Fire Attorney Form With Irs

Description

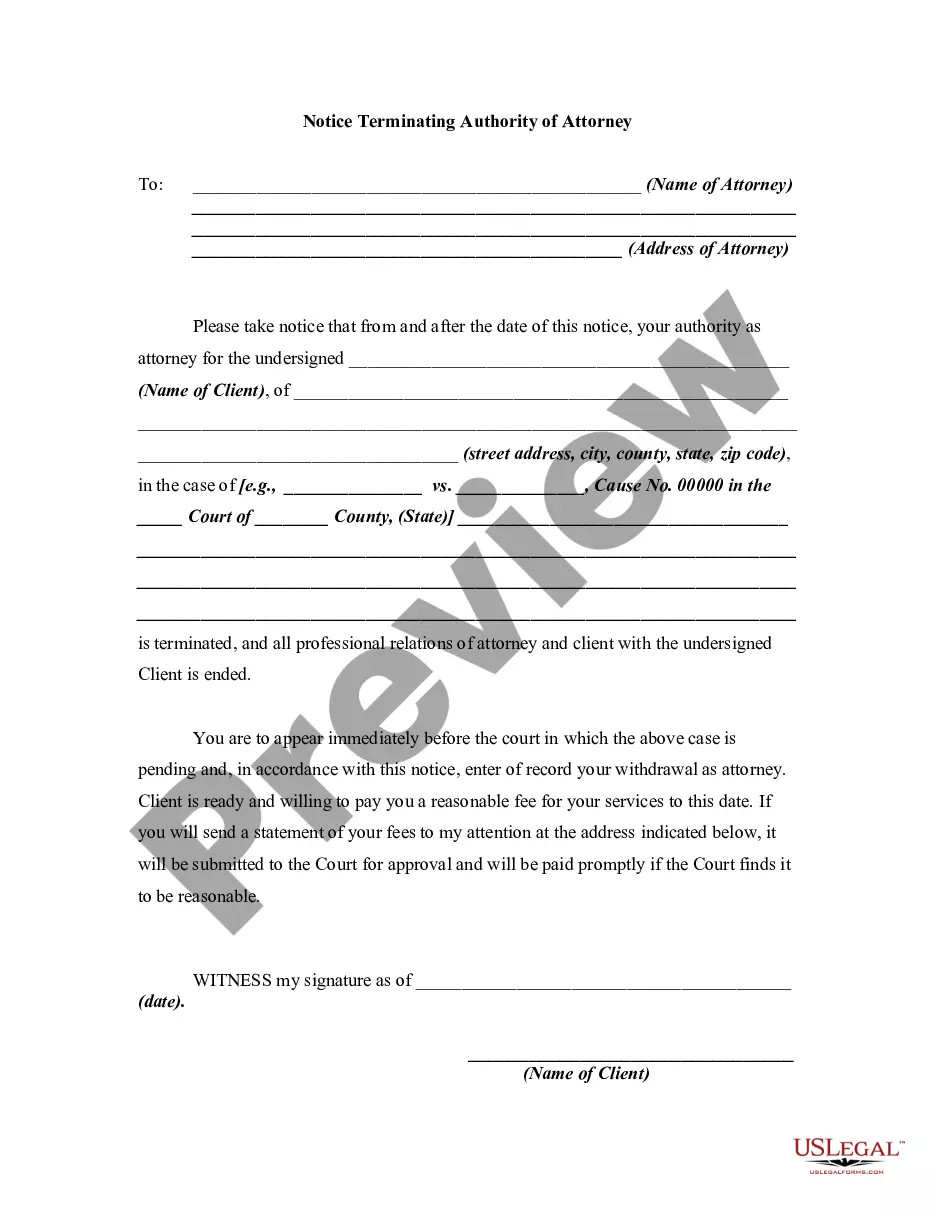

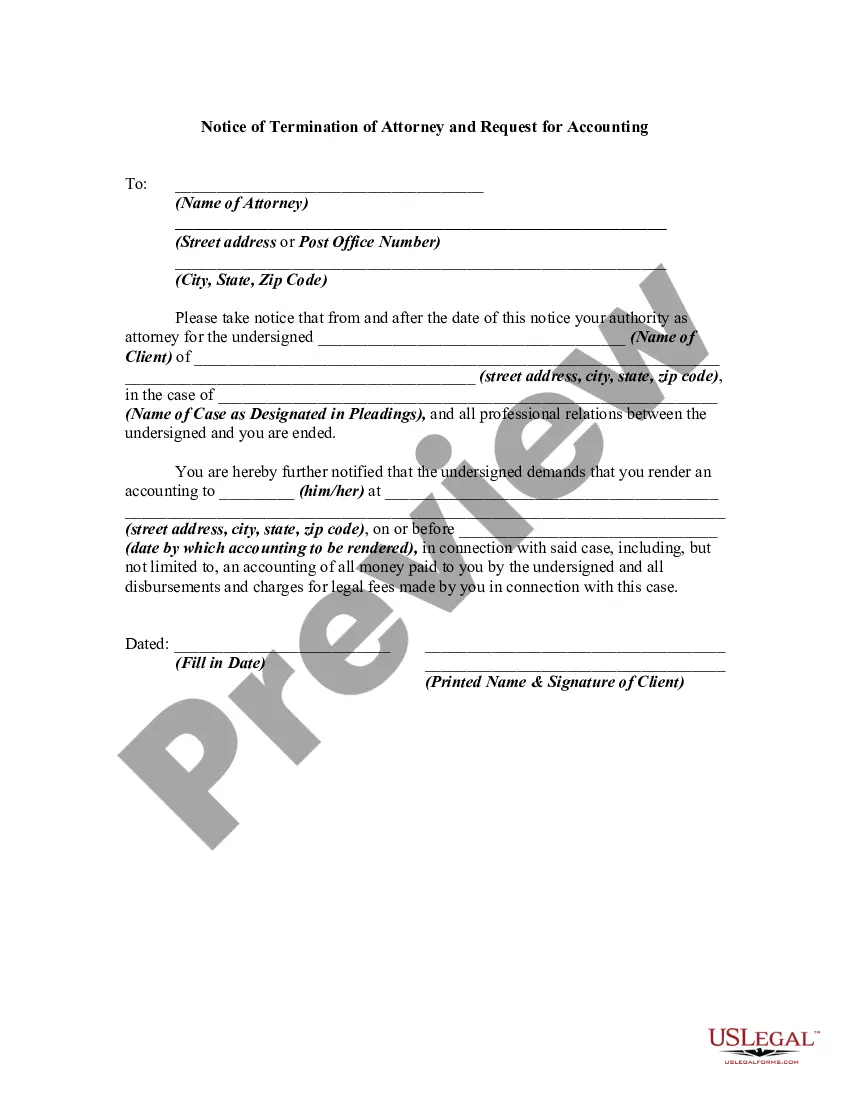

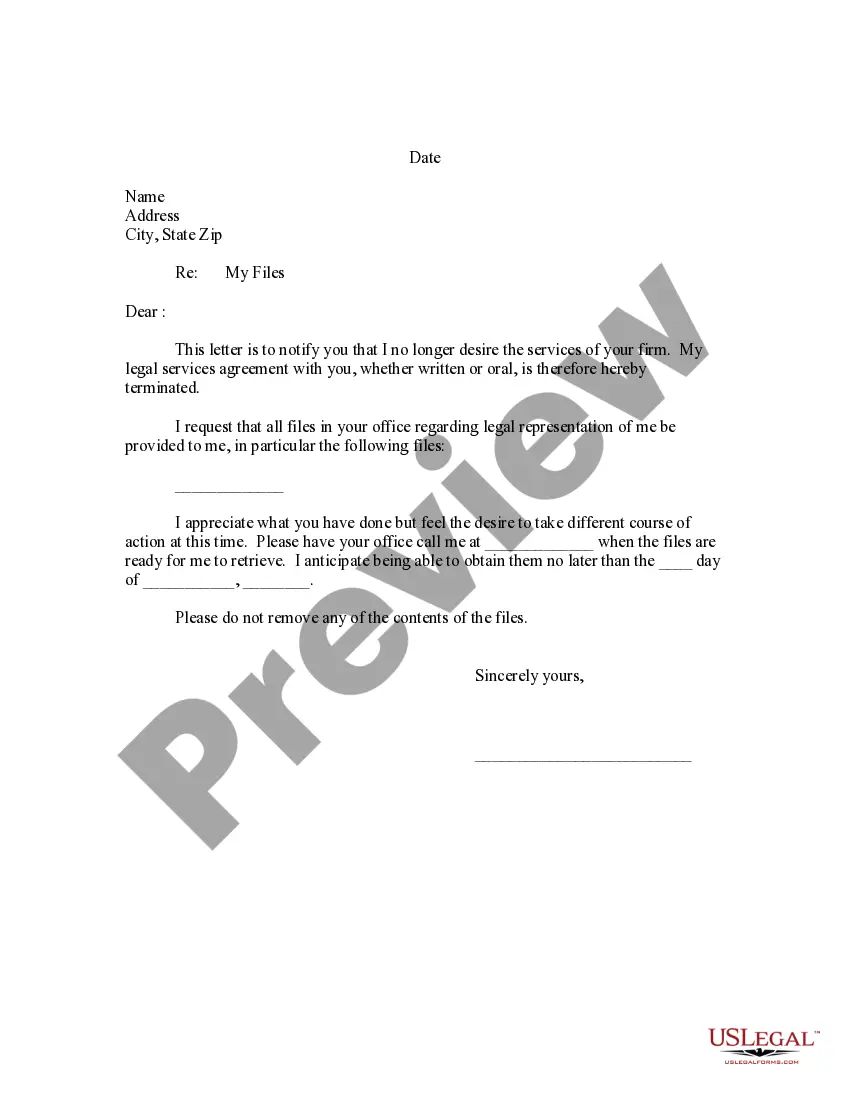

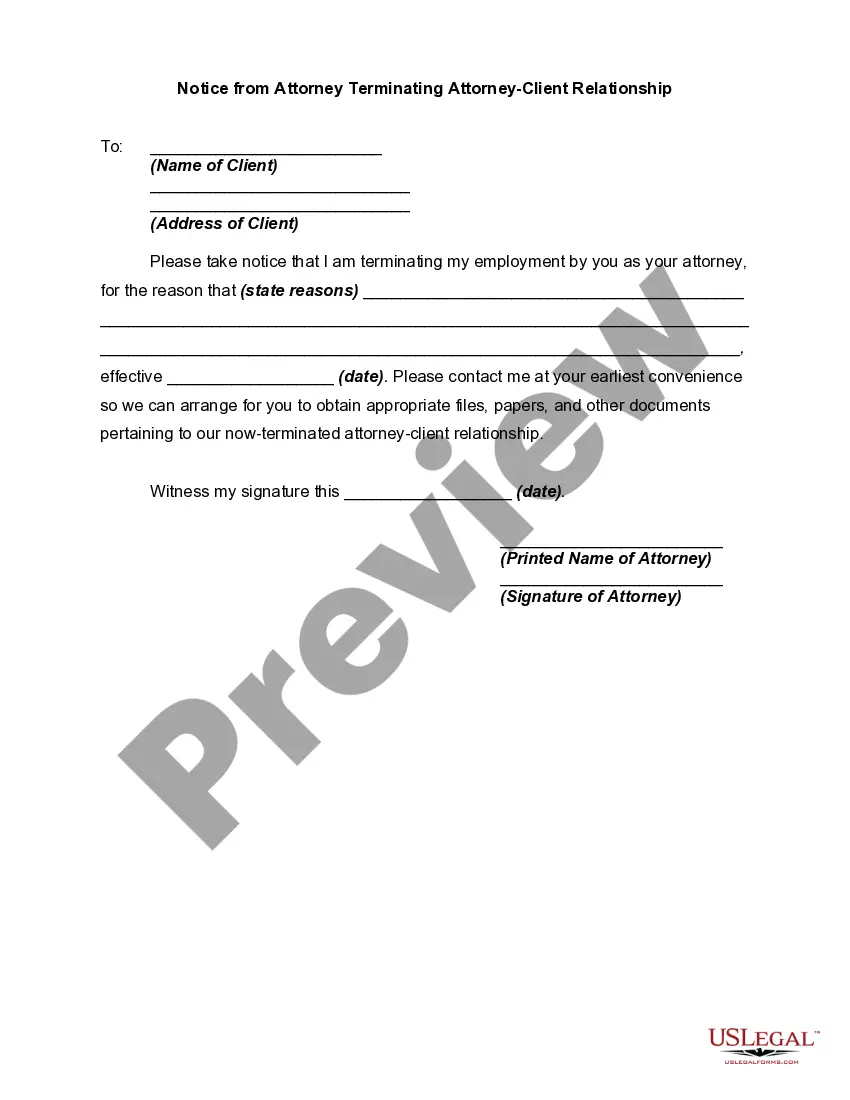

How to fill out Notice To Fire Or Terminating Authority Of Attorney?

Whether for commercial objectives or personal matters, everyone must handle legal issues at some stage in their lives.

Filling out legal documents necessitates meticulous focus, beginning with choosing the right form example.

With an extensive US Legal Forms collection available, you won't need to waste time looking for the suitable template on the internet. Utilize the library’s simple navigation to find the right template for any circumstance.

- Locate the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is an incorrect document, return to the search function to find the Fire Attorney Form With Irs template you need.

- Acquire the template when it suits your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can purchase the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment option: you may use a credit card or PayPal account.

- Choose the document format you desire and download the Fire Attorney Form With Irs.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Form 56 is used to notify the IRS of your appointment of a fiduciary, while Form 2848 is a power of attorney for tax matters. The key difference lies in the scope of authority; Form 56 pertains to fiduciary responsibilities, whereas Form 2848 allows broader representation in tax issues. If you need someone to handle your tax affairs, a fire attorney form with irs is the appropriate choice.

Form 8821 is used to authorize someone to access your tax information from the IRS. This form is particularly useful when you need someone to review your tax details without taking any action on your behalf. While it allows for information access, for comprehensive representation, you might still want to consider a fire attorney form with irs.

Form 8453 serves as a declaration for electronic tax return signatures. It allows taxpayers to authorize an electronic filing while submitting their returns. If you are utilizing a fire attorney form with irs for electronic filings, this form might be necessary to complete the process successfully.

The amount the IRS will settle for varies based on individual circumstances, including the total tax owed and the taxpayer's financial situation. Settlements often depend on negotiations and the specific case at hand. Engaging a fire attorney form with irs can help you navigate this process more effectively, increasing your chances of a favorable settlement.

The primary difference between Form 8821 and Form 2848 lies in their functions. Form 8821 grants authorization to receive tax information, while Form 2848 allows someone to represent you in tax matters and act on your behalf. If you need comprehensive representation, you should consider the fire attorney form with irs, specifically Form 2848.

Form 2848 is the official power of attorney for tax matters. This form allows you to designate an individual, such as a tax professional or a fire attorney form with irs, to represent you before the IRS. The authorized individual can perform various tasks, including signing documents and receiving information related to your tax matters.

Form 8821 is not a power of attorney; it is a tax information authorization form. This form allows you to authorize someone to receive and inspect your confidential tax information from the IRS. If you need someone to act on your behalf, you would need to consider a fire attorney form with irs, such as Form 2848.

To submit a power of attorney to the IRS, complete form 2848 and send it to the appropriate IRS service center. This form acts as your Fire attorney form with IRS, granting your representative authority to act on your behalf. Always ensure you retain copies for personal records.

The taxpayer and their authorized representative complete IRS form 2848. The taxpayer must provide their details while their representative fills in their information, establishing a Fire attorney form with IRS relationship. Accurate completion ensures that the IRS recognizes the authorized representative.

The best way to send documents to the IRS is by certified mail with return receipt requested. This method provides proof of postage and ensures that your documents, including the Fire attorney form with IRS, reach the IRS safely. Always keep copies of everything you send for your own records.