Order Safe Deposit Box With Credit Card

Description

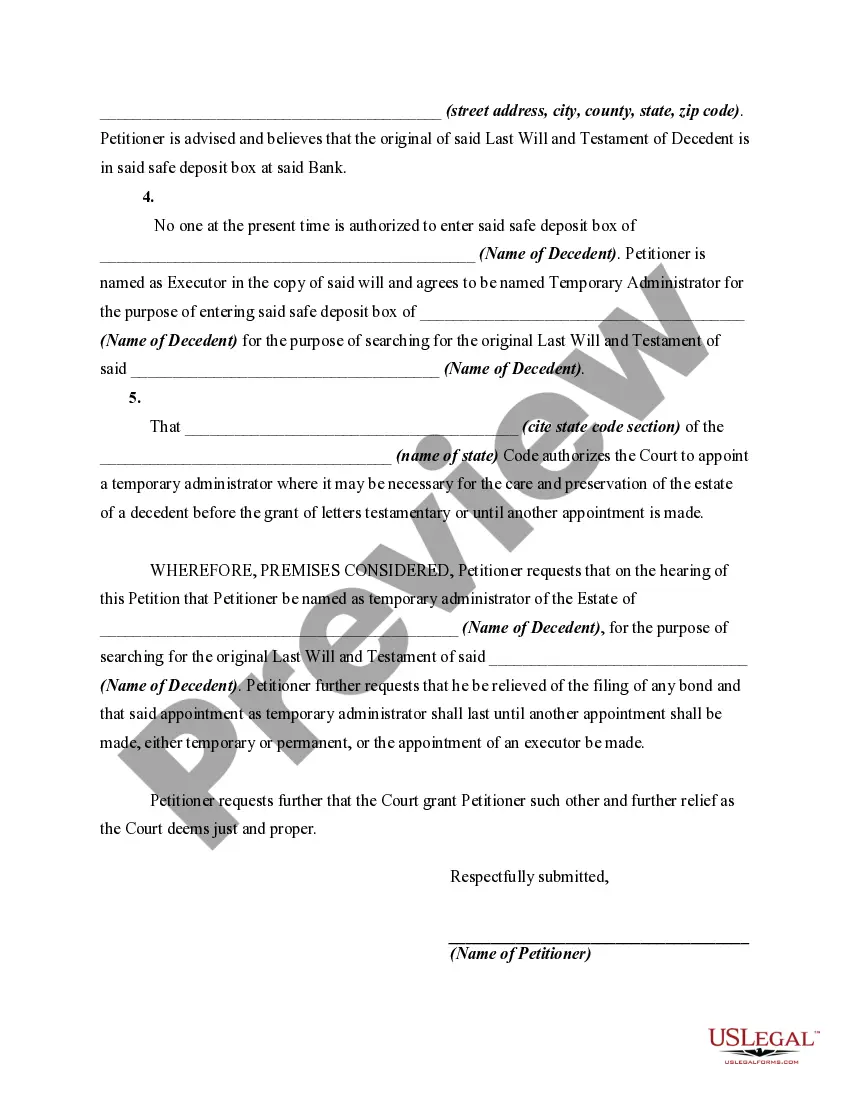

How to fill out Petition For Appointment Of Temporary Administrator In Order To Gain Access To Safe Deposit Box?

Regardless of whether it's for corporate reasons or personal issues, everyone encounters legal circumstances at some point during their lifetime.

Completing legal paperwork requires meticulous care, beginning with choosing the appropriate form template.

Once it is saved, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms library available, you will never waste time searching for the correct sample on the internet. Take advantage of the library’s user-friendly navigation to find the right template for any circumstance.

- For instance, selecting the incorrect version of an Order Safe Deposit Box With Credit Card will result in its denial upon submission.

- Thus, it is crucial to have a dependable source for legal documents like US Legal Forms.

- To acquire an Order Safe Deposit Box With Credit Card template, follow these straightforward procedures.

- Utilize the search field or catalog navigation to locate the sample you require.

- Review the form’s description to verify that it aligns with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If the form is not the right one, return to the search tool to find the Order Safe Deposit Box With Credit Card template that you need.

- Obtain the template once it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the document by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your method of payment: either by credit card or via PayPal.

- Pick the file format you desire and download the Order Safe Deposit Box With Credit Card.

Form popularity

FAQ

You're better off keeping the following items out of your safe deposit box: Passports. Only copies of living wills, advanced medical directives, and durable powers of attorney. Valuables you have not insured. Cash. Anything illegal.

The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes.

You CAN keep cash in a safety deposit box, but it is not recommended. It is perfectly legal and you can never get in trouble for it, but in case of an emergency, such as a natural disaster, the contents of a SD box is not insured.

A person can place just about anything that will fit in a safe deposit box in one. Holders of these boxes are granted complete privacy by the financial institutions where they're located. Someone could store cash, jewelry and other valuables, savings bonds, deeds to property and information about an inheritance there.