Civil Summons Form For Credit Card Debt

Description

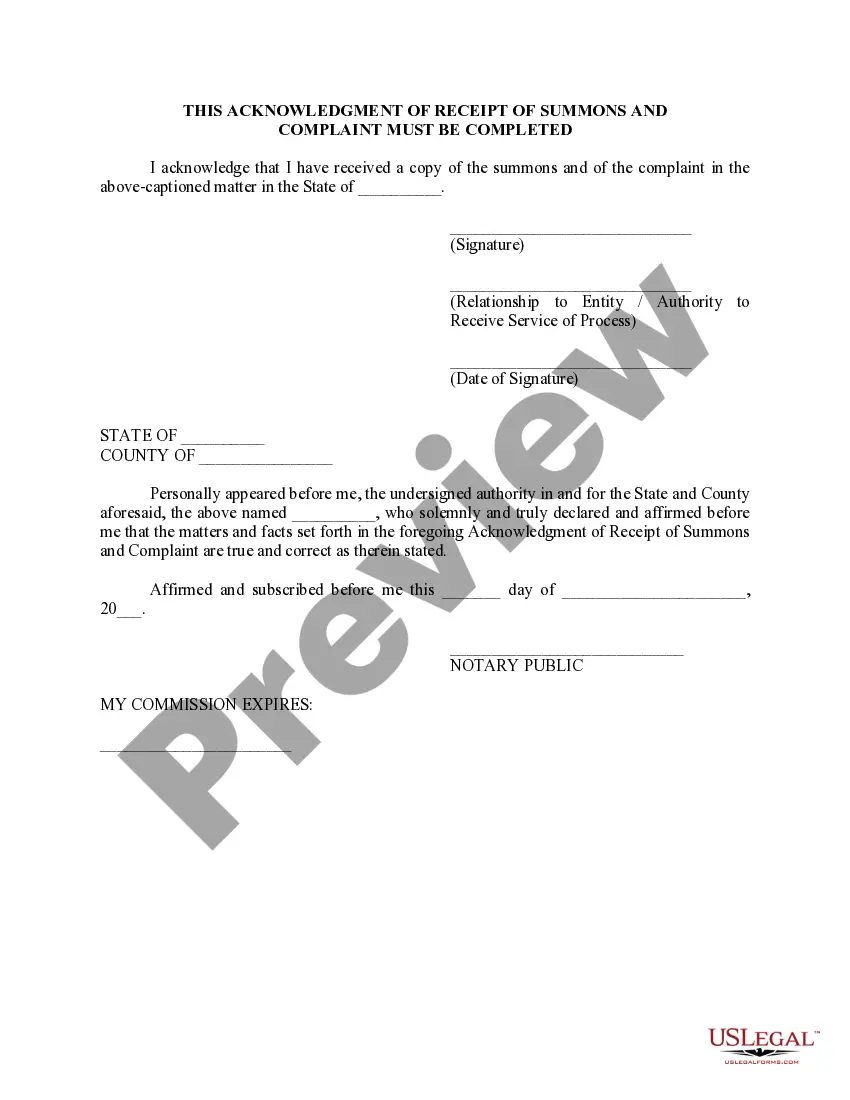

How to fill out Notice - Served With Complaint And Summons?

Finding a reliable source for the latest and most suitable legal templates is a significant part of managing bureaucracy.

Selecting the correct legal documents requires precision and careful consideration, which is why it is crucial to obtain examples of Civil Summons Form For Credit Card Debt exclusively from reputable websites, such as US Legal Forms. An incorrect template could cost you time and hinder your current situation.

Eliminate the hassles associated with your legal paperwork. Explore the comprehensive US Legal Forms catalog where you can discover legal templates, evaluate their relevance to your situation, and instantly download them.

- Use the catalog search or navigation to find your template.

- Review the description of the form to verify its suitability for your state and county requirements.

- Check the form preview, if available, to ensure it is indeed the template you need.

- Return to the search if the Civil Summons Form For Credit Card Debt does not meet your criteria and look for the correct document.

- If you are confident about the form's applicability, proceed to download it.

- As a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you haven’t created an account yet, click Buy now to obtain the form.

- Select a pricing plan that aligns with your requirements.

- Advance to the registration step to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Civil Summons Form For Credit Card Debt.

- Once the form is saved on your device, you can edit it using the editor or print it to finish manually.

Form popularity

FAQ

Hear this out loud PauseMost negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Hear this out loud PauseIf you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

The truth is that there are no magic words to stop a debt collector from collecting the debt. In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its ?Please cease and desist all calls and contact with me immediately.?

Hear this out loud PauseIf you owe money and you don't pay it back your creditor might take you to court. You should reply to the claim as early as possible - usually within 2 weeks. If you disagree you owe the debt, you can tell your creditor this when you reply.

Contacting the person or company who owes you money. Speak to the person who owes you money. ... Using mediation to reach agreement over debt dispute. ... Using a solicitor. ... Using a debt recovery agency. ... Recovering debts through the courts. ... Claiming online. ... More useful links.