Writ State Garnishment For State Taxes

Description

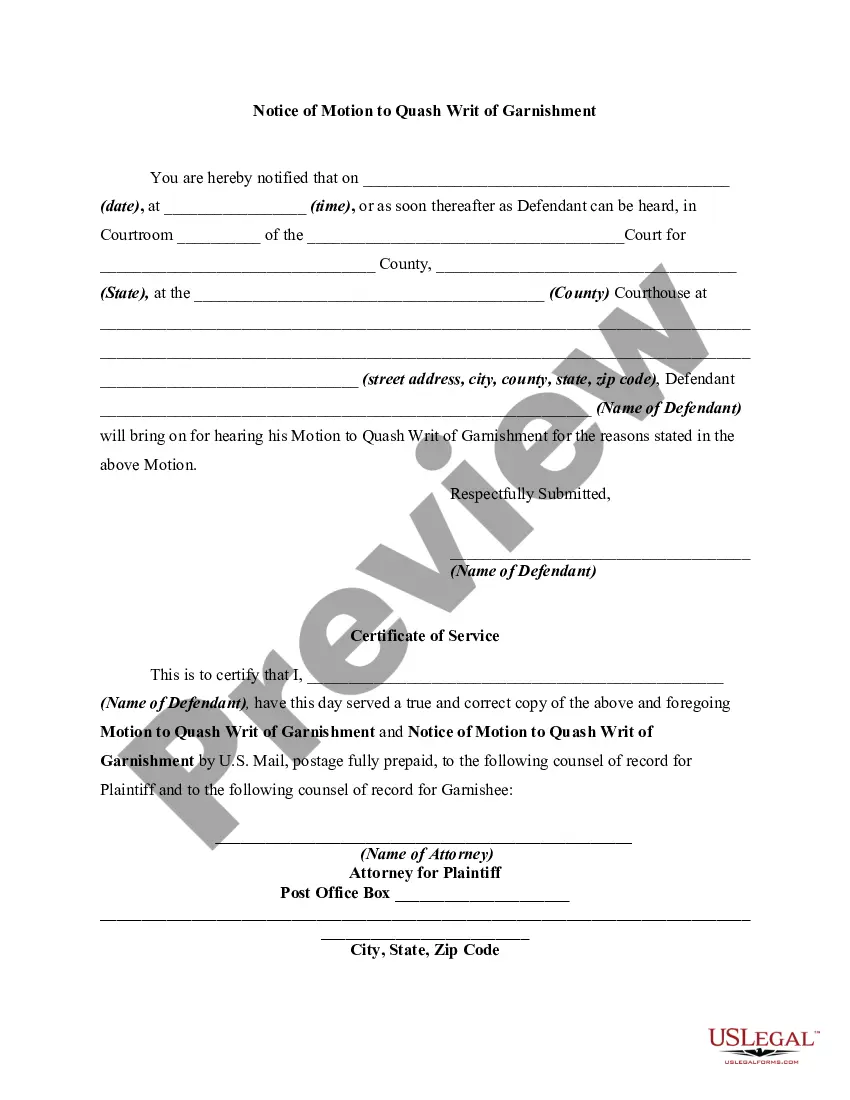

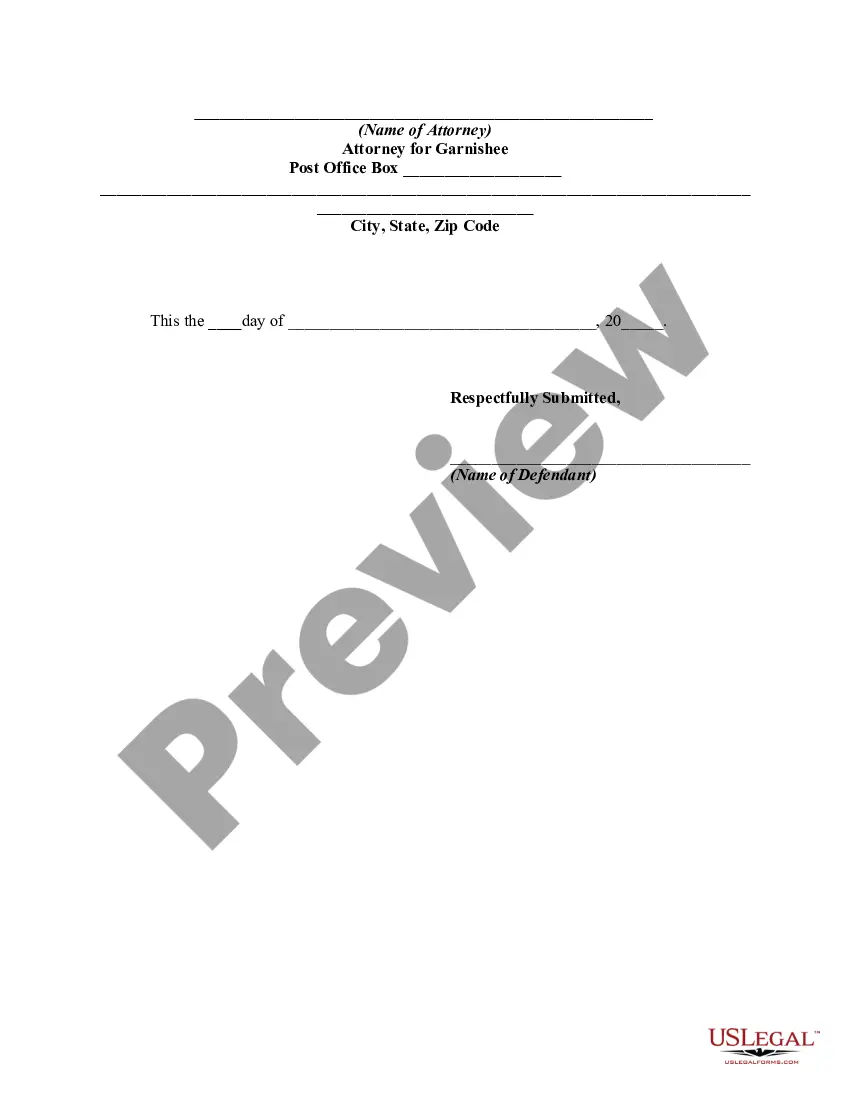

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Accessing legal document examples that adhere to federal and state laws is vital, and the internet provides many choices to select from.

However, what’s the benefit of wasting time looking for the appropriate Writ State Garnishment For State Taxes example online if the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for any professional and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our specialists keep up with legislative updates, so you can always feel assured your paperwork is current and compliant when acquiring a Writ State Garnishment For State Taxes from our site.

Click Buy Now once you’ve found the correct form and select a subscription plan. Create an account or Log In and process a payment using PayPal or a credit card. Choose the correct format for your Writ State Garnishment For State Taxes and download it. All documents you find through US Legal Forms are reusable. To re-download and fill out previously acquired forms, access the My documents tab in your account. Take advantage of the most extensive and user-friendly legal document service!

- Acquiring a Writ State Garnishment For State Taxes is quick and straightforward for both existing and new users.

- If you already possess an account with a valid subscription, Log In and save the document example you need in the appropriate format.

- If you are new to our site, adhere to the steps below.

- Examine the template using the Preview option or via the text outline to verify it meets your requirements.

- Search for an alternative example using the search feature at the top of the page if necessary.

Form popularity

FAQ

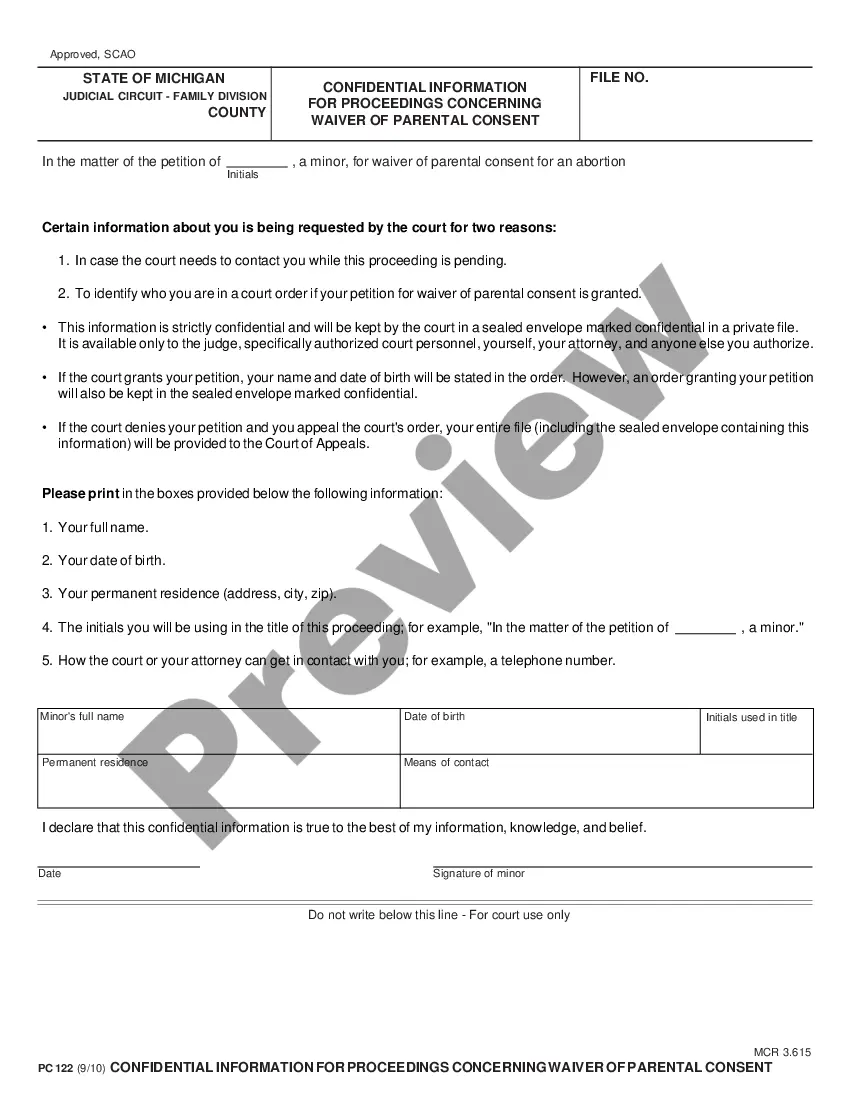

Once the writ of garnishment is served on the State of Michigan, it creates a ?judicial lien? on the tax refund in favor of the creditor. If a bankruptcy is filed within 90 days of the writ of garnishment being served on the State of Michigan, the judicial lien is avoidable and the tax refund will go the individual.

The CRA may garnish your income, garnish your bank account, seize and sell your assets, or use any other means under the laws that apply to collect the amount you owe. Before starting legal action, the CRA must do the following: make 3 attempts to give verbal legal warning by phone. send 1 written legal warning letter.

If the garnishee is the State of Michigan, you need the debtor's social security number. If you don't include all the required information, the garnishee does not have to process the writ. File the Request and Writ for Garnishment with the court that entered the judgment. There is a $15 filing fee.

Garnishing your refund Federal law allows only state and federal government agencies (not individual or private creditors) to take your refund as payment toward a debt. However, once you deposit the refund into your bank account, these rules no longer apply.

Generally, the IRS will take 25 to 50% of your disposable income. Disposable income is the amount left after legally required deductions such as taxes and Social Security (FICA). There are exceptions to this rule, however, that could protect some or all of your earnings from wage garnishment.