Sample Revocable Trust Form With Two Points

Description

How to fill out College Education Trust Agreement?

Crafting legal papers from the ground up can frequently be somewhat daunting.

Certain situations may entail extensive investigation and significant financial investment.

If you’re seeking a more straightforward and cost-effective method of preparing Sample Revocable Trust Form With Two Points or any other documents without unnecessary complications, US Legal Forms is readily available.

Our digital catalog of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

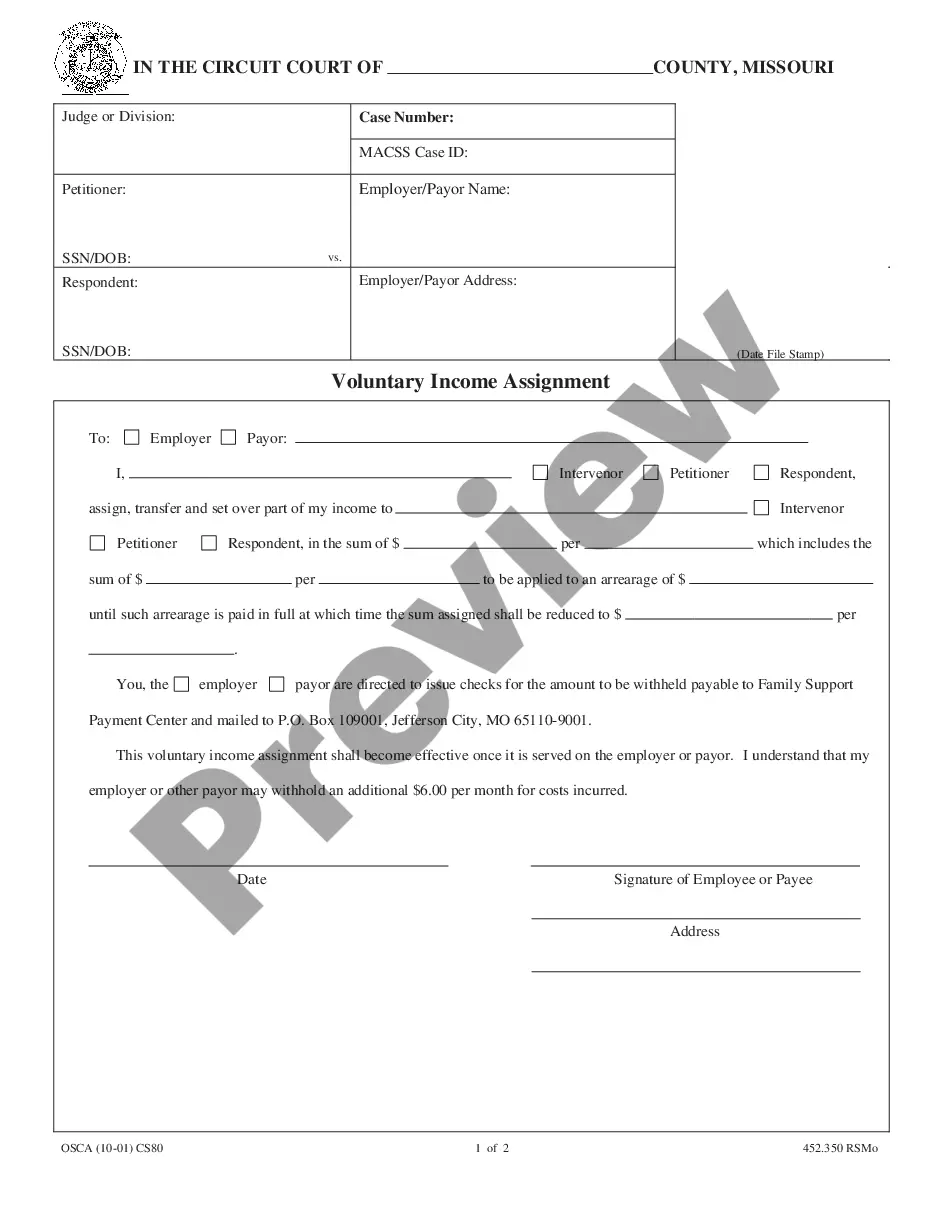

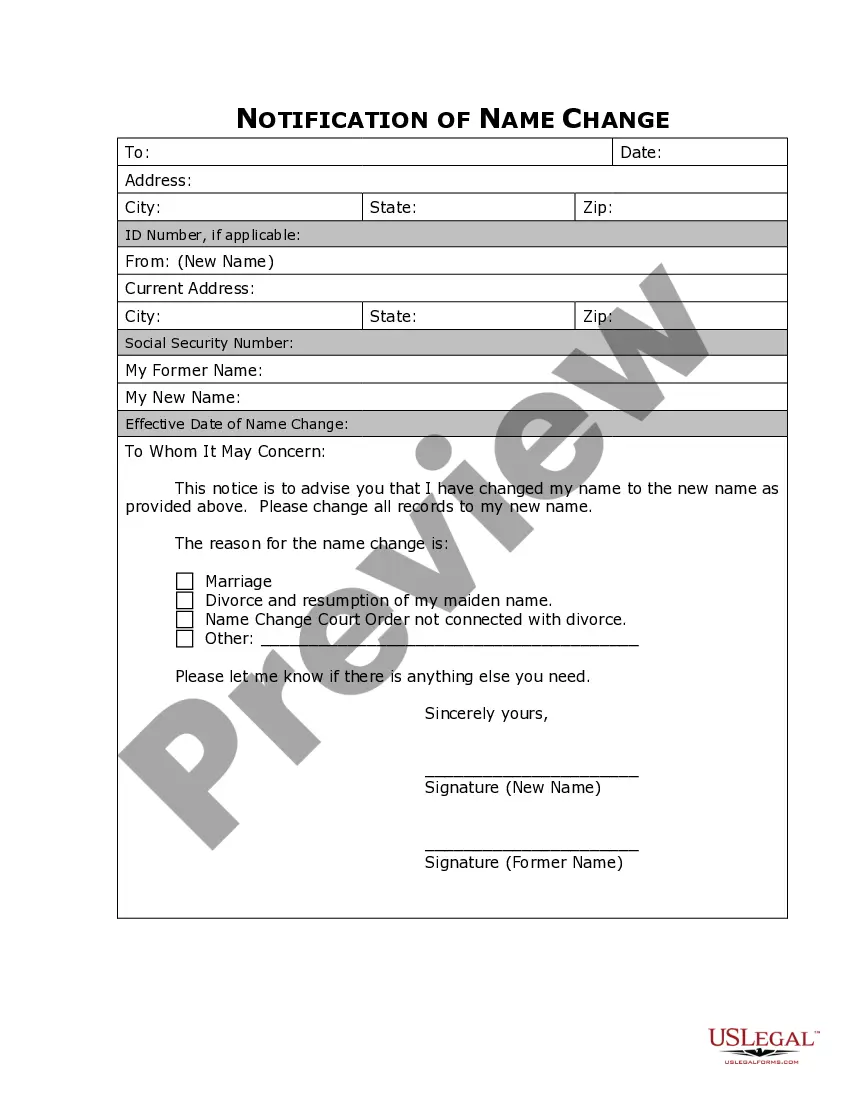

Ensure the document preview and descriptions align with what you are seeking. Verify that the template you select fulfills the requirements of your state and county. Select the appropriate subscription option to obtain the Sample Revocable Trust Form With Two Points. Download the file, complete it, certify it, and print it. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and make form execution easy and efficient!

- With just a few clicks, you can promptly access state- and county-compliant documents meticulously prepared for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can effortlessly find and download the Sample Revocable Trust Form With Two Points.

- If you’re already familiar with our services and have set up an account, simply Log In, select the form and download it or re-download it later in the My documents section.

- Not registered yet? No worries. It takes just a few minutes to set it up and browse through the catalog.

- However, before directly downloading the Sample Revocable Trust Form With Two Points, adhere to these suggestions.

Form popularity

FAQ

Revocable trusts are a good choice for those concerned with keeping records and information about assets private after your death. The probate process that wills are subjected to can make your estate an open book since documents entered into it become public record, available for anyone to access.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

List your assets and decide which you'll include in the trust. ... Gather the paperwork. ... Decide whether you will be the sole grantor. ... Choose beneficiaries. ... Choose a successor trustee. ... Choose someone to manage property for minor children. ... Prepare the trust document. ... Sign and Notarize.

Upon the decedent's death, the typical "A/B Trust" is divided into two subtrusts, which are often referred to as the ?Survivor's Trust? and the "Decedent's Trust." It is called an A/B Trust because the Survivor's Trust is referred to as Trust A, and the Decedent's Trust is referred to as Trust B. (a) Survivor's Trust.