Life Insurance Trust Form With Crummey Powers

Description

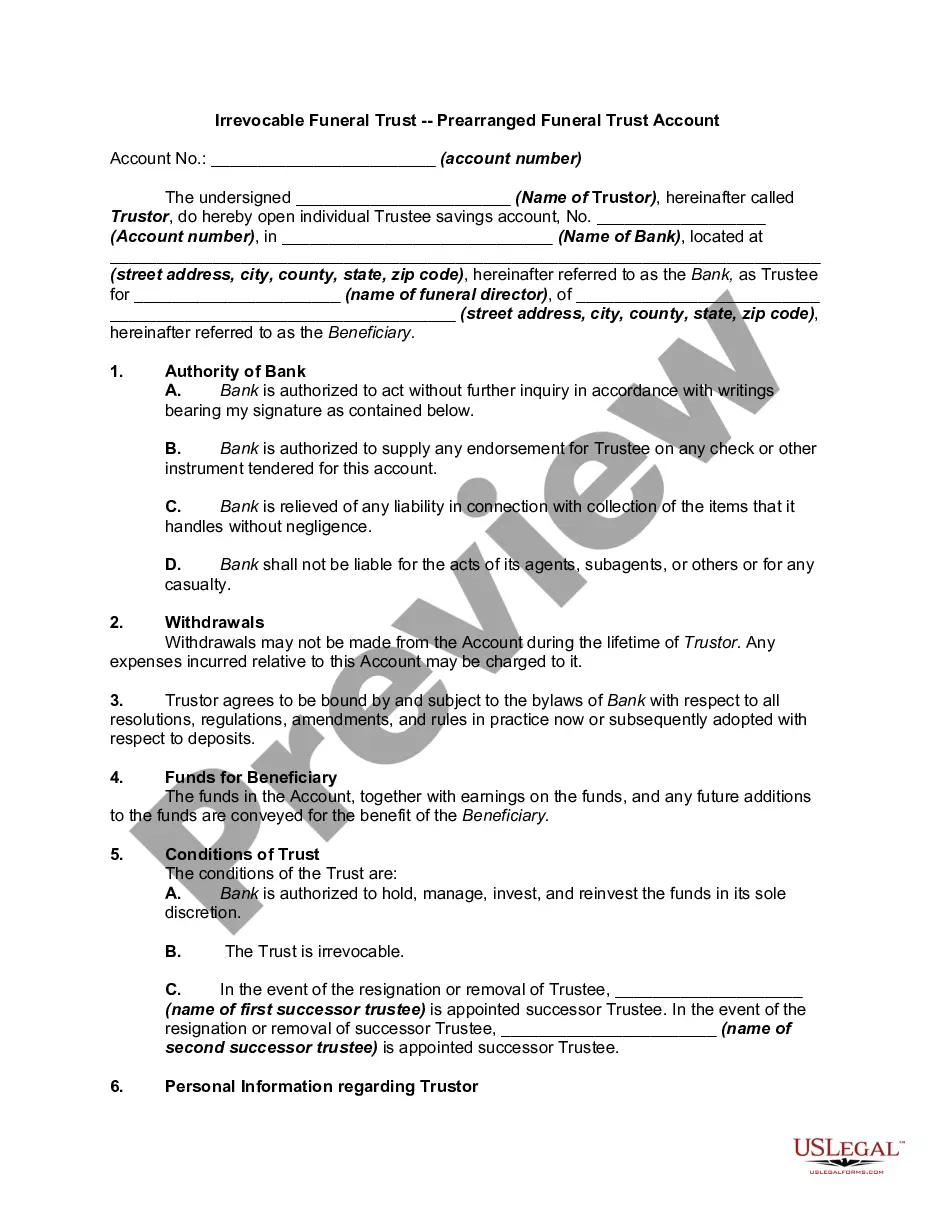

How to fill out Irrevocable Trust Funded By Life Insurance?

Drafting legal documents from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of creating Life Insurance Trust Form With Crummey Powers or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific forms carefully put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the Life Insurance Trust Form With Crummey Powers. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the library. But before jumping straight to downloading Life Insurance Trust Form With Crummey Powers, follow these tips:

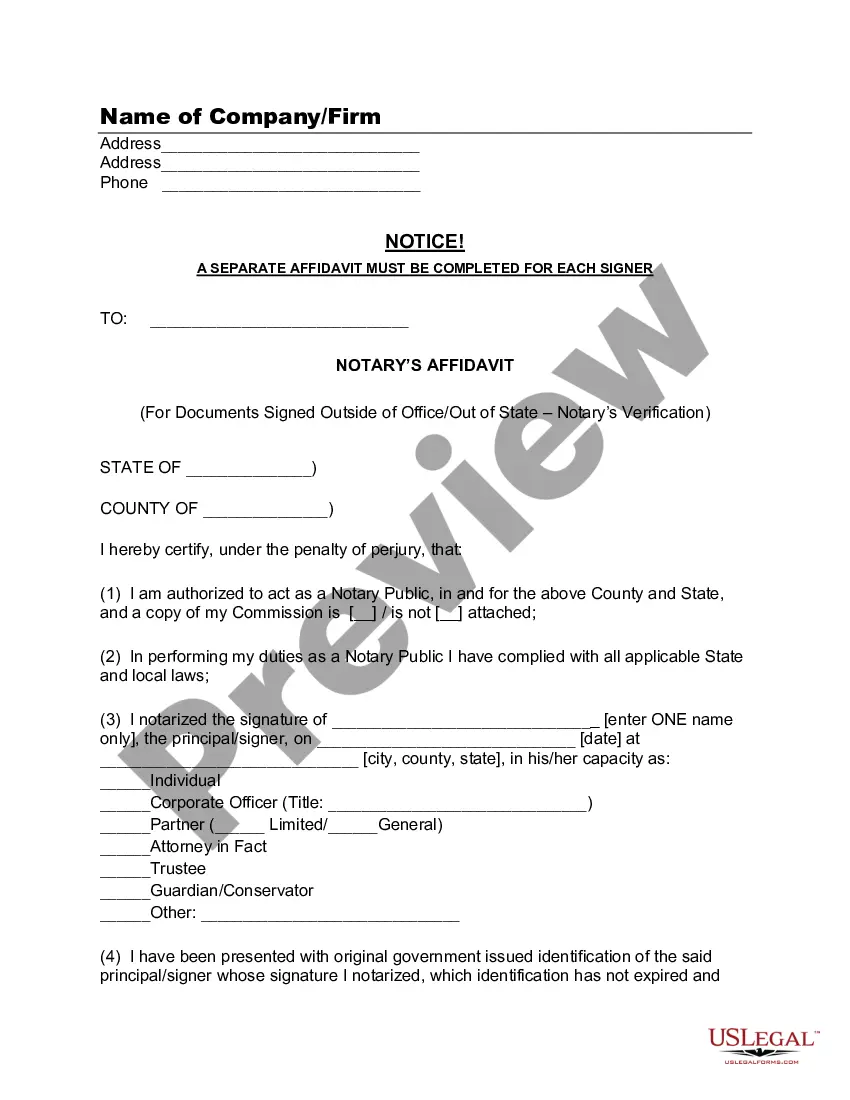

- Check the form preview and descriptions to ensure that you are on the the form you are looking for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Choose the right subscription option to get the Life Insurance Trust Form With Crummey Powers.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of experience. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

Crummey Letter Overview When gifts are put into the trust, the Crummey notice must be delivered to beneficiaries. The letter must state the amount of the gift. The Crummy letter must inform each beneficiary that they can take out money from the trust and do so immediately.

The time limited power of withdrawal granted in order to create present interests in the donees have come to be known as "Crummey powers." One of the key provisions in an unfunded irrevocable life insurance trust is the "Crummey power." By inserting a special trust provision creating a presently exercisable power of ...

Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion. For Crummey power to work, individuals must stipulate that the gift is part of the trust when it is drafted.

A Crummey letter is a written document detailing what the Crummey power is being given to beneficiaries so the funds are eligible for the gift tax exclusion. The IRS mandates that Crummey letters be sent to trust beneficiaries, so the Crummey notice is vital.

Prior to the beneficiary's turning age 21, income retained by the trust is taxed to the trust. Because the trust is a separate taxpayer, separate income tax returns for the trust must be filed each year. Any income distributed to the beneficiary will be taxed to the beneficiary, subject to the kiddie tax rules.