Acceptance Of Appointment As Successor Trustee Form Withdrawal

Description

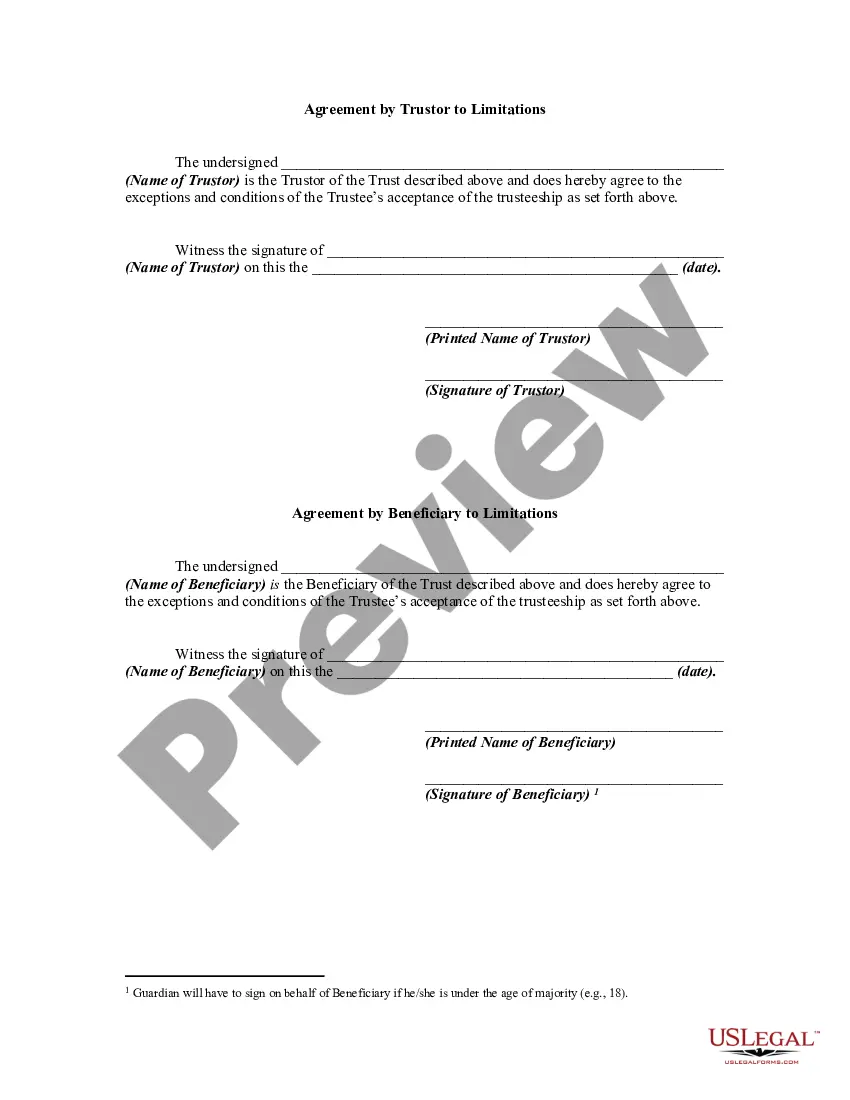

How to fill out Acceptance Of Appointment By Trustee With Limitations?

Creating legal documents from the ground up can occasionally be intimidating.

Specific situations may require extensive research and a significant financial commitment.

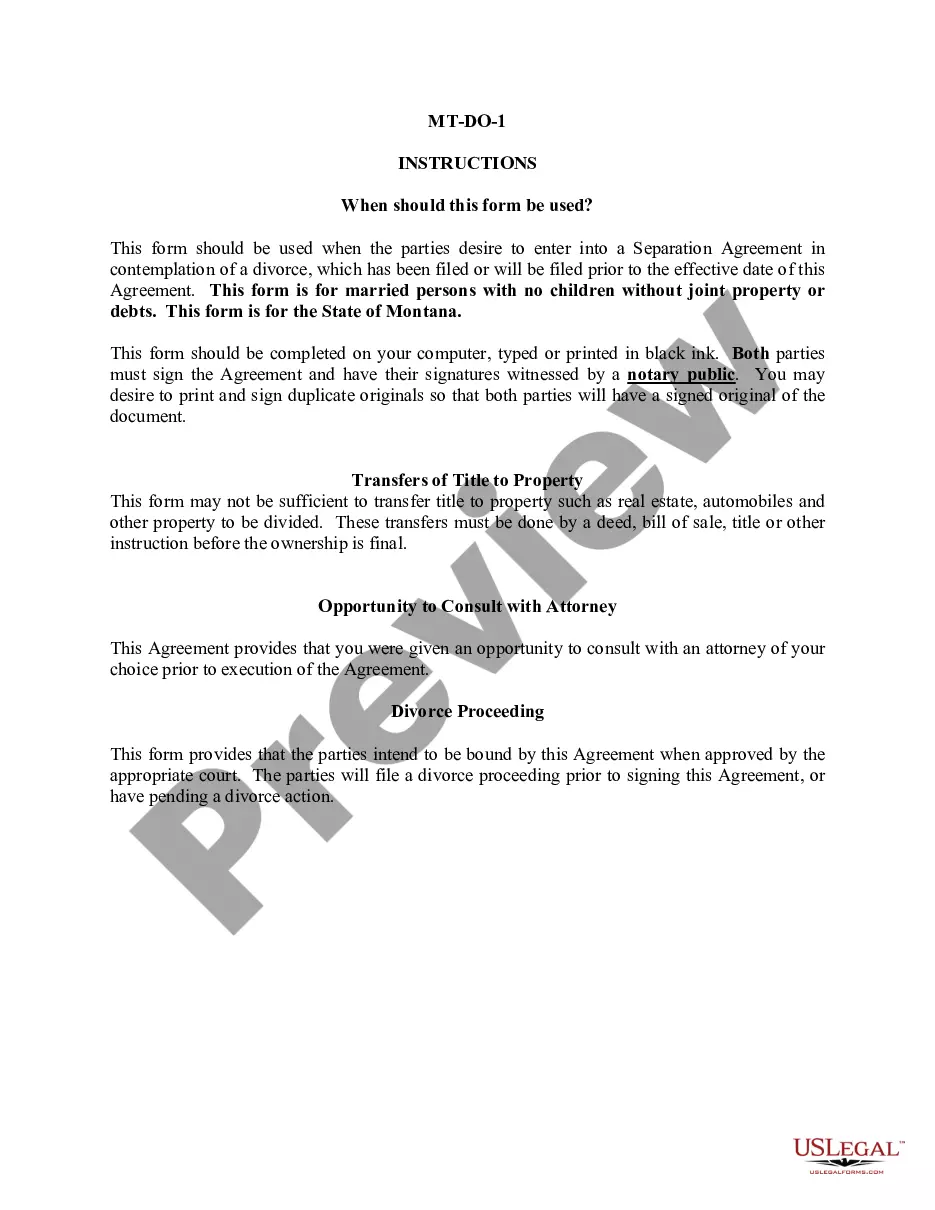

If you're seeking a simpler and more budget-friendly method of preparing the Acceptance Of Appointment As Successor Trustee Form Withdrawal or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

Examine the form preview and descriptions to ensure you have located the document you seek. Confirm that the template you select adheres to the laws and regulations of your state and county. Choose the most suitable subscription option to acquire the Acceptance Of Appointment As Successor Trustee Form Withdrawal. Download the form, then complete, sign, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make form execution a straightforward and efficient process!

- Utilize our website whenever you require trustworthy and dependable services to easily find and download the Acceptance Of Appointment As Successor Trustee Form Withdrawal.

- If you are familiar with our website and have previously established an account, simply Log In to your account, find the form, and download it or re-download it anytime later in the My documents section.

- Don't have an account? No worries. It only takes a few minutes to register and explore the library.

- However, before proceeding to download the Acceptance Of Appointment As Successor Trustee Form Withdrawal, consider these suggestions.

Form popularity

FAQ

Trustee resignation sometimes occurs prior to the administration of the trust. In this scenario, the named successor trustee should inform the trust administration attorney that they wish to resign and sign a document called Declination to Serve as Trustee.

A petition for removal of a trustee can be filed by either a co-trustee or a beneficiary. The petition may also seek financial damages from the trustee. Sufficient evidence needs to be submitted to show the court that the trustee violated the terms of the trust agreement or their fiduciary duty.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

Each successor Trustee succeeds its predecessor Trustee by accepting in writing its appointment as successor Trustee and by filing the acceptance with the former Trustee and the Plan Administrator without the signing or filing of any further statement.

If the trustee has money to give you, they should do so. There is no way the trustee can refuse to provide you with accounting information or financial information. They can also speak with you. Nevertheless, many beneficiaries are struggling with these horror stories.