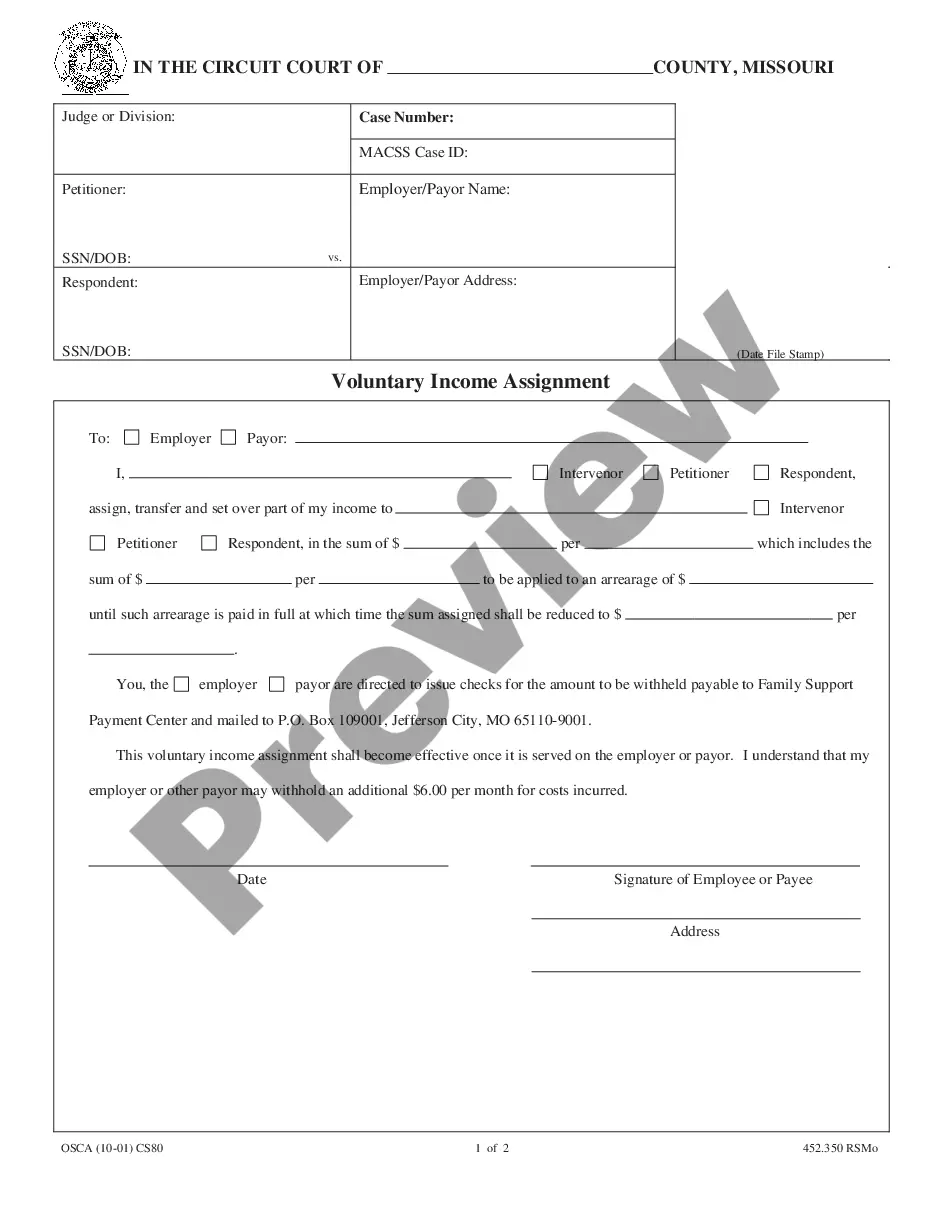

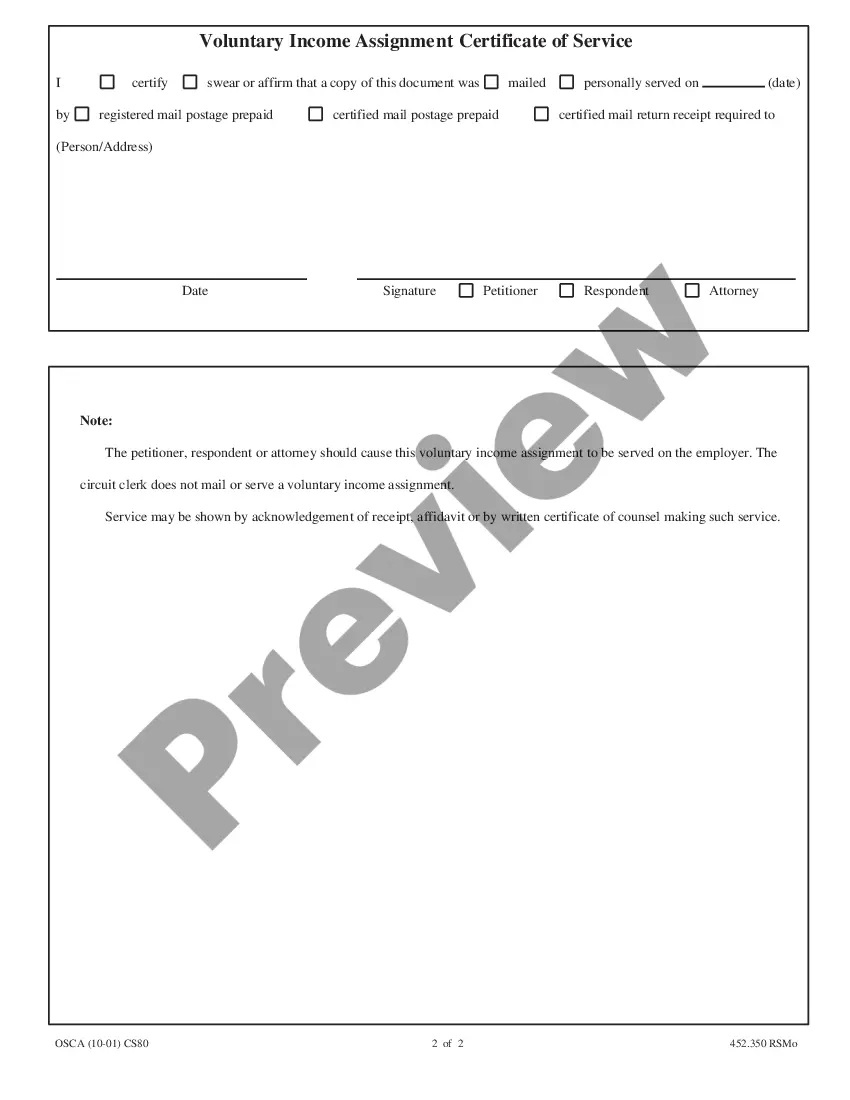

This form is used by the person ordered to pay child support or maintenance to request an employer or another person to hold back money owed. This form can also be used to request money withhold that is owed to a parent or ex-spouse by someone who is not an employer.

Missouri Voluntary Income Assignment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Voluntary Income Assignment?

Obtain any template from 85,000 legal documents, including Missouri Voluntary Income Assignment, available online at US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you currently hold a subscription, Log In. After you reach the form’s page, click the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the guidelines below.

With US Legal Forms, you will always have immediate access to the correct downloadable template. The platform gives you entry to documents and organizes them into categories to simplify your search. Utilize US Legal Forms to acquire your Missouri Voluntary Income Assignment effortlessly and swiftly.

- Verify the state-specific requirements for the Missouri Voluntary Income Assignment you intend to use.

- Review the description and preview the sample.

- When you are sure the sample meets your needs, simply click Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make payment using one of two convenient methods: credit card or PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- After your reusable form has been downloaded, print it or save it to your device.

Form popularity

FAQ

Form 40 in Missouri is the individual income tax return form used by residents who need to report their income. If you are involved in a Missouri Voluntary Income Assignment, this form is vital for accurately declaring your income. Be sure to keep it handy during tax season to ensure you meet all state requirements.

You can obtain Form 108 in Missouri through the Missouri Department of Revenue's website or at local tax offices. Additionally, US Legal Forms provides accessible templates and forms, including Form 108, which can be downloaded easily. This resource can save you time and ensure you have the correct documentation for your needs.

On your tax return, you should use your current residential address. This is essential for receiving correspondence from the Missouri Department of Revenue regarding your Missouri Voluntary Income Assignment. Make sure the address is clear and matches any official documents to avoid confusion.

Filling out the 53/1 form in Missouri involves providing accurate personal information, income details, and any applicable deductions. Ensure you reference your Missouri Voluntary Income Assignment terms while completing the form. For guidance, you can visit the US Legal Forms platform, which offers templates and instructions to simplify the process.

Form MO 1040V is a payment voucher for individual income tax in Missouri. It is typically used when you are making a payment to the Department of Revenue and is important for those under a Missouri Voluntary Income Assignment. Submitting this form correctly can help streamline your tax payment process.

In Missouri, you need to file Form 53 1 annually with your income tax return. This form is crucial for reporting your Missouri Voluntary Income Assignment arrangements. Keep in mind that timely filing helps you avoid penalties and ensures compliance with state regulations.

Wage garnishment rules in Missouri dictate that creditors can only garnish a portion of an employee's wages, typically up to 25% of disposable income. Employees must be notified of any garnishments and have the right to contest them. Familiarizing yourself with these rules is important, especially if you are considering a Missouri voluntary income assignment.

To stop a garnishment in Missouri, you can file a motion with the court to contest the garnishment or negotiate payment terms directly with your creditor. Understanding your rights under Missouri law is essential in this process. Utilizing platforms like USLegalForms can provide you with forms and guidance to effectively address your garnishment issues.

Section 287.780 of the Missouri workers' compensation law pertains to the compensation and benefits available to injured workers. This section outlines the rights and responsibilities of both employees and employers. Understanding this law can help employees navigate Missouri voluntary income assignments in connection with their workers' compensation claims.

Discussing wages is not illegal in Missouri; in fact, such conversations can promote transparency and fairness in the workplace. Employees have the right to share information about their earnings without fear of retaliation. This openness can foster a better understanding of Missouri voluntary income assignments and how they function.