Trustee Aj

Description

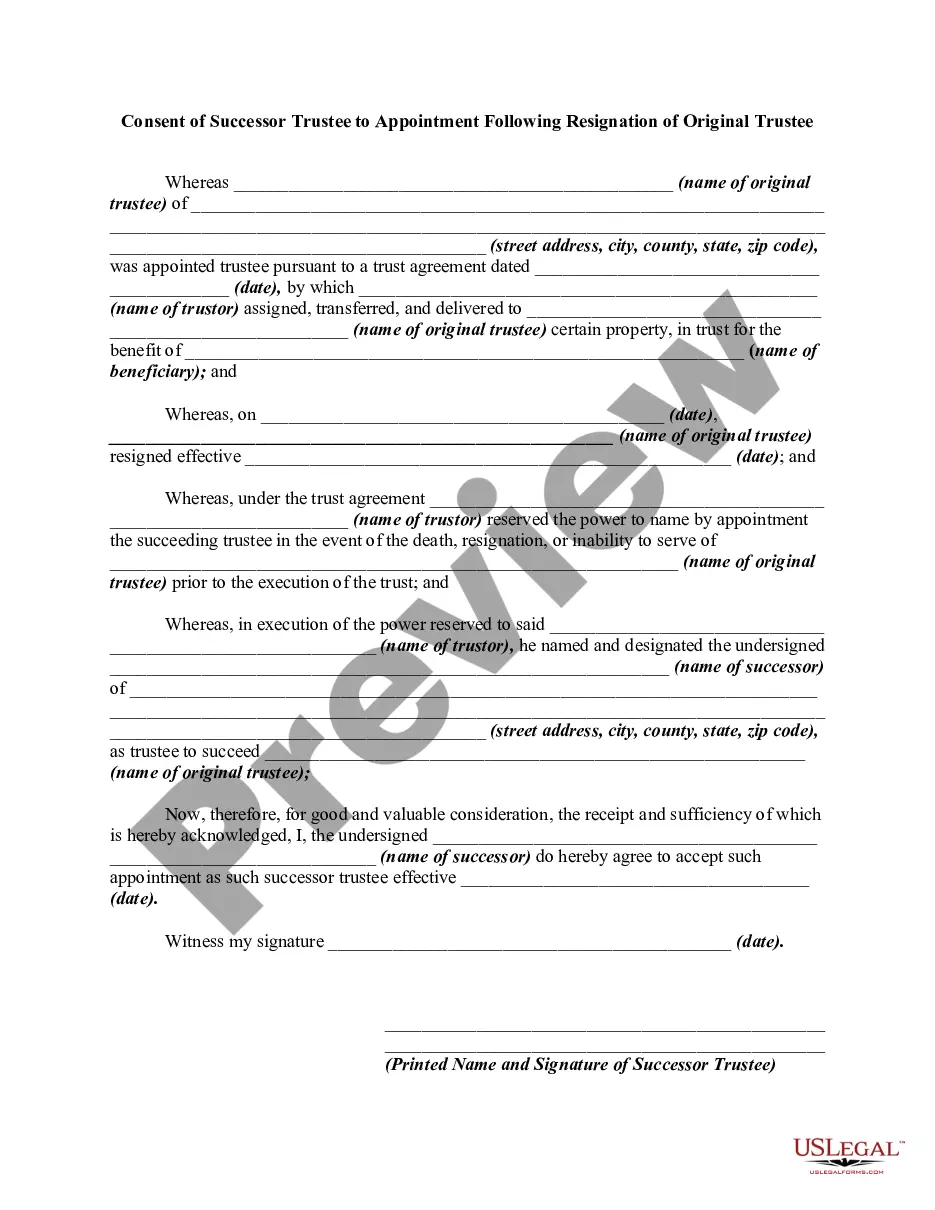

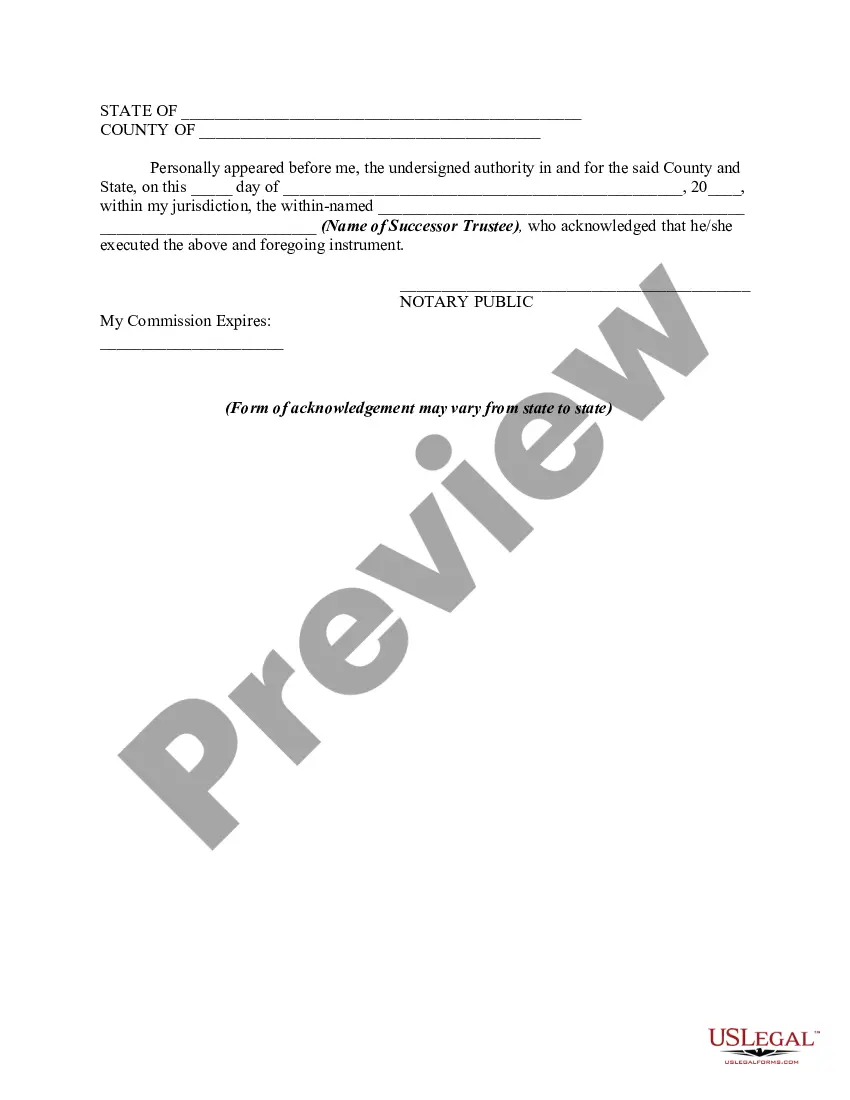

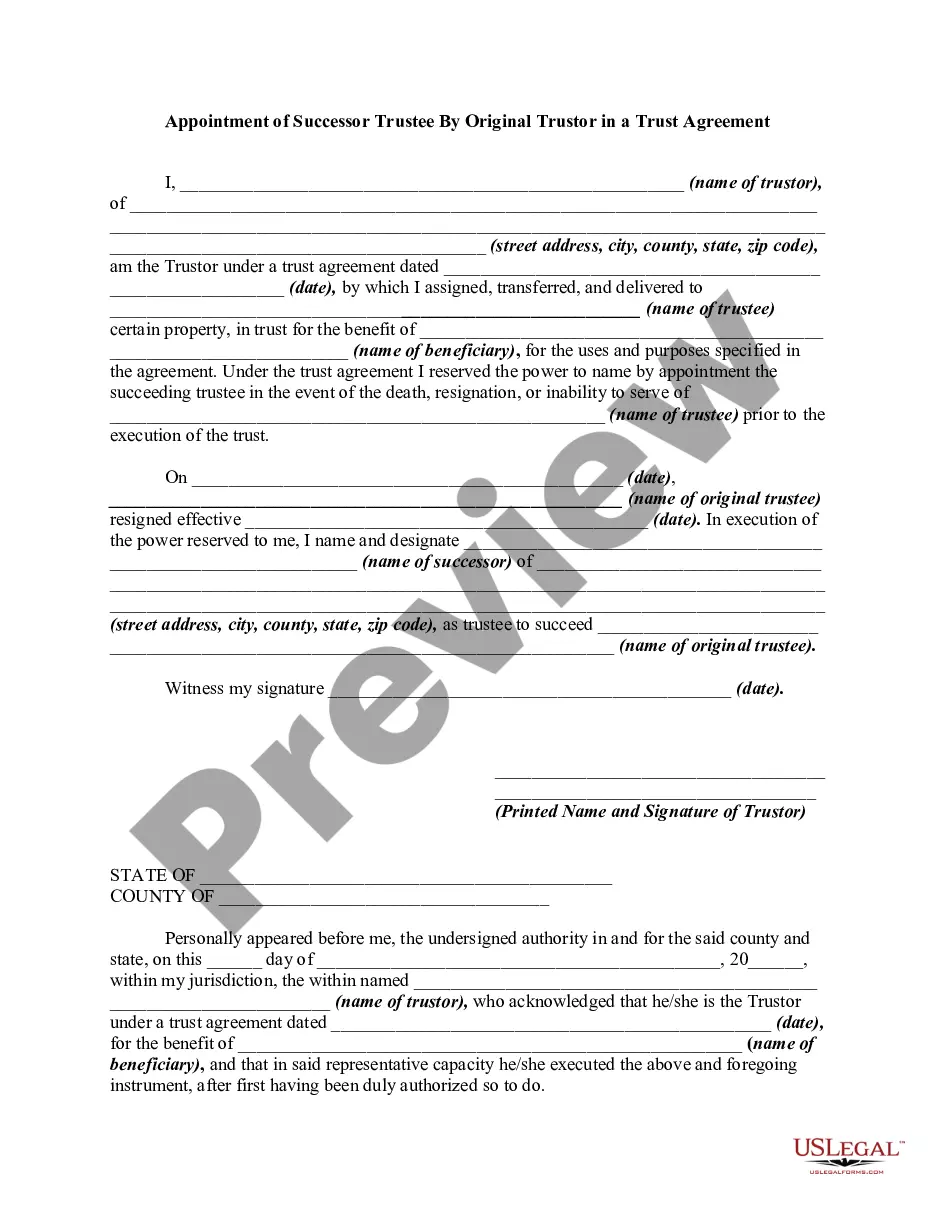

How to fill out Consent Of Successor Trustee To Appointment Following Resignation Of Original Trustee?

- Begin by visiting the US Legal Forms website and sign in to your existing account if you have one, ensuring your subscription is active.

- If you're new to the service, start by reviewing the form descriptions and preview mode to find the right document that complies with local jurisdiction.

- Utilize the search bar to find an alternate template if your requirements change or if you find discrepancies.

- Select the document you need by clicking the 'Buy Now' button and choosing your preferred subscription plan. You will need to register for an account if you haven't yet.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the chosen form to your device. You can always access it later from the 'My Forms' section in your profile.

Once you've followed these steps, you'll have easy access to a wealth of legal documents designed to meet your needs. US Legal Forms empowers users by ensuring they can easily navigate legal requirements with high-quality templates.

Start your journey with Trustee aj today and streamline your legal document process. Don't miss out on the ease and efficiency US Legal Forms has to offer!

Form popularity

FAQ

To get a trustee account, start by researching banks or financial institutions that specialize in trust services. Once you find a suitable option, gather the required documents, such as your trust agreement and identification. After that, you can visit the bank or apply online. Utilizing USLegalForms can help you navigate the process of setting up your trustee aj account effectively.

Opening a trustee account typically involves filling out an application and providing relevant documentation to the bank or financial institution. You will need to provide the trust agreement, identification, and proof of address. Make sure to ask about any specific requirements they might have. Using USLegalForms can assist you in preparing the necessary documents for your trustee aj account.

A trustee account serves to manage and protect assets held in trust for the benefit of beneficiaries. The trustee oversees the account, ensuring that funds are used according to the terms specified in the trust document. This account provides a structured way to handle inheritance, ensuring financial responsibility and compliance. Establishing a trustee aj account simplifies the management of these responsibilities.

Choosing a trustee is a critical decision that should involve careful consideration. Typically, individuals appoint a trusted friend, family member, or a professional, such as a lawyer or financial advisor. It’s important to select someone who understands your wishes and can manage assets responsibly. Using resources like USLegalForms can help streamline the selection process for a trustee aj.

Many banks provide trust accounts, including large national banks and regional institutions. Popular choices often include Wells Fargo, Bank of America, and Chase. Additionally, credit unions and local banks may also offer competitive options. You should compare services and fees to find the best fit for your needs when looking for a trustee aj.

The role of a trustee in a trust is to administer the assets according to the wishes outlined in the trust document. This involves managing investments, ensuring proper distributions, and maintaining clear communication with beneficiaries. A competent trustee safeguards the trust's integrity while serving the needs of the beneficiaries, embodying the essential functions of Trustee aj to achieve effective trust management.

In the context of a trust, both the trustee and the beneficiary have distinct rights. The trustee has the authority to manage the trust and make decisions, but those decisions must be made in alignment with the beneficiaries' interests. Beneficiaries hold rights to receive assets or distributions as stipulated in the trust document, establishing a balance of power where both parties play critical roles under the framework of Trustee aj.

A trustee can manage trust assets, make investments, and distribute funds to beneficiaries according to the trust terms. However, a trustee cannot use trust assets for personal purposes or make decisions that serve their interests over the beneficiaries. It's crucial to understand these boundaries to maintain trust integrity, which aligns with the responsibilities of a Trustee aj.

The three primary duties of a trustee include the duty of loyalty, the duty of care, and the duty to follow the trust terms. The duty of loyalty ensures that the trustee prioritizes the interests of the beneficiaries above all else. Following the trust terms directs how the trustee should manage assets and distributions, while the duty of care requires prudent decision-making in the administration of trust property, reflecting the core principles of Trustee aj.

A trustee has significant power over a trust, as they manage the assets and make decisions regarding distributions. This influence includes handling investments, paying taxes, and ensuring compliance with the trust document. However, it's essential to note that a trustee must act in the best interests of the beneficiaries, not for personal gain, following the principles of Trustee aj.