Transfer Trustee Trust With Foreign

Description

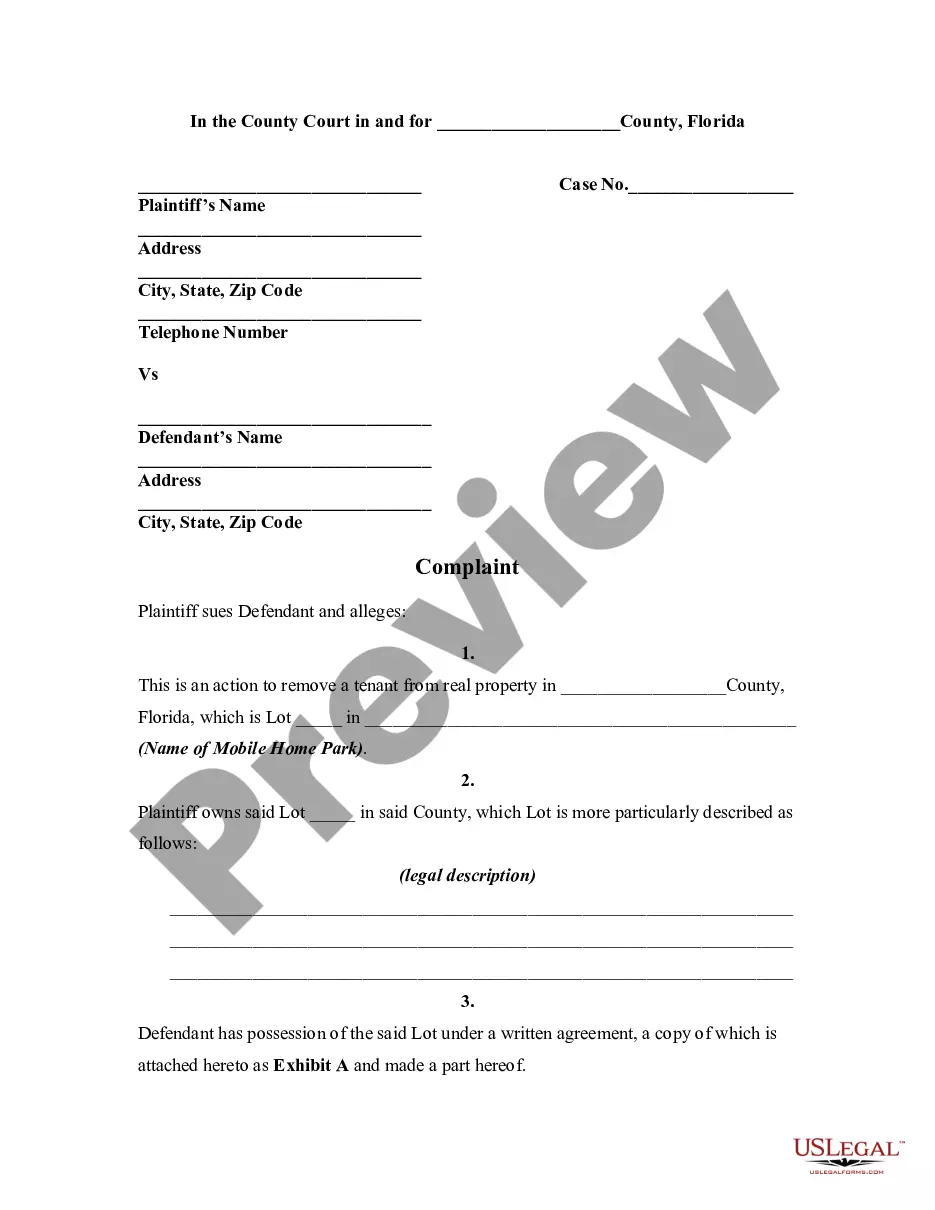

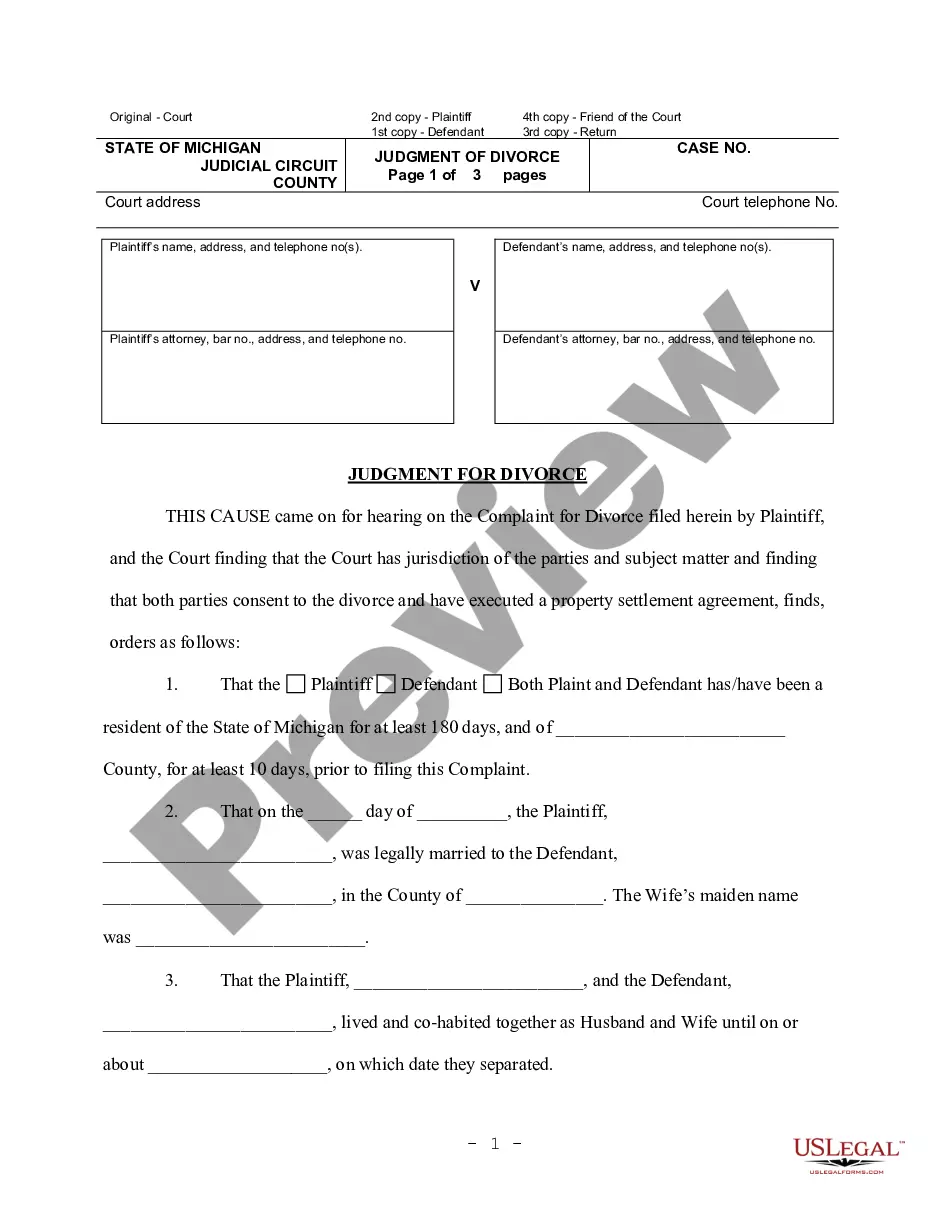

How to fill out Bill Of Transfer To A Trust?

Legal paperwork management can be daunting, even for the most skilled experts.

If you're looking for a Transfer Trustee Trust With Foreign and lack the time to search for the accurate and current version, the process can be overwhelming.

Access state- or county-specific legal and business forms. US Legal Forms addresses all requirements you may have, from personal to business documents, all in one location.

Utilize cutting-edge tools to complete and manage your Transfer Trustee Trust With Foreign.

Here are the steps to follow after getting the form you need: Confirm it is the correct form by previewing it and reading its description. Make sure the sample is recognized in your state or county. Select Buy Now when you’re ready. Choose a subscription plan. Select your desired file format and Download, fill it out, sign it, print it, and send your document. Leverage the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Transform your everyday document management into a seamless and user-friendly experience today.

- Access a valuable resource base of articles, guides, and manuals relevant to your circumstances and requirements.

- Conserve time and effort searching for the documents you need, and take advantage of US Legal Forms’ advanced search and Review tool to obtain Transfer Trustee Trust With Foreign.

- If you possess a membership, sign in to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to access the documents you have previously downloaded and to organize your folders as desired.

- If it’s your first time using US Legal Forms, create a free account for unlimited access to all platform benefits.

- A comprehensive web form directory could revolutionize the way anyone manages these circumstances effectively.

- US Legal Forms stands as a frontrunner in online legal documents, providing over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

To change the trustee of a trust with the IRS, you must follow specific procedures outlined in the trust document. Typically, you will need to notify the IRS of the change, especially if you are transferring a trustee trust with foreign aspects. Updating the trust's tax identification number may also be necessary, depending on the circumstances. Seeking guidance from legal and tax professionals can help ensure a smooth transition.

Yes, a foreign person can serve as a trustee for a U.S. trust. When you transfer a trustee trust with foreign individuals involved, you should consider the legal implications. A foreign trustee may face specific tax reporting requirements, which can complicate the trust's administration. Utilizing resources from platforms like US Legal Forms can help navigate these complexities.

No, a trustee does not need to live in the same country as the trust or its beneficiaries. However, if you plan to transfer a trustee trust with foreign connections, having a trustee who understands both jurisdictions is beneficial. This can simplify administration and compliance with local laws. It's crucial to choose someone knowledgeable about international trust management.

Yes, a foreign trust may need to file Form 1041 to report income to the IRS. If you are transferring a trustee trust with foreign elements, you must ensure compliance with U.S. tax laws. This form helps the IRS track income and distributions from the trust. Consulting with a tax professional can help clarify your specific obligations.

Transferring ownership of a trust typically involves drafting a trust amendment or creating a new trust. You will want to ensure that all legal documents are in order and that the new trustee understands their responsibilities. If you plan to transfer trustee trust with foreign individuals, using platforms like US Legal Forms can streamline the process and provide necessary legal documentation.

Yes, a foreigner can be a beneficiary of a US trust. However, tax implications may arise, depending on the type of trust and the beneficiary's residency status. When you consider transferring trustee trust with foreign beneficiaries, it is wise to consult legal experts to navigate any potential issues.

Individuals who are under legal guardianship, convicted felons, or those who are not competent to manage financial affairs are generally disqualified from serving as trustees. Additionally, conflicts of interest can disqualify someone from this role. Always ensure that you choose a qualified individual when you plan to transfer trustee trust with foreign aspects to maintain trust integrity.

The 5-year rule refers to how foreign trusts must report their income to the IRS. If a trust has a US beneficiary, it may need to follow stricter reporting requirements. Understanding this rule is crucial when you aim to transfer trustee trust with foreign elements. Consulting with tax professionals can provide clarity on your obligations.

US resident can serve as a trustee, but there are specific legal considerations to keep in mind. You will want to verify that the trust complies with US laws and the laws of the trustee's country. When you transfer trustee trust with foreign individuals, seeking guidance from professionals can simplify the process.

Yes, a trustee can reside in a different country. However, managing a trust from abroad may introduce various complexities, such as tax implications and differing legal standards. It is advisable to consult legal experts when you decide to transfer trustee trust with foreign individuals to ensure compliance with relevant laws.