Garnishee Garnishment Employer Withheld

Description

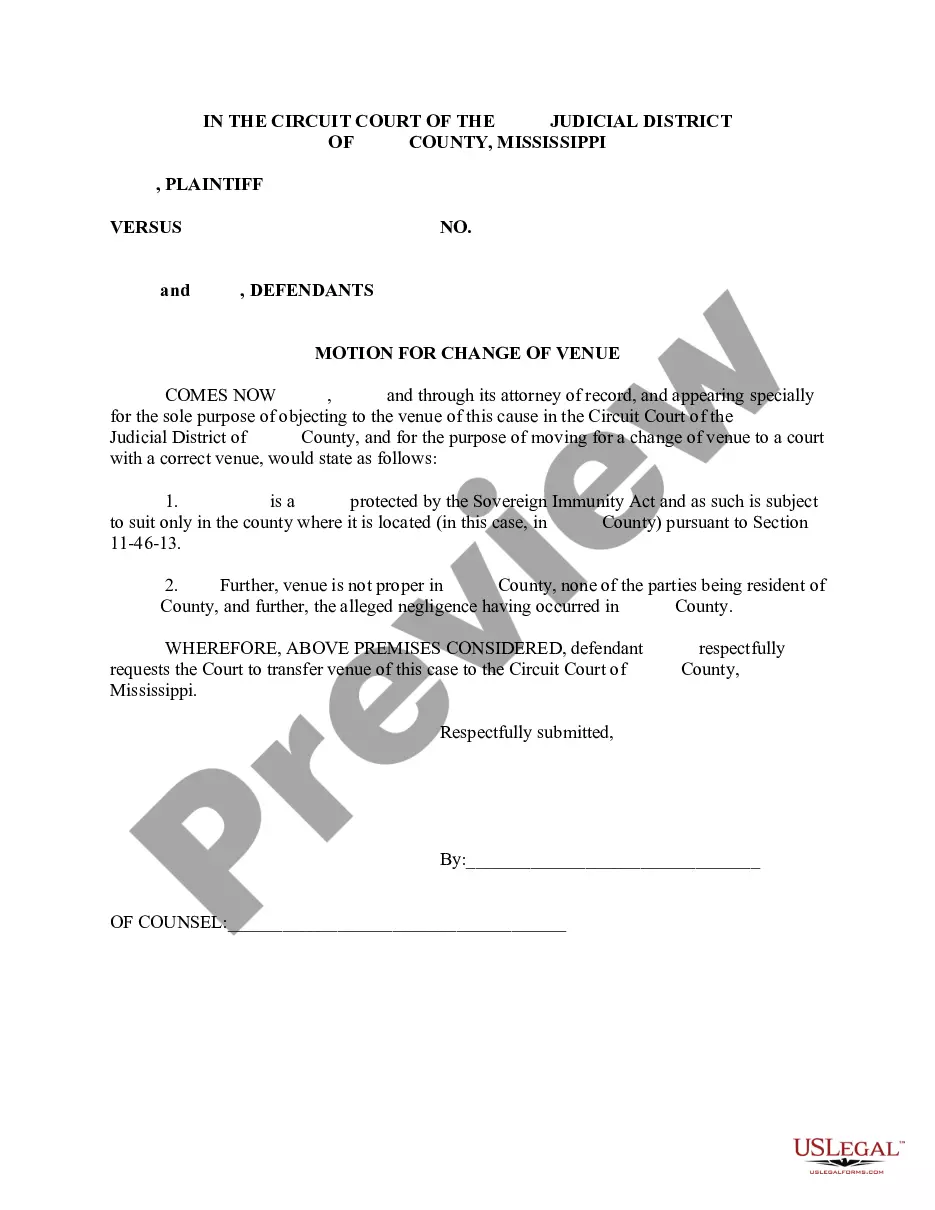

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Creating legal documents from the ground up can frequently be intimidating.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more economical method of preparing Garnishee Garnishment Employer Withheld or any other documents without unnecessary complications, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal forms encompasses nearly every element of your financial, legal, and personal matters.

Examine the document preview and descriptions to ensure you have located the document you are seeking. Verify if the template you select aligns with the rules and laws of your state and county. Choose the appropriate subscription plan to obtain the Garnishee Garnishment Employer Withheld. Download the form, then fill it out, validate, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document completion effortless and efficient!

- With just a few clicks, you can swiftly access state- and county-compliant forms carefully compiled for you by our legal professionals.

- Utilize our website whenever you require a dependable and trustworthy service through which you can conveniently find and download the Garnishee Garnishment Employer Withheld.

- If you’re familiar with our services and have previously established an account with us, simply Log In to your account, find the form, and download it or retrieve it later in the My documents section.

- Don’t have an account? No problem. It requires minimal time to sign up and explore the library.

- However, before rushing to download Garnishee Garnishment Employer Withheld, adhere to these guidelines.

Form popularity

FAQ

Employers are typically notified of a wage garnishment via court order or IRS levy. They must comply with the garnishment request and start withholding and remitting payment as soon as the order is received. IRS wage garnishment and levy paperwork will walk you through the steps of completing the wage garnishment.

A wage garnishment is any legal or equitable procedure through which some portion of a person's earnings is required to be withheld for the payment of a debt.

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

Garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. It refers to a legal process that instructs a third party to deduct payments directly from a debtor's wage or bank account. Typically, the third party is the debtor's employer and is known as the garnishee.