Trustee Resignation Form Illinois Withdrawn

Description

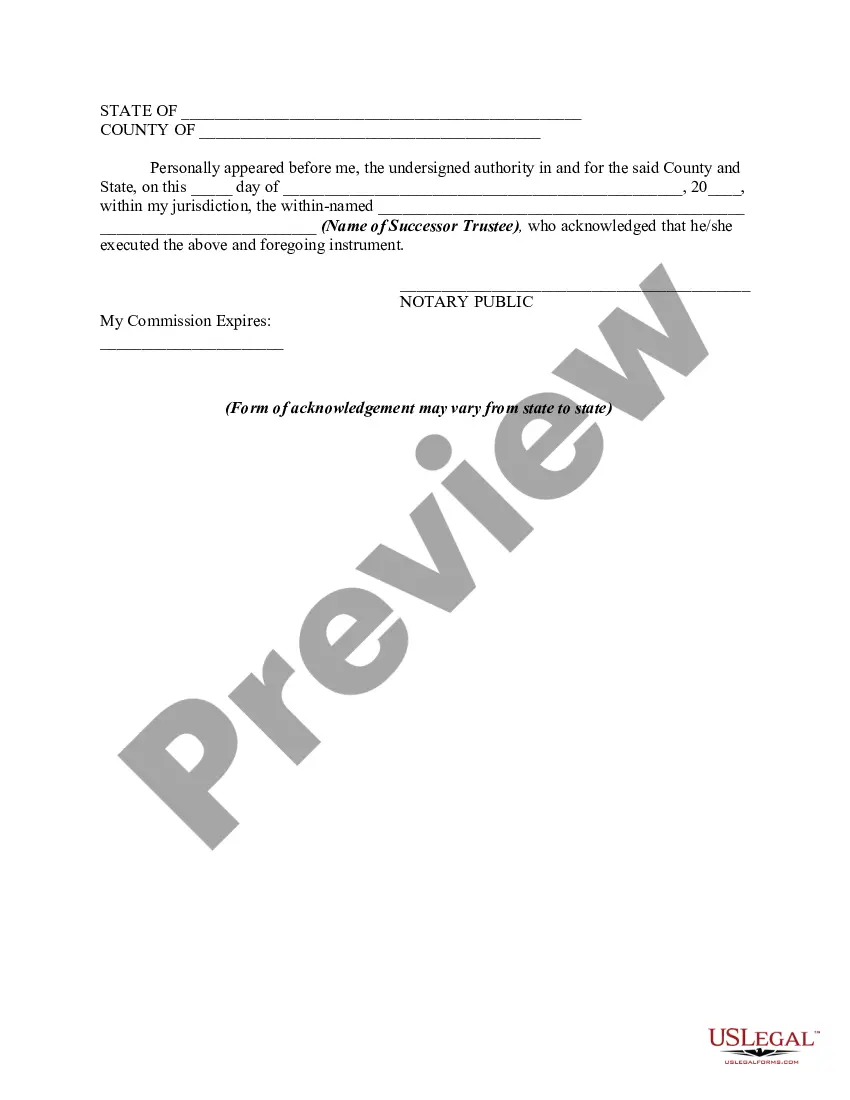

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their life.

Completing legal documents requires meticulous care, beginning with selecting the correct form template.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With an extensive US Legal Forms catalog available, you don't need to waste time searching for the correct template online. Utilize the library's user-friendly navigation to find the right form for any situation.

- For instance, if you select an incorrect version of a Trustee Resignation Form Illinois Withdrawn, it will be rejected upon submission.

- Thus, it is crucial to have a trustworthy source for legal documents such as US Legal Forms.

- To obtain a Trustee Resignation Form Illinois Withdrawn template, follow these straightforward steps.

- Locate the template you require using the search box or catalog navigation.

- Review the form’s details to confirm it corresponds with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search tool to find the Trustee Resignation Form Illinois Withdrawn sample you need.

- Download the file when it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t possess an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate payment option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Trustee Resignation Form Illinois Withdrawn.

Form popularity

FAQ

When a trustee resigns from a trust, the trust's administration may be affected, but it does not invalidate the trust itself. The resignation typically requires the completion of a Trustee resignation form in Illinois to document the change officially. Following the resignation, the designated successor trustee should be appointed to ensure continuity in managing the trust's assets. Using US Legal Forms can simplify obtaining the necessary documentation and guidance for this important transition.

A trustee can be removed under various circumstances, such as failure to perform their duties, misconduct, or if they become incapacitated. The trust document may outline specific grounds for removal, or Illinois law may provide additional reasons. In many cases, beneficiaries can petition the court for trustee removal, ensuring the trust is managed appropriately. Accessing a Trustee resignation form in Illinois can facilitate this process.

When a trustee resigns, it's important to first review the trust document for specific instructions regarding resignation. You may need to complete a Trustee resignation form in Illinois to formalize the process. Additionally, appointing a successor trustee promptly ensures that the trust continues to operate smoothly. Utilizing US Legal Forms can help you obtain the correct forms and guidance for this transition.

In most cases, a trustee resignation letter does not need to be notarized. However, the specific requirements can vary depending on the trust's terms and state laws. It is wise to consult the trust document or seek legal advice to ensure compliance. Utilizing a Trustee resignation form Illinois withdrawn can help clarify any necessary steps.

To write a resignation letter as a trustee, start by addressing the beneficiaries and clearly state your intention to resign. Include the name of the trust, your reason for resigning, and the effective date of your resignation. A well-structured resignation letter, along with a Trustee resignation form Illinois withdrawn, ensures that all parties are informed and that the transition proceeds smoothly.

To resign from your role as a trustee, you must complete a Trustee resignation form Illinois withdrawn. This form typically requires your name, the name of the trust, and the date of your resignation. After filling it out, submit the form to the trust's beneficiaries and document the process for your records. It's advisable to check the trust document for any specific requirements regarding your resignation.

Under the Illinois Trust Code, a qualified beneficiary, settlor, or co-trustee can request that a court remove a trustee and replace them with a successor. A court also has the power to remove a trustee on its own initiative if it finds grounds for doing so.

If the trust document names you as the successor trustee and you don't want to serve, you need to formally resign, in writing. Notify each of the trust beneficiaries that you have done so. It might seem odd to resign from something that you've never agreed to do, but that's the way it works.

808. Directed trusts. more persons given authority by the trust instrument to direct, consent to, veto, or otherwise exercise all or any portion of the distribution powers and discretions of the trust, including, but not limited to, authority to make discretionary distribution of income or principal.