Transfer Trustee Trust With Individual

Description

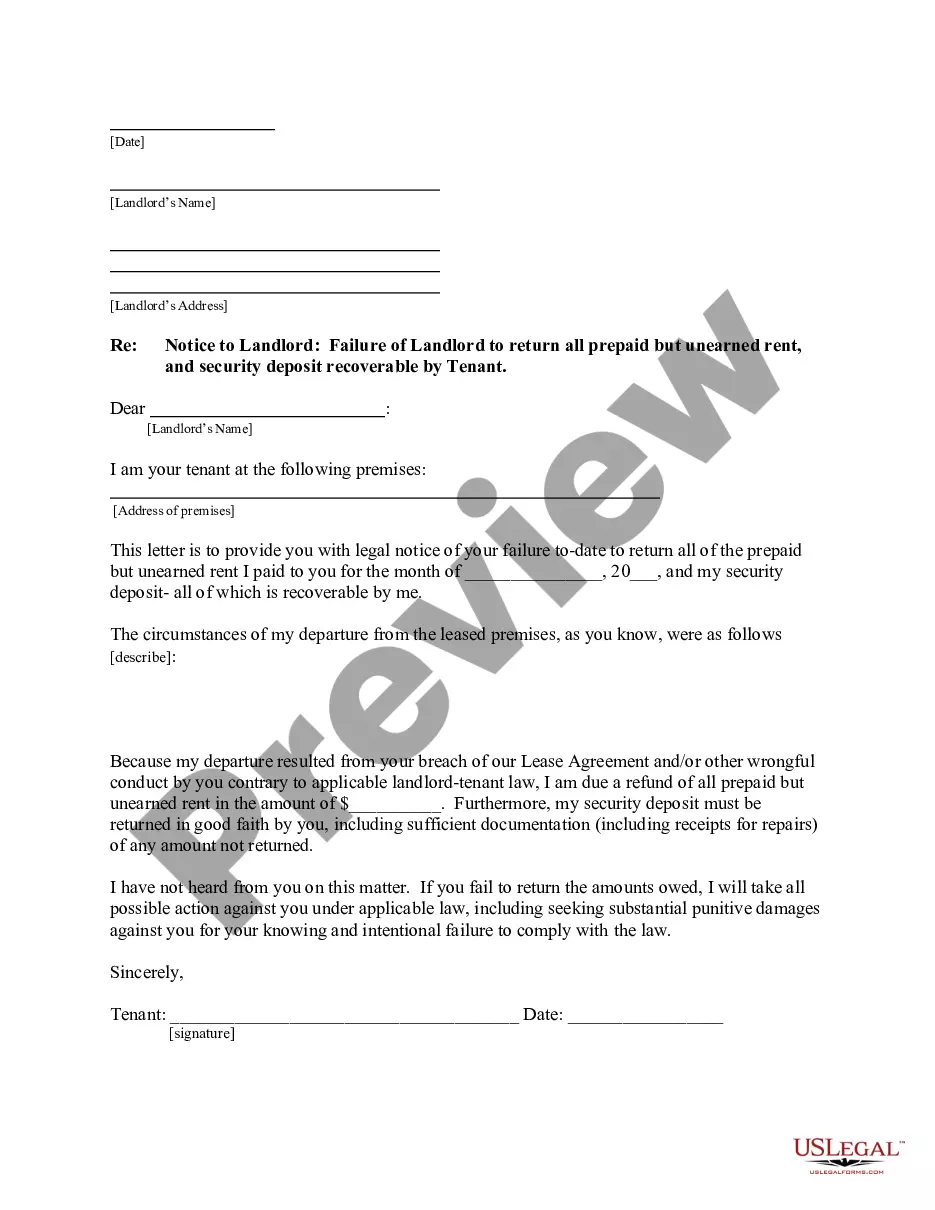

How to fill out Bill Of Transfer To A Trust?

The Transfer Trustee Trust With Individual shown on this page is a reusable formal template crafted by professional attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and lawyers more than 85,000 verified, state-specific documents for any business and personal occasion. It’s the fastest, easiest, and most dependable way to acquire the paperwork you require, as the service ensures the utmost level of data security and anti-malware defenses.

Join US Legal Forms to have verified legal templates for all of life’s events readily available.

- Search for the document you need and verify it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your requirements. If it doesn’t, utilize the search feature to find the appropriate one. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Select the pricing option that fits your needs and create an account. Use PayPal or a credit card to process a quick payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the fillable template.

- Choose the format you prefer for your Transfer Trustee Trust With Individual (PDF, DOCX, RTF) and download the template to your device.

- Fill out and sign the document.

- Print the template to complete it by hand. Alternatively, use an online multifunctional PDF editor to efficiently and accurately fill out and sign your form with an electronic signature.

- Re-download your documents. Utilize the same document again whenever needed. Open the My documents tab in your profile to redownload any previously purchased forms.

Form popularity

FAQ

Transferring property from a trust to an individual requires careful attention to detail and compliance with legal procedures. First, review the trust agreement for any stipulations regarding property transfer. Then, you may need to fill out specific forms and possibly record the transfer with local authorities. Utilizing resources from US Legal Forms can help streamline this process and ensure you meet all legal requirements.

Yes, a trust can be transferred to another person, but the process involves specific legal steps. To transfer a trustee trust with an individual, you typically need to follow the terms outlined in the trust document. It is important to consult with an attorney or use a reliable platform like US Legal Forms to ensure compliance with state laws and proper documentation.

While it's not mandatory to hire a lawyer for a deed transfer, having legal assistance can ensure the process is done correctly and complies with state laws. A lawyer can help you navigate any complexities, especially if the trust has specific requirements. If you prefer a more straightforward approach, USLegalForms provides resources and templates that can guide you through the deed transfer without needing extensive legal counsel.

Transferring assets out of a trust involves identifying the specific assets you wish to transfer and following the trust's guidelines for distribution. You will typically need to create and sign transfer documents, which may vary based on the asset type, such as real estate or financial accounts. Make sure to document the transaction properly to maintain clear records. For detailed templates and guidance, consider using USLegalForms.

To transfer property from a trust to an individual, you need to prepare and execute a deed that reflects the transfer. This deed should clearly state the property details and the individual receiving it. After signing, record the deed with the appropriate local authority to finalize the transfer. USLegalForms can help you with templates and instructions to ensure a smooth process.

Yes, you can move a house out of a trust by executing a deed that transfers ownership from the trust to the individual. This process typically involves drafting a new deed and recording it with the local government office. Always ensure that the trust allows for such transfers and that you comply with any legal requirements. For assistance, consider using USLegalForms to access the right documents.

To transfer a trust to an individual, you must first review the trust document for any specific instructions regarding transfers. You generally need to execute a formal transfer document, which may include a deed or assignment form. It's essential to ensure that the transfer aligns with the trust's terms and state laws. Using a service like USLegalForms can simplify this process by providing the necessary documents and guidance.