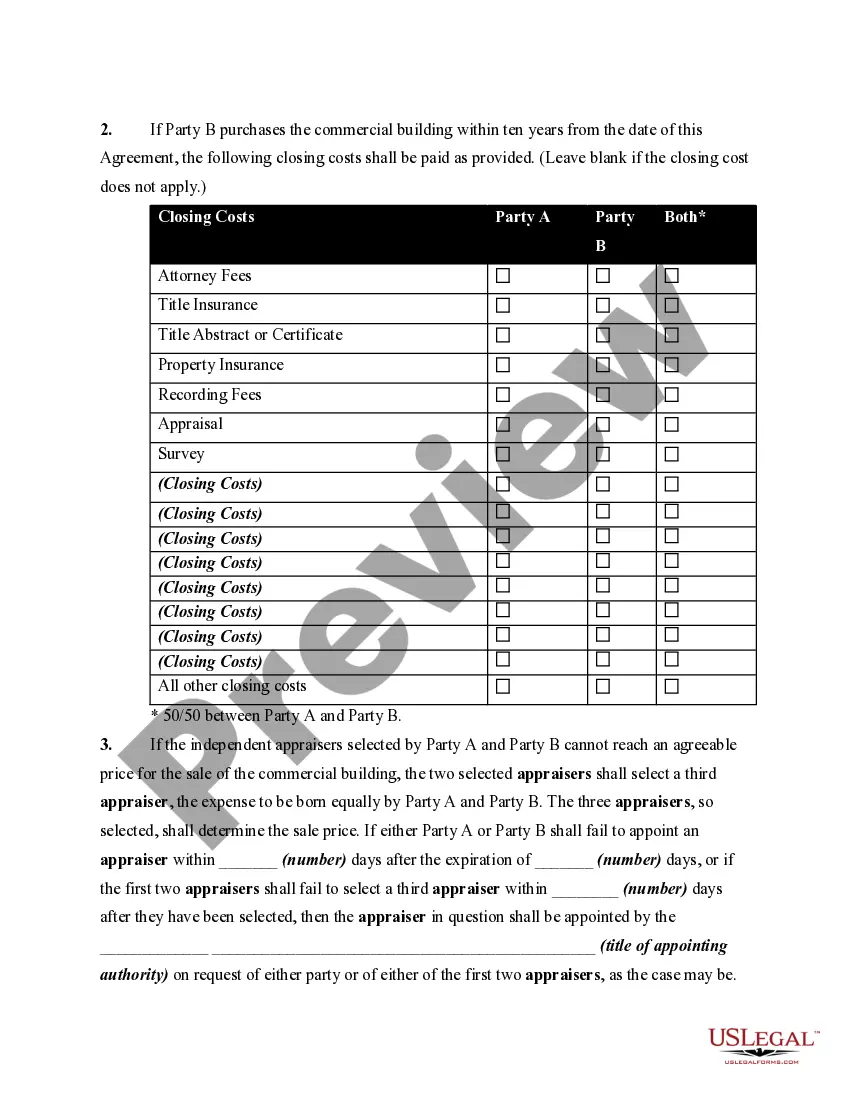

Agreement Futures Contract With Option

Description

How to fill out Agreement Between Partners For Future Sale Of Commercial Building?

Well-crafted formal paperwork is one of the crucial safeguards against complications and lawsuits, but acquiring it without legal counsel may require time.

Whether you must swiftly locate a current Agreement Futures Contract With Option or any other templates for work, family, or business situations, US Legal Forms is always available to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Agreement Futures Contract With Option at any time, as all documents acquired on the platform remain accessible in the My documents tab of your profile. Save time and money on drafting formal documents. Experience US Legal Forms today!

- Ensure that the form aligns with your circumstances and location by reviewing the description and preview.

- Search for an alternative sample (if necessary) using the Search bar in the page header.

- Press Buy Now when you identify the suitable template.

- Select the pricing package, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select the file format for your Agreement Futures Contract With Option: PDF or DOCX.

- Click Download, then print the template to complete it or incorporate it into an online editor.

Form popularity

FAQ

To trade options you need a margin approved brokerage account with access to options and futures trading. Options on futures quotes are available from the CME (CME) and the Chicago Board Options Exchange (CBOE), where options and futures trade.

An option on a futures contract gives the holder the right, but not the obligation, to buy or sell a specific futures contract at a strike price on or before the option's expiration date. These work similarly to stock options, but differ in that the underlying security is a futures contract.

Rather than trade the futures contract alone, options on futures allows a trader to make a trading assumption about the direction of price similar to trading a futures contract, but with the advantages of only risking what you paid for the option rather than the usual higher cost of the futures contract, all while

Multi-Leg Trades Just like equities, options on futures can also be traded using multi-leg trade strategies like spreads and butterflies. Combinations can be traded as one order or add legs to existing positions to build spreads.

A collar is basically the combination of a futures/cash market position plus buying a lower put plus selling a higher call option. The strategy is designed in such a way that the premium received on the call option will compensate for the cost of the put option.