Trust Notice To Beneficiaries With Multiple

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Utilizing legal document examples that adhere to federal and state statutes is essential, and the internet provides countless choices to select from.

However, what is the purpose of squandering time searching for the appropriate Trust Notice To Beneficiaries With Multiple example online when the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any business or personal situation. They are easy to navigate with all documents organized by state and intended use. Our specialists keep abreast of legislative updates, ensuring that your form is current and compliant when obtaining a Trust Notice To Beneficiaries With Multiple from our site.

All templates available through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents section in your account. Experience the most comprehensive and user-friendly legal document service!

- Acquiring a Trust Notice To Beneficiaries With Multiple is fast and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document example you need in your chosen format.

- If you're new to our platform, follow these instructions.

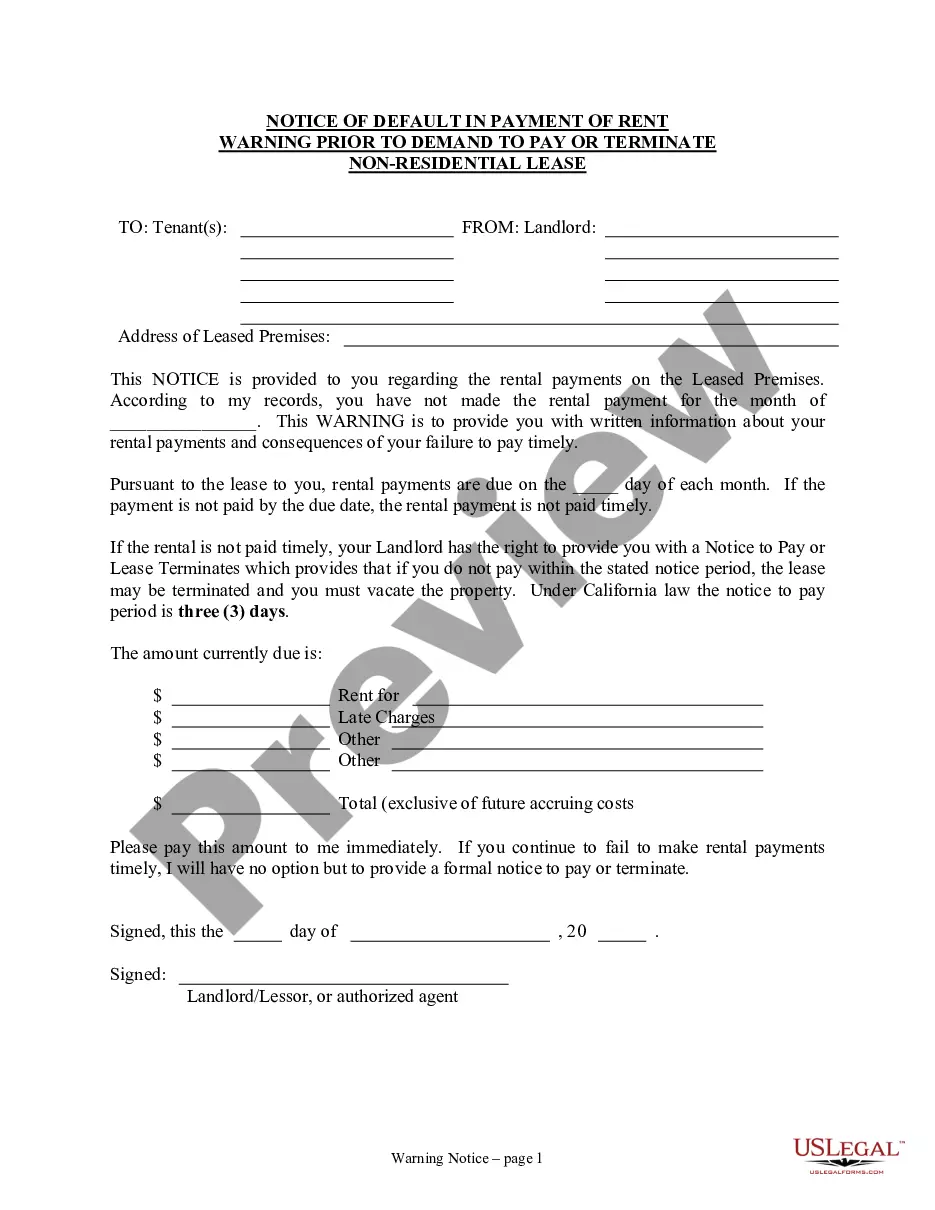

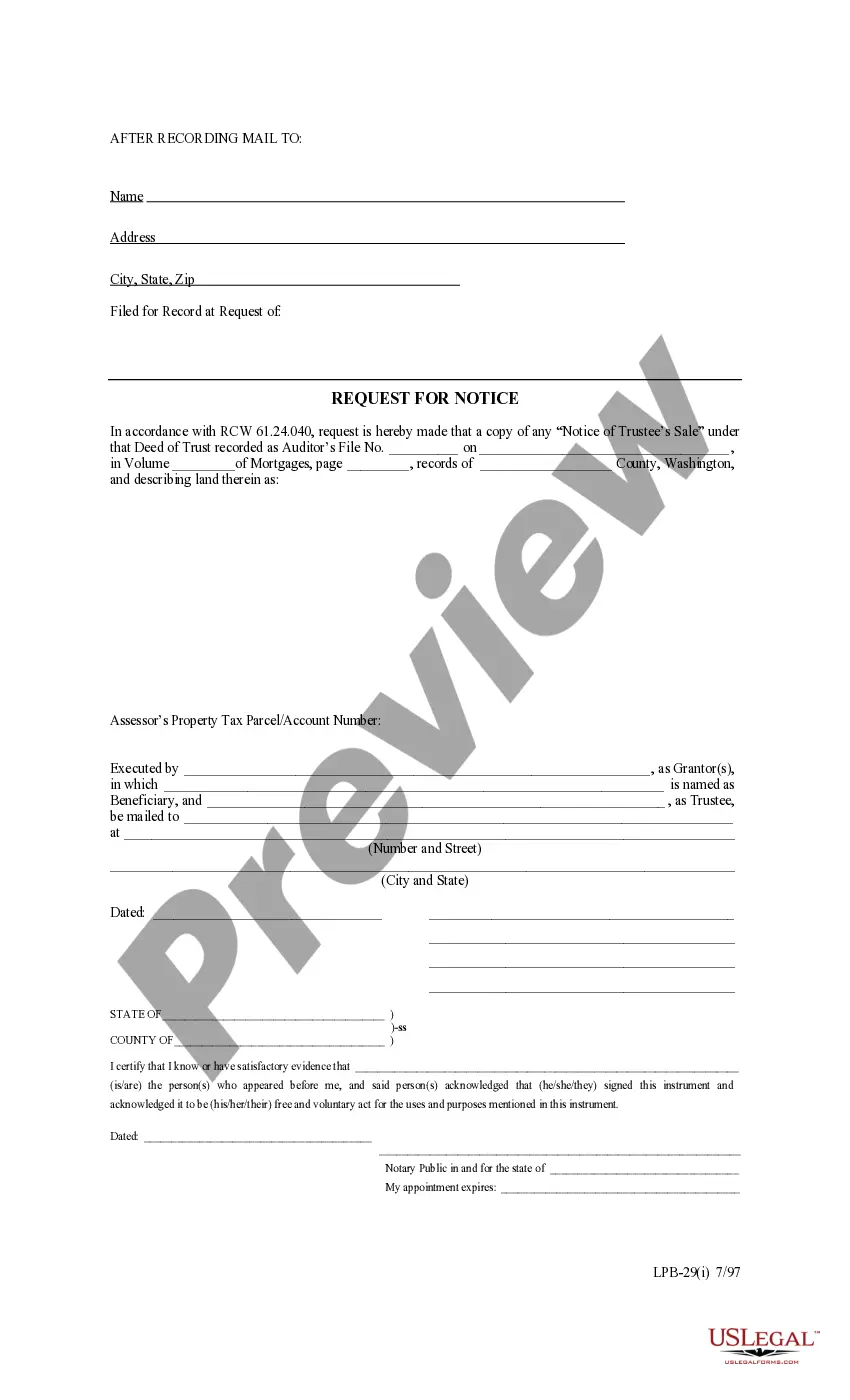

- Review the template using the Preview feature or by reviewing the text outline to confirm it satisfies your needs.

- Use the search function at the top of the page to find another sample if necessary.

- Click Buy Now once you've located the appropriate form and select a subscription plan.

- Register an account or Log In and proceed with payment via PayPal or credit card.

- Choose the format for your Trust Notice To Beneficiaries With Multiple and download it.

Form popularity

FAQ

A letter to notify beneficiaries of a trust serves as an official communication that informs individuals about their rights and interests in a trust. This trust notice to beneficiaries with multiple recipients outlines the details of the trust, including its assets and any relevant timelines. By sending this letter, trustees ensure transparency and clarity regarding the obligations and distributions involved. Utilizing platforms like US Legal Forms can simplify the process of drafting this notice, ensuring it meets legal standards and includes all necessary information.

A trust with multiple beneficiaries allows assets to be divided among them according to the terms set forth in the trust agreement. The trustee oversees the distribution process and ensures that every beneficiary receives their fair share. Issuing a trust notice to beneficiaries with multiple individuals helps keep everyone informed about their entitlements and the administration of the trust. This method creates a smoother trust management experience.

Trusts that include multiple beneficiaries operate on specific terms outlined by the trust document. Each beneficiary typically receives a predetermined share of the trust assets, which the trustee manages. A trust notice to beneficiaries with multiple parties clarifies how assets are allocated, providing transparency. The system is designed to protect the interests of all beneficiaries involved.

When a trust has multiple beneficiaries, clear communication is essential. A trust notice to beneficiaries with multiple individuals ensures everyone understands their rights and shares in the trust. It helps prevent misunderstandings and disputes among beneficiaries. Proper documentation can help guide the distribution process effectively.

One major disadvantage of a trust is the complexity involved in setting it up. Establishing a trust often requires extensive legal documentation and investment of time. Additionally, ongoing management may demand resources that some individuals may not be prepared for. Consider using the uSlegalforms platform to simplify the trust creation process, especially when issuing a trust notice to beneficiaries with multiple.

If there is more than one beneficiary for a policy, each beneficiary must make a separate claim to receive their portion of the funds. The primary beneficiary is the first person (or, if multiple primary beneficiaries, persons) to receive the death benefit.

Usually you'll name primary and contingent beneficiaries. The primary beneficiary is the first person or entity named to receive the asset. The contingent is the "backup" in case the primary beneficiary is unable or unwilling to accept the asset. You can name multiple beneficiaries for several types of accounts.

Here are the essentials, in most states: Explain that the trust exists. ... Provide your name and contact information. ... Tell beneficiaries that they have the right to see a copy of the trust document and that you will send them one if they request it. ... Give the deadline for court challenges.

If the policyholder would like to name multiple beneficiaries to a single policy, he or she can specify any number of ?co-beneficiaries.? When multiple beneficiaries are listed, insurance companies can split the same death benefit amongst them.