Trust Fund And How They Work For South Africa

Description

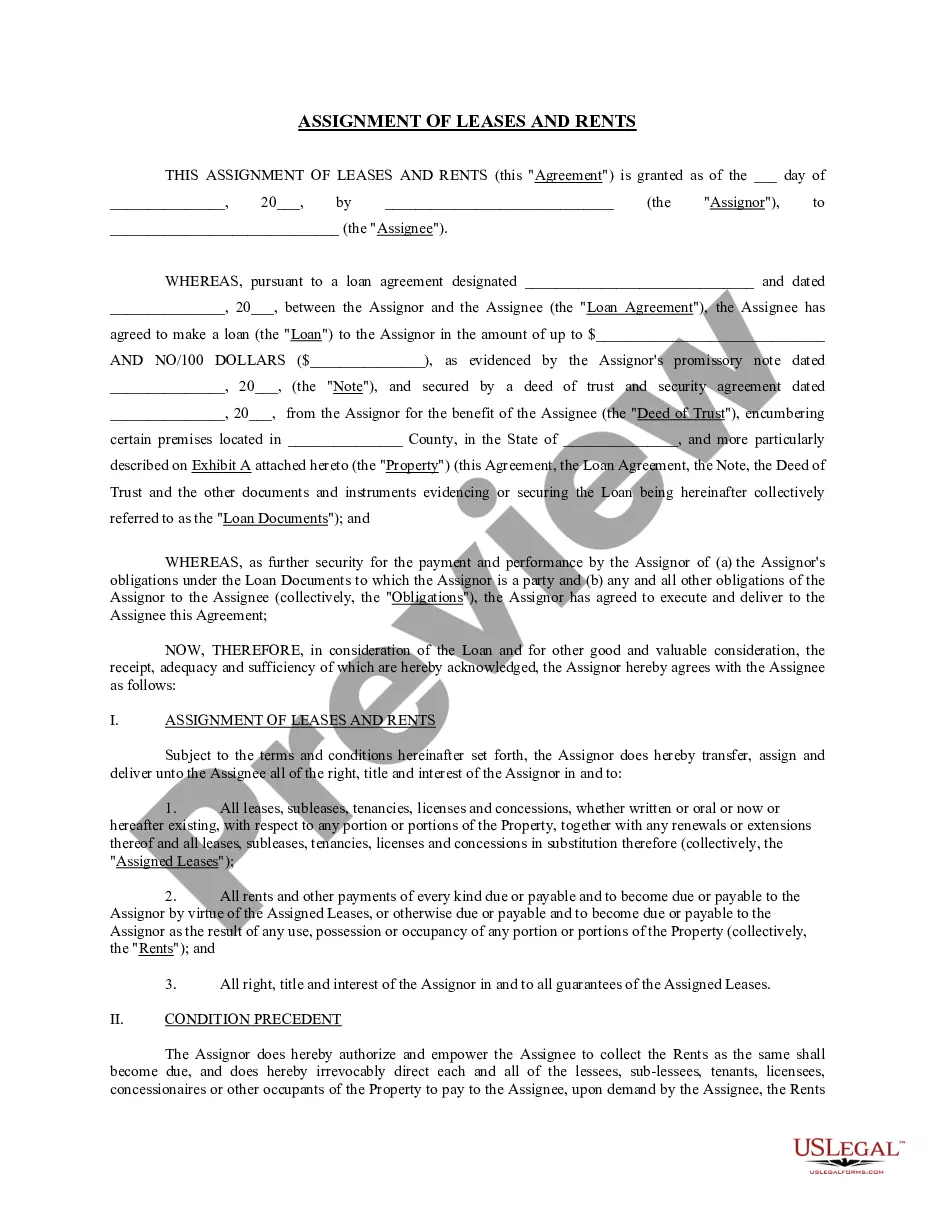

How to fill out Irrevocable Trust Funded By Life Insurance?

Legal papers management can be frustrating, even for skilled experts. When you are interested in a Trust Fund And How They Work For South Africa and don’t get the time to spend trying to find the appropriate and up-to-date version, the procedures can be demanding. A robust online form library might be a gamechanger for everyone who wants to handle these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any demands you could have, from personal to enterprise paperwork, all-in-one location.

- Employ advanced resources to complete and deal with your Trust Fund And How They Work For South Africa

- Gain access to a resource base of articles, instructions and handbooks and materials connected to your situation and requirements

Save time and effort trying to find the paperwork you need, and employ US Legal Forms’ advanced search and Review tool to get Trust Fund And How They Work For South Africa and download it. In case you have a membership, log in in your US Legal Forms account, search for the form, and download it. Take a look at My Forms tab to find out the paperwork you previously saved as well as deal with your folders as you see fit.

Should it be your first time with US Legal Forms, create an account and get unlimited usage of all benefits of the library. Here are the steps for taking after accessing the form you want:

- Verify it is the right form by previewing it and looking at its information.

- Ensure that the sample is acknowledged in your state or county.

- Choose Buy Now once you are ready.

- Select a subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and deliver your papers.

Take advantage of the US Legal Forms online library, supported with 25 years of experience and trustworthiness. Enhance your day-to-day papers management into a smooth and easy-to-use process right now.

Form popularity

FAQ

Where the Trust itself is taxed, it is taxed at a flat rate of 45%. Special Trusts are taxed on a sliding scale from 18% to 45% (same as natural persons). Top Tip: Trusts do not qualify for any of the rebates provided for in Section 6 of the Income Tax Act.

The registration number of an inter vivos trust starts with the letters IT, followed by a number issued by the Master of the High Court's office, followed by the year the trust was registered.

A trust is a legal arrangement whereby control over property is transferred to a person or organisation (the trustee) for the benefit of someone else (the beneficiary). You can register two types of trusts, namely the inter-vivos trust and the testamentary trust.

Deeds Office Search: If the trust owns property, a search at the Deeds Office can provide confirmation of the trust's ownership and registration. Consult with a Trust Attorney: Engaging with a professional who specialises in South African trust law can provide clarity.

Setting up a trust can cost between R4,000 and R12,000. Careful consideration must be given to the wording of the trust deed because you want to ensure that the trust is both tax effective, and also that your family will continue to benefit when you die.