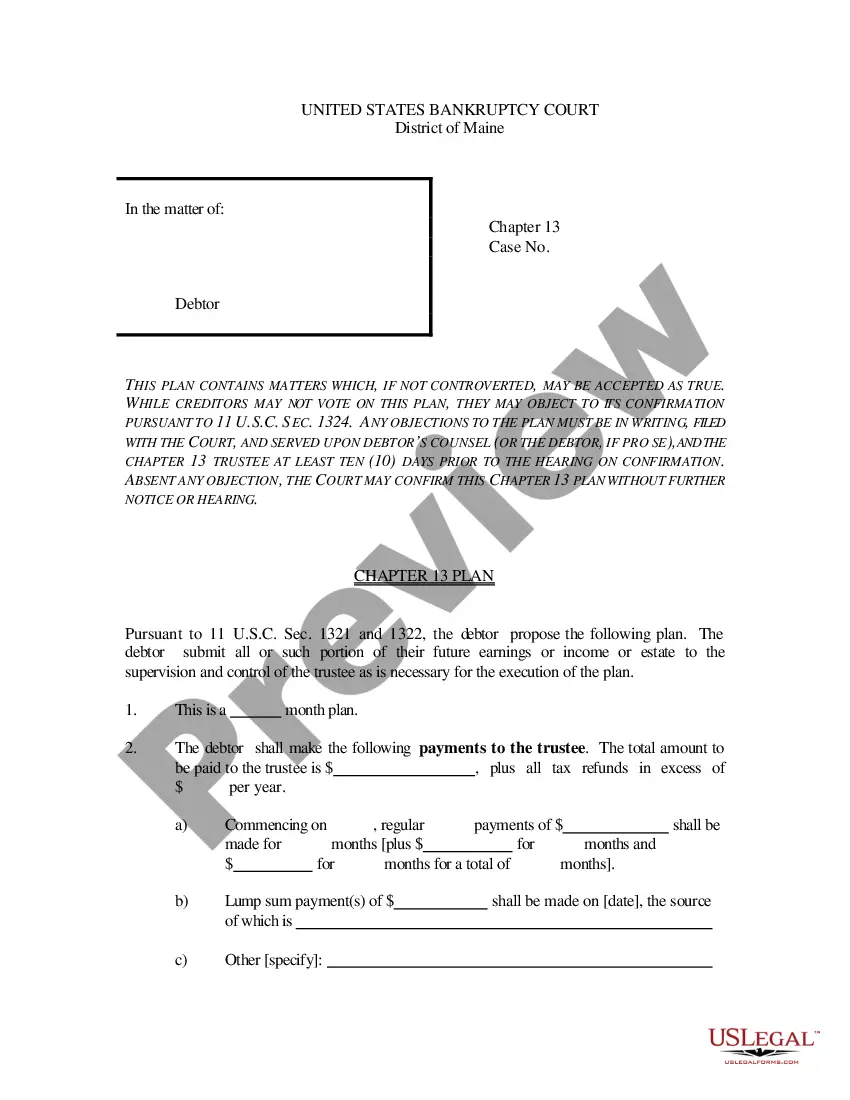

Security Interest Definition With Example

Description

How to fill out Assignment Of Interest Of Seller In A Security Agreement?

Regardless of whether for professional objectives or personal matters, everyone must handle legal issues at some point in their lifetime.

Completing legal documents requires meticulous care, beginning with selecting the correct form template. For instance, if you choose an incorrect version of a Security Interest Definition With Example, it will be denied once you submit it. Thus, it is essential to have a reliable source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct sample online. Take advantage of the library’s straightforward navigation to find the suitable form for any circumstance.

- Obtain the sample you require by using the search bar or catalog browsing.

- Review the form’s details to ensure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search feature to find the Security Interest Definition With Example sample you need.

- Download the file when it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you haven't created an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Security Interest Definition With Example.

- Once it is downloaded, you can fill out the form with editing software or print it and complete it by hand.

Form popularity

FAQ

A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it if the loan goes bad. A security interest lowers the risk for a lender, allowing it to charge lower interest on the loan.

Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

There are five ways a creditor may perfect a security interest: (1) by filing a financing statement, (2) by taking or retaining possession of the collateral, (3) by taking control of the collateral, (4) by taking control temporarily as specified by the UCC, or (5) by taking control automatically.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.

A lender can perfect a lien on a borrower's deposit account only by obtaining "control" over the account, which requires one of the following arrangements: (1) the borrower maintains its deposit account directly with the lender; (2) the lender becomes the actual owner of the borrower's deposit accounts with the ...