Trust Fund Withdrawal Tax

Description

How to fill out Irrevocable Trust Funded By Life Insurance?

Dealing with legal paperwork and operations could be a time-consuming addition to your day. Trust Fund Withdrawal Tax and forms like it usually need you to look for them and navigate how to complete them properly. As a result, regardless if you are taking care of economic, legal, or individual matters, using a thorough and practical web catalogue of forms at your fingertips will go a long way.

US Legal Forms is the best web platform of legal templates, featuring more than 85,000 state-specific forms and numerous tools that will help you complete your paperwork quickly. Explore the catalogue of appropriate papers available with just one click.

US Legal Forms offers you state- and county-specific forms available at any time for downloading. Protect your papers management procedures by using a top-notch service that lets you prepare any form within a few minutes with no additional or hidden fees. Just log in to your profile, identify Trust Fund Withdrawal Tax and acquire it straight away within the My Forms tab. You may also access previously downloaded forms.

Would it be your first time making use of US Legal Forms? Register and set up an account in a few minutes and you will get access to the form catalogue and Trust Fund Withdrawal Tax. Then, adhere to the steps listed below to complete your form:

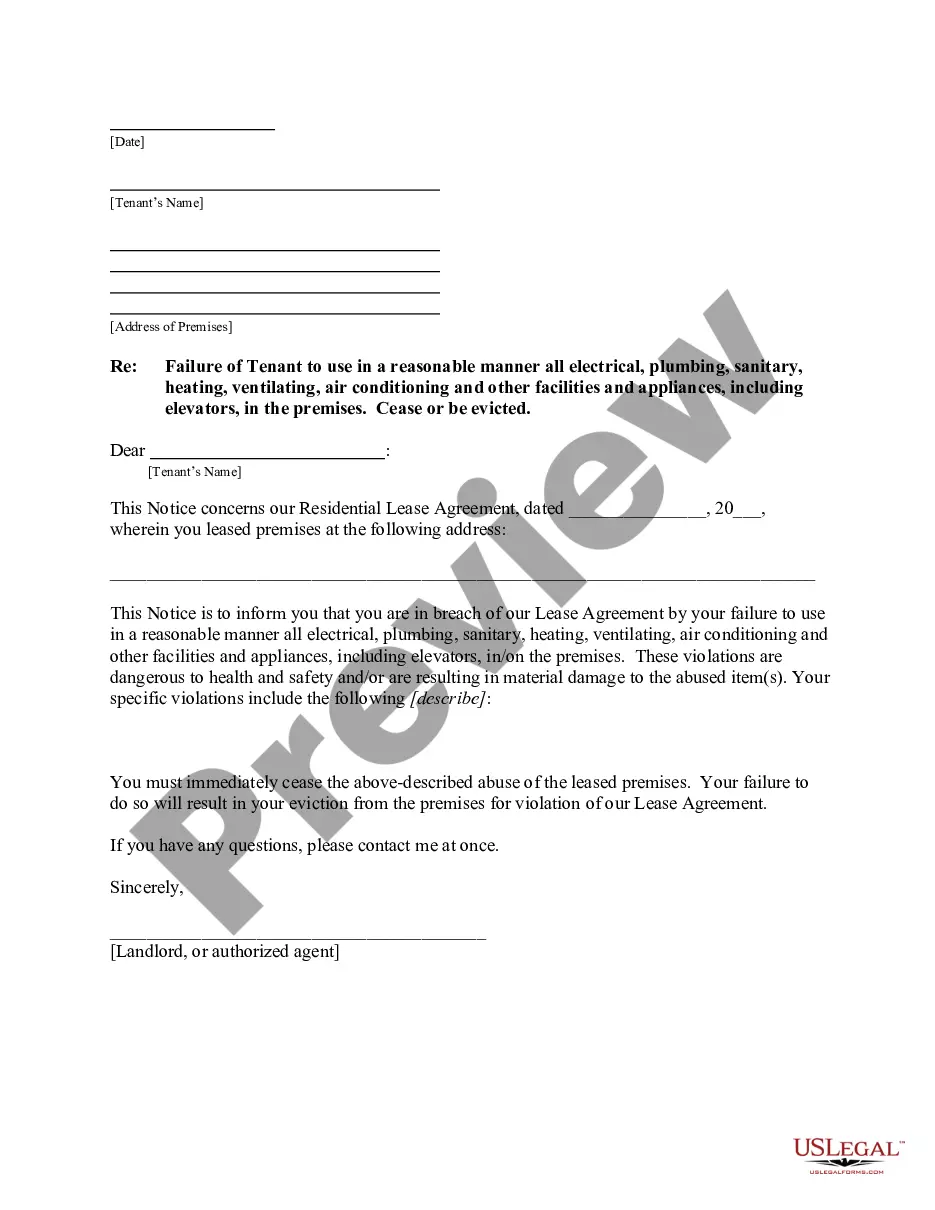

- Be sure you have the proper form by using the Preview feature and reading the form information.

- Select Buy Now when ready, and select the monthly subscription plan that fits your needs.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of experience assisting users manage their legal paperwork. Discover the form you need today and enhance any process without having to break a sweat.

Form popularity

FAQ

As noted above, when a trust calculates the distributable net income, it essentially prevents any instance of double taxation of the funds issued by a trust. The formula to calculate the figure is as follows: Distributable Net Income (DNI) = Taxable Income - Capital Gains + Tax Exemption.

Beneficiaries of a trust typically pay taxes on distributions they receive from the trust's income. However, they are not subject to taxes on distributions from the trust's principal.

Trust beneficiaries must pay taxes on income and other distributions from a trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Principal Distributions. When a trust beneficiary receives a distribution from the trust's principal balance, he does not have to pay taxes on it, the reason being the Internal Revenue Service (IRS) assumes this money was already taxed before it was placed into the trust.

If the trust holds the income and does not disburse it to the beneficiary by year-end, then the trust is liable for the taxes. However, if funds are distributed to one or more beneficiaries, the income is taxable to the person who receives it. The taxable amount depends on the interest vs. principal allocation.