Form To Dissolve Trust

Description

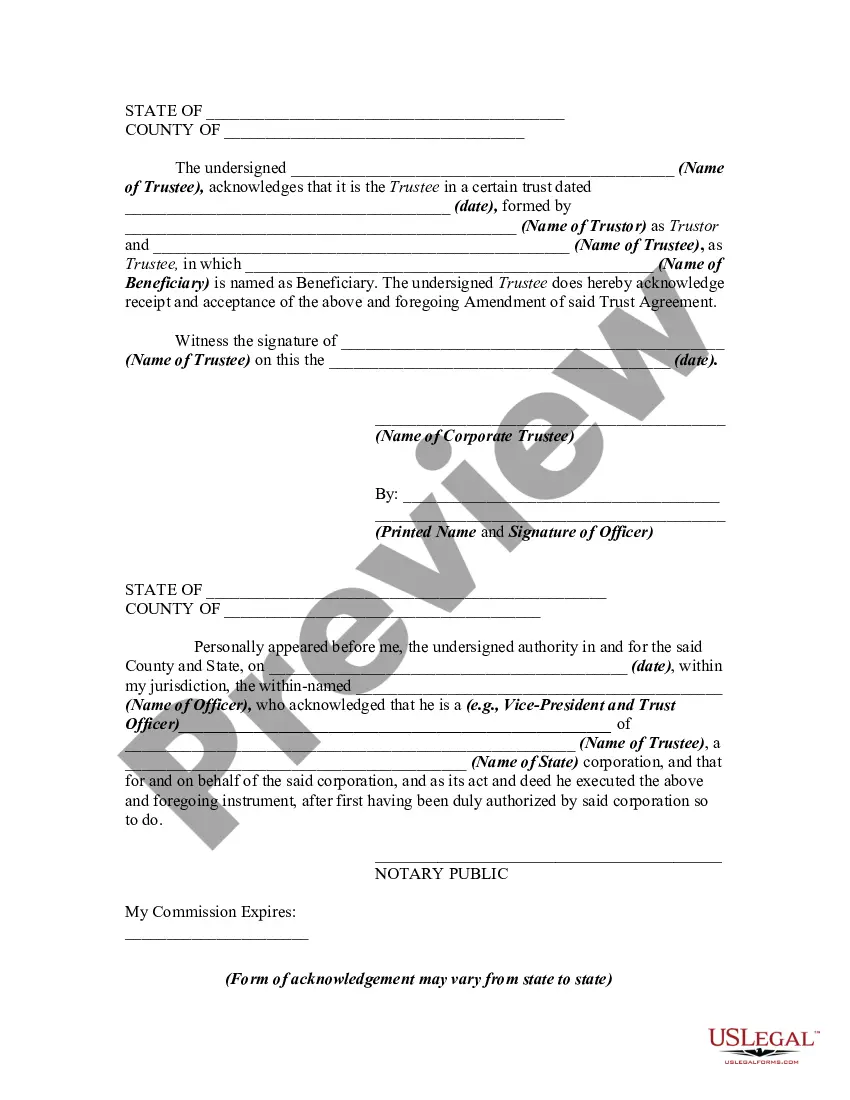

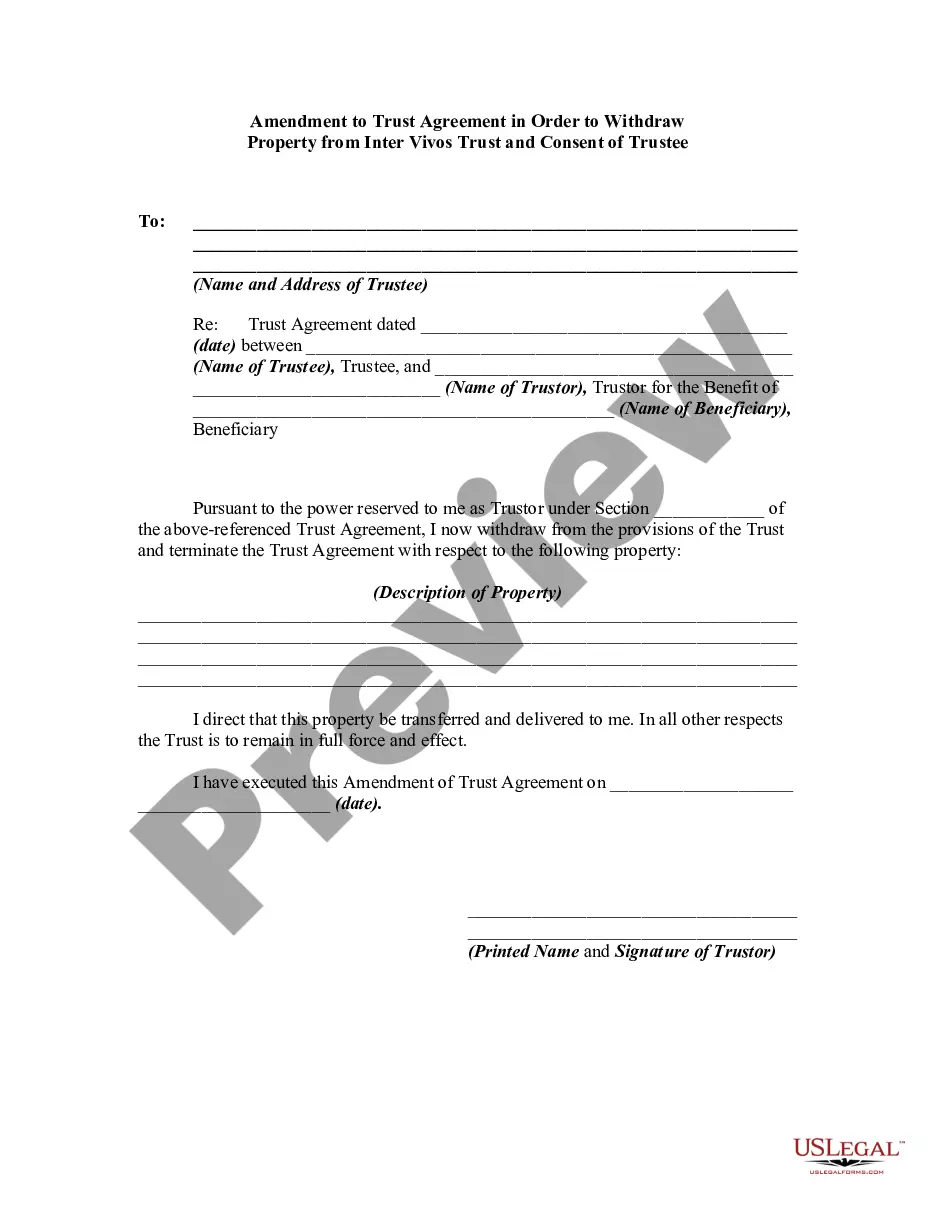

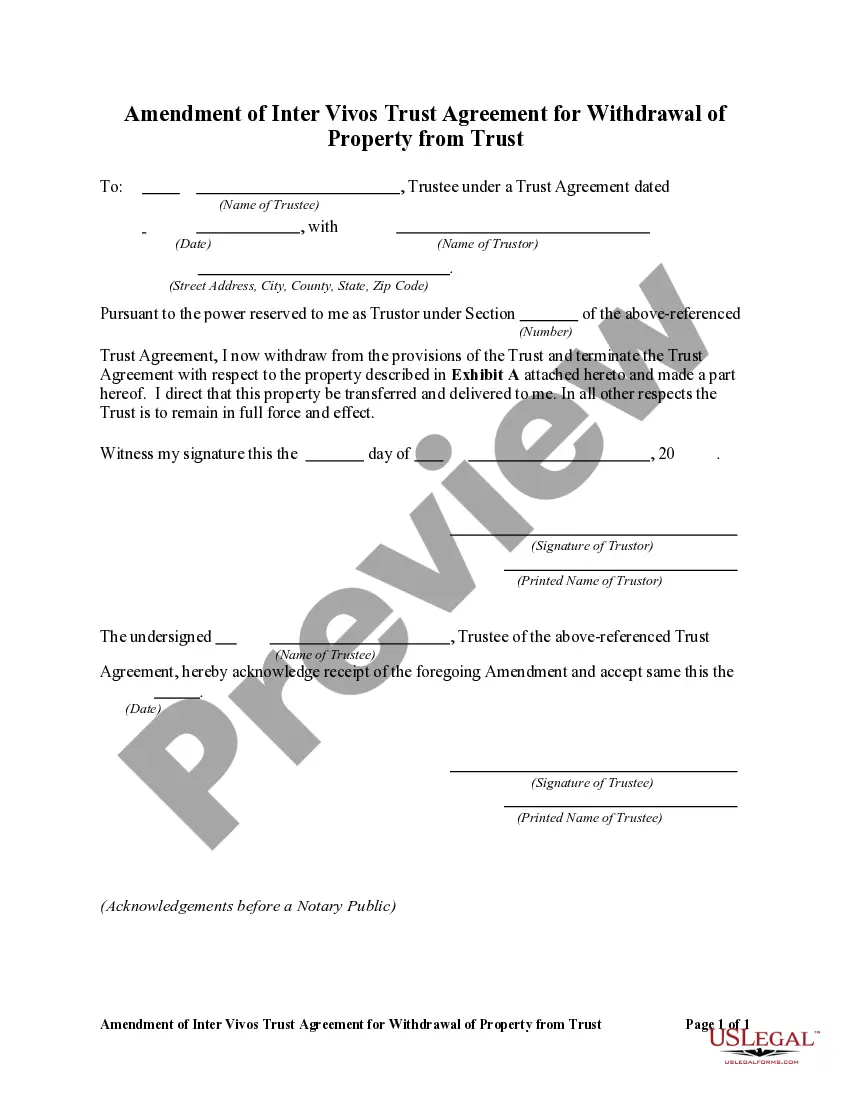

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

- Log into your account at US Legal Forms. If you’re a new user, create an account to access the forms library.

- Use the Preview mode to check the form description. Ensure it meets your requirements and complies with local laws.

- If necessary, utilize the Search feature to find the right document that suits your specific needs.

- Select your form and click on the Buy Now button to choose your desired subscription plan.

- Complete the purchase by providing your payment details, either through a credit card or PayPal.

- Download the document to your device for completion. You can access it later through the My Forms section of your account.

Once you've completed these steps, you'll have the document needed to dissolve your trust efficiently. US Legal Forms ensures that users have access to a robust collection of legal forms, making the process straightforward and user-friendly.

Start streamlining your legal forms today with US Legal Forms. Transform the way you handle legal documentation!

Form popularity

FAQ

To dissolve a trust with the IRS, start by filing the appropriate forms, including Form 1041 for the final tax return. You will also need to prepare a form to dissolve trust that outlines the details of the termination process. Make sure to distribute the trust’s assets in accordance with the trust document. For assistance, uslegalforms can guide you in following the correct procedures to ensure compliance with IRS regulations.

When terminating a trust, there may be various tax implications to consider. For example, the assets held within the trust may trigger capital gains taxes upon distribution. Additionally, you must file a final return that reflects these changes, typically using a form to dissolve trust. To navigate these complexities, you might find it beneficial to consult a tax professional or use our resources to clarify your situation.

Filing a final tax return for a trust involves completing IRS Form 1041, the U.S. Income Tax Return for Estates and Trusts. You will report any income earned by the trust up until its dissolution. It's crucial to include a form to dissolve trust with your final tax filing to indicate that the trust is being terminated. If you have questions during this process, platforms like uslegalforms can provide comprehensive guidance.

To discharge a trust, you need to follow a series of steps. Begin by reviewing the trust documents to understand its terms and conditions. It’s essential to gather necessary paperwork, such as a form to dissolve trust, to officially terminate the trust and distribute its assets accordingly. Consulting a legal professional can help ensure that you follow the proper process.

To terminate a trust with the IRS, you must ensure all tax obligations are met before dissolving it. This includes filing the final tax return for the trust. Completing a form to dissolve trust can be beneficial because it helps formalize the process, making it easier to submit necessary documents to the IRS.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms and conditions. This can lead to confusion and disputes among beneficiaries later on. To avoid this, ensure clarity in the trust document and consider a form to dissolve trust if changes are necessary in the future.

The difficulty of dissolving a trust varies based on its complexity and the number of beneficiaries involved. Generally, if you have all necessary documents and communicate effectively with involved parties, the process can be straightforward. Consider utilizing a form to dissolve trust to streamline your efforts and ensure all legal aspects are covered.

Dissolving a trust can have various tax implications depending on the trust's structure and assets. Typically, income generated from trust assets may be taxed before distribution. It's essential to use a form to dissolve trust properly, as it provides documentation that can help clarify tax obligations to the IRS later.

Terminating a trust involves several steps. Start by reviewing the trust agreement to understand the provisions for dissolution. Next, gather consent from all beneficiaries, and then complete a form to dissolve trust, which formalizes the termination. Consulting with a lawyer may offer additional guidance through this process.

The best way to dissolve an irrevocable trust is to follow the specific steps outlined in the trust document. First, gather all involved parties and consult with a legal professional to ensure compliance with state laws. Using a reliable form to dissolve trust can simplify this process, ensuring all necessary legal requirements are met.