Foreclose Judgment Lien Foreclosure

Description

How to fill out Complaint Or Petition To Foreclose On Mechanic's Lien?

Managing legal documents and tasks may be a lengthy addition to your day.

Foreclosure Judgment Lien Foreclosure and similar forms usually necessitate searching for them and comprehending how to fill them out correctly.

Therefore, whether you are dealing with financial, legal, or personal issues, having a detailed and functional online directory of forms at your disposal will greatly assist you.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms and various tools that will expedite your document completion.

Is this your first time using US Legal Forms? Register and create your account in a few minutes to gain access to the form directory and Foreclosure Judgment Lien Foreclosure. Then, follow the steps below to complete your form: Ensure you have the correct form using the Review feature and by reading the form description. Click Buy Now when ready, and select the monthly subscription plan that suits your requirements. Choose Download then fill out, eSign, and print the form. US Legal Forms has 25 years of experience helping clients manage their legal documents. Acquire the form you need today and simplify any process effortlessly.

- Explore the collection of relevant documents available to you with just a single click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Enhance your document management processes by utilizing a quality service that enables you to create any form in minutes without extra or hidden fees.

- Simply Log In to your account, find Foreclosure Judgment Lien Foreclosure, and obtain it instantly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

The foreclosure process in Pennsylvania typically takes around six months to a year, depending on various factors such as court schedules and the homeowner's response. After the lender files for foreclosure, there are legal steps that must be followed, including notifications and hearings. If you are dealing with a foreclose judgment lien foreclosure, staying informed about the timeline can help you prepare and explore your options effectively. Utilizing resources from platforms like uslegalforms can provide valuable guidance during this period.

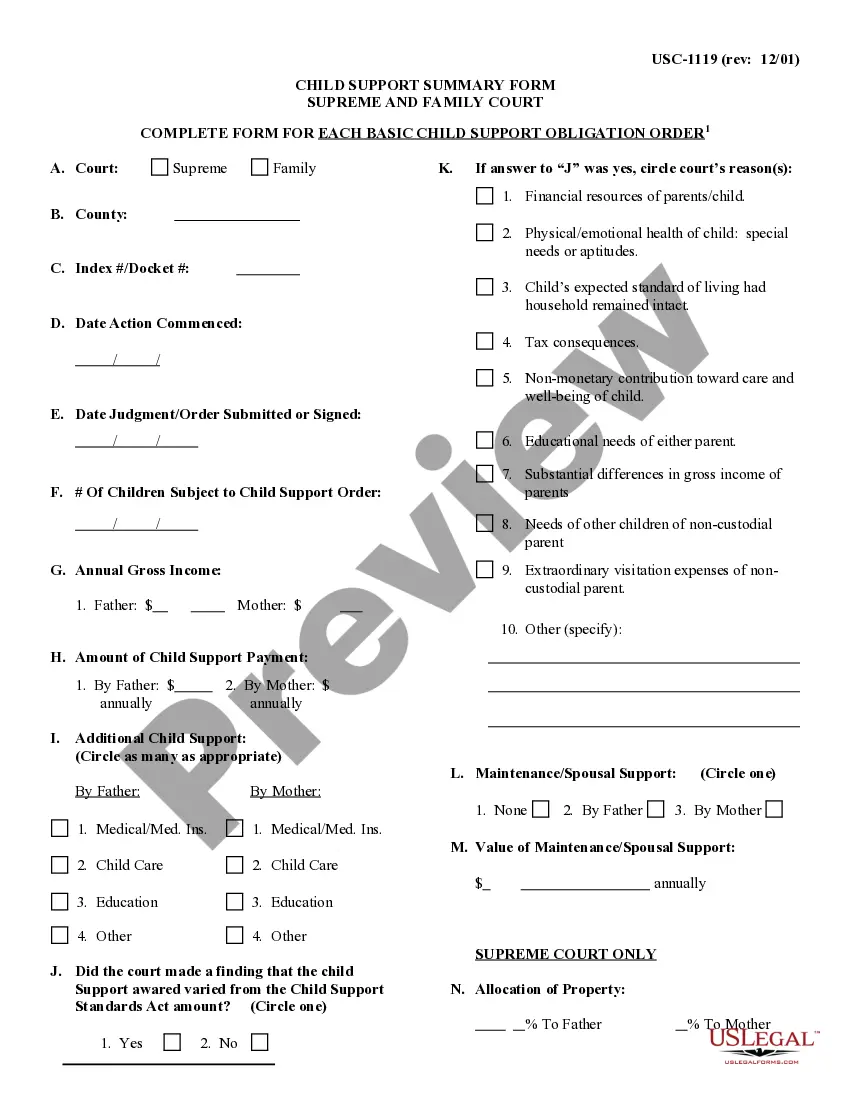

A lien is a legal claim against a property to secure payment of a debt. When a property owner fails to satisfy that debt, the lender may initiate a foreclosure, which is the legal process to reclaim the property. In the context of foreclose judgment lien foreclosure, the lien typically arises from a court judgment against the property owner. Understanding this distinction helps you navigate the complexities of property rights and obligations.

In Minnesota, a judgment typically lasts for ten years. However, you can renew it for another ten years if necessary. With the right legal guidance, you can navigate the process of foreclose judgment lien foreclosure effectively. Understanding how long a judgment remains active can help you make informed decisions about your financial situation.

As a result, a foreclosure in your past lowers your credit score and can make it difficult to get new loans at good interest rates. It can even make it more difficult to find a job or a rental property, as many employers and landlords use credit reports as one way to assess your reliability.

The creditor can foreclose on the judgment lien property. ingly, the judgment creditor needs to find the debtor's assets, then get the aide of the court to make the judgment lien attach to that asset and then foreclose on that asset.

Process of a Foreclosure or Power of Sale in Ontario In a foreclosure, the process involves court supervision. The lender initiates the foreclosure by filing a Statement of Claim with the court. The homeowner is then served with the Statement of Claim and has the opportunity to respond.

If the lender starts a foreclosure action Usually, this happens after you've missed three months of payments. But it can happen sooner. If there's a Supreme Court registry near where your home is located, the lender must start the proceedings there. You will receive a document called a petition for foreclosure.

Foreclosure is what happens when you can't pay your mortgage and the lender takes over owning your home. The lender then sells your home to pay off what you owe them. You have no control over how the home is sold and will be given notice to leave the property, sometimes even before it's sold.