Beneficiary Information With The Authorization

Description

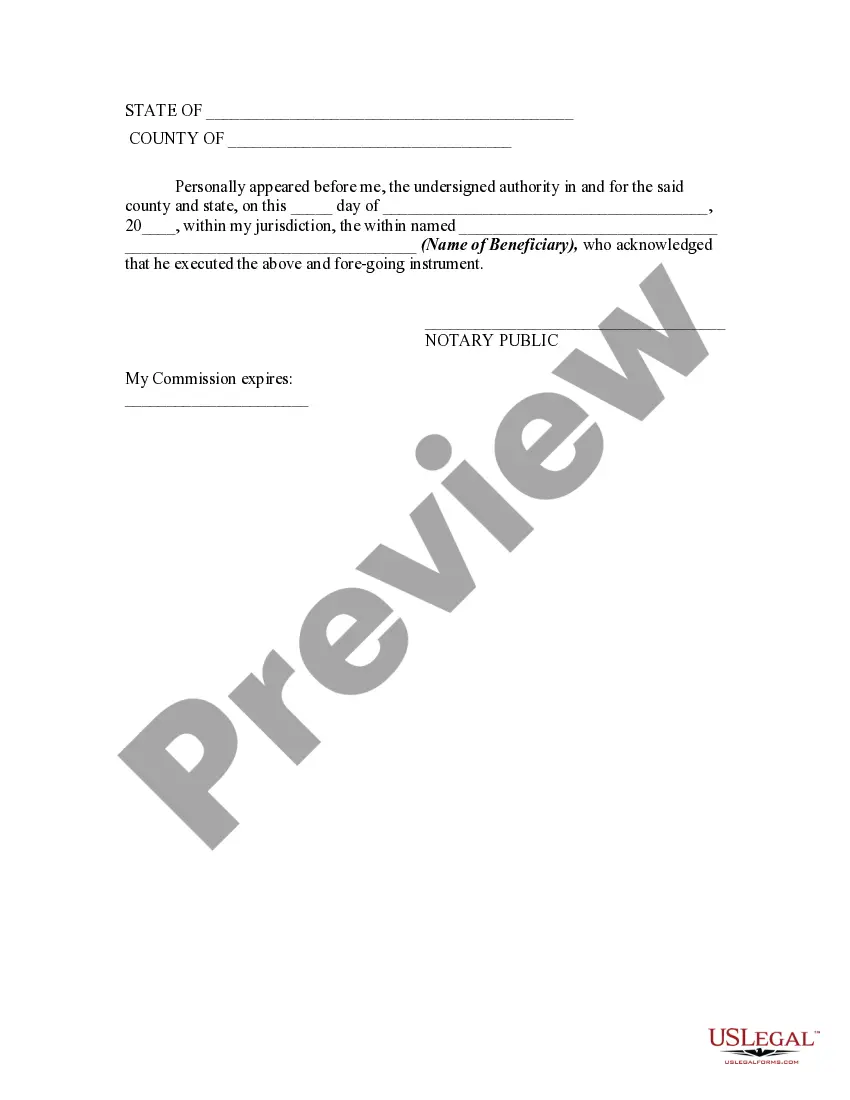

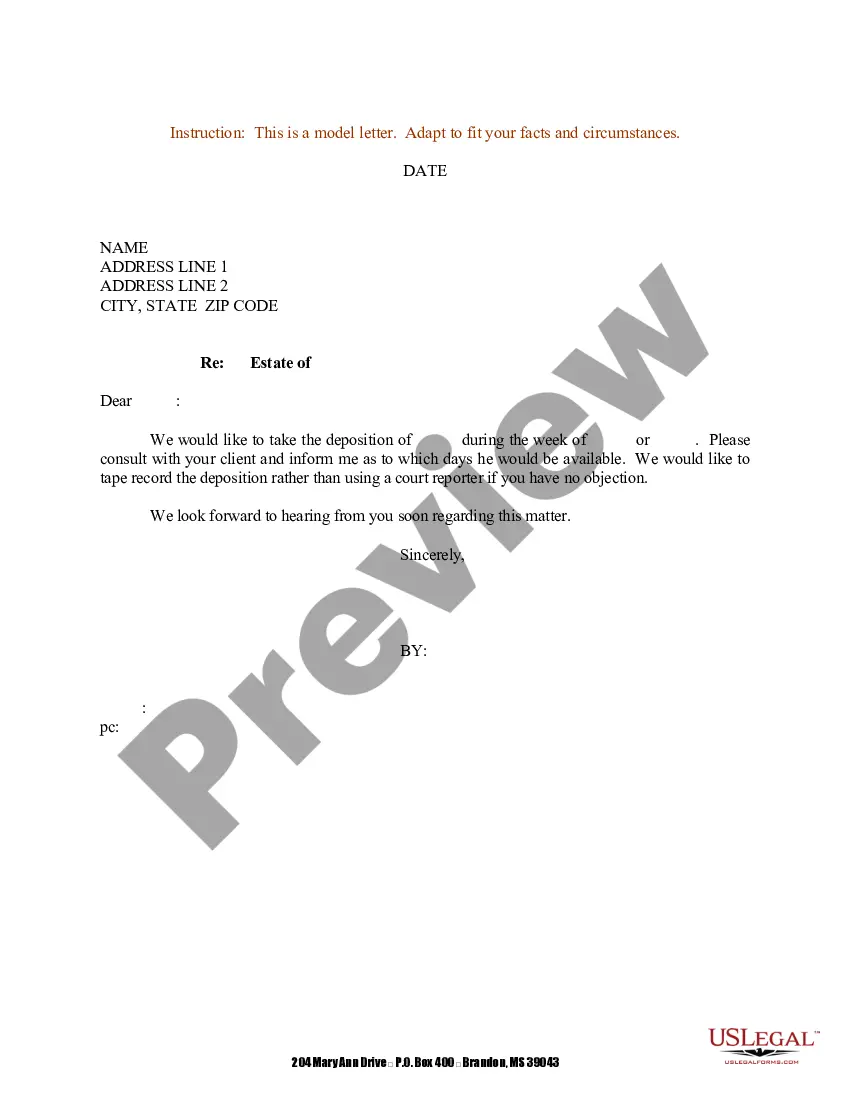

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

- Begin by accessing your US Legal Forms account. If you are an existing user, log in and ensure your subscription is active. If it has expired, renew it based on your payment plan.

- For new users, start by exploring the available forms. Check the Preview mode and form descriptions to find the exact document that fits your local jurisdiction.

- Utilize the Search tab to locate alternative templates if your needs are not met. Choose the appropriate document that suits your requirements.

- Proceed to purchase the document by clicking on the Buy Now button, selecting your preferred subscription plan, and creating an account.

- Complete your transaction by entering your payment details via credit card or PayPal.

- Once the payment is confirmed, download your form. You can save the template to your device and access it later from the My Forms section of your profile.

In conclusion, using US Legal Forms allows you to handle beneficiary information with the authorization seamlessly. With its extensive library and supportive resources, you ensure that your documents are precise and legally sound.

Get started today by visiting US Legal Forms and find the solutions you need to empower your legal documentation process!

Form popularity

FAQ

Beneficiary consent is the approval granted by a beneficiary to share information about their benefits or entitlements. This consent allows specific parties, such as financial institutions or estate executors, to access beneficiary information with the authorization necessary to manage assets thoroughly. It is important to obtain this consent to ensure that all communication remains legitimate and authorized. Our platform provides the tools to easily create and manage these essential consent forms.

A beneficiary is a person or entity designated to receive assets, benefits, or proceeds from a will, trust, insurance policy, or retirement account. Essentially, beneficiaries are the individuals who gain from someone else's financial arrangements, based on the terms of legal documents. Understanding who qualifies as a beneficiary is crucial, especially when dealing with estate planning. Accurate records, including beneficiary information with the authorization, facilitate this process.

Beneficiary information refers to the data that identifies individuals entitled to receive benefits or assets under a will or trust. This information includes names, contact details, and the specific benefits each beneficiary is entitled to, all documented with the necessary authorization. Providing accurate beneficiary information is vital for a smooth distribution process. Our US Legal Forms platform can assist in organizing and providing this essential information.

A beneficiary consent to release is a document that grants permission for the disclosure of specified beneficiary information with the authorization. This consent ensures that only approved parties can access sensitive data related to beneficiaries. By obtaining this consent, you help maintain privacy while allowing necessary information to be shared. This process is essential for proper management of trusts and estates.

In a beneficiary account description, include the type of account and any relevant identifiers, such as account numbers. Clearly state the relationship of the beneficiary to you, ensuring the beneficiary information with the authorization is explicit. This clarity helps prevent any confusion or disputes regarding your assets.

To name a beneficiary, gather their full name, relationship to you, Social Security number, and contact details. Additionally, specify the assets or accounts connected to the beneficiary information with the authorization. This clarity ensures that your wishes are understood and followed upon your passing.

The beneficiary statement outlines who will receive your assets after you pass away. It includes important details such as the beneficiary's name, their relationship to you, and the specific assets involved. This statement is crucial, as it ensures your wishes regarding the distribution of your estate, along with the necessary beneficiary information with the authorization, are honored.

A beneficiary example can include a family member, such as a spouse or child, designated to receive assets from an estate or insurance policy. For instance, you may name your daughter as a beneficiary for your life insurance policy. This gives her access to the funds and underscores the importance of ensuring that your beneficiary information with the authorization is up to date.

Filling out a beneficiary statement involves gathering essential details such as the beneficiary's full name, their relationship to you, and any identifying information like Social Security numbers when required. You'll also need to describe the assets that the beneficiary information with the authorization will apply to. Platforms like USLegalForms can simplify this process by providing templates to guide you.

To write a beneficiary statement effectively, start by clearly stating the full name of the beneficiary. Next, include their relationship to you and any relevant contact information. Don't forget to specify the asset or account that the beneficiary information with the authorization pertains to, ensuring clarity and accuracy in your declaration.