Trust Fund With Interest

Description

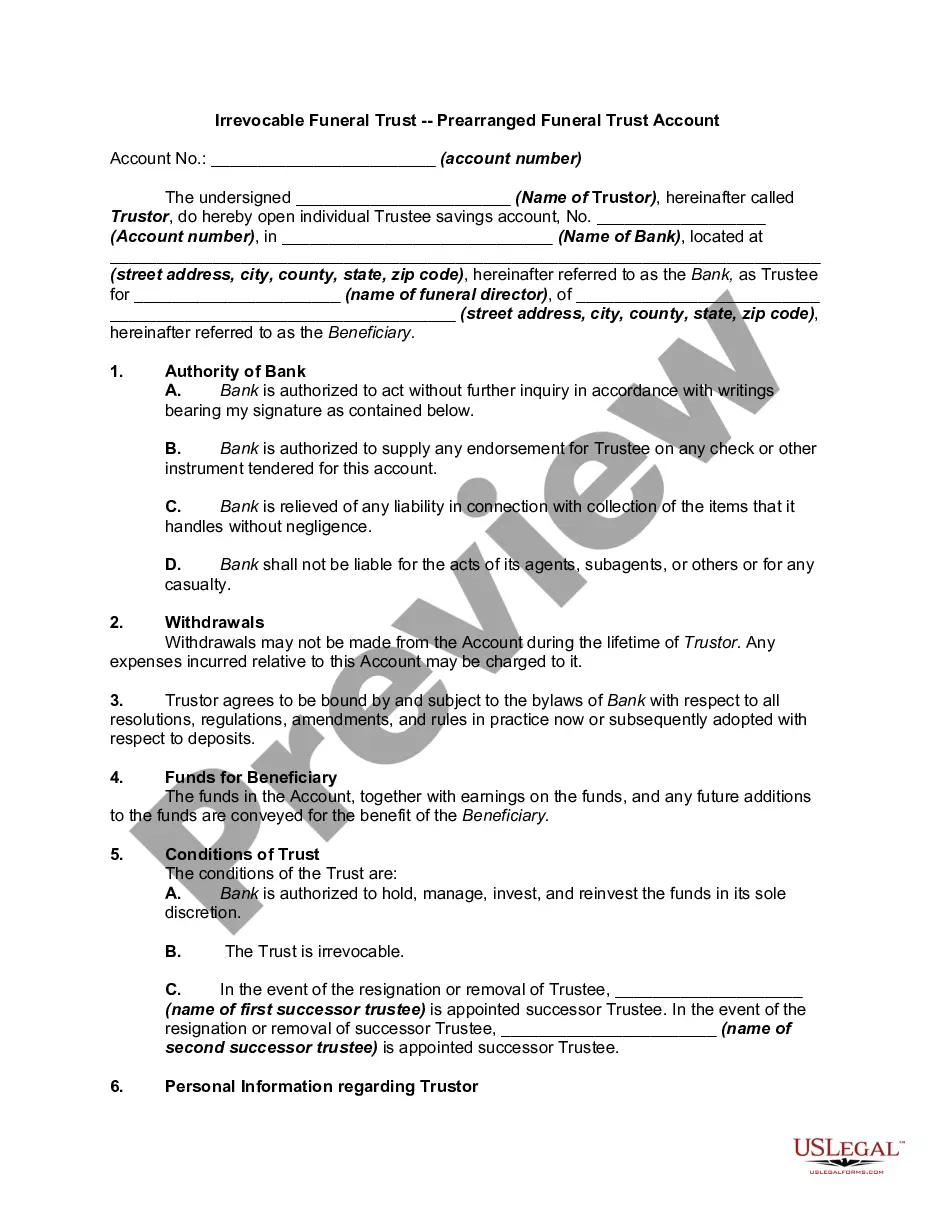

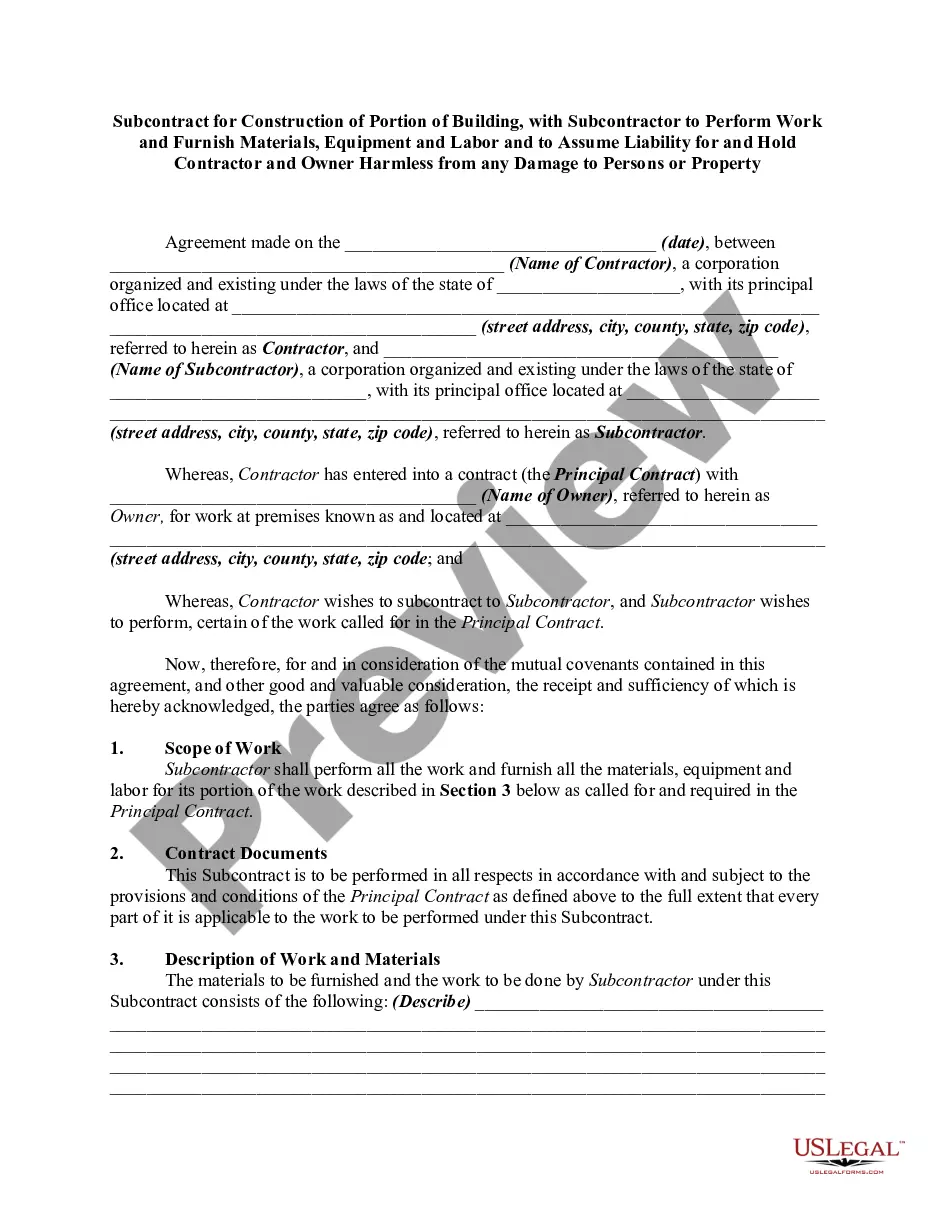

How to fill out Irrevocable Trust Funded By Life Insurance?

Whether for business purposes or for individual affairs, everyone has to manage legal situations sooner or later in their life. Filling out legal paperwork demands careful attention, beginning from picking the appropriate form sample. For instance, when you choose a wrong version of the Trust Fund With Interest, it will be declined when you send it. It is therefore essential to get a trustworthy source of legal papers like US Legal Forms.

If you have to get a Trust Fund With Interest sample, follow these easy steps:

- Find the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to locate the Trust Fund With Interest sample you require.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Trust Fund With Interest.

- When it is saved, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time searching for the right template across the web. Utilize the library’s simple navigation to find the appropriate template for any situation.

Form popularity

FAQ

It is a way to hold items for the benefit of someone, yet the account itself doesn't earn interest or change value. Only the assets within the trust fund can gain interest or provide other investment returns, not the trust fund itself.

Beneficial interest refers to a right to income or use of assets in a trust. People with a beneficial interest do not own title to the property, but they have some right to benefit from the property. This is to be contrasted with trustees and other agents of the trust who only have managing duties.

Once money is placed into the trust, the interest it accumulates is taxable as income, either to the beneficiary or the trust itself. The trust must pay taxes on any interest income it holds and does not distribute past year-end. Interest income the trust distributes is taxable to the beneficiary who receives it.

(a) An official has an economic interest in the pro rata share of the interests in real property, sources of income, and investments of a trust in which the official has a direct, indirect, or beneficial interest of 10 percent or greater.

Yes, all money deposited in a trust account is invested and earns interest or yield returns, or both.