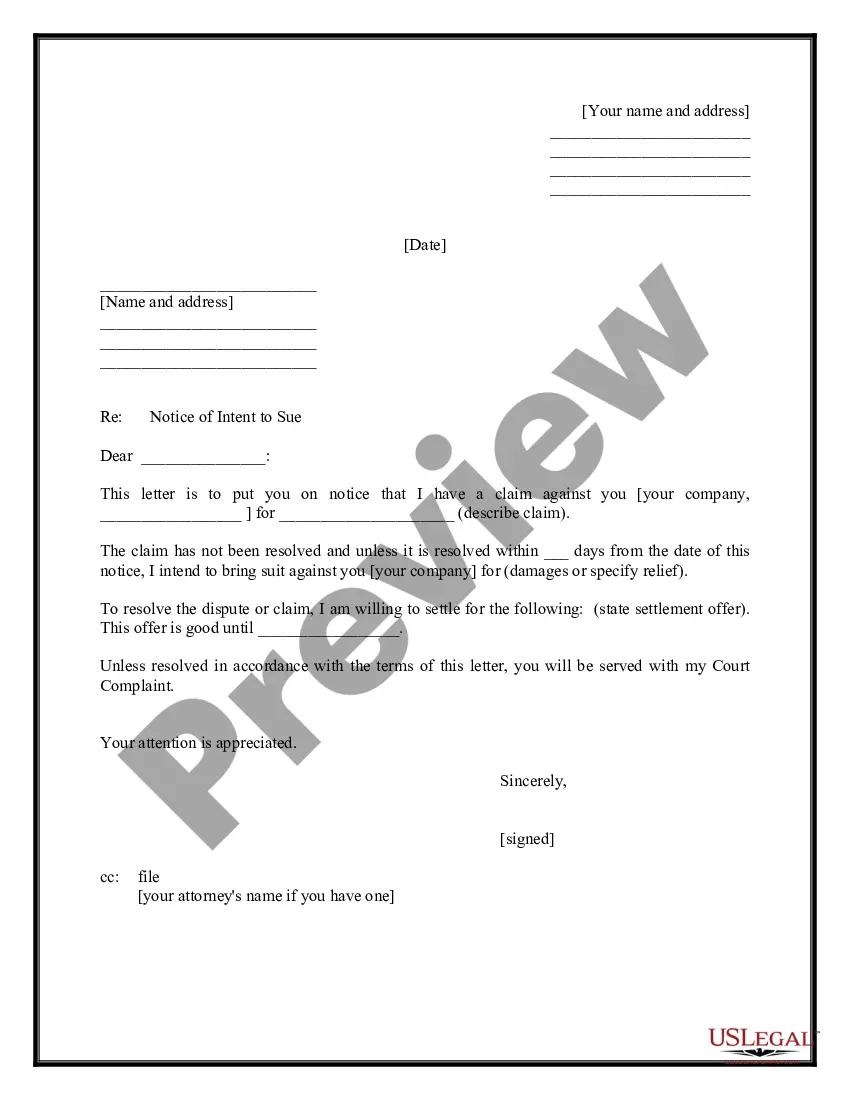

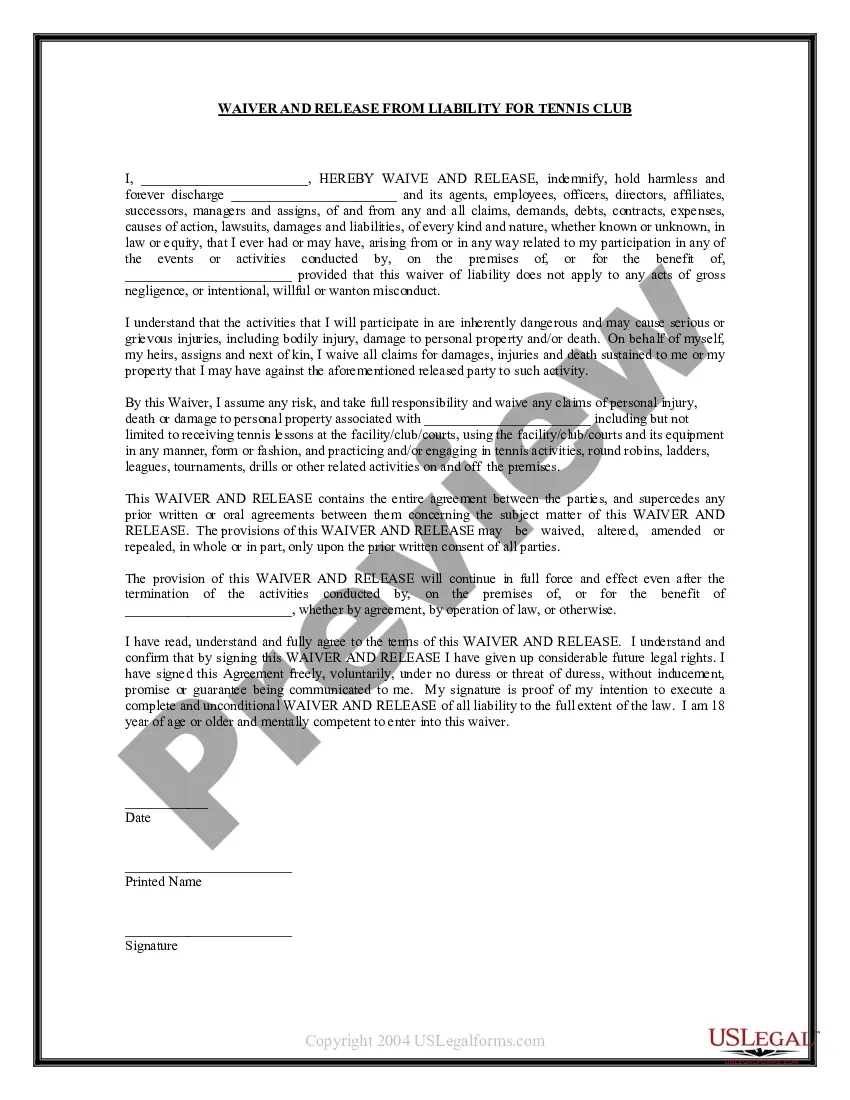

A letter template for debt settlement is a pre-written document that assists individuals in negotiating a settlement with their creditors to resolve outstanding debts. This formal letter serves as a tool to communicate with creditors, clearly outlining the debtor's financial situation and proposing a feasible settlement plan. There are various types of letter templates for debt settlement, each catering to different circumstances and scenarios. Some commonly used letter templates for debt settlement include: 1. General Debt Settlement Letter Template: This is a generic letter template that can be used for any type of debt, whether it be credit card debt, medical bills, personal loans, or others. It includes essential elements such as the debtor's personal details, creditor information, account numbers, outstanding balance, and a formal request for a settlement negotiation. 2. Credit Card Debt Settlement Letter Template: This specific template is designed for individuals seeking to settle outstanding credit card debts. It highlights the credit card issuer's name, account number, current balance, and proposed settlement amount. It also mentions the debtor's willingness to pay a lump sum or establish a payment plan to settle the debt. 3. Medical Debt Settlement Letter Template: Medical bills can often accumulate, leaving individuals burdened with substantial debt. This template focuses on addressing medical debts, including detailed information like the service provider's name, treatment dates, bill amounts, insurance coverage, and a proposal for a reduced settlement amount. 4. Personal Loan Debt Settlement Letter Template: For individuals dealing with unpaid personal loans, this template comes in handy. It outlines the borrower's information, lender details, loan amount, outstanding balance, and a proposed settlement offer to potentially reduce the debt burden. 5. Student Loan Debt Settlement Letter Template: Student loan debt can be overwhelming for many borrowers. This template specifically addresses the negotiation of student loan debt, including pertinent information such as loan service details, loan amount, outstanding balance, proposed settlement terms, and a request for debt forgiveness or reduced payment. Letter templates for debt settlement simplify the negotiation process for debtors, aiding them in presenting a clear and concise proposal to their creditors. These templates provide a structured framework, ensuring that key information is included, and enhance the chances of reaching a mutually agreeable settlement.

Letter Template For Debt Settlement

Description

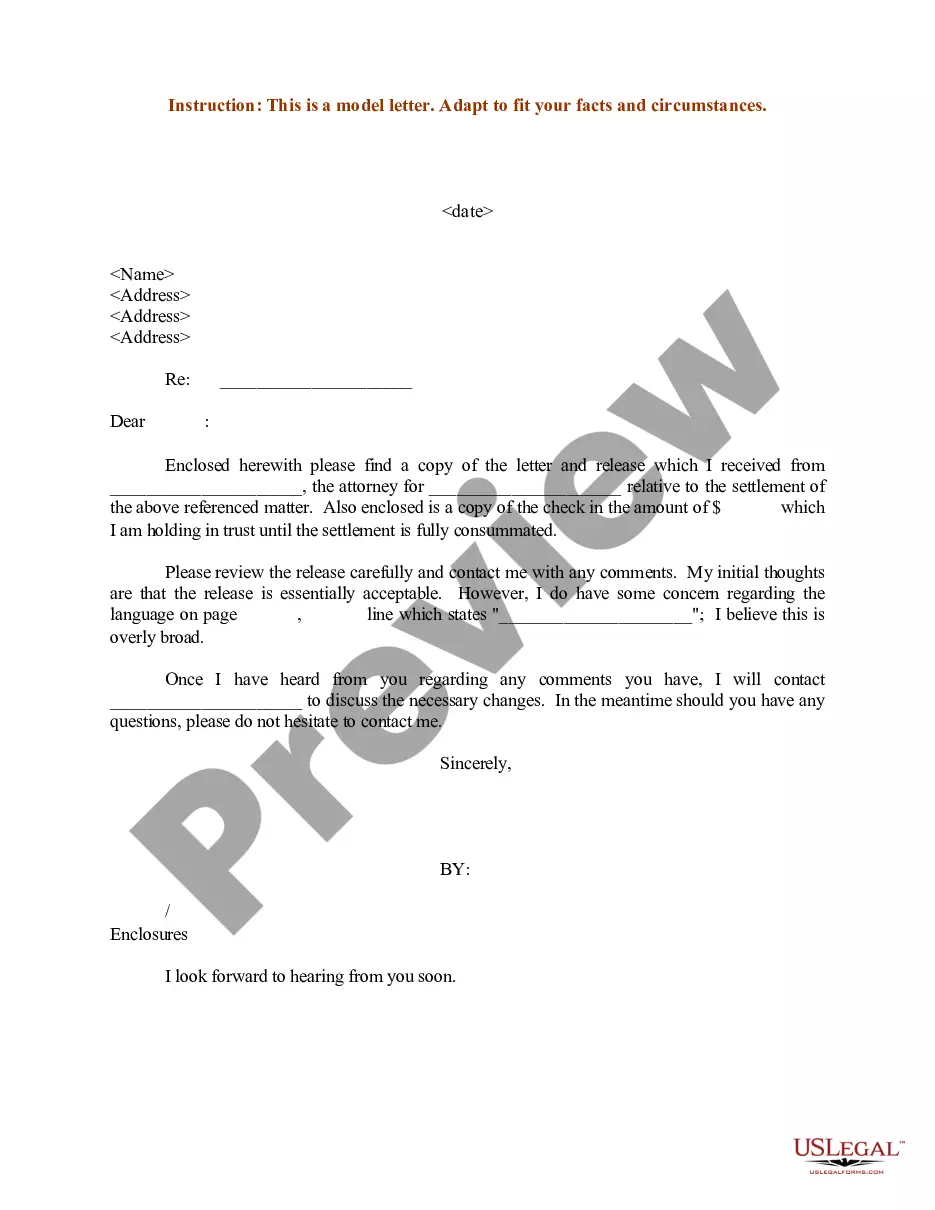

How to fill out Sample Letter For Settlement Offer With Review Of Release?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Some situations may require extensive research and a substantial financial investment.

If you’re searching for a simpler and more cost-effective method of preparing Letter Template For Debt Settlement or any other documentation without navigating through obstacles, US Legal Forms is always available to you.

Our digital repository of over 85,000 current legal templates encompasses nearly every facet of your financial, legal, and personal matters.

However, before rushing to download the Letter Template For Debt Settlement, adhere to these suggestions: Review the form preview and descriptions to confirm that you are on the correct document. Ensure the form you choose meets the standards of your state and county. Select the most appropriate subscription option to purchase the Letter Template For Debt Settlement. Download the form, then fill it out, certify it, and print it. US Legal Forms enjoys an impeccable reputation and boasts over 25 years of experience. Join us today and simplify document completion into a straightforward and efficient process!

- With just a few clicks, you can promptly access state- and county-compliant templates carefully designed for you by our legal professionals.

- Utilize our platform whenever you require a trustworthy and dependable service where you can easily find and download the Letter Template For Debt Settlement.

- If you are familiar with our website and have created an account before, simply Log In to your account, choose the template and download it immediately or re-download it later from the My documents section.

- Not signed up yet? No worries. It only takes a few minutes to set up and explore the catalog.

Form popularity

FAQ

If you are in possession of a will of a deceased person, you must either file it with the appropriate court or deliver it to the person named in the will as executor, as under Rhode Island law the will is to be filed within 30 days after death.

A Rhode Island Power of Attorney (PoA) is a legal document that gives a selected individual or entity permission to handle legal matters on your behalf, such as buying or selling property, signing contracts, and accessing bank accounts.

In Rhode Island, you must specify on the form that the power is durable. If you do not, the form will lose effect if you become incapacitated, which defeats its purpose in some cases. Rhode Island requires that two witnesses or a notary public sign your form.

A Brief Summary of Rhode Island Durable Power of Attorney Law. As with most other states, Rhode Island statute allows the patient's appointed health care agent (named in the durable power of attorney) to refuse any procedure that prolongs the dying process.

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

A Rhode Island durable statutory power of attorney form is used to transfer authority over financial acts from one person (?principal?) to someone else (?agent?). The principal can choose more than one agent to act on their behalf and select to have them work jointly or severally.

Common exemptions Rhode Island imposes a 7 percent sales tax on the sale of most tangible items. However, the state offers exemptions on a range of goods and services, as well as for certain organizations and types of sales. Common exempt goods include clothing and footwear, food, and medical items.

A Rhode Island durable statutory power of attorney form is used to transfer authority over financial acts from one person (?principal?) to someone else (?agent?). The principal can choose more than one agent to act on their behalf and select to have them work jointly or severally.