Trust Account With Barclays

Description

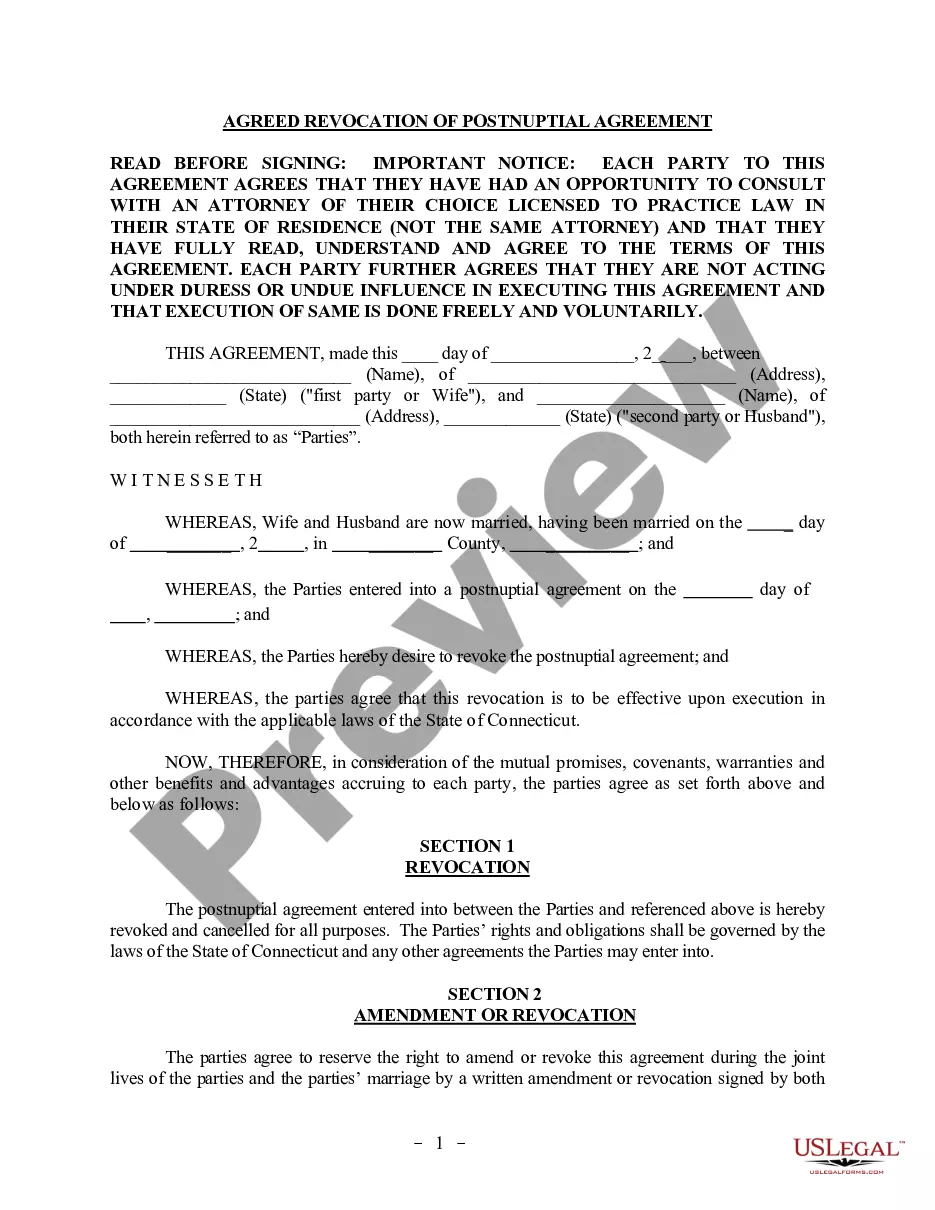

How to fill out Irrevocable Trust Funded By Life Insurance?

Dealing with legal papers and procedures can be a time-consuming addition to your entire day. Trust Account With Barclays and forms like it typically need you to look for them and navigate the way to complete them properly. Therefore, whether you are taking care of economic, legal, or individual matters, having a thorough and convenient online library of forms at your fingertips will significantly help.

US Legal Forms is the best online platform of legal templates, offering more than 85,000 state-specific forms and a number of tools to help you complete your papers quickly. Discover the library of appropriate papers available to you with just a single click.

US Legal Forms gives you state- and county-specific forms available at any moment for downloading. Protect your papers administration procedures with a top-notch service that lets you put together any form within minutes with no extra or hidden cost. Just log in to the account, identify Trust Account With Barclays and acquire it straight away in the My Forms tab. You can also access previously saved forms.

Would it be the first time utilizing US Legal Forms? Register and set up up a free account in a few minutes and you’ll gain access to the form library and Trust Account With Barclays. Then, follow the steps listed below to complete your form:

- Be sure you have found the proper form using the Review option and reading the form information.

- Choose Buy Now when all set, and choose the monthly subscription plan that is right for you.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise assisting users handle their legal papers. Discover the form you need today and streamline any operation without having to break a sweat.

Form popularity

FAQ

Comprehensive banking and financing solutions, including cash management and liquidity management, client monies management, term loans, trade and working capital solutions and FX management.

A number of well-known banks in the UK have, over the past year or so, stopped offering traditional banking services to trusts, citing issues such as cost, complexity and compliance as reasons for exiting a long-established part of the market.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust ing to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

You may need to write a Letter of Instruction requesting that the name on your account be changed to the name of your Trust. Include your bank account number, the name of your Trust, your Social Security number, mailing address, phone number, and email address.

Our services are available to Smart Investor account holders, so you'll need to open an account to explore the funds, ETFs and investment trusts we offer.