the employee to begin working.

To correct a Form W-2 you have already submitted, file a Form W-2c with a separate Form W-3c for each year needing correction. File a Form W-3c whenever you file a Form W-2c, even if you are only filing a Form W-2c to correct an employee's name or Social Security number (SSN).