Trust Agreements

Description

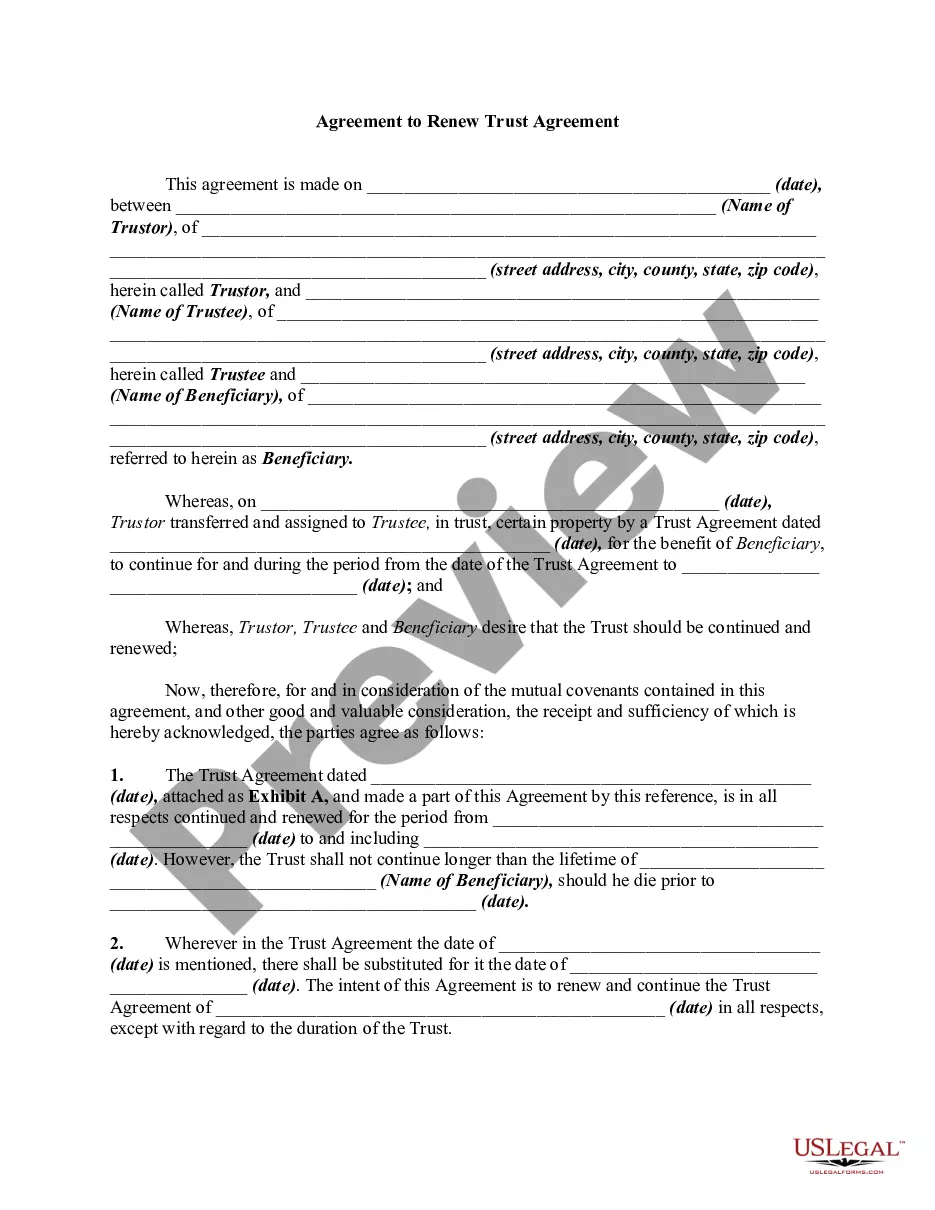

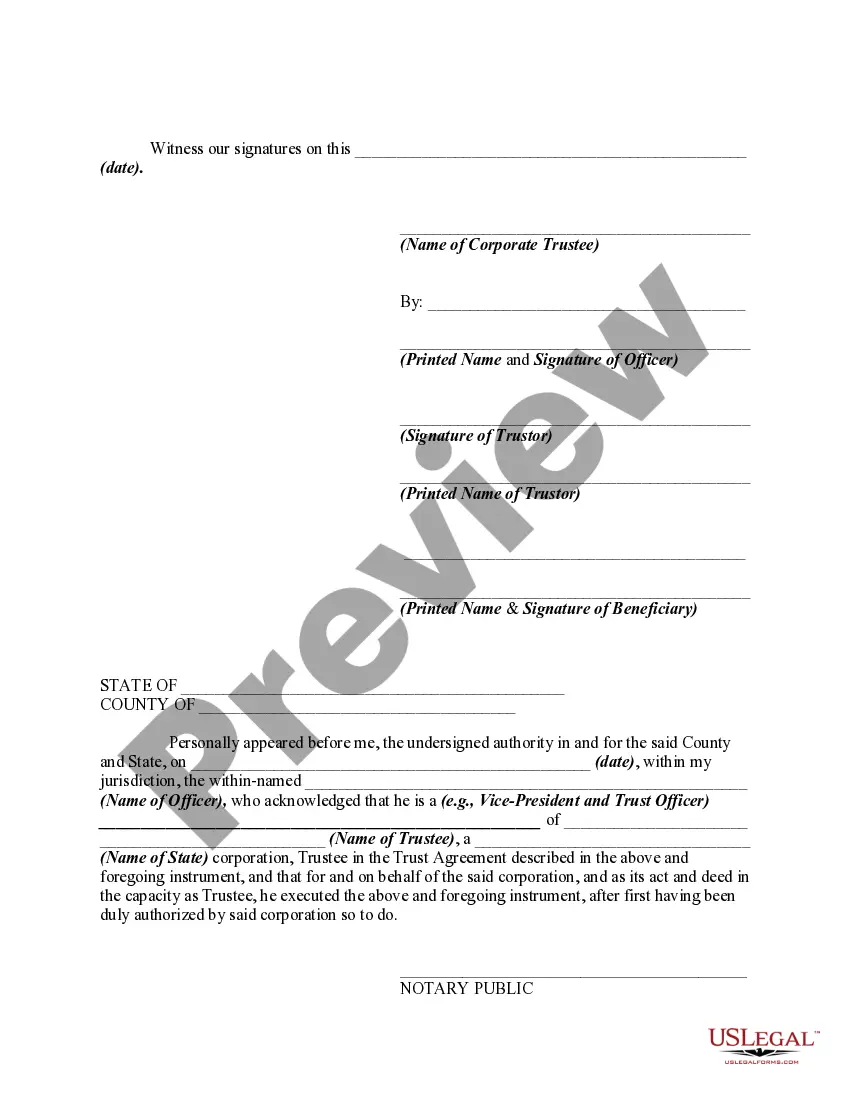

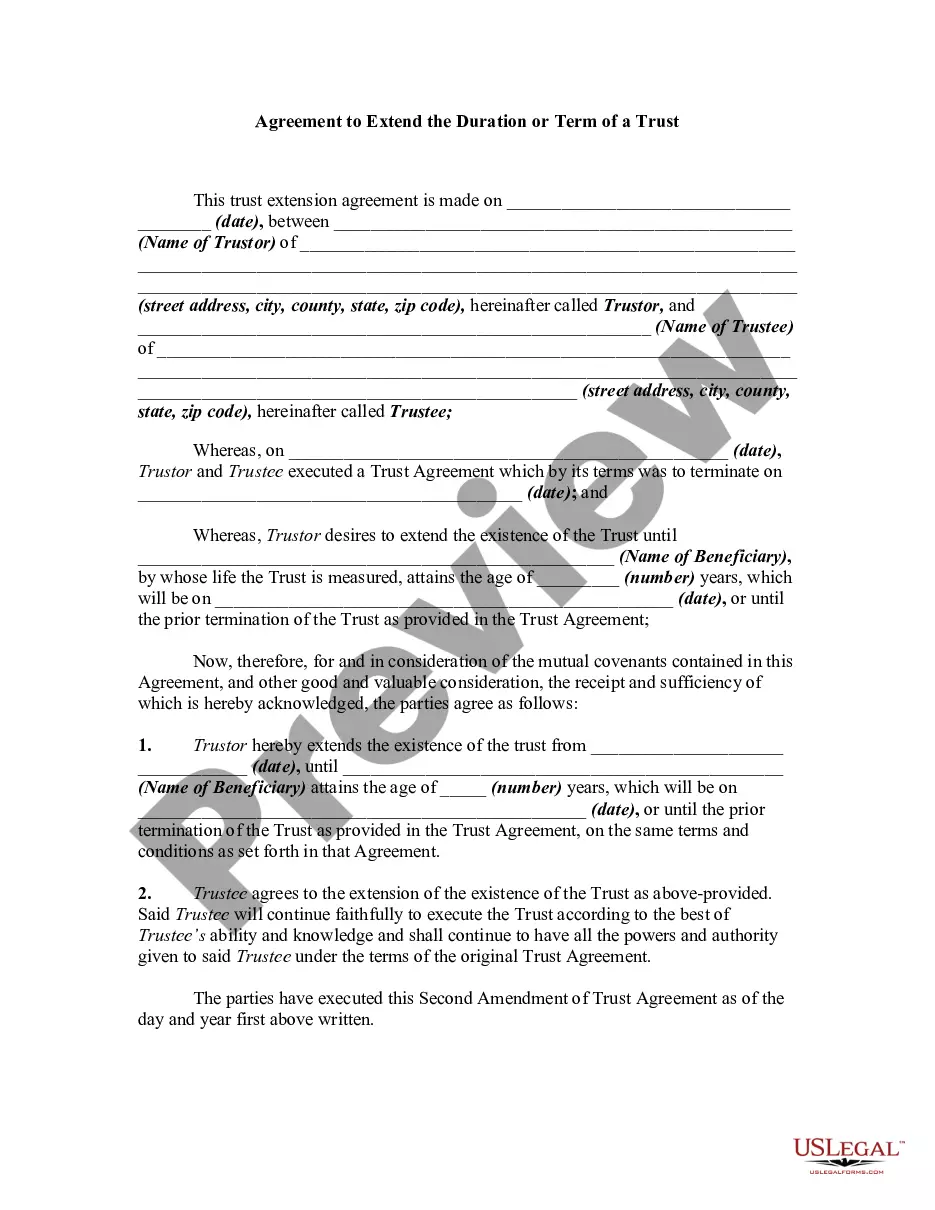

How to fill out Agreement To Renew Trust Agreement?

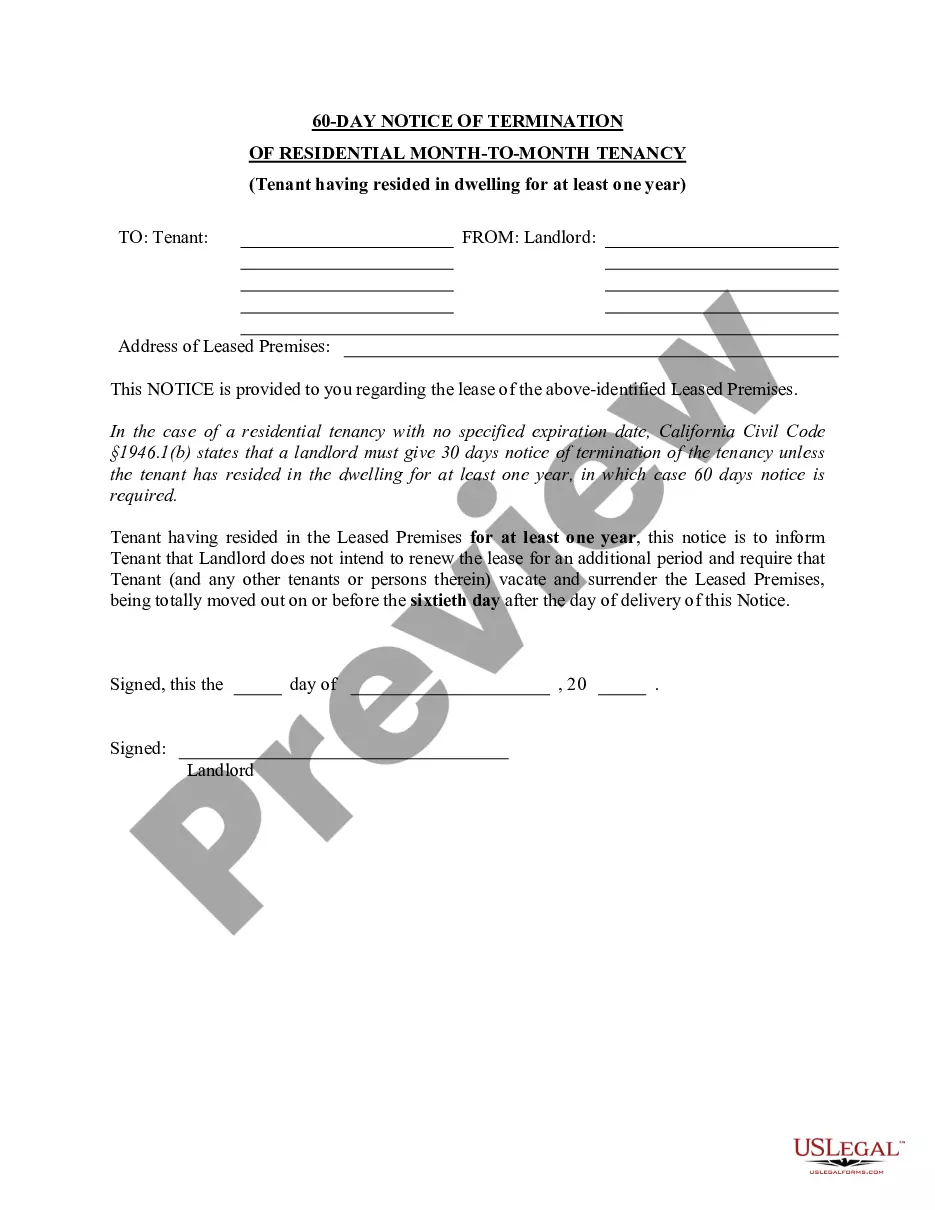

- If you're an existing user, simply log in to your account, check the status of your subscription, and download your desired trust agreement form by clicking the Download button.

- If you're new to US Legal Forms, start by previewing the available trust agreement templates. Make sure to review the descriptions to select the form that meets your requirements and complies with your local laws.

- If the initial template isn’t the right fit, utilize the Search tab to find an alternative that aligns better with your needs.

- Next, click on the Buy Now button for your chosen template and select your preferred subscription plan. Remember to create an account to gain access to the extensive library.

- Proceed to make your payment using a credit card or PayPal to finalize your subscription.

- Lastly, download the trust agreement form to your device. You can always access it later in the My Forms section of your account.

In conclusion, US Legal Forms streamlines the process of obtaining trust agreements, offering an extensive library and expert assistance to ensure your documents are legally sound and tailored to your needs.

Start utilizing our services today to secure your peace of mind regarding your legal agreements.

Form popularity

FAQ

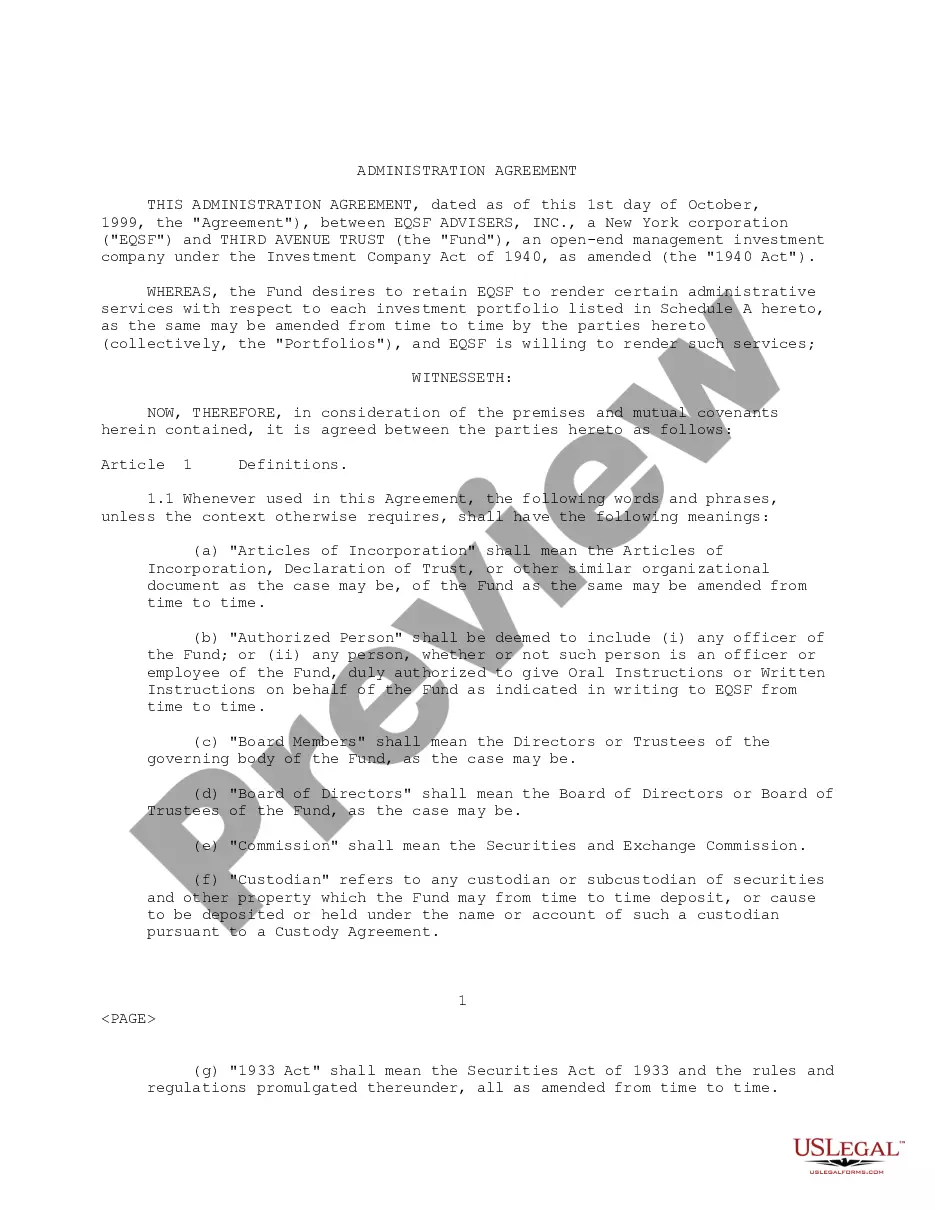

To establish a trust, you generally need a trust agreement form that outlines the details of your trust. This document should include information about the trust's assets, beneficiaries, and the trustee's responsibilities. You can find easy-to-use forms on platforms like uslegalforms, which cater to various trust agreements. Using the right form is crucial for ensuring your trust operates smoothly and legally.

Typically, a trust agreement is prepared by an estate planning attorney. This legal professional understands the complexities of trust agreements and ensures that all necessary components are included. You can also use online platforms, like uslegalforms, which provide templates and resources for creating your own trust agreement. However, consulting with an attorney can help tailor the agreement to your specific needs.

While putting assets in a trust offers many benefits, one downside is the potential loss of personal control over those assets. Trust agreements designate a trustee to manage the assets, which can feel limiting for some individuals. Understanding the implications and responsibilities involved is crucial before making this decision.

One potential downfall of having a trust is the ongoing maintenance and administration that can be time-consuming and often requires additional legal fees. Trust agreements need to be updated periodically to reflect changes in circumstances or laws. A proactive approach can help manage these challenges effectively.

Certain assets may not be suitable for a trust due to tax implications or control issues. For example, retirement accounts and life insurance policies often require specific beneficiaries outside of trust agreements. It's essential to consult with a financial advisor to determine the best strategy for asset placement.

A common mistake parents make is not fully funding the trust. Trust agreements only function as intended when the assets are properly transferred into the trust. Regular communication with a legal expert can help ensure all assets are accounted for and properly managed.

Deciding whether to place assets in a trust depends on your parents' specific situation and goals. Trust agreements can help avoid probate, protect assets, and provide peace of mind. Engaging a legal professional can clarify whether this step aligns with their financial planning.

A trust agreement typically includes details about the assets held in the trust, the beneficiaries, and the trustee's responsibilities. It also outlines how and when the assets will be distributed. Understanding these components is crucial to ensure that your trust agreements accurately reflect your wishes.

A family trust can come with costs and complexities that may not be suitable for everyone. Setting up trust agreements requires careful planning and legal advice, which can be expensive. Additionally, once established, a trust restricts how assets can be moved or accessed, which may not align with future family needs.

Typically, a lawyer sets up a trust, as they possess the legal knowledge required to draft trust agreements accurately. While accountants can provide valuable financial advice and insight, it is the lawyer's expertise that ensures the trust complies with legal standards. Collaborating with both professionals can offer a comprehensive approach to managing your trust and financial planning. To simplify the trust establishment process, consider utilizing the US Legal Forms platform for reliable templates and guidance.