Partnership Interest Purchase For Services Rendered

Description

How to fill out Sale And Assignment Of A Percentage Ownership Interest In A Limited Liability Company?

It’s widely known that transitioning into a legal career doesn’t happen overnight, nor can you swiftly learn how to prepare a Partnership Interest Purchase For Services Rendered without a specialized background.

Drafting legal documents is an extensive undertaking that necessitates specific education and expertise.

So why not entrust the drafting of the Partnership Interest Purchase For Services Rendered to the experts.

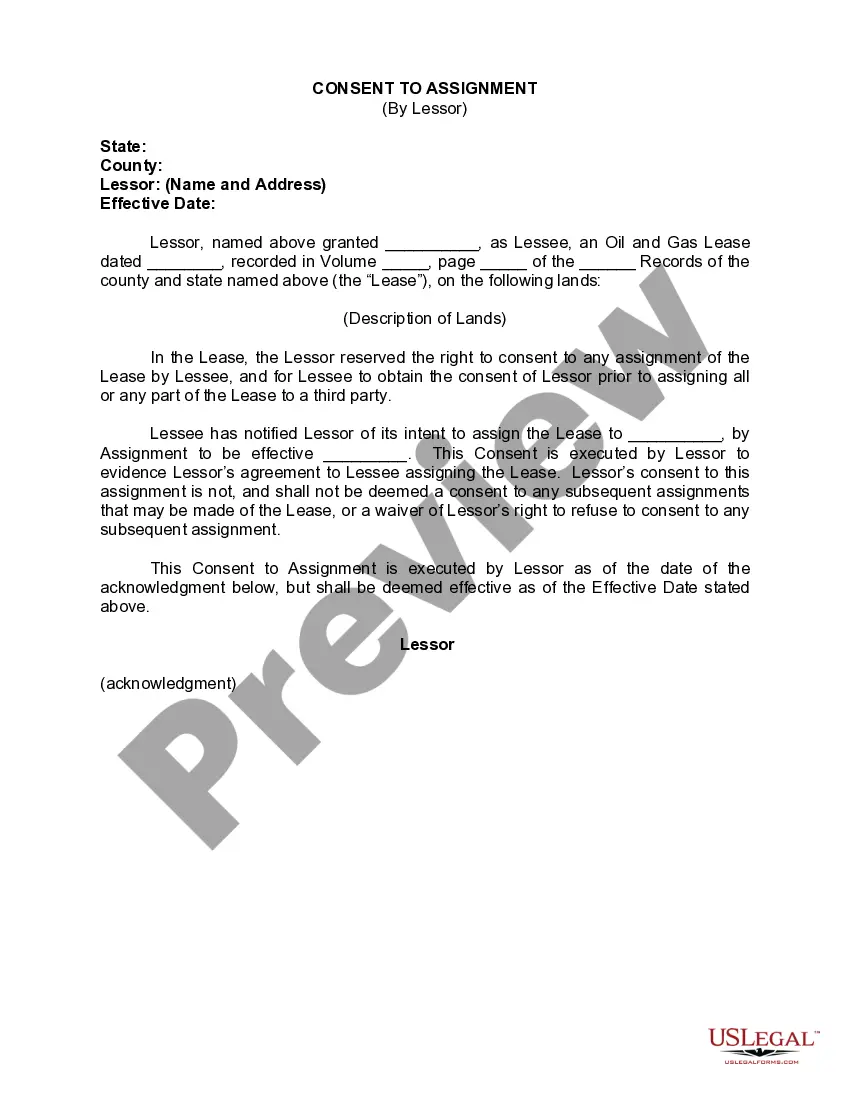

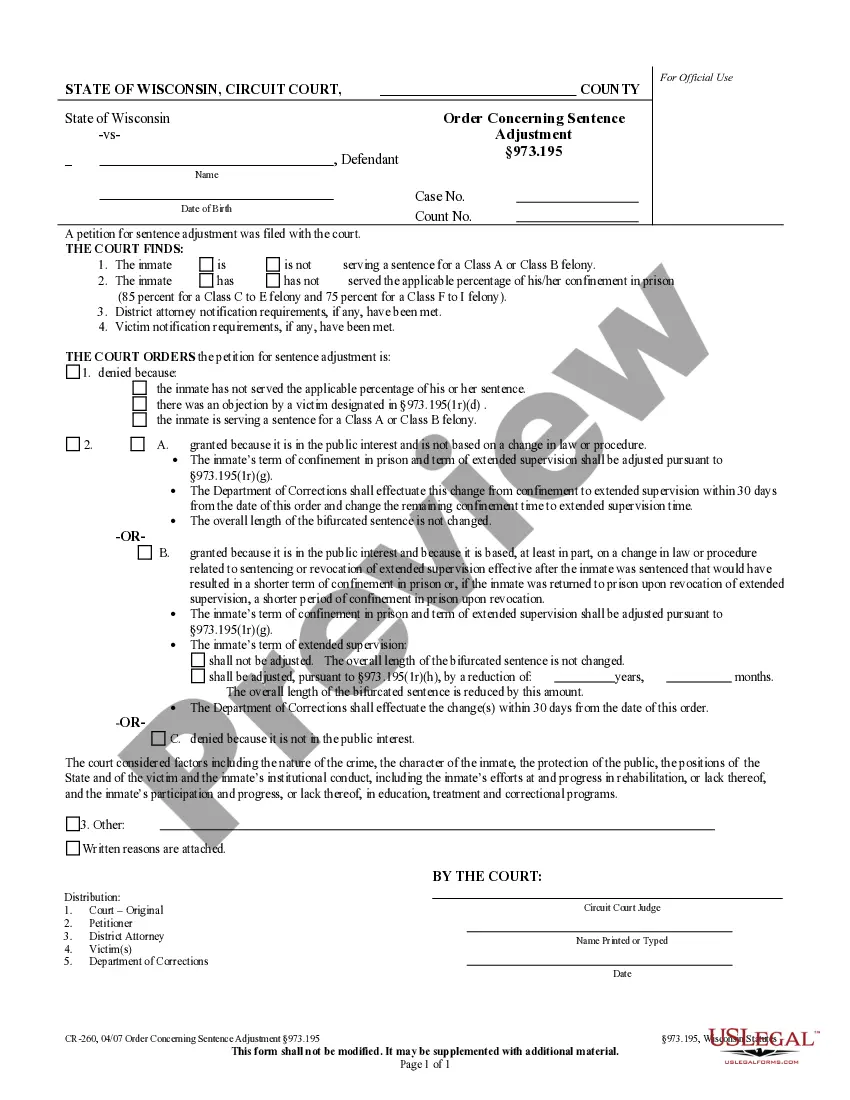

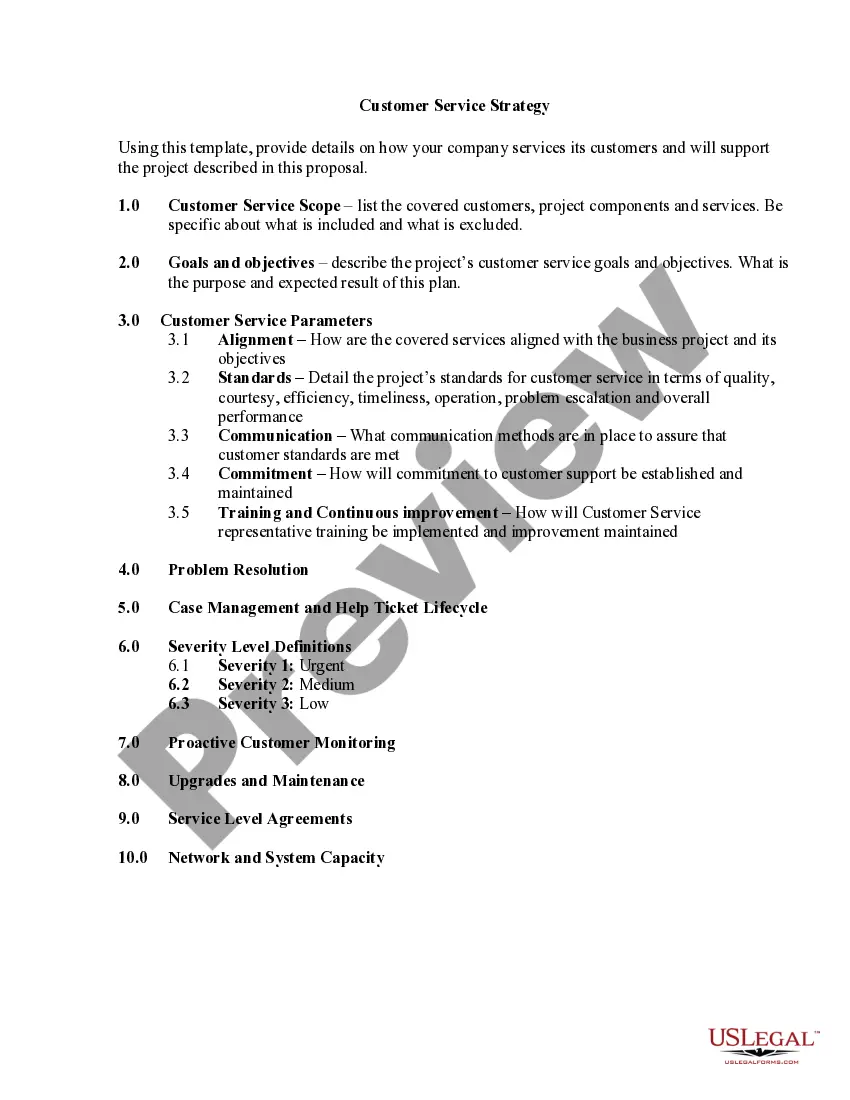

Preview it (if this option is available) and review the supporting description to determine if the Partnership Interest Purchase For Services Rendered is what you’re looking for.

If you need another form, restart your search. Create a free account and select a subscription plan to acquire the form. Click Buy now. Once the transaction is completed, you can obtain the Partnership Interest Purchase For Services Rendered, fill it out, print it, and send it by mail to the relevant individuals or entities.

- With US Legal Forms, one of the most extensive legal template collections, you can find everything from court documents to templates for internal corporate communications.

- We understand the importance of compliance and adherence to federal and local laws and regulations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can begin using our website and obtain the form you need in just a few minutes.

- Locate the required form using the search bar at the top of the page.

Form popularity

FAQ

Yes, a partnership can buy back a partner's interest, provided it aligns with the terms set forth in the partnership agreement. This buyback allows the partnership to regain control and adjust ownership stakes as needed. Clearly documenting the partnership interest purchase for services rendered during this process is critical to ensure transparency. Utilizing platforms like uslegalforms can help create the necessary agreements.

When a partner sells their partnership interest, the new partner assumes the rights and responsibilities outlined in the partnership agreement. This transaction may affect profit distribution and management decisions within the partnership. It is recommended to document the partnership interest purchase for services rendered in the sale agreement to safeguard all parties. Engaging with legal professionals can help streamline this process.

The 7 year rule for partnerships generally refers to the time frame during which partners must maintain their capital accounts after a partnership interest purchase. This rule affects how gains and losses are allocated among partners. Understanding this rule is vital to ensure compliance and to avoid potential tax issues. Knowing the nuances of the 7 year rule can be beneficial for all involved in the partnership.

An interest in exchange for services in an LLC involves providing a partner with a share of ownership in return for their work or expertise. This arrangement allows the partner to benefit from the company's profits while contributing to its success. Clearly defining the terms of this partnership interest purchase for services rendered in an operating agreement can help prevent misunderstandings. Effective communication among members is key.

To report a partnership buyout, the partnership must file Form 1065 with the IRS, indicating the changes in ownership. Each partner also needs to report their share of the partnership’s income or loss on their individual tax returns. It is essential to document the partnership interest purchase for services rendered in the agreement to ensure clarity during tax reporting. Consulting with a tax professional can provide further guidance.

When a partnership interest is purchased, the buyer acquires a share of the partnership's profits, losses, and management rights. This transaction often involves a formal agreement that outlines the terms of the purchase. Additionally, the partnership must update its records to reflect the new ownership structure. Understanding the implications of a partnership interest purchase for services rendered is crucial for both parties.

The tax implications of a buyout can vary significantly based on the structure of the partnership interest purchase for services rendered. Generally, if the buyout leads to a gain, it may be subject to capital gains tax. Additionally, you may need to account for depreciation recapture if assets are involved. Understanding these implications is crucial, and seeking guidance from a tax advisor can provide clarity.

To report a partnership buyout, you need to properly document the partnership interest purchase for services rendered on your tax return. Typically, you will use IRS Form 1065 and Schedule K-1 to report income, deductions, and other relevant information. Make sure to keep thorough records of the transaction, as these will be necessary for accurate reporting. Consulting US Legal Forms can simplify the documentation process and ensure compliance.

Common K-1 mistakes often arise from incorrect reporting of partnership interest purchases for services rendered. These might include miscalculating income, omitting expenses, or failing to report distributions accurately. It is crucial to review all entries carefully and ensure that the information aligns with your partnership agreement. Utilizing platforms like US Legal Forms can help you streamline the reporting process and minimize errors.