Beneficiary Pet Any Foreigner

Description

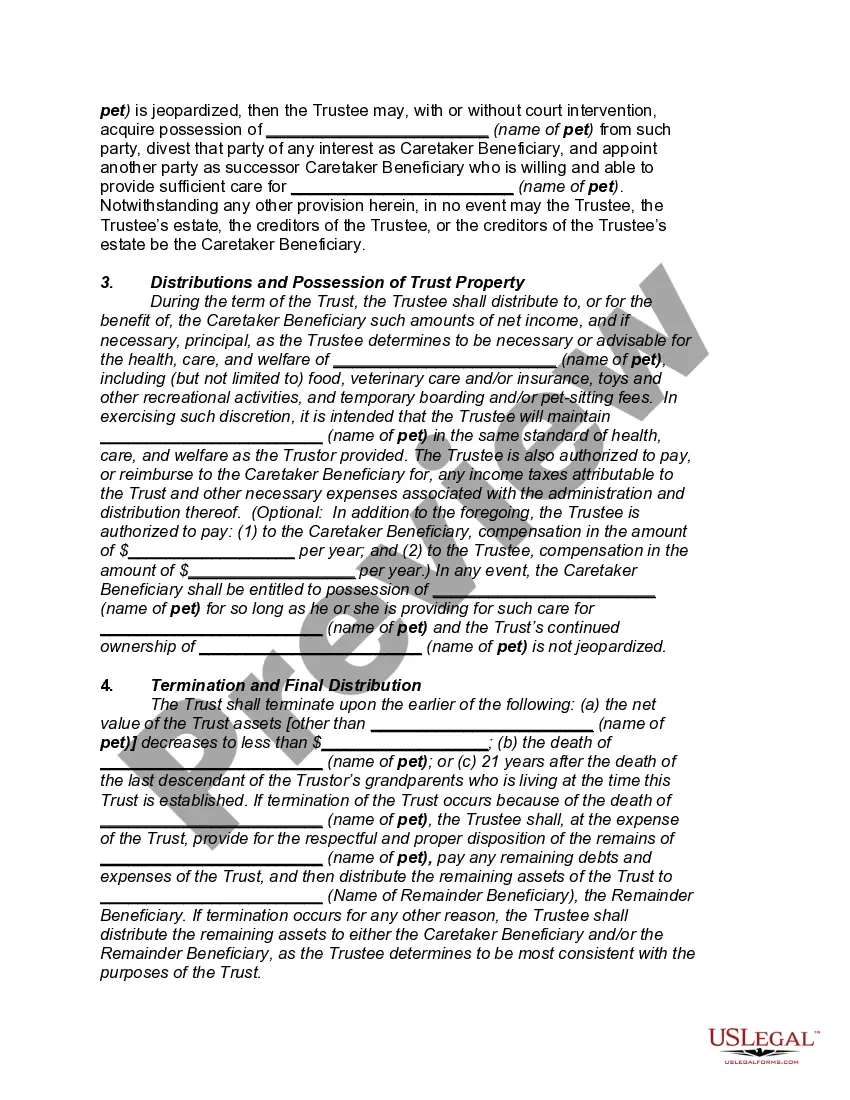

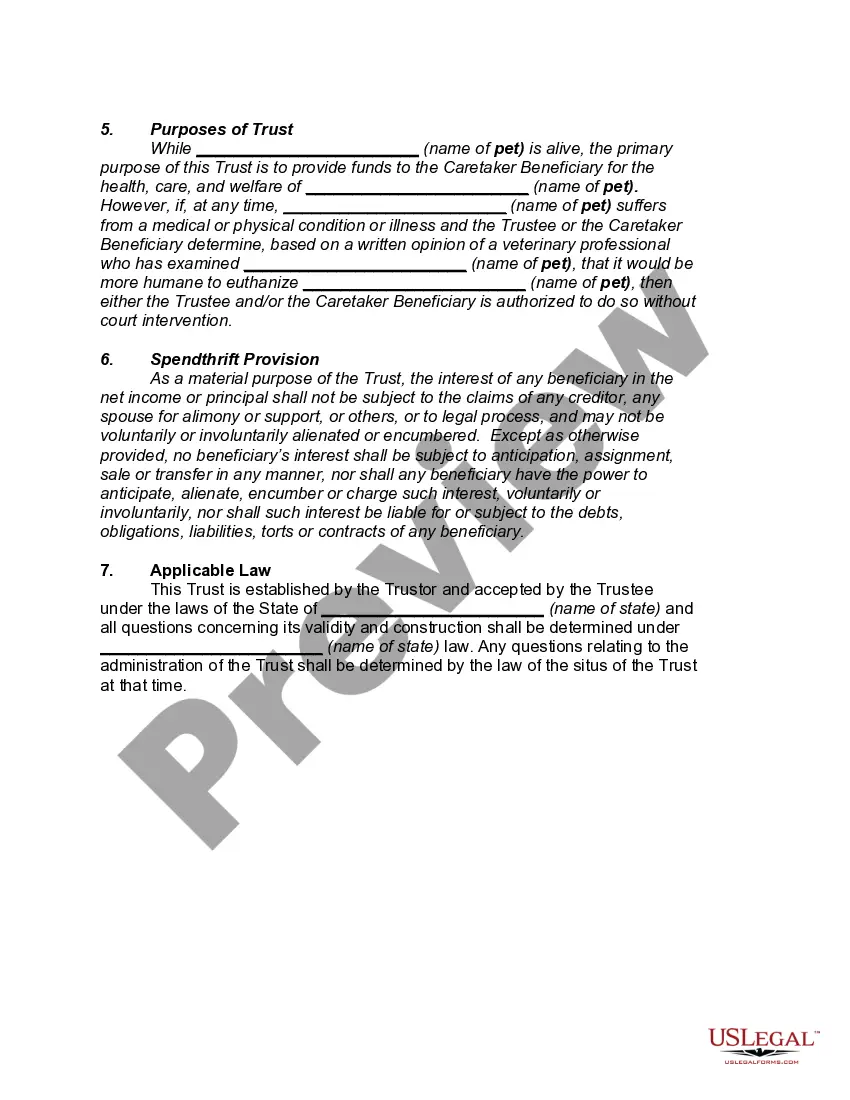

How to fill out Bequest In Trust For The Care And Maintenance Of Pet (Long Form)?

Regardless of whether for commercial reasons or personal issues, everyone must confront legal matters at some point in their lives.

Filling out legal paperwork requires meticulous care, beginning with selecting the appropriate form template.

Complete the profile registration form. Choose your payment method: utilize a credit card or PayPal account. Select the document format you prefer and download the Beneficiary Pet Any Foreigner. Once downloaded, you can fill out the form using editing software or print it and complete it manually. With a comprehensive US Legal Forms catalog available, you do not have to waste time searching for the right template online. Utilize the library’s user-friendly navigation to find the correct template for any occasion.

- For example, if you select an incorrect version of the Beneficiary Pet Any Foreigner, it will be rejected when submitted.

- Thus, it is vital to have a trustworthy source for legal documents such as US Legal Forms.

- If you need to obtain a Beneficiary Pet Any Foreigner template, follow these simple steps.

- Acquire the template you require using the search field or catalog browsing.

- Review the form’s description to ensure it fits your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search feature to find the Beneficiary Pet Any Foreigner template you need.

- Download the file when it meets your specifications.

- If you have a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

Form popularity

FAQ

In addition to the withholding requirement, naming a beneficiary who resides in a foreign country may allow the foreign country to tax the property and accounts of the trust. In most cases, a foreign person is subject to US tax on its US source income.

Naming an international beneficiary may have legal and tax implications in both your home country and the beneficiary's country. It's advisable to consult with legal and tax professionals to understand the potential consequences and ensure compliance with relevant laws.

Naming a non-US citizen as a beneficiary of a Trust could have consequences for inheritance or income-tax. For one, selecting a foreign citizen as a beneficiary can expose the Trust to increased tax liability.

The fact that you are a non-U.S. citizen should be irrelevant in this situation. If your husband named you as beneficiary, then all you should have to do is present the bank with a death certificate for your husband and identification for yourself.

?Spouses are considered eligible designated beneficiaries, even non-citizens spouses. As such your spouse can use the lifetime distribution rules rather than the 10-year limit. Further, it sounds like your wife is a U.S. tax resident so the distributions to her would not be subject to non-resident withholding.?