Modify Interest Rate Forecast

Description

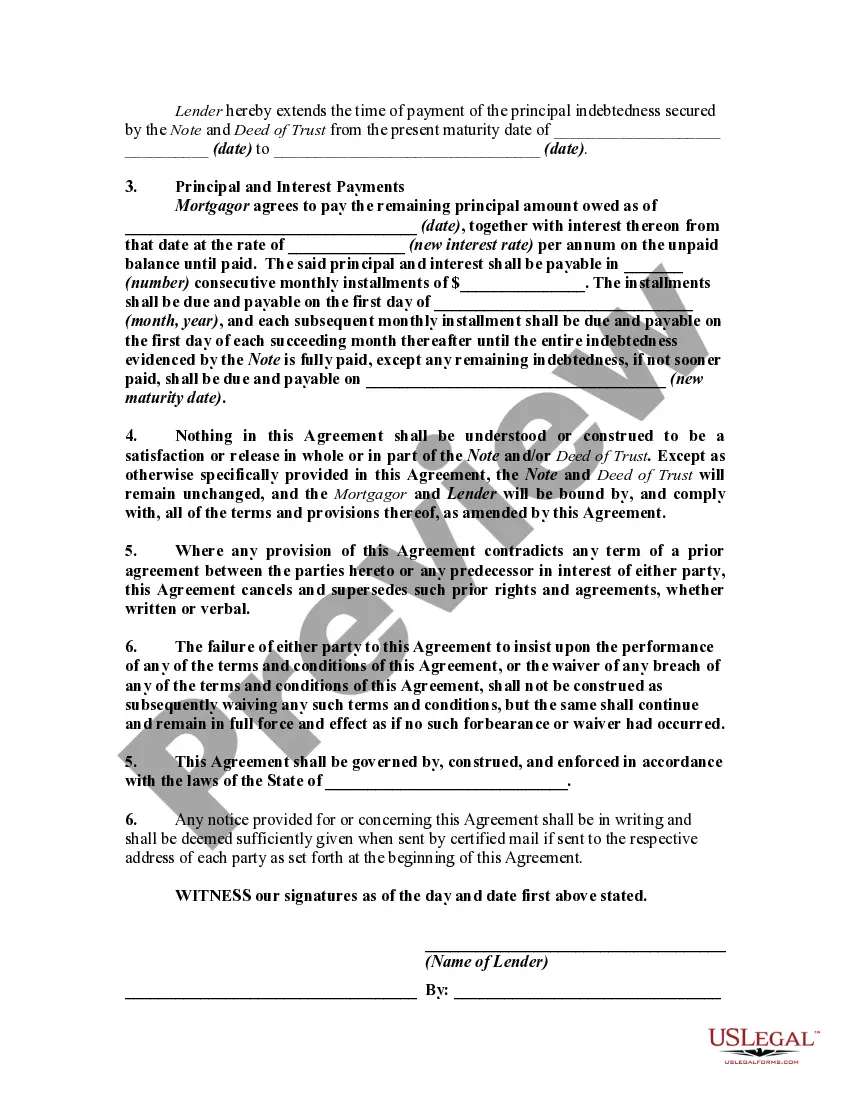

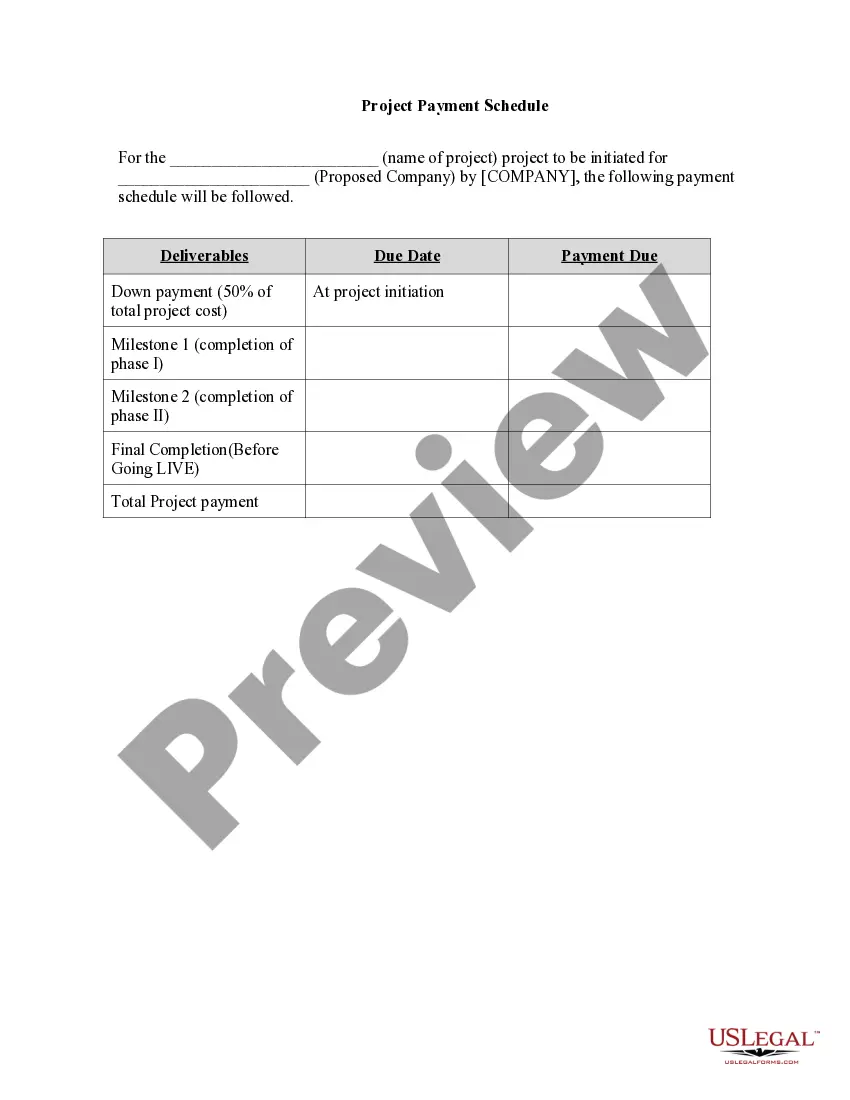

How to fill out Agreement To Change Or Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Deed Of Trust?

Managing legal documents and procedures can be an arduous addition to your entire day.

Adjusting Interest Rate Forecast and forms similar to it typically necessitate that you search for them and understand how to fill them out correctly.

As a result, whether you are addressing financial, legal, or personal issues, having a comprehensive and user-friendly online directory of forms readily available will greatly assist.

US Legal Forms is the premier online system of legal templates, providing over 85,000 state-specific documents and numerous resources that will enable you to complete your paperwork effortlessly.

Is this your first experience with US Legal Forms? Sign up and create an account in a few moments, and you’ll unlock access to the form directory and Modify Interest Rate Forecast. Next, follow the steps below to fill out your form.

- Browse the collection of relevant documents at your fingertips with just one click.

- US Legal Forms provides you with state- and county-specific documents accessible anytime for download.

- Protect your document management tasks using a high-quality service that allows you to generate any form in just minutes without additional or concealed charges.

- Just Log In to your account, locate Modify Interest Rate Forecast and obtain it instantly from the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

Answer and Explanation: It is challenging to forecast the interest rates because they fluctuate continuously and they depend on many factors such as investors in the credit markets, management of countries and banking managing trend.

Review your budget. ... Pay down your other debts. ... Make extra repayments on your home loan. ... Put your savings in a high interest savings account. ... Use an offset account. ... Compare your interest rate regularly. ... Talk with your lender about moving to a lower rate. ... 8 Review your home loan and consider refinancing.

You can capitalize on higher rates by purchasing real estate and selling off unneeded assets. Short-term and floating-rate bonds are also suitable investments during rising rates as they reduce portfolio volatility. Hedge your bets by investing in inflation-proof investments and instruments with credit-based yields.

The Fed now expects its benchmark federal funds rate to close out 2024 at an effective rate of 5.1%, which is higher than its June forecast of 4.6%. That means that borrowing costs for loans, auto financing and credit cards will remain pretty much the same through 2024, as the current effective rate is 5.33%.

Forecast interest rates based on the yield-curve interest rates in effect at the as-of date and consistent with the modeling bucket definitions. Make incremental changes to an existing forecast scenario. Flatten or steepen the yield curve around a specific point on the curve.